GSF Angel Investing MasterClass - Mar'23

AI Summary

AI Summary

Key Insights

- The document covers the basics of angel investing from the perspective of an experienced tech entrepreneur.

- It discusses the rationale for angel investing, the different types of angel investing decisions, and the journey of becoming an angel investor.

- The document explores sectors of focus for angel investing, deal sourcing methods, deal constructs, and funding criteria.

- It also addresses common pitfalls and mistakes in angel investing and offers suggestions for other angel investors.

- Links to the author's Twitter and LinkedIn profiles are provided.

GSF Angel Investing MasterClass - Mar'23

- 1. GSF Angel Investing MasterClass Mar’23

- 2. Background • Tech entrepreneur (SlideShare → IndiaStack) • SuperAngel / Expert in angel investing?? Not really! - Learning a new skill by trial/error

- 3. Rationale for Angel Investing? • Startups have been life changing for me… pay it forward! • Learn vicariously from other smart, ambitious people • Money needs a more productive use than banks, MFs ✓Generate alpha over public markets (ROI expectancy)

- 4. Why Angel Invest – three types of decisions! • Return/IRR focused deals (80%) • “GuruDakshina” ― learn about new, upcoming sector ― think paying tuition fees for learning • “Be a Good Samaritan” or “Pay-It-Forward”

- 5. Angel Journey • Started 2015-16 • Angel investing is a side hustle, doing it part time (can’t devote a lot of time/attention) • Over 40 startups – 80% seed/angel, 20% Series A • Don’t lead (or take board seats), but available to founders as they want • 30% mortality, 20% at par returns, rest 50% in the game • Don’t actively track IRR based on MOIC (paper money!), but likely to beat public mkt returns

- 6. Sectors in Focus • Startup landscape is broad, you must aim for a “Circle of Competence” • Machines give mechanical advantage, Software gives leverage • Thumb Rule for software business ✓Marginal cost of production tends to zero (diminishing marginal cost) • SAAS, Consumer, Fintech, HealthTech, Edtech – where software plays pivotal role • Accept what you don’t know – e.g. lending startups

- 7. Angel Deal sourcing • 50% Direct deals • 50% Syndicates (or other pooled vehicles) Dynamics / Life Cycles of above two are very diff • Syndicates - remote, no touch, passive, non-engaging (almost like mutual funds investing, or index investing) • Direct deals - High touch, “get into the trenches” with founders, high emotional involvement

- 8. Deal Construct • Preferably 2-3 members founding team • Pedigree vs Raw talent ― “Pedigree excels at what they’re told to do, raw talent excels at what they were not told to do” • Approach - “Bottoms Up” v/s “Top Down” • Opportunity - “Blue Ocean” v/s “Red Ocean”

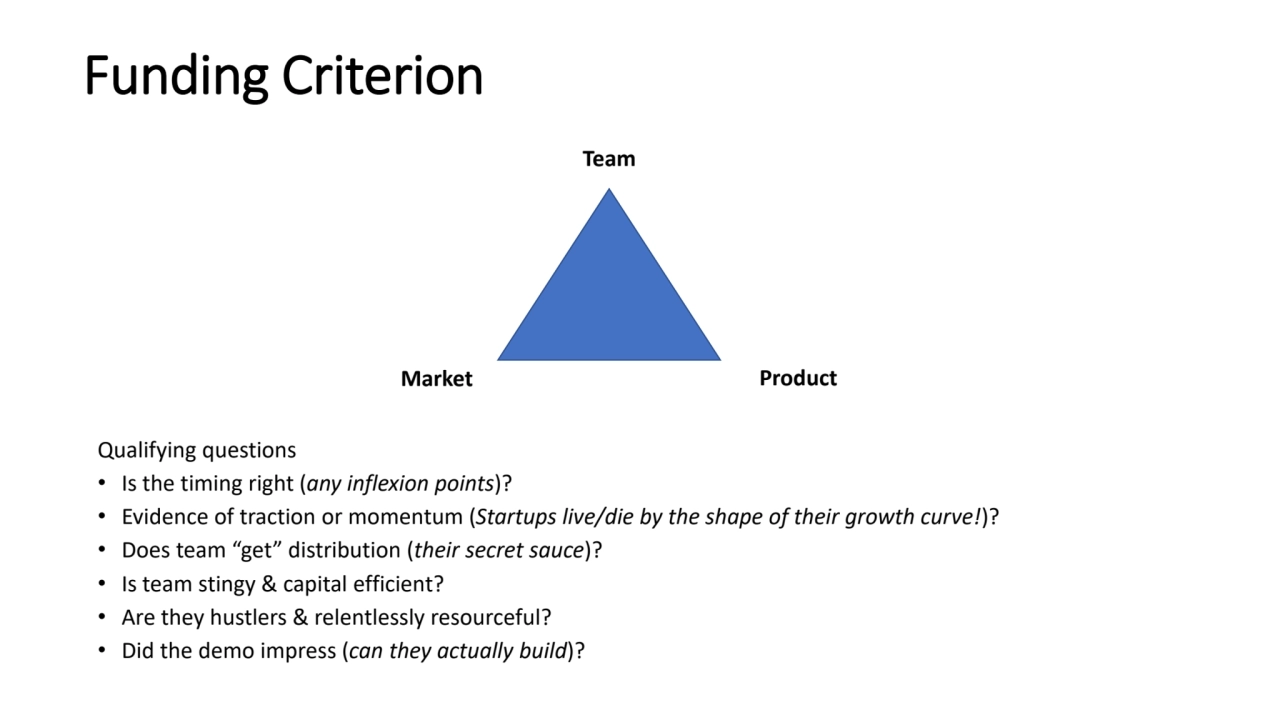

- 9. Funding Criterion Qualifying questions • Is the timing right (any inflexion points)? • Evidence of traction or momentum (Startups live/die by the shape of their growth curve!)? • Does team “get” distribution (their secret sauce)? • Is team stingy & capital efficient? • Are they hustlers & relentlessly resourceful? • Did the demo impress (can they actually build)? Team Market Product

- 10. Valuation Focus? “You succeed in venture capital by backing the right deals, not by haggling over valuation”

- 11. Pitfalls / Mistakes • Founders “circle of competence” is key success factor • Struggle to give founders behavioural / attitudinal feedback • Not leading deals sometimes is a disadvantage • Timing the exit?

- 12. Suggestions to other angels • Develop your area of competency – Be good at something that lies in critical path of startup success • Develop ability to independently evaluate people, business or technologies. Depending on network, social proof/signal isn’t always a good idea

- 13. Thanks https://twitter.com/amitranjan https://www.linkedin.com/in/amitranjanprofile/