Marvell 3q2024 financial results

AI Summary

AI Summary

Key Insights

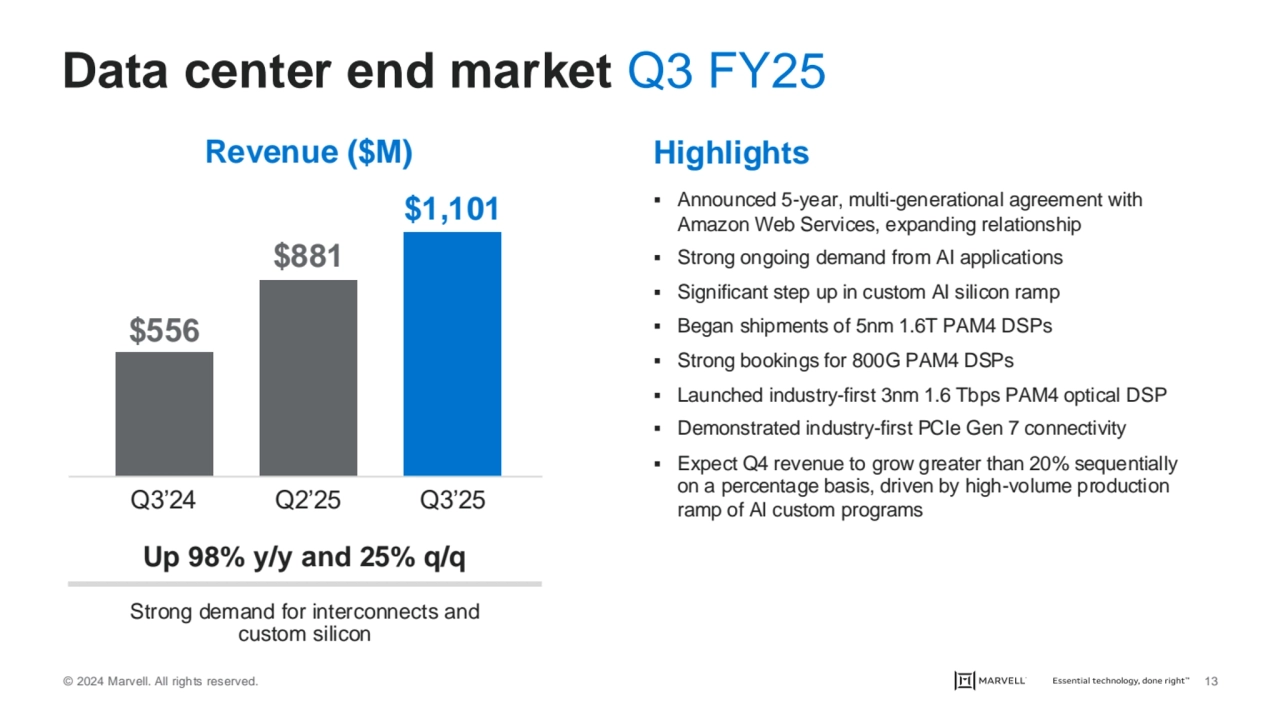

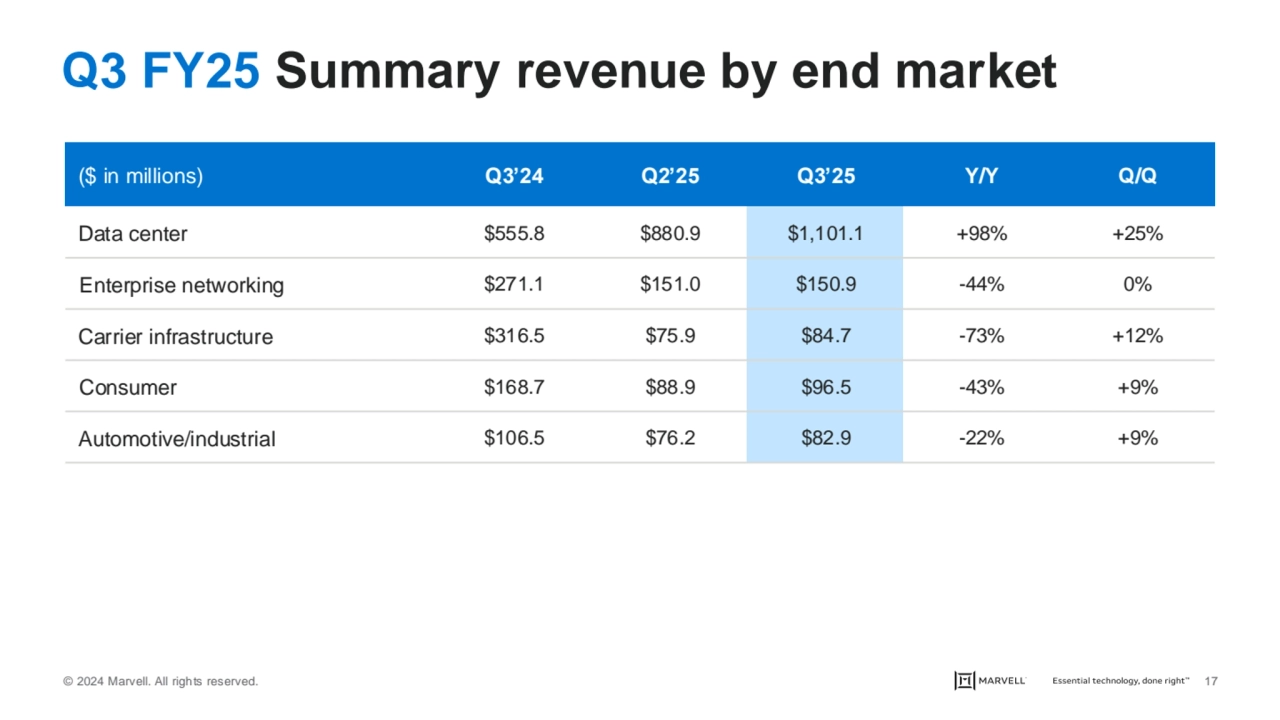

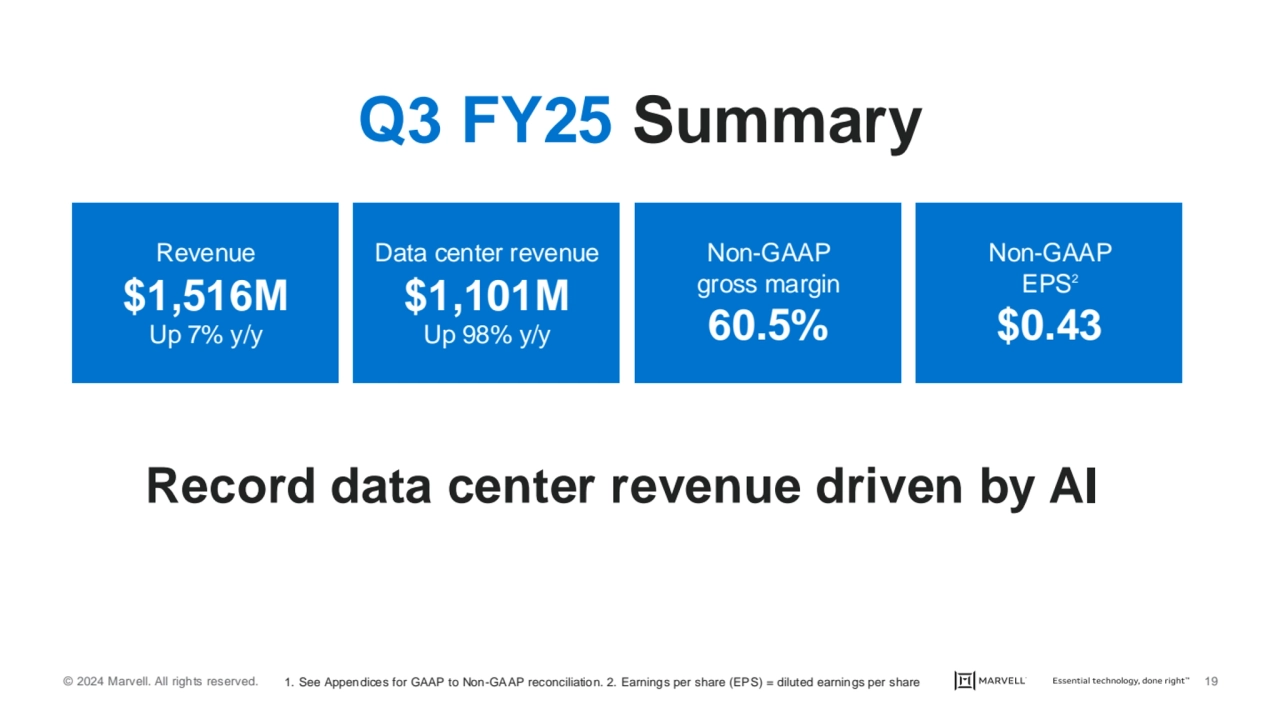

- Marvell's Q3 FY25 revenue increased by 7% year-over-year and 19% quarter-over-quarter, with data center revenue growing significantly by 98% year-over-year and 25% quarter-over-quarter.

