Financing Startup Communities (Feb 2024)

AI Summary

AI Summary

Key Insights

- The document outlines a strategy for building sustainable startup communities by integrating equity, debt, and real estate investment.

- It emphasizes the importance of access to capital, job creation, and essential services for fostering vibrant communities.

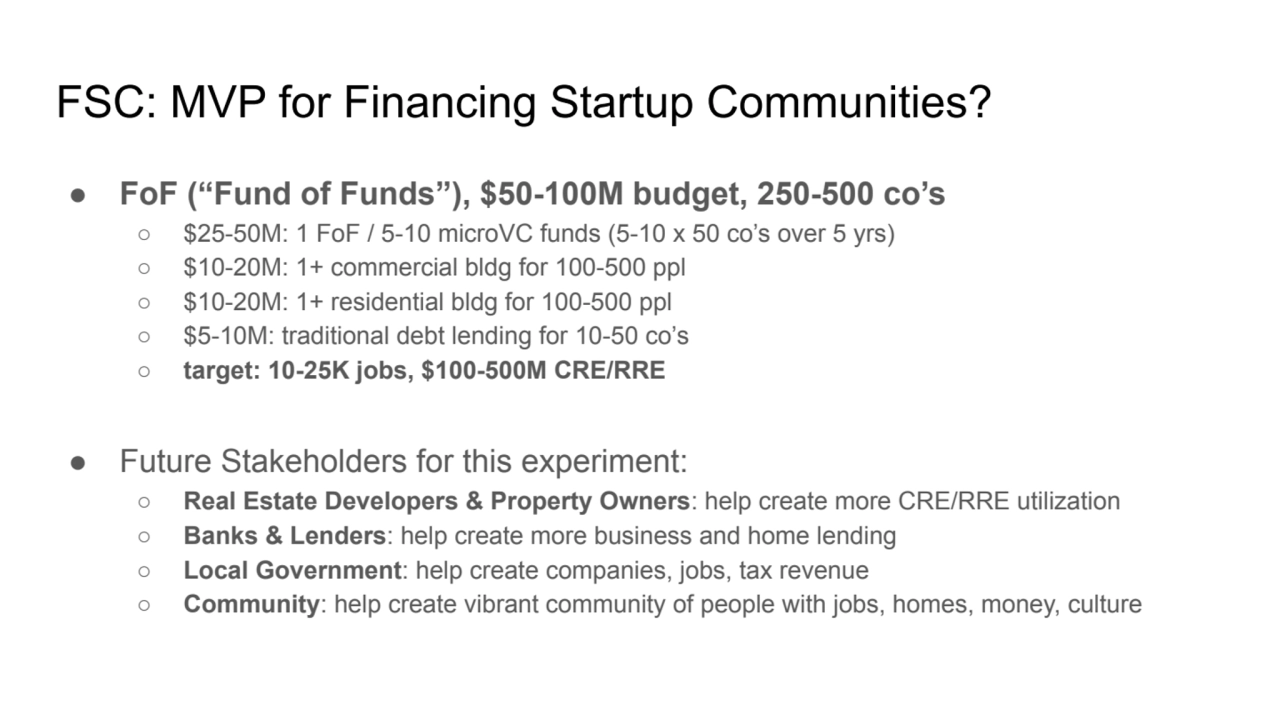

- A key component is the MVP (Minimum Viable Product) for a Financing Startup Community (FSC) involving a $50-100M budget and the creation of 250-500 companies.

- The presentation discusses how blending VC, real estate, and debt can create gravity, diversification, and liquidity within startup ecosystems.

