Fixed Income Insights Explained

AI Summary

AI Summary

Key Insights

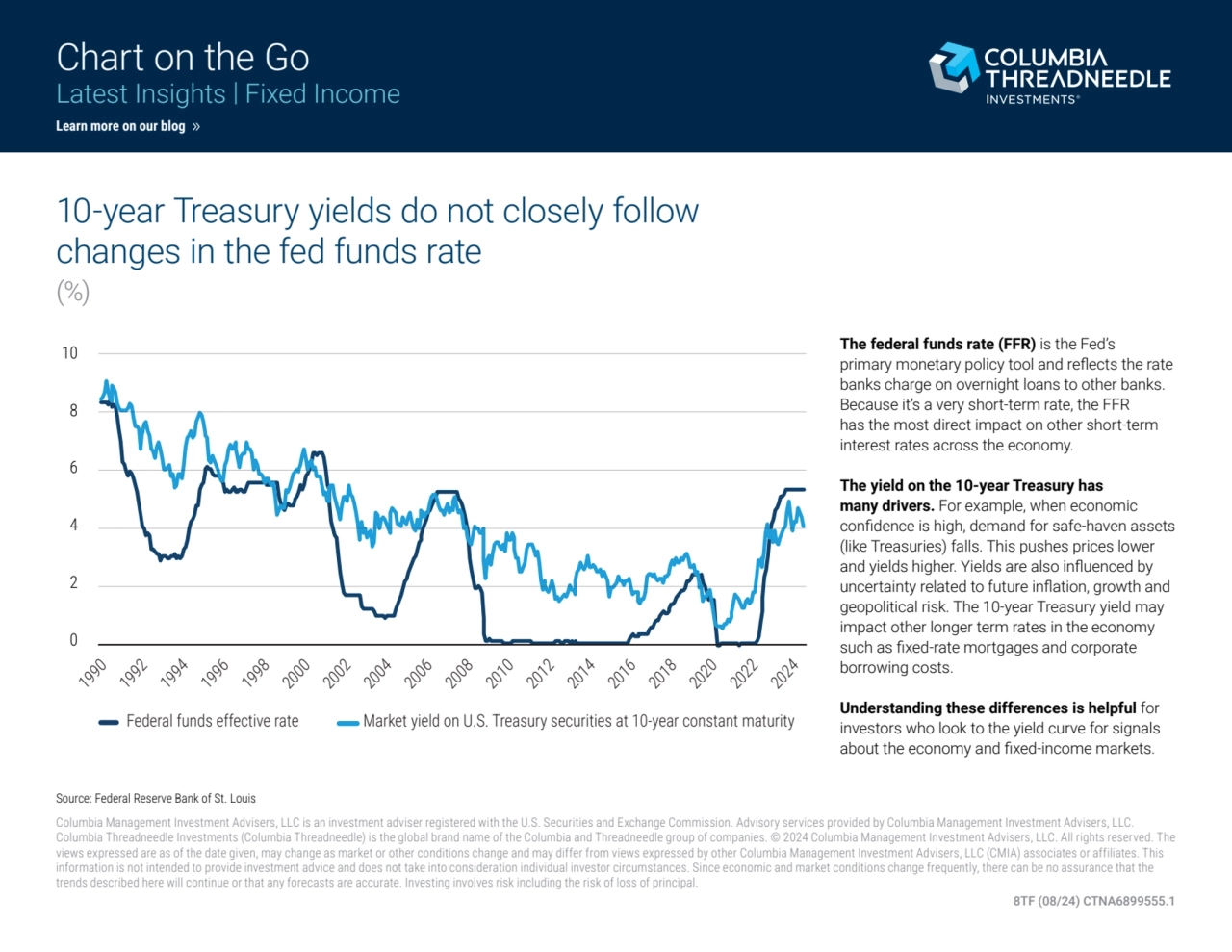

- The Federal Funds Rate (FFR) is the Fed's primary tool and impacts short-term rates.

- 10-year Treasury yields are influenced by economic confidence, inflation, and geopolitical risk.

- High economic confidence decreases demand for safe-haven assets like Treasuries, lowering prices and raising yields.

- Investors use yield curve differences to get a sense of the economy and fixed income markets.

Fixed Income Insights Explained

- 1. Chart on the Go Latest Insights | Fixed Income Learn more on our blog 10-year Treasury yields do not closely follow changes in the fed funds rate (%) Source: Federal Reserve Bank of St. Louis Columbia Management Investment Advisers, LLC is an investment adviser registered with the U.S. Securities and Exchange Commission. Advisory services provided by Columbia Management Investment Advisers, LLC. Columbia Threadneedle Investments (Columbia Threadneedle) is the global brand name of the Columbia and Threadneedle group of companies. © 2024 Columbia Management Investment Advisers, LLC. All rights reserved. The views expressed are as of the date given, may change as market or other conditions change and may differ from views expressed by other Columbia Management Investment Advisers, LLC (CMIA) associates or affiliates. This information is not intended to provide investment advice and does not take into consideration individual investor circumstances. Since economic and market conditions change frequently, there can be no assurance that the trends described here will continue or that any forecasts are accurate. Investing involves risk including the risk of loss of principal. 8TF (08/24) CTNA6899555.1 The federal funds rate (FFR) is the Fed’s primary monetary policy tool and reflects the rate banks charge on overnight loans to other banks. Because it’s a very short-term rate, the FFR has the most direct impact on other short-term interest rates across the economy. The yield on the 10-year Treasury has many drivers. For example, when economic confidence is high, demand for safe-haven assets (like Treasuries) falls. This pushes prices lower and yields higher. Yields are also influenced by uncertainty related to future inflation, growth and geopolitical risk. The 10-year Treasury yield may impact other longer term rates in the economy such as fixed-rate mortgages and corporate borrowing costs. Understanding these differences is helpful for investors who look to the yield curve for signals about the economy and fixed-income markets. Federal funds effective rate 199019921994199619982000200220042006200820102012201420162018202020222024 10 8 6 4 2 0 Market yield on U.S. Treasury securities at 10-year constant maturity