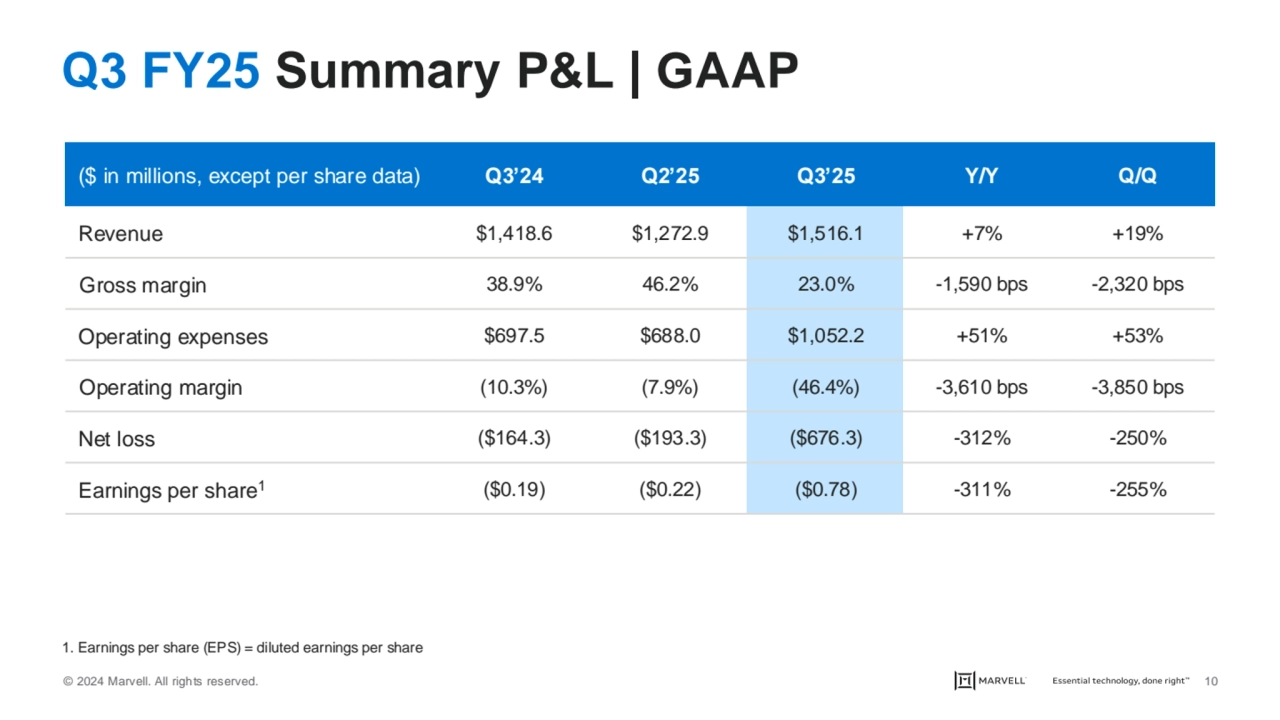

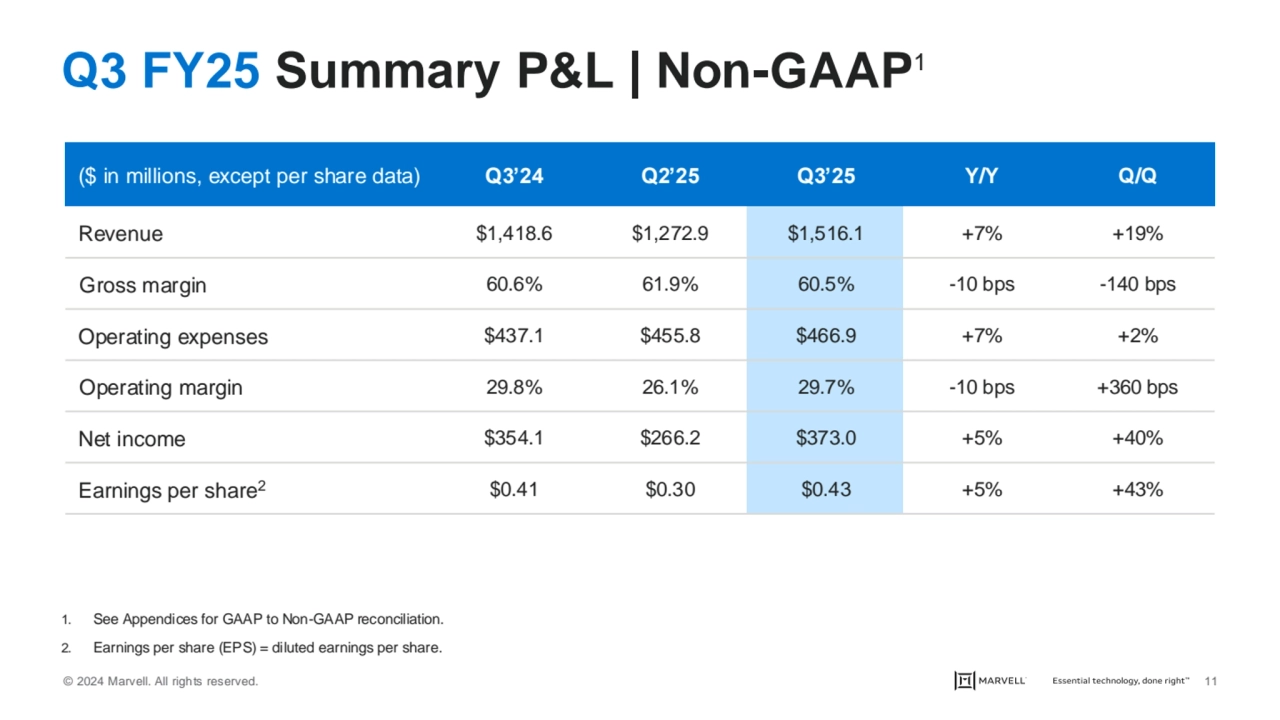

- The company's Q3 FY25 financial results are presented in both GAAP and Non-GAAP metrics, providing a comprehensive view of their performance with reconciliations in the appendices.

- Marvell's data center end market demonstrated strong performance with revenue reaching $1.101 million, driven by AI applications and a multi-generational agreement with Amazon Web Services.

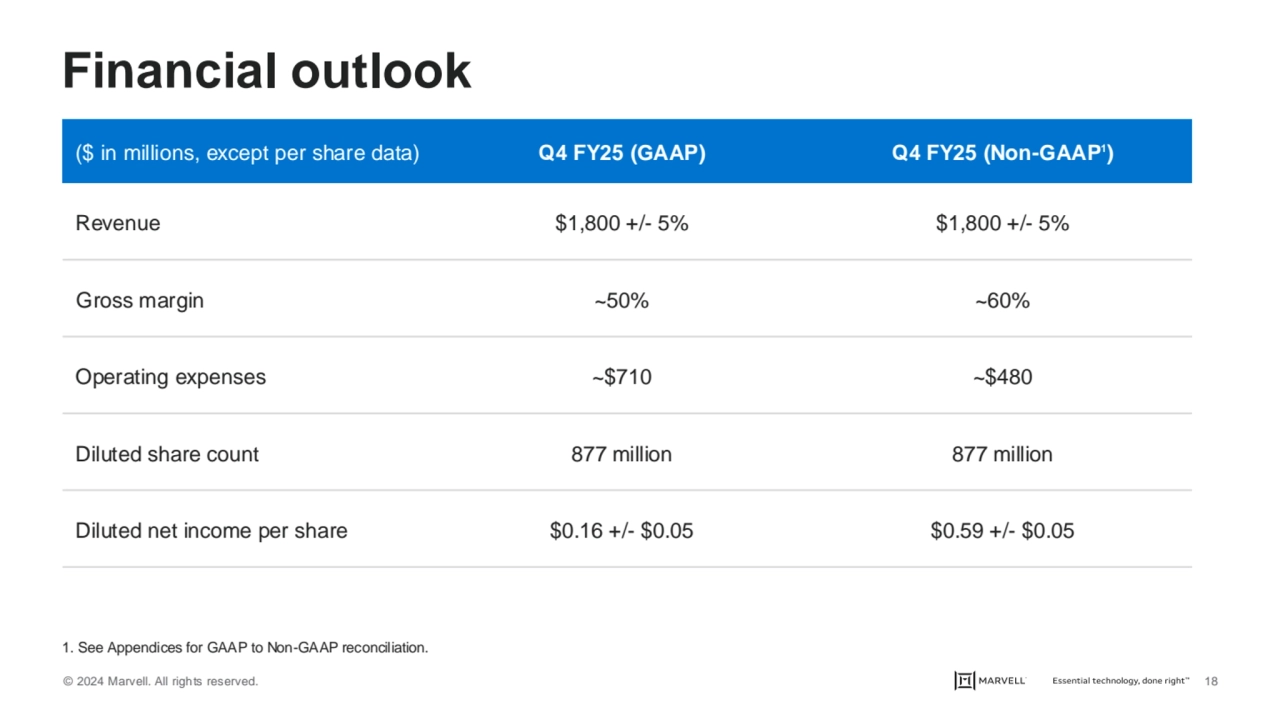

- Marvell provided a financial outlook for Q4 FY25, projecting revenue of $1,800 +/- 5% under both GAAP and Non-GAAP standards, with gross margins estimated at ~50% (GAAP) and ~60% (Non-GAAP).

Marvell 3q2024 financial results

- 1. Financial and Business Results Q3 FY25 December 3, 2024

- 2. © 2024 Marvell. All rights reserved. 2 Forward-looking statements Except for statements of historical fact, this presentation contains forward-looking statements (within the meaning of the federal securities laws) including statements related to future revenue, future earnings, and the success of our product releases that involve risks and uncertainties. Words such as “anticipates,” “expects,” “intends,” “plans,” “projects,” “believes,” “seeks,” “estimates,” “can,” “may,” “will,” “would” and similar expressions identify such forward-looking statements. These statements are not guarantees of results and should not be considered as an indication of future activity or future performance. Actual events or results may differ materially from those described in this presentation due to a number of risks and uncertainties. For other factors that could cause Marvell’s results to vary from expectations, please see the risk factors identified in Marvell’s Quarterly Report on Form 10-Q for the fiscal quarter ended August 3, 2024 as filed with the SEC on August 30, 2024 and other factors detailed from time to time in Marvell’s filings with the SEC. Marvell undertakes no obligation to revise or update publicly any forward-looking statements.

- 3. © 2024 Marvell. All rights reserved. 3 Non-GAAP financial measures ▪ During this presentation, we may refer to certain financial measures on a U.S. non-GAAP basis. ▪ We believe that the presentation of non-GAAP financial measures provides important supplemental information to management and investors regarding financial and business trends relating to our financial condition and results of operations. ▪ While we use non-GAAP financial measures as a tool to enhance our understanding of certain aspects of our financial performance, we do not consider these measures to be a substitute for, or superior to, the information provided by GAAP financial measures. ▪ A reconciliation for non-GAAP financial measures is in the Appendices to this presentation.

- 4. © 2024 Marvell. All rights reserved. 4 Fiscal year nomenclature The Company’s fiscal year is the 52- or 53-week period ending on the Saturday closest to January 31. Accordingly, every fifth or sixth fiscal year will have a 53-week period. The additional week in a 53-week year is added to the fourth quarter, making such quarter consist of 14 weeks. Fiscal 2023 had a 52-week year. Fiscal 2024 had a 53-week year. Fiscal 2025 will be a 52-week year. The third quarter of fiscal year 2025 is the three-month period ended November 2, 2024.