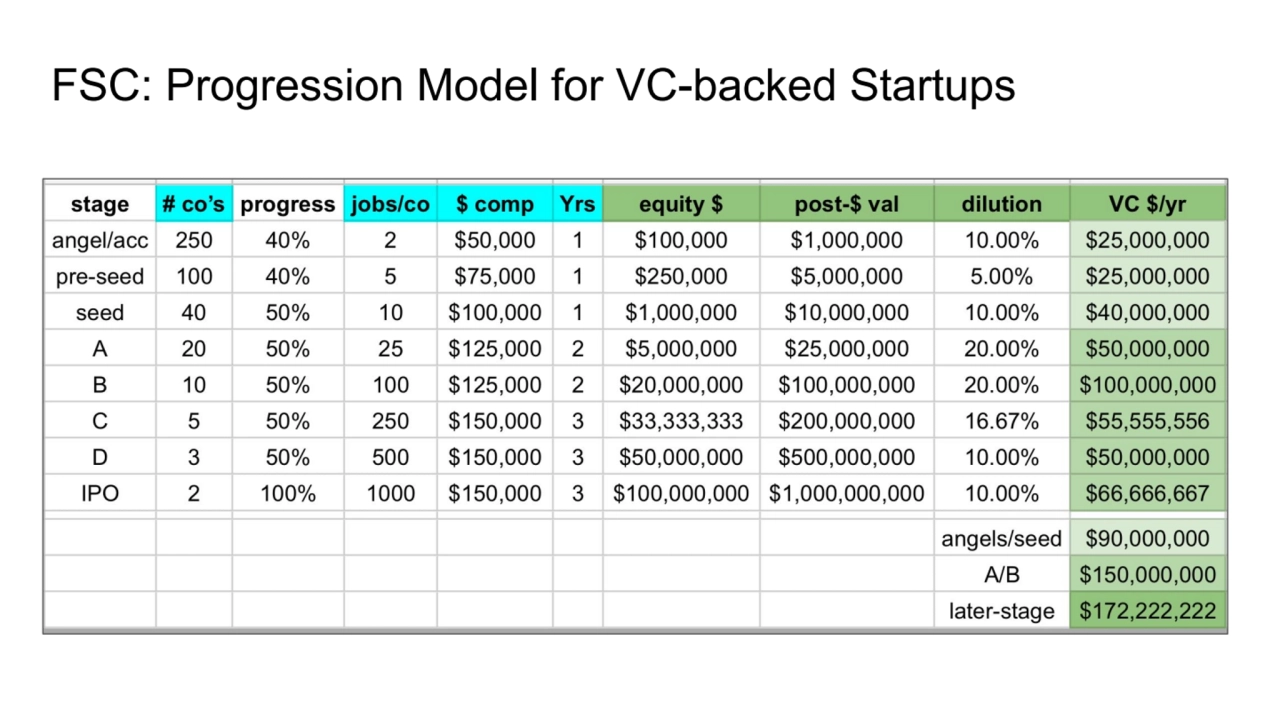

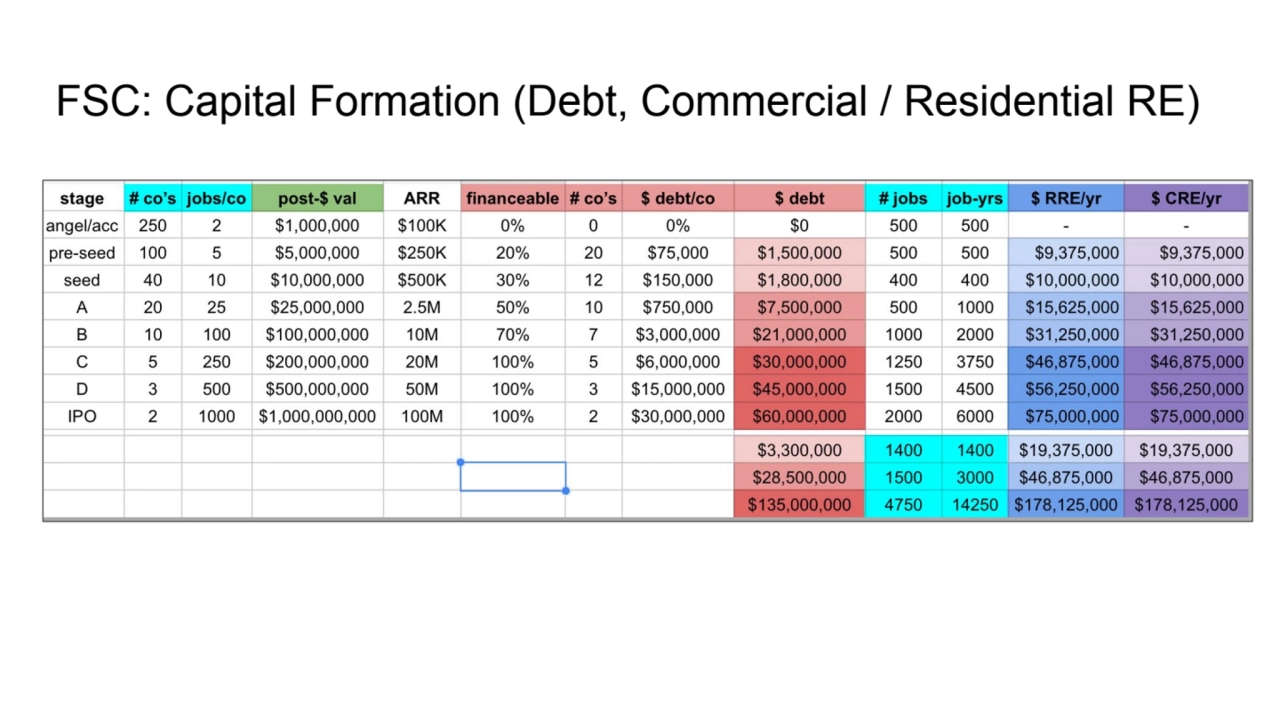

- The document analyzes the progression model for VC-backed startups and the capital formation through debt, commercial, and residential real estate.

Financing Startup Communities (Feb 2024)

- 1. Financing Startup Communities #FSC Dave McClure, PracticalVC.com @DaveMcClure linkedin.in/davemcclure Vitalia, Startup Societies Feb 2024, Roatan, Honduras