- 5. © 2024 Marvell. All rights reserved. 5 Recent announcements DECEMBER 3, 2024 Marvell Announces Industry’s First 3nm 1.6 Tbps PAM4 Interconnect Platform Accelerated Infrastrutcure NEWS LINK OCTOBER 14, 2024 Marvell Delivers Custom Ethernet NIC at Open Compute Project NEWS LINK DECEMBER 2, 2024 Marvell Expands Strategic Collaboration with AWS to Enable Accelerated Infrastructure NEWS LINK OCTOBER 15, 2024 Marvell Demonstrates Industry-Leading 3nm PCIe Gen 7 Connectivity at OCP 2024 NEWS LINK

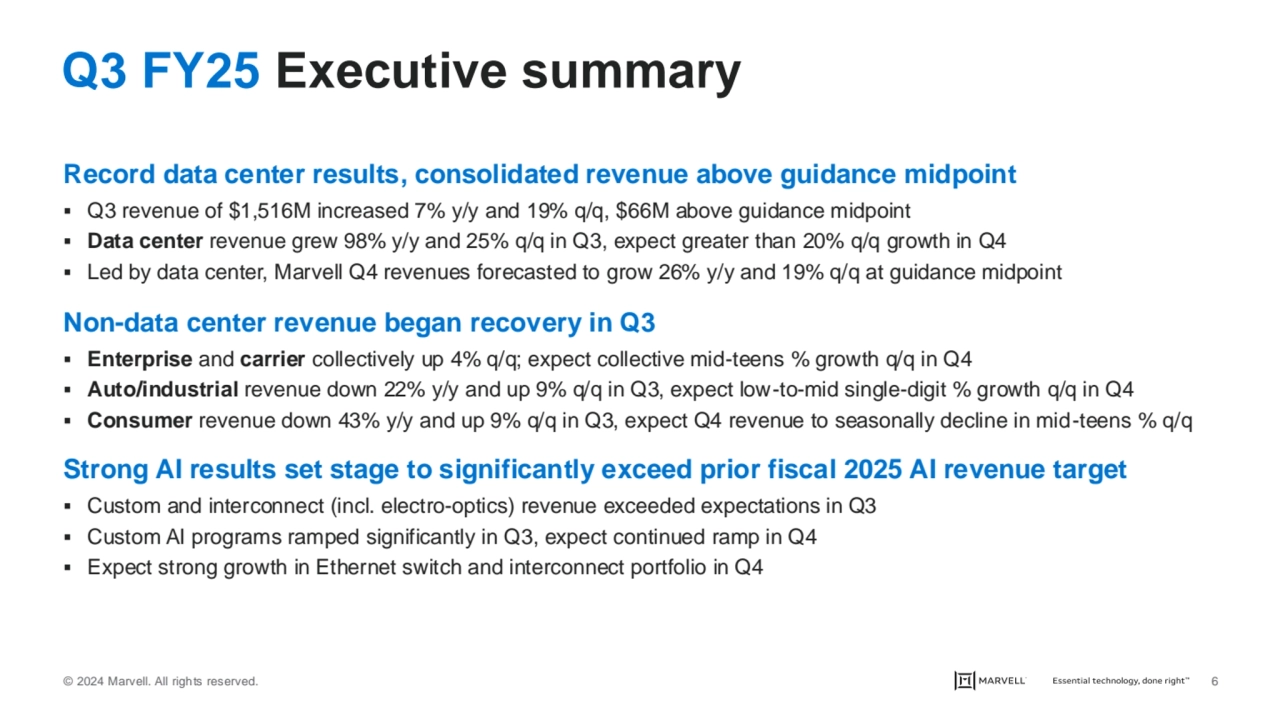

- 6. © 2024 Marvell. All rights reserved. 6 Record data center results, consolidated revenue above guidance midpoint ▪ Q3 revenue of $1,516M increased 7% y/y and 19% q/q, $66M above guidance midpoint ▪ Data center revenue grew 98% y/y and 25% q/q in Q3, expect greater than 20% q/q growth in Q4 ▪ Led by data center, Marvell Q4 revenues forecasted to grow 26% y/y and 19% q/q at guidance midpoint Non-data center revenue began recovery in Q3 ▪ Enterprise and carrier collectively up 4% q/q; expect collective mid-teens % growth q/q in Q4 ▪ Auto/industrial revenue down 22% y/y and up 9% q/q in Q3, expect low-to-mid single-digit % growth q/q in Q4 ▪ Consumer revenue down 43% y/y and up 9% q/q in Q3, expect Q4 revenue to seasonally decline in mid-teens % q/q Strong AI results set stage to significantly exceed prior fiscal 2025 AI revenue target ▪ Custom and interconnect (incl. electro-optics) revenue exceeded expectations in Q3 ▪ Custom AI programs ramped significantly in Q3, expect continued ramp in Q4 ▪ Expect strong growth in Ethernet switch and interconnect portfolio in Q4 Q3 FY25 Executive summary

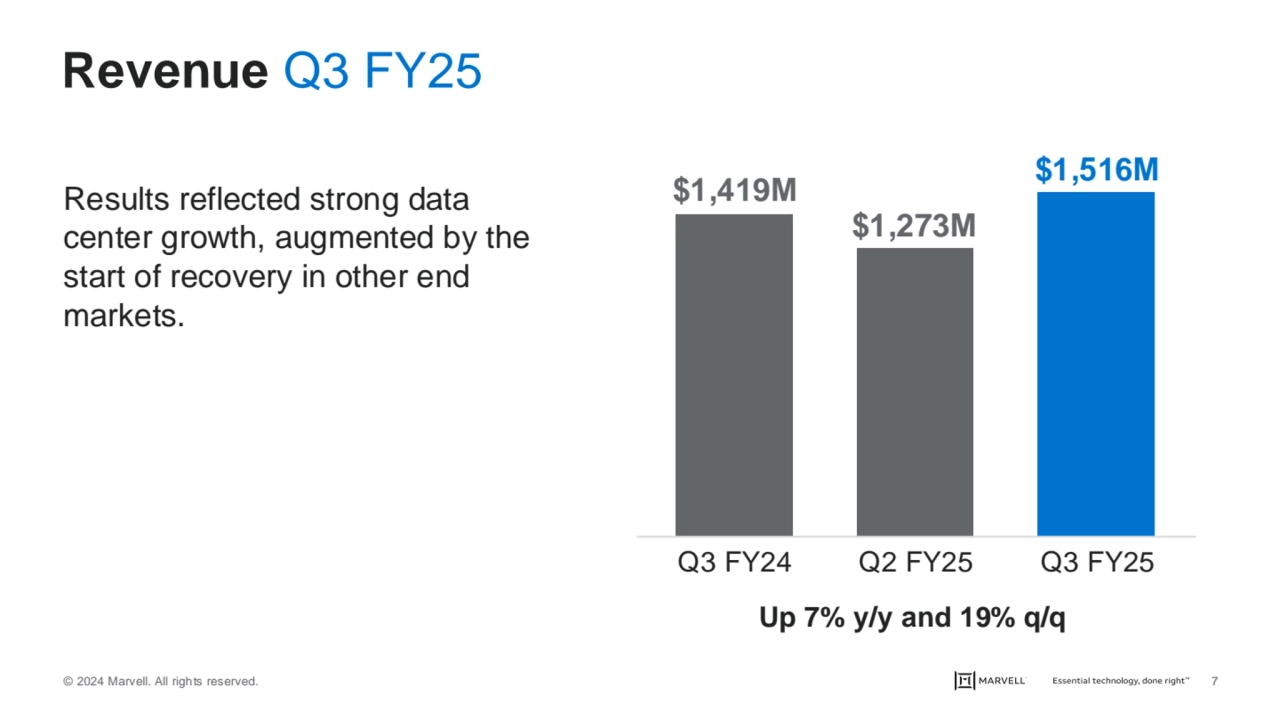

- 7. © 2024 Marvell. All rights reserved. 7 Revenue Q3 FY25 Results reflected strong data center growth, augmented by the start of recovery in other end markets. $1,419M $1,273M $1,516M Q3 FY24 Q2 FY25 Q3 FY25 Up 7% y/y and 19% q/q

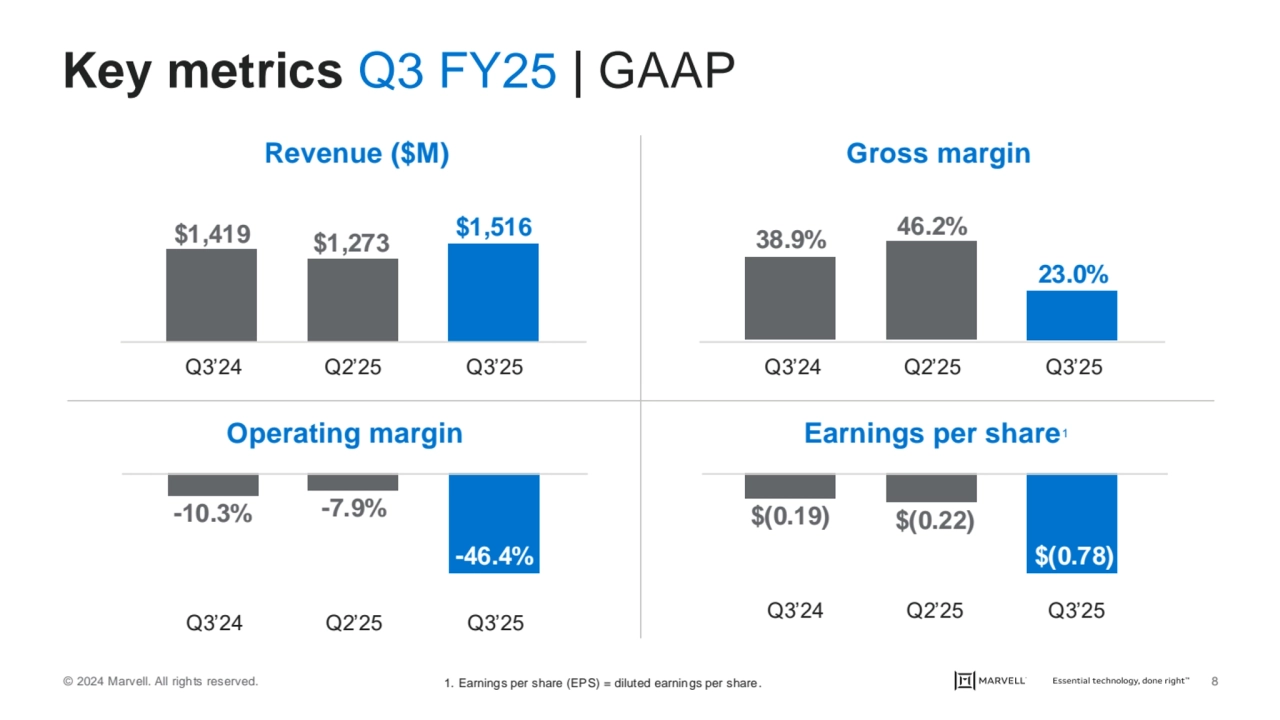

- 8. © 2024 Marvell. All rights reserved. 8 Key metrics Q3 FY25 | GAAP $1,419 $1,273 $1,516 38.9% 46.2% 23.0% Q3’24 Q2’25 Q3’25 Q3’24 Q2’25 Q3’25 Revenue ($M) Gross margin Operating margin Earnings per share1 -10.3% -7.9% -46.4% $(0.19) $(0.22) $(0.78) Q3’24 Q2’25 Q3’25 Q3’24 Q2’25 Q3’25 1. Earnings per share (EPS) = diluted earnings per share.

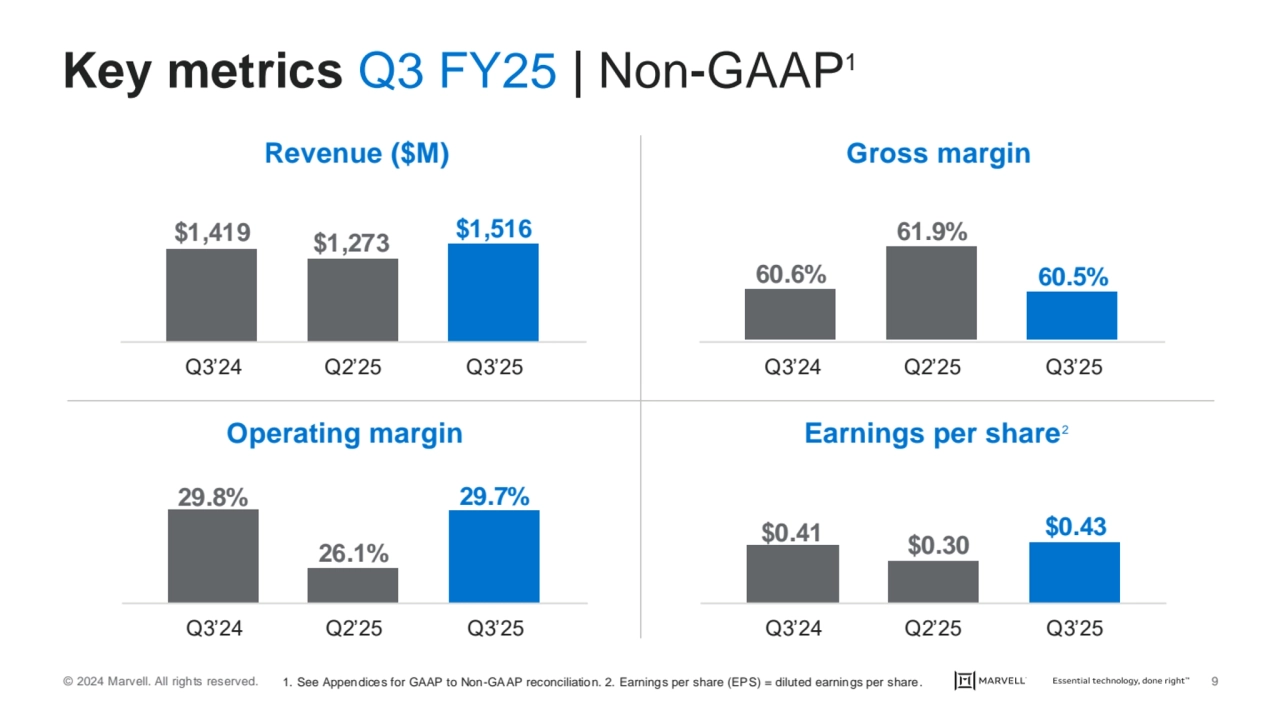

- 9. © 2024 Marvell. All rights reserved. 9 Key metrics Q3 FY25 | Non-GAAP1 $1,419 $1,273 $1,516 60.6% 61.9% 60.5% Q3’24 Q2’25 Q3’25 Q3’24 Q2’25 Q3’25 Revenue ($M) Gross margin Earnings per share Operating margin 2 29.8% 26.1% 29.7% $0.41 $0.30 $0.43 Q3’24 Q2’25 Q3’25 Q3’24 Q2’25 Q3’25 1. See Appendices for GAAP to Non-GAAP reconciliation. 2. Earnings per share (EPS) = diluted earnings per share.

- 10. © 2024 Marvell. All rights reserved. 10 Q3 FY25 Summary P&L | GAAP ($ in millions, except per share data) Q3’24 Q2’25 Q3’25 Y/Y Q/Q Revenue $1,418.6 $1,272.9 $1,516.1 +7% +19% Gross margin 38.9% 46.2% 23.0% -1,590 bps -2,320 bps Operating expenses $697.5 $688.0 $1,052.2 +51% +53% Operating margin (10.3%) (7.9%) (46.4%) -3,610 bps -3,850 bps Net loss ($164.3) ($193.3) ($676.3) -312% -250% Earnings per share1 ($0.19) ($0.22) ($0.78) -311% -255% 1. Earnings per share (EPS) = diluted earnings per share

- 11. © 2024 Marvell. All rights reserved. 11 Q3 FY25 Summary P&L | Non-GAAP1 ($ in millions, except per share data) Q3’24 Q2’25 Q3’25 Y/Y Q/Q Revenue $1,418.6 $1,272.9 $1,516.1 +7% +19% Gross margin 60.6% 61.9% 60.5% -10 bps -140 bps Operating expenses $437.1 $455.8 $466.9 +7% +2% Operating margin 29.8% 26.1% 29.7% -10 bps +360 bps Net income $354.1 $266.2 $373.0 +5% +40% Earnings per share2 $0.41 $0.30 $0.43 +5% +43% 1. See Appendices for GAAP to Non-GAAP reconciliation. 2. Earnings per share (EPS) = diluted earnings per share.

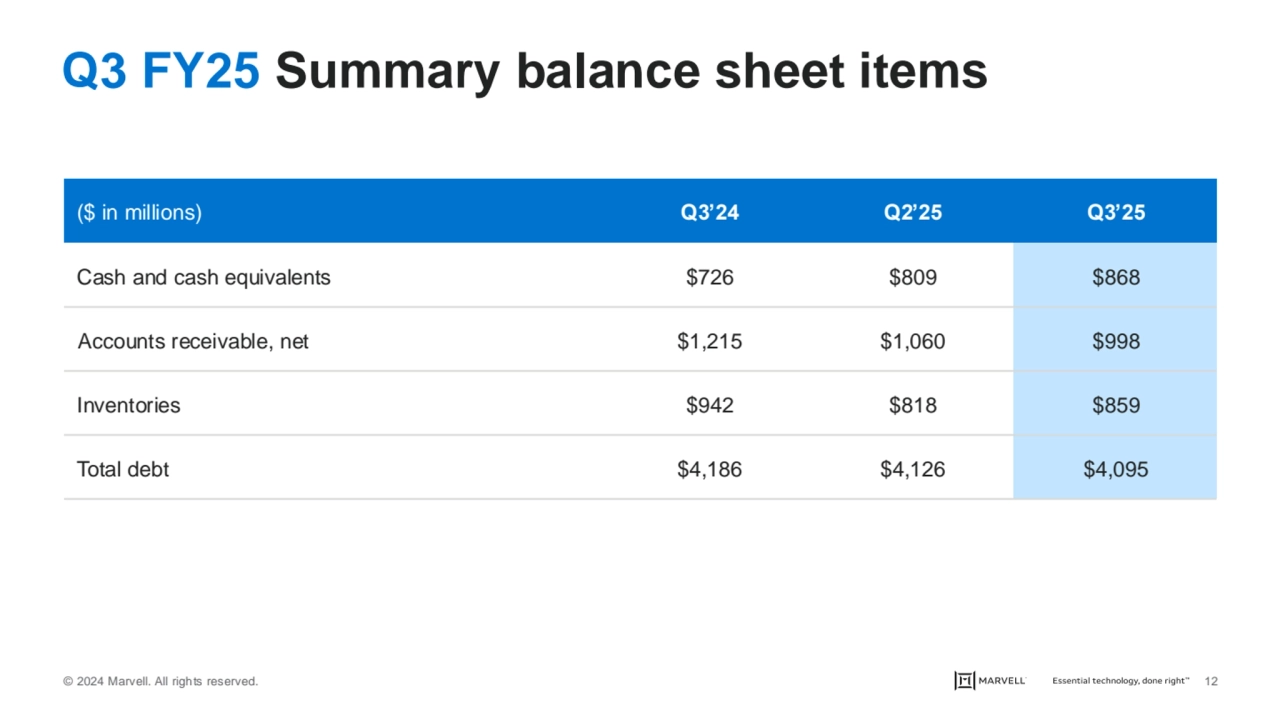

- 12. © 2024 Marvell. All rights reserved. 12 Q3 FY25 Summary balance sheet items ($ in millions) Q3’24 Q2’25 Q3’25 Cash and cash equivalents $726 $809 $868 Accounts receivable, net $1,215 $1,060 $998 Inventories $942 $818 $859 Total debt $4,186 $4,126 $4,095

- 13. © 2024 Marvell. All rights reserved. 13 Data center end market Q3 FY25 Highlights ▪ Announced 5-year, multi-generational agreement with Amazon Web Services, expanding relationship ▪ Strong ongoing demand from AI applications ▪ Significant step up in custom AI silicon ramp ▪ Began shipments of 5nm 1.6T PAM4 DSPs ▪ Strong bookings for 800G PAM4 DSPs ▪ Launched industry-first 3nm 1.6 Tbps PAM4 optical DSP ▪ Demonstrated industry-first PCIe Gen 7 connectivity ▪ Expect Q4 revenue to grow greater than 20% sequentially on a percentage basis, driven by high-volume production ramp of AI custom programs $556 $881 $1,101 Revenue ($M) Up 98% y/y and 25% q/q Strong demand for interconnects and custom silicon Q3’24 Q2’25 Q3’25