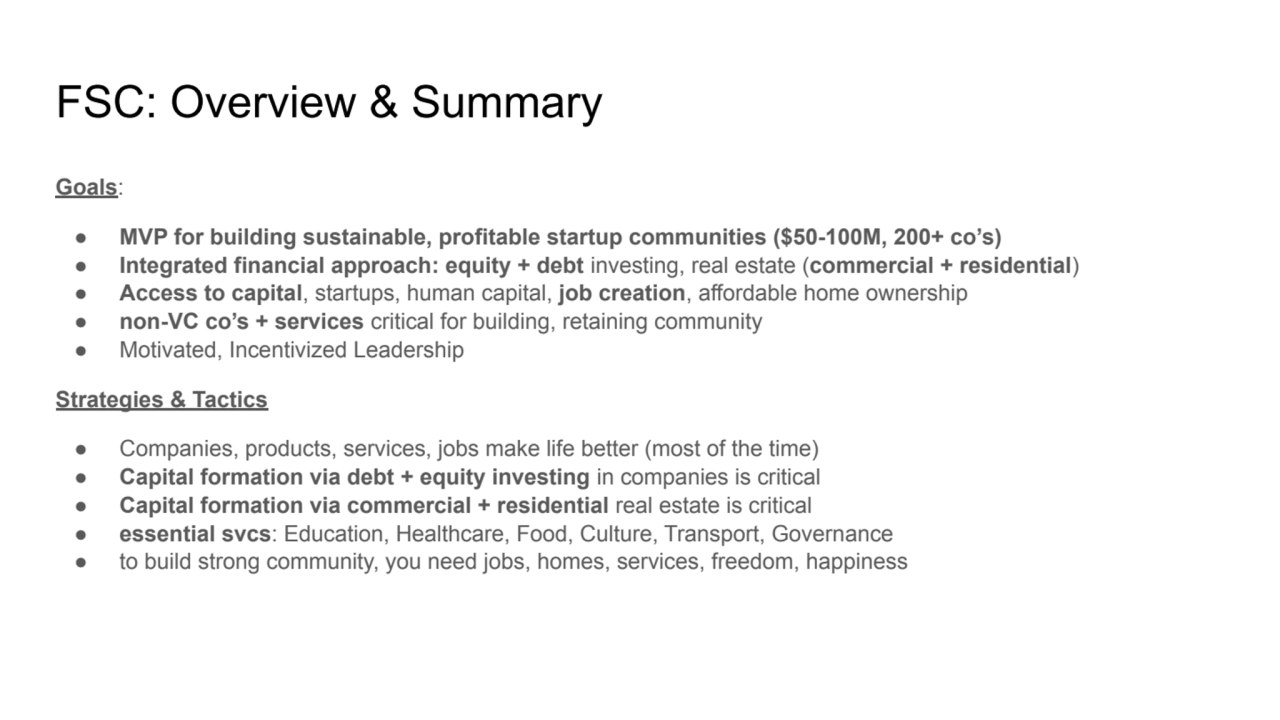

- 2. FSC: Overview & Summary Goals: ● MVP for building sustainable, profitable startup communities ($50-100M, 200+ co’s) ● Integrated financial approach: equity + debt investing, real estate (commercial + residential) ● Access to capital, startups, human capital, job creation, affordable home ownership ● non-VC co’s + services critical for building, retaining community ● Motivated, Incentivized Leadership Strategies & Tactics ● Companies, products, services, jobs make life better (most of the time) ● Capital formation via debt + equity investing in companies is critical ● Capital formation via commercial + residential real estate is critical ● essential svcs: Education, Healthcare, Food, Culture, Transport, Governance ● to build strong community, you need jobs, homes, services, freedom, happiness