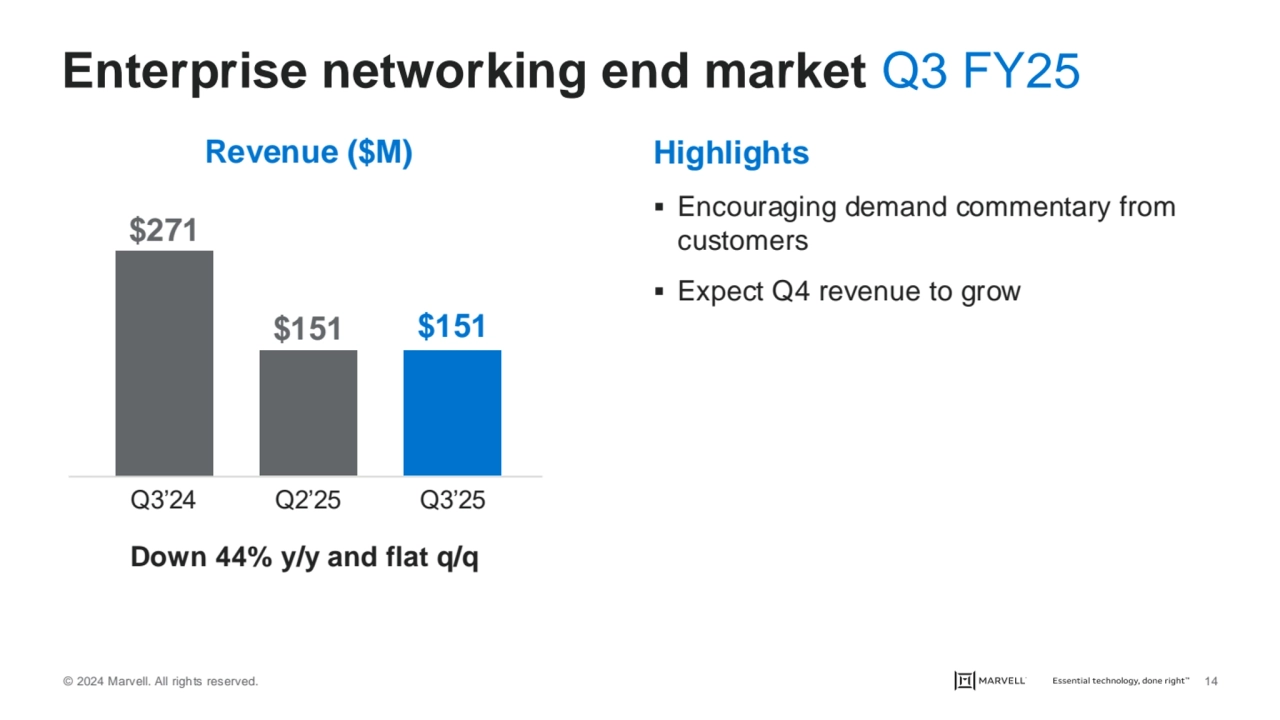

- 14. © 2024 Marvell. All rights reserved. 14 Enterprise networking end market Q3 FY25 Highlights ▪ Encouraging demand commentary from customers ▪ Expect Q4 revenue to grow $271 $151 $151 Revenue ($M) Down 44% y/y and flat q/q Q3’24 Q2’25 Q3’25

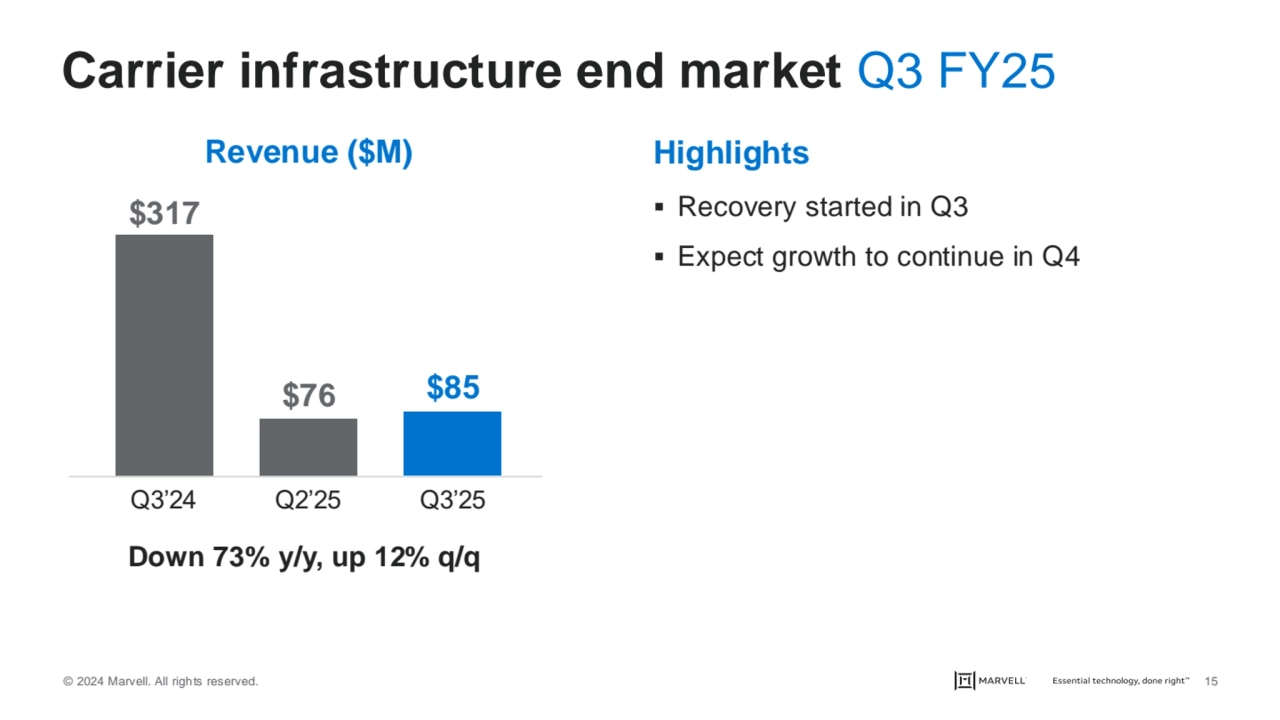

- 15. © 2024 Marvell. All rights reserved. 15 Carrier infrastructure end market Q3 FY25 Highlights ▪ Recovery started in Q3 ▪ Expect growth to continue in Q4 $317 $76 $85 Revenue ($M) Down 73% y/y, up 12% q/q Q3’24 Q2’25 Q3’25

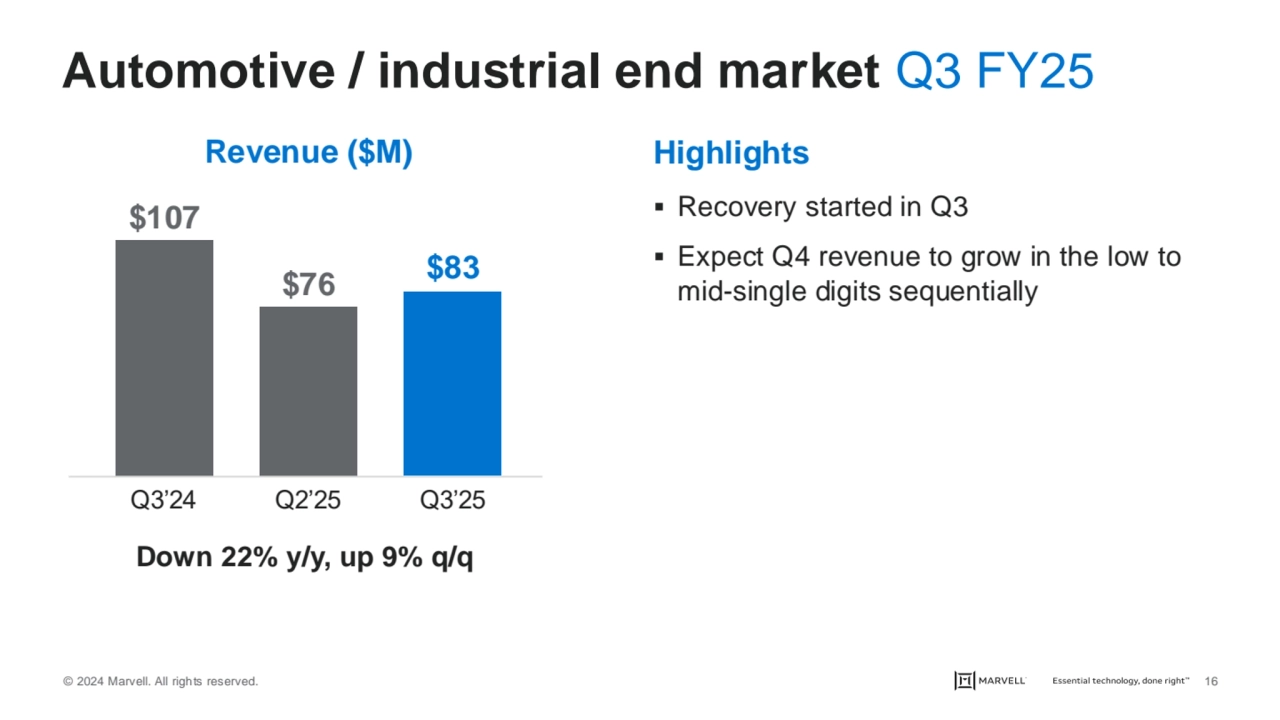

- 16. © 2024 Marvell. All rights reserved. 16 Automotive / industrial end market Q3 FY25 Highlights ▪ Recovery started in Q3 ▪ Expect Q4 revenue to grow in the low to mid-single digits sequentially $107 $76 $83 Revenue ($M) Down 22% y/y, up 9% q/q Q3’24 Q2’25 Q3’25

- 17. © 2024 Marvell. All rights reserved. 17 ($ in millions) Q3’24 Q2’25 Q3’25 Y/Y Q/Q Data center $555.8 $880.9 $1,101.1 +98% +25% Enterprise networking $271.1 $151.0 $150.9 -44% 0% Carrier infrastructure $316.5 $75.9 $84.7 -73% +12% Consumer $168.7 $88.9 $96.5 -43% +9% Automotive/industrial $106.5 $76.2 $82.9 -22% +9% Q3 FY25 Summary revenue by end market

- 18. © 2024 Marvell. All rights reserved. 18 Financial outlook ($ in millions, except per share data) Q4 FY25 (GAAP) Q4 FY25 (Non-GAAP1) Revenue $1,800 +/- 5% $1,800 +/- 5% Gross margin ~50% ~60% Operating expenses ~$710 ~$480 Diluted share count 877 million 877 million Diluted net income per share $0.16 +/- $0.05 $0.59 +/- $0.05 1. See Appendices for GAAP to Non-GAAP reconciliation.