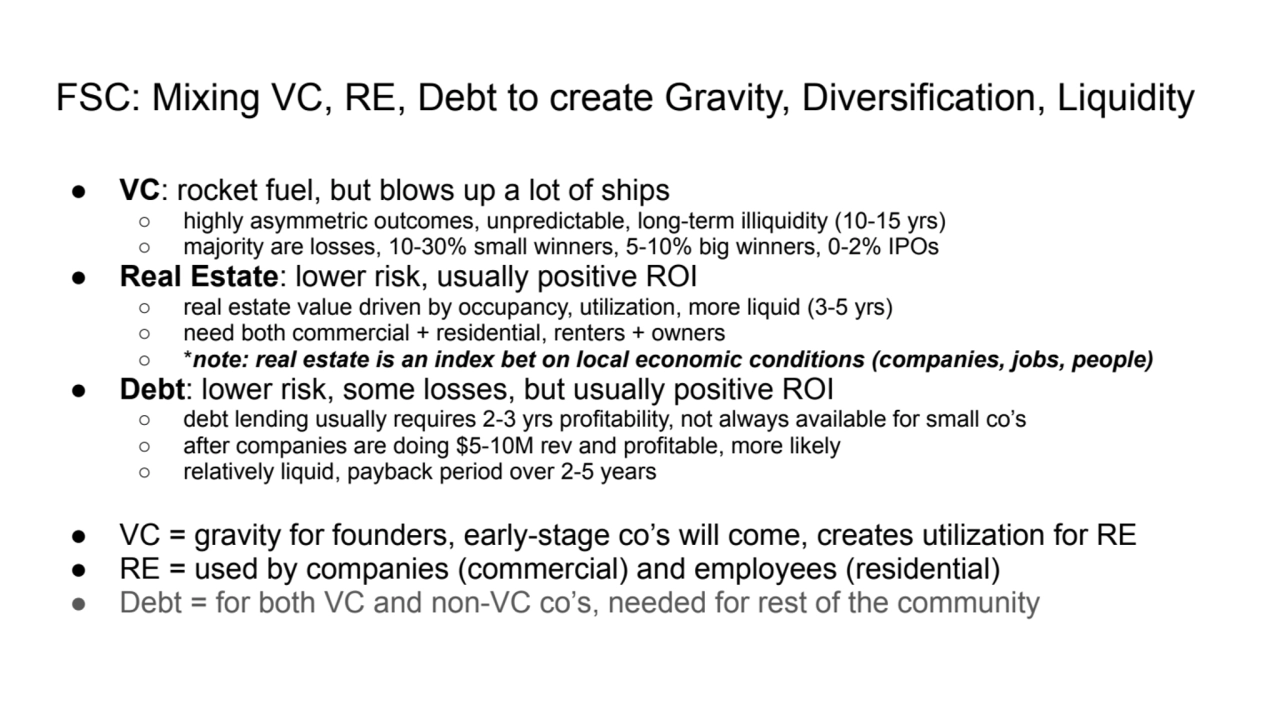

- 3. FSC: Mixing VC, RE, Debt to create Gravity, Diversification, Liquidity ● VC: rocket fuel, but blows up a lot of ships ○ highly asymmetric outcomes, unpredictable, long-term illiquidity (10-15 yrs) ○ majority are losses, 10-30% small winners, 5-10% big winners, 0-2% IPOs ● Real Estate: lower risk, usually positive ROI ○ real estate value driven by occupancy, utilization, more liquid (3-5 yrs) ○ need both commercial + residential, renters + owners ○ *note: real estate is an index bet on local economic conditions (companies, jobs, people) ● Debt: lower risk, some losses, but usually positive ROI ○ debt lending usually requires 2-3 yrs profitability, not always available for small co’s ○ after companies are doing $5-10M rev and profitable, more likely ○ relatively liquid, payback period over 2-5 years ● VC = gravity for founders, early-stage co’s will come, creates utilization for RE ● RE = used by companies (commercial) and employees (residential) ● Debt = for both VC and non-VC co’s, needed for rest of the community

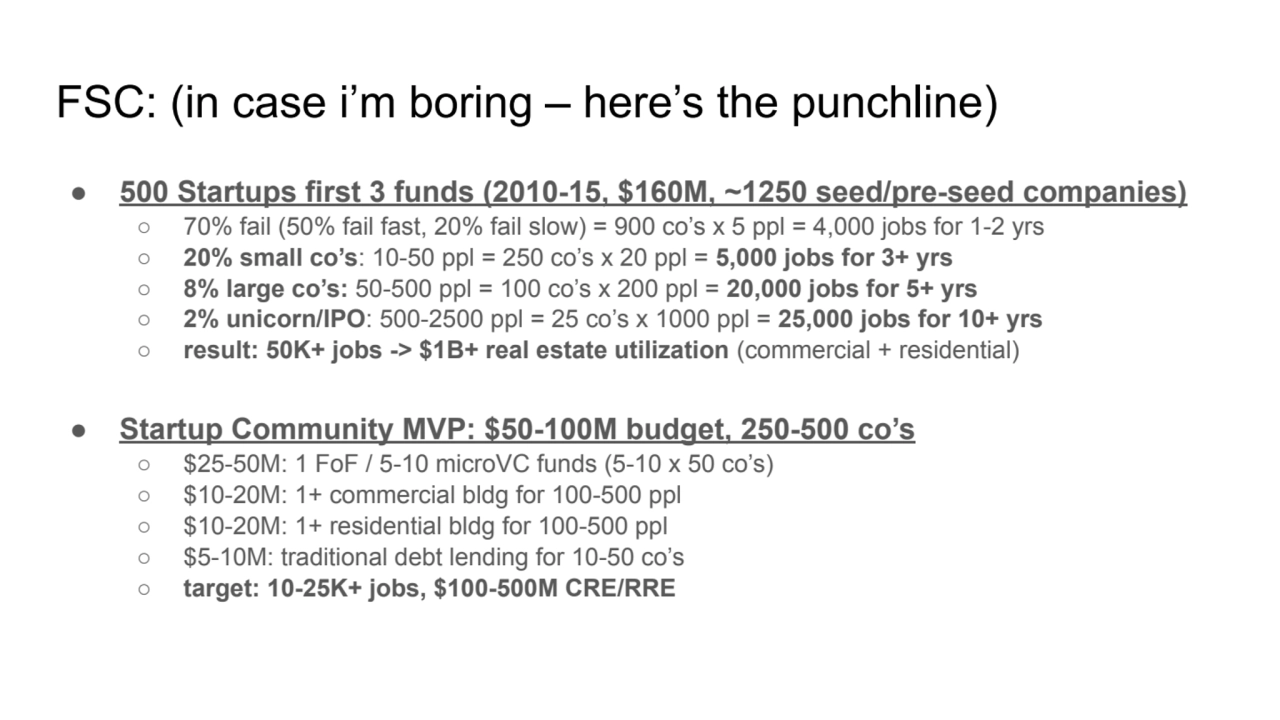

- 4. FSC: (in case i’m boring – here’s the punchline) ● 500 Startups first 3 funds (2010-15, $160M, ~1250 seed/pre-seed companies) ○ 70% fail (50% fail fast, 20% fail slow) = 900 co’s x 5 ppl = 4,000 jobs for 1-2 yrs ○ 20% small co’s: 10-50 ppl = 250 co’s x 20 ppl = 5,000 jobs for 3+ yrs ○ 8% large co’s: 50-500 ppl = 100 co’s x 200 ppl = 20,000 jobs for 5+ yrs ○ 2% unicorn/IPO: 500-2500 ppl = 25 co’s x 1000 ppl = 25,000 jobs for 10+ yrs ○ result: 50K+ jobs -> $1B+ real estate utilization (commercial + residential) ● Startup Community MVP: $50-100M budget, 250-500 co’s ○ $25-50M: 1 FoF / 5-10 microVC funds (5-10 x 50 co’s) ○ $10-20M: 1+ commercial bldg for 100-500 ppl ○ $10-20M: 1+ residential bldg for 100-500 ppl ○ $5-10M: traditional debt lending for 10-50 co’s ○ target: 10-25K+ jobs, $100-500M CRE/RRE

- 5. FSC: Who is this crazy nerd? Dave McClure ● hillbilly from West Virginia + grew up in Columbia, MD ● engineer, BS Applied Mathematics, Johns Hopkins Univ ● moved to Silicon Valley in early 90’s (tech startups + ultimate frisbee) ● software developer, founder, angel investor, eventually VC ● worked at PayPal, Founders Fund, other tech startups ● founder 500 Startups (early-stage), Practical VC (later-stage, secondary) ● side projects: GeeksOnaPlane, 42Geeks.com, Network States fanboi Optimism, Belief, Motivation ● I’m an optimist and I believe in humanity (altho we fuckup a lot) ● I believe founders + capitalism can be a force for good (but far from perfect) ● I want to work and live with fun, smart, caring people – all over the world ● “Make Love Trade, Not War” – people who trade are less likely to kill each other

- 6. FSC: Inspirations, Role Models ● Property Rights, Capitalism, Founders, Startups, Mortgage Finance ● The Mystery of Capital, Hernando de Soto (also “The Other Path”) ● Homesteading / Squatting (informal) -> formal ownership over time ● Debt, Equity, Microfinance, Securitization, Financial Engineering ● Bill Gross (Idealab), Paul Graham (YC), Vitalik Buterin (ETH) ● Software Eats The World, Marc Andreessen (also “It’s Time to Build”) ● The Network State, Balaji Srinivasan ● Erick Brimen, Prospera ● Sesame Street, Bugs Bunny, Free to Be You and Me, Mary Tyler Moore ● my mom (entrepreneur, solo parent, 60’s/70’s hippie, feminist, confident, occasionally wrong but never in doubt… thx for those crazy genes mom)