- 19. © 2024 Marvell. All rights reserved. 19 Q3 FY25 Summary Revenue $1,516M Up 7% y/y Data center revenue $1,101M Up 98% y/y Non-GAAP gross margin 60.5% Non-GAAP EPS2 $0.43 Record data center revenue driven by AI 1. See Appendices for GAAP to Non-GAAP reconciliation. 2. Earnings per share (EPS) = diluted earnings per share

- 20. © 2024 Marvell. All rights reserved. 20 Appendices Reconciliations from GAAP to Non-GAAP

- 21. © 2024 Marvell. All rights reserved. 21 Non-GAAP financial measures exclude the effect of stock-based compensation expense, amortization of acquired intangible assets, acquisition and divestiture-related costs, restructuring and other related charges (including, but not limited to, asset impairment charges, recognition of future contractual obligations, employee severance costs, and facilities related charges), resolution of legal matters, and certain expenses and benefits that are driven primarily by discrete events that management does not consider to be directly related to Marvell’s core business. Although Marvell excludes the amortization of all acquired intangible assets from these non-GAAP financial measures, management believes that it is important for investors to understand that such intangible assets were recorded as part of purchase price accounting arising from acquisitions, and that such amortization of intangible assets that relate to past acquisitions will recur in future periods until such intangible assets have been fully amortized. Investors should note that the use of intangible assets contributed to Marvell’s revenues earned during the periods presented and are expected to contribute to Marvell’s future period revenues as well. Marvell uses a non-GAAP tax rate to compute the non-GAAP tax provision. This non-GAAP tax rate is based on Marvell’s estimated annual GAAP income tax forecast, adjusted to account for items excluded from Marvell’s non-GAAP income, as well as the effects of significant non-recurring and period specific tax items which vary in size and frequency, and excludes tax deductions and benefits from acquired tax loss and credit carryforwards and changes in valuation allowance on acquired deferred tax assets. Marvell’s non-GAAP tax rate is determined on an annual basis and may be adjusted during the year to take into account events that may materially affect the non-GAAP tax rate such as tax law changes; acquisitions; significant changes in Marvell’s geographic mix of revenue and expenses; or changes to Marvell’s corporate structure. For the third quarter of fiscal 2025, a non-GAAP tax rate of 7.0% has been applied to the non-GAAP financial results. Marvell believes that the presentation of non-GAAP financial measures provides important supplemental information to management and investors regarding financial and business trends relating to Marvell’s financial condition and results of operations. While Marvell uses non-GAAP financial measures as a tool to enhance its understanding of certain aspects of its financial performance, Marvell does not consider these measures to be a substitute for, or superior to, financial measures calculated in accordance with GAAP. Consistent with this approach, Marvell believes that disclosing non-GAAP financial measures to the readers of its financial statements provides such readers with useful supplemental data that, while not a substitute for GAAP financial measures, allows for greater transparency in the review of its financial and operational performance. Externally, management believes that investors may find Marvell’s non-GAAP financial measures useful in their assessment of Marvell’s operating performance and the valuation of Marvell. Internally, Marvell’s non-GAAP financial measures are used in the following areas: ▪ Management’s evaluation of Marvell’s operating performance; ▪ Management’s establishment of internal operating budgets; ▪ Management’s performance comparisons with internal forecasts and targeted business models; and ▪ Management’s determination of the achievement and measurement of certain types of compensation including Marvell’s annual incentive plan and certain performance-based equity awards (adjustments may vary from award to award). Non-GAAP financial measures have limitations in that they do not reflect all of the costs associated with the operations of Marv ell’s business as determined in accordance with GAAP. As a result, you should not consider these measures in isolation or as a substitute for analysis of Marvell’s results as reported under GAAP. The exclusion of the above items from our GAAP financial metrics does not necessarily mean that these costs are unusual or infrequent. Discussion of Non-GAAP financial measures

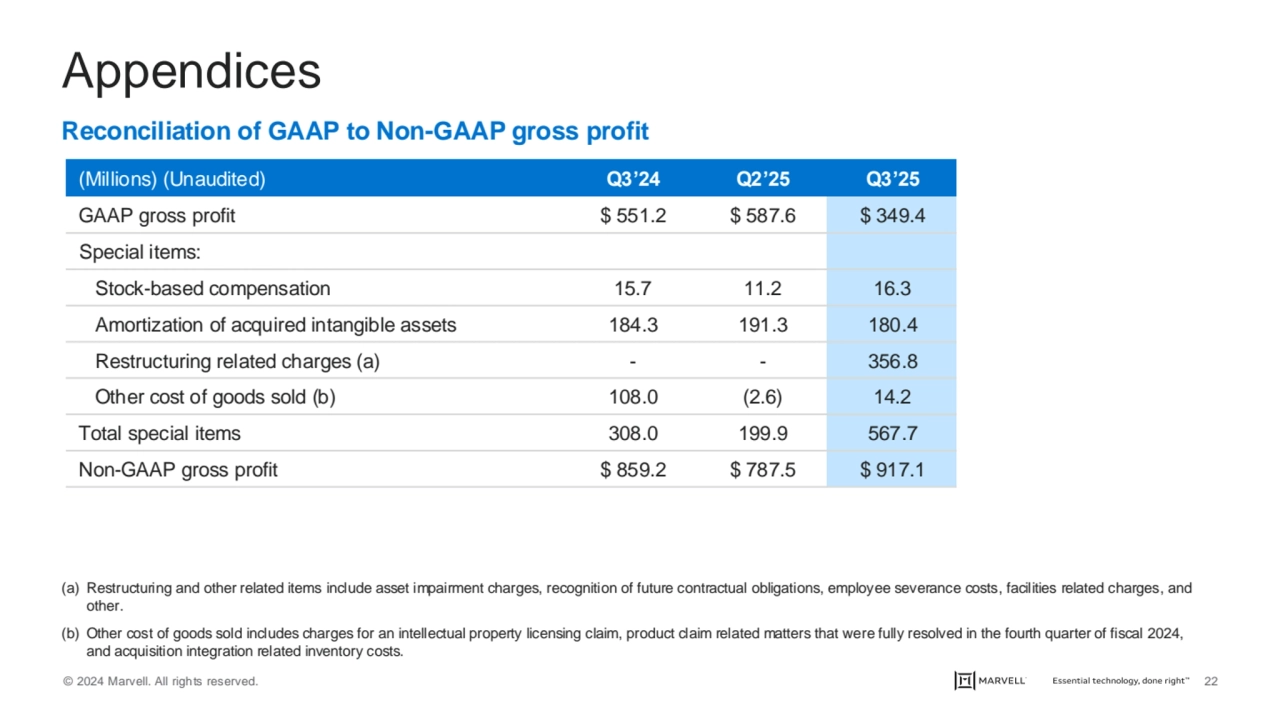

- 22. © 2024 Marvell. All rights reserved. 22 Appendices (Millions) (Unaudited) Q3’24 Q2’25 Q3’25 GAAP gross profit $ 551.2 $ 587.6 $ 349.4 Special items: Stock-based compensation 15.7 11.2 16.3 Amortization of acquired intangible assets 184.3 191.3 180.4 Restructuring related charges (a) - - 356.8 Other cost of goods sold (b) 108.0 (2.6) 14.2 Total special items 308.0 199.9 567.7 Non-GAAP gross profit $ 859.2 $ 787.5 $ 917.1 Reconciliation of GAAP to Non-GAAP gross profit (a) Restructuring and other related items include asset impairment charges, recognition of future contractual obligations, employee severance costs, facilities related charges, and other. (b) Other cost of goods sold includes charges for an intellectual property licensing claim, product claim related matters that were fully resolved in the fourth quarter of fiscal 2024, and acquisition integration related inventory costs.

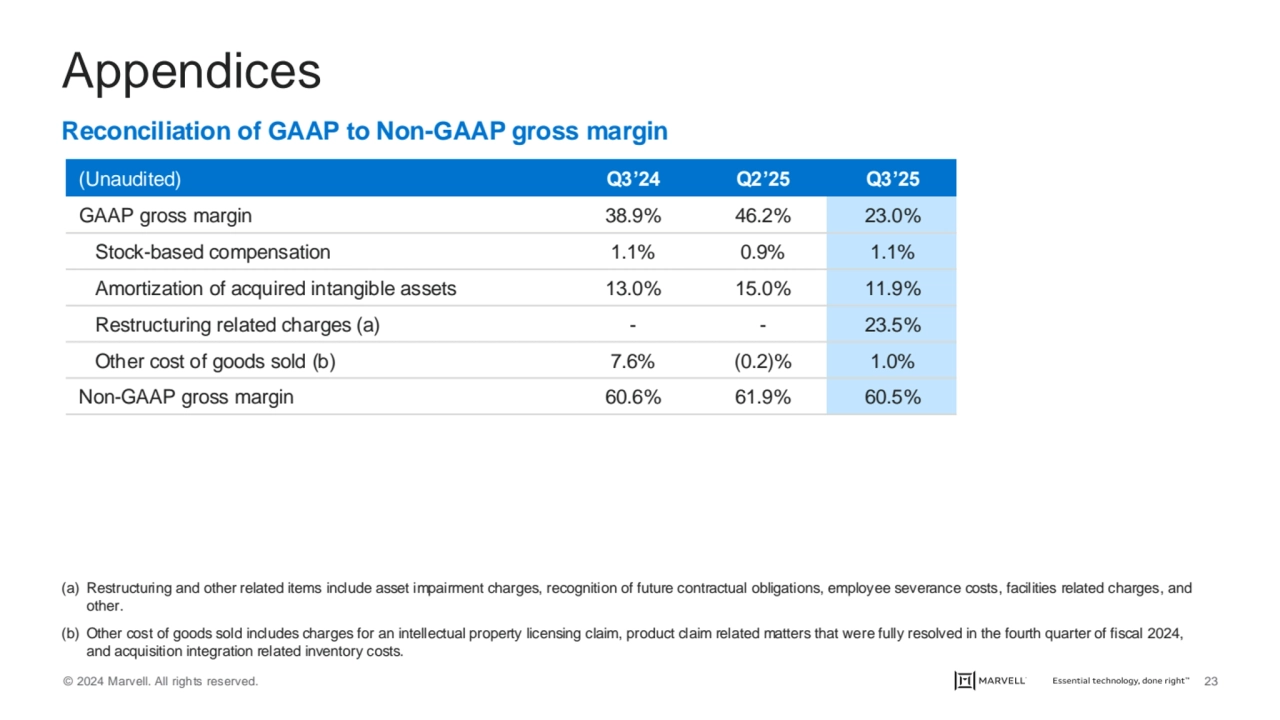

- 23. © 2024 Marvell. All rights reserved. 23 Appendices (Unaudited) Q3’24 Q2’25 Q3’25 GAAP gross margin 38.9% 46.2% 23.0% Stock-based compensation 1.1% 0.9% 1.1% Amortization of acquired intangible assets 13.0% 15.0% 11.9% Restructuring related charges (a) - - 23.5% Other cost of goods sold (b) 7.6% (0.2)% 1.0% Non-GAAP gross margin 60.6% 61.9% 60.5% Reconciliation of GAAP to Non-GAAP gross margin (a) Restructuring and other related items include asset impairment charges, recognition of future contractual obligations, employee severance costs, facilities related charges, and other. (b) Other cost of goods sold includes charges for an intellectual property licensing claim, product claim related matters that were fully resolved in the fourth quarter of fiscal 2024, and acquisition integration related inventory costs.

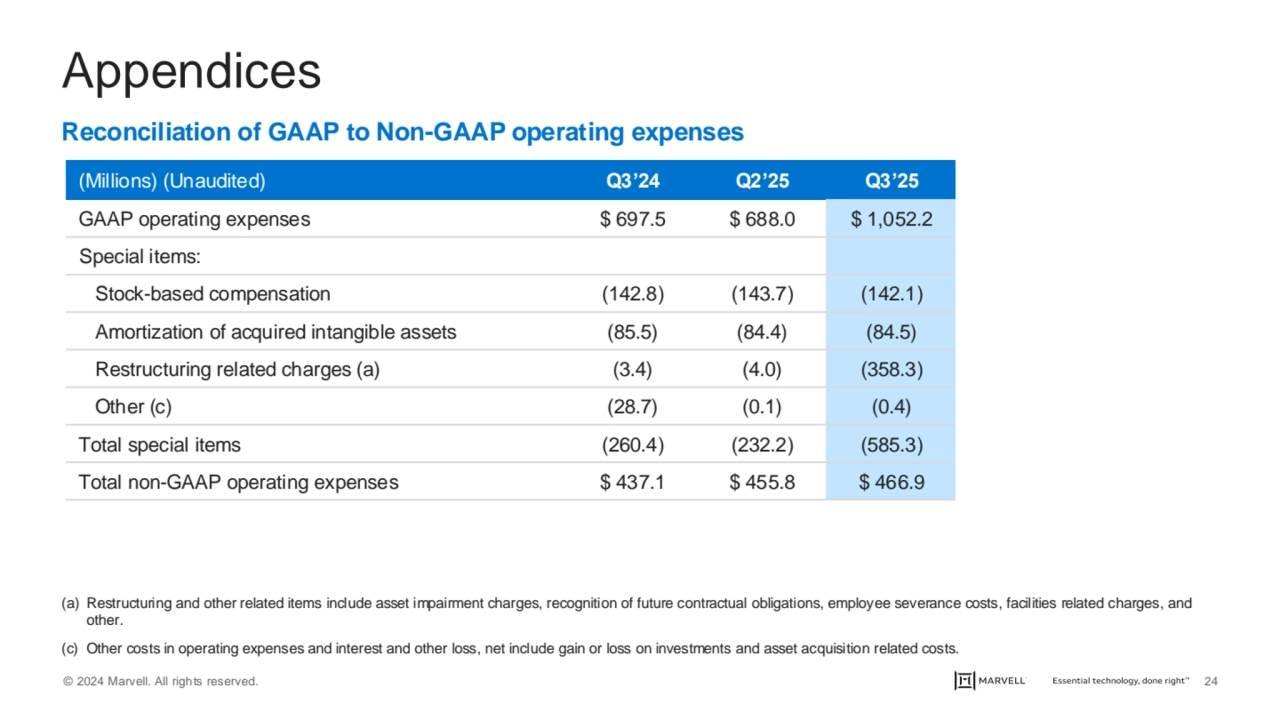

- 24. © 2024 Marvell. All rights reserved. 24 Appendices Reconciliation of GAAP to Non-GAAP operating expenses (Millions) (Unaudited) Q3’24 Q2’25 Q3’25 GAAP operating expenses $ 697.5 $ 688.0 $ 1,052.2 Special items: Stock-based compensation (142.8) (143.7) (142.1) Amortization of acquired intangible assets (85.5) (84.4) (84.5) Restructuring related charges (a) (3.4) (4.0) (358.3) Other (c) (28.7) (0.1) (0.4) Total special items (260.4) (232.2) (585.3) Total non-GAAP operating expenses $ 437.1 $ 455.8 $ 466.9 (a) Restructuring and other related items include asset impairment charges, recognition of future contractual obligations, employee severance costs, facilities related charges, and other. (c) Other costs in operating expenses and interest and other loss, net include gain or loss on investments and asset acquisition related costs.

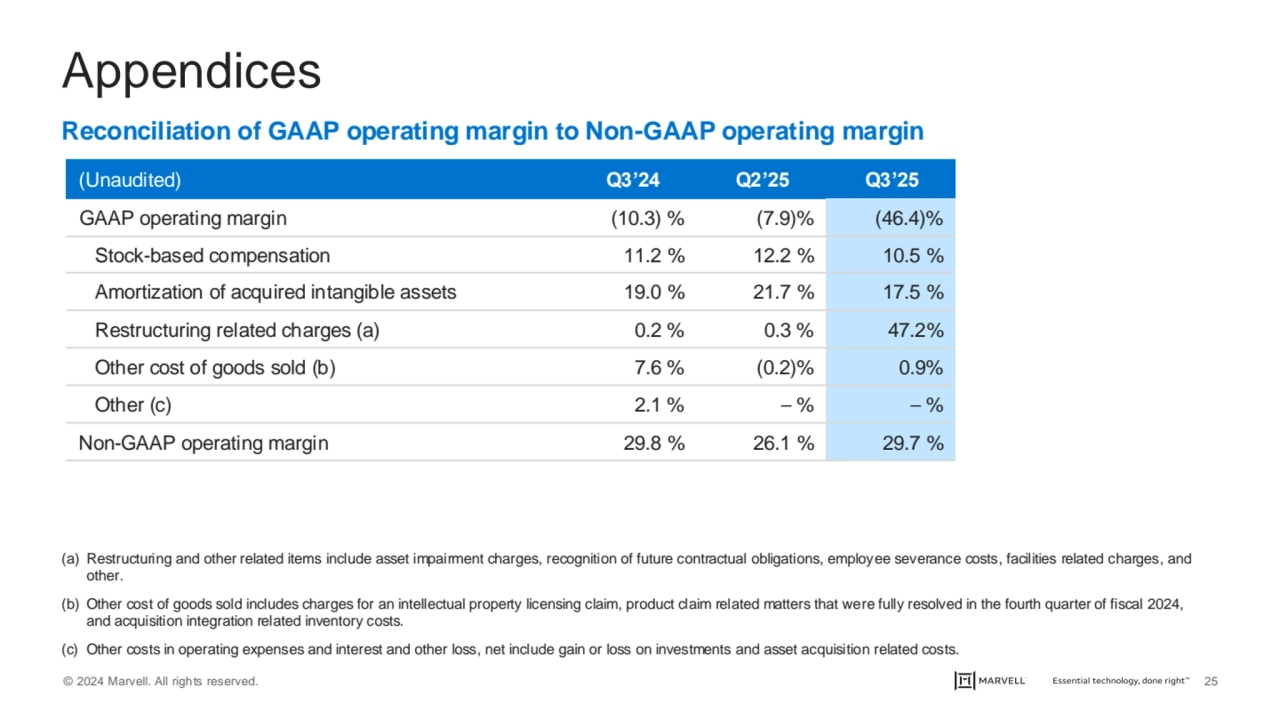

- 25. © 2024 Marvell. All rights reserved. 25 Appendices Reconciliation of GAAP operating margin to Non-GAAP operating margin (Unaudited) Q3’24 Q2’25 Q3’25 GAAP operating margin (10.3) % (7.9)% (46.4)% Stock-based compensation 11.2 % 12.2 % 10.5 % Amortization of acquired intangible assets 19.0 % 21.7 % 17.5 % Restructuring related charges (a) 0.2 % 0.3 % 47.2% Other cost of goods sold (b) 7.6 % (0.2)% 0.9% Other (c) 2.1 % ⎯ % ⎯ % Non-GAAP operating margin 29.8 % 26.1 % 29.7 % (a) Restructuring and other related items include asset impairment charges, recognition of future contractual obligations, employee severance costs, facilities related charges, and other. (b) Other cost of goods sold includes charges for an intellectual property licensing claim, product claim related matters that were fully resolved in the fourth quarter of fiscal 2024, and acquisition integration related inventory costs. (c) Other costs in operating expenses and interest and other loss, net include gain or loss on investments and asset acquisition related costs.