- 7. FSC: Examples of Global / Regional Tech Communities ● Silicon Valley, Sand Hill Rd: Stanford, Traitorous Eight, Fairchild, Intel, Bell Labs, AAPL, GOOG, META, NVDA, ORCL, TSLA, NFLX, multiple VC firms ● Boston, Rt 128: Harvard/MIT, DEC, Raytheon, ARD, bio tech ● other US Tech Metros: Seattle (AMZN, MSFT), LA, NY, Austin, Miami?, etc ● China: Beijing, Shanghai, Shenzhen ● India: Bangalore, Delhi, Mumbai ● other global metros: SG, Dubai, London, Tokyo, Tel Aviv, Riyadh? ● next 20-50 yrs: the “global south” (SE Asia, Latam, Africa, Middle East)

- 8. FSC: Examples of Startup Micro-Communities Notable Micro-Communities ● Idealab (1996, Pasadena, CalTech, Bill Gross) ● Y Combinator (2005, Boston / Silicon Valley) ● TechStars (2007), SeedCamp (2008), 500 Startups (2010) ● Entrepreneur First (2011), Antler (2017), Ondeck (2019) ● (sorry – other examples i’m forgetting / overlooking?) Attributes ● 100+ companies, $10-100M+ seed-stage capital ● talented, optimistic people, “driven” founders with passion, mission ● gravity around a physical location(s), daily/weekly community, cult-like following ● not just an office, work / live environments, non-work activities ● 1+ big winner (maybe 10 years later!) that create heros, mentors, role models

- 9. FSC: My journey from engineer -> founder -> investor Early Attempts + a few fails (1990-2010) ● community: 20 years of user groups, meetups, conferences (1992-2010) ● startups: my first “failed” startup + acquisition (1994-98) -> pre-IPO PayPal (2001-04) ● teaching: Stanford Facebook class (2007), “Startup Metrics for Pirates: AARRR!” (2008) ● angel investing: ~15 angel investments (2004-2009), SlideShare, Mint.com ● VC investing: ~40 deals, Founders Fund “FF Angel” (2008-10), Facebook fbFund (2009) 500 Startups + a few successes (2010-15) ● 500 F1 (2010-11, $30M, 265 companies) ● 500 F2 (2012-13, $45M, 325 companies) ● 500 F3 (2014-15, $85M, 676 companies)

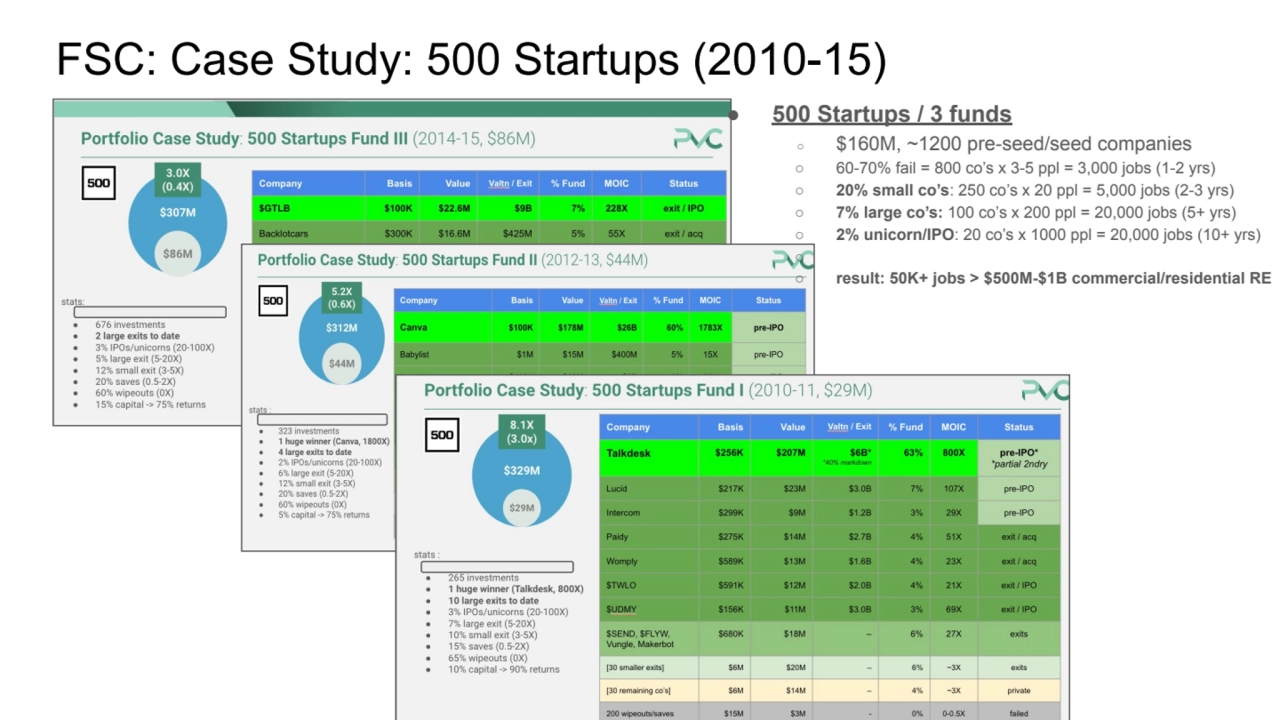

- 10. FSC: Case Study: 500 Startups (2010-15) ● 500 Startups / 3 funds ○ $160M, ~1200 pre-seed/seed companies ○ 60-70% fail = 800 co’s x 3-5 ppl = 3,000 jobs (1-2 yrs) ○ 20% small co’s: 250 co’s x 20 ppl = 5,000 jobs (2-3 yrs) ○ 7% large co’s: 100 co’s x 200 ppl = 20,000 jobs (5+ yrs) ○ 2% unicorn/IPO: 20 co’s x 1000 ppl = 20,000 jobs (10+ yrs) ○ ○ result: 50K+ jobs > $500M-$1B commercial/residential RE

- 11. FSC: Progression Model for VC-backed Startups

- 12. FSC: Capital Formation (Debt, Commercial / Residential RE)

- 13. FSC: MVP for Financing Startup Communities? ● FoF (“Fund of Funds”), $50-100M budget, 250-500 co’s ○ $25-50M: 1 FoF / 5-10 microVC funds (5-10 x 50 co’s over 5 yrs) ○ $10-20M: 1+ commercial bldg for 100-500 ppl ○ $10-20M: 1+ residential bldg for 100-500 ppl ○ $5-10M: traditional debt lending for 10-50 co’s ○ target: 10-25K jobs, $100-500M CRE/RRE ● Future Stakeholders for this experiment: ○ Real Estate Developers & Property Owners: help create more CRE/RRE utilization ○ Banks & Lenders: help create more business and home lending ○ Local Government: help create companies, jobs, tax revenue ○ Community: help create vibrant community of people with jobs, homes, money, culture

- 14. FSC: Conclusions, Next Steps ● Equity Capital -> Companies ● Companies -> Jobs, Offices, Product & Services ● Jobs -> Renters / Home Buyers, Borrowers, Taxes ● Jobs -> non-tech companies that provide services ● Debt Capital -> lending for both tech and non-tech companies ● Result: Successful, Sustainable, Startup (and non-startup) Communities ● … also, more freedom, happiness, food, culture, and frisbee

- 15. Thanks for listening! Please send feedback tell me what you liked, what sucked, what could be done better ● email: dave.mcclure@gmail.com ● twitter/X: @davemcclure ● Linkedin: https://linkedin.com/in/davemcclure