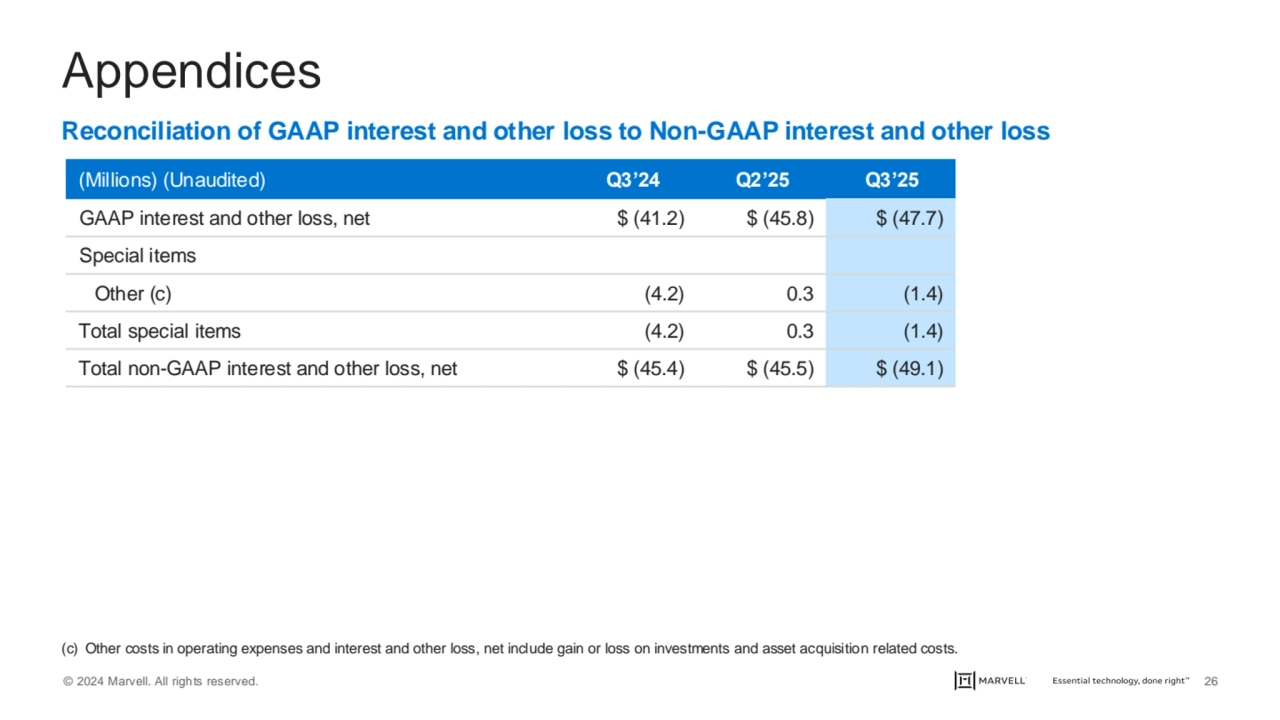

- 26. © 2024 Marvell. All rights reserved. 26 Appendices Reconciliation of GAAP interest and other loss to Non-GAAP interest and other loss (Millions) (Unaudited) Q3’24 Q2’25 Q3’25 GAAP interest and other loss, net $ (41.2) $ (45.8) $ (47.7) Special items Other (c) (4.2) 0.3 (1.4) Total special items (4.2) 0.3 (1.4) Total non-GAAP interest and other loss, net $ (45.4) $ (45.5) $ (49.1) (c) Other costs in operating expenses and interest and other loss, net include gain or loss on investments and asset acquisition related costs.

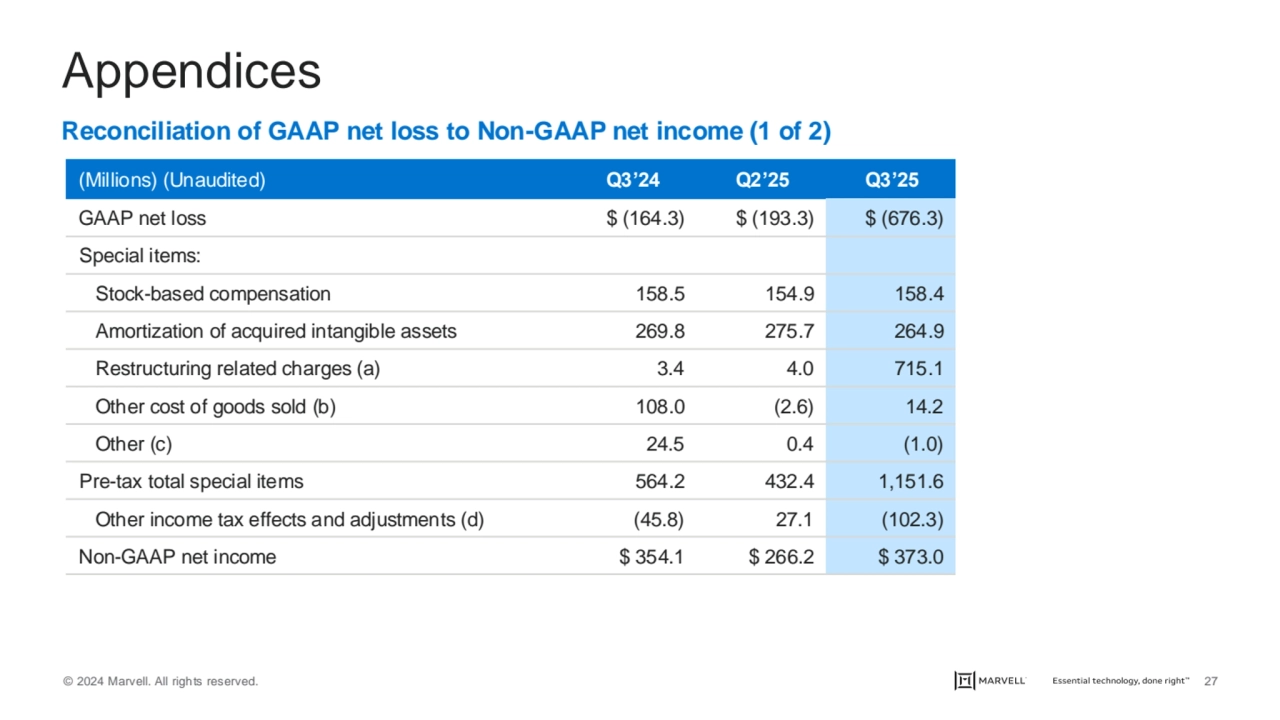

- 27. © 2024 Marvell. All rights reserved. 27 Appendices Reconciliation of GAAP net loss to Non-GAAP net income (1 of 2) (Millions) (Unaudited) Q3’24 Q2’25 Q3’25 GAAP net loss $ (164.3) $ (193.3) $ (676.3) Special items: Stock-based compensation 158.5 154.9 158.4 Amortization of acquired intangible assets 269.8 275.7 264.9 Restructuring related charges (a) 3.4 4.0 715.1 Other cost of goods sold (b) 108.0 (2.6) 14.2 Other (c) 24.5 0.4 (1.0) Pre-tax total special items 564.2 432.4 1,151.6 Other income tax effects and adjustments (d) (45.8) 27.1 (102.3) Non-GAAP net income $ 354.1 $ 266.2 $ 373.0

- 28. © 2024 Marvell. All rights reserved. 28 Appendices Reconciliation of GAAP net loss to Non-GAAP net income (2 of 2) (a) Restructuring and other related items include asset impairment charges, recognition of future contractual obligations, employee severance costs, facilities related charges, and other. (b) Other cost of goods sold includes charges for an intellectual property licensing claim, product claim related matters that were fully resolved in the fourth quarter of fiscal 2024, and acquisition integration related inventory costs. (c) Other costs in operating expenses and interest and other loss, net include gain or loss on investments and asset acquisition related costs. (d) Other income tax effects and adjustments relate to tax provision based on a non-GAAP income tax rate of 7.0% for the three and nine months ended November 2, 2024 and three months ended August 3, 2024. Other income tax effects and adjustments relate to tax provision based on a non-GAAP income tax rate of 6% for the three and nine months ended October 28, 2023.

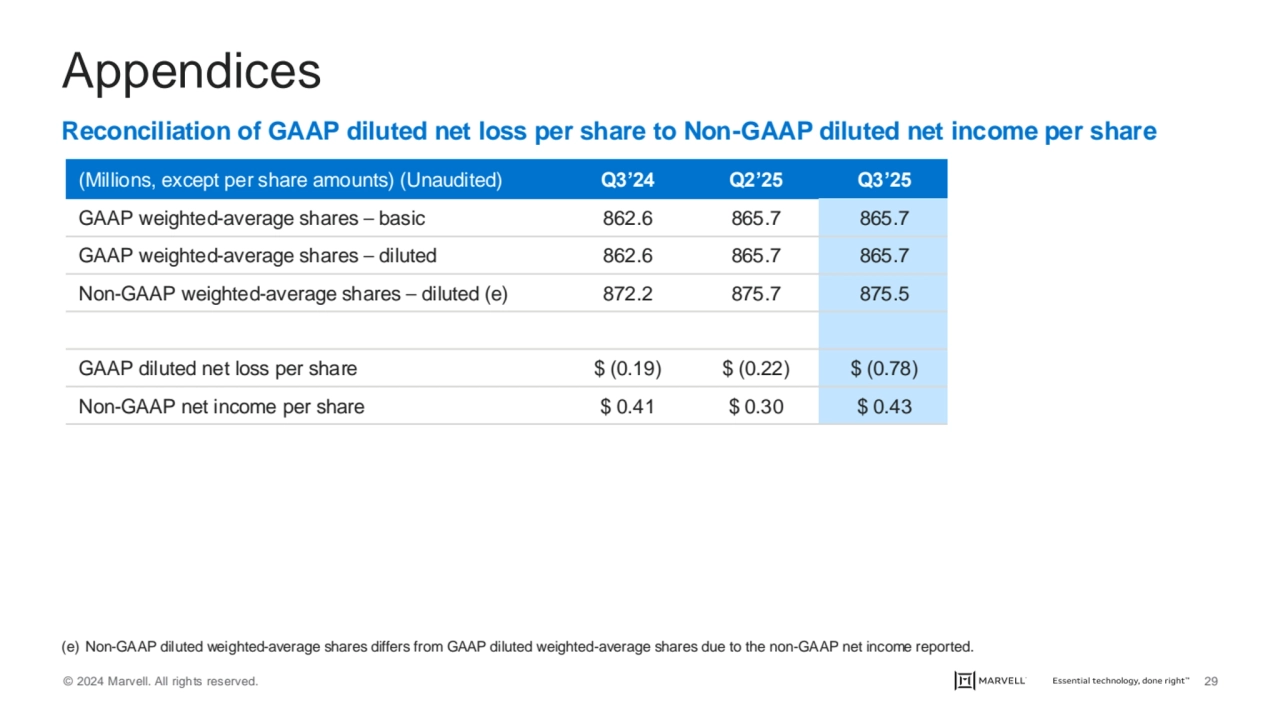

- 29. © 2024 Marvell. All rights reserved. 29 Appendices Reconciliation of GAAP diluted net loss per share to Non-GAAP diluted net income per share (Millions, except per share amounts) (Unaudited) Q3’24 Q2’25 Q3’25 GAAP weighted-average shares ⎯ basic 862.6 865.7 865.7 GAAP weighted-average shares ⎯ diluted 862.6 865.7 865.7 Non-GAAP weighted-average shares ⎯ diluted (e) 872.2 875.7 875.5 GAAP diluted net loss per share $ (0.19) $ (0.22) $ (0.78) Non-GAAP net income per share $ 0.41 $ 0.30 $ 0.43 (e) Non-GAAP diluted weighted-average shares differs from GAAP diluted weighted-average shares due to the non-GAAP net income reported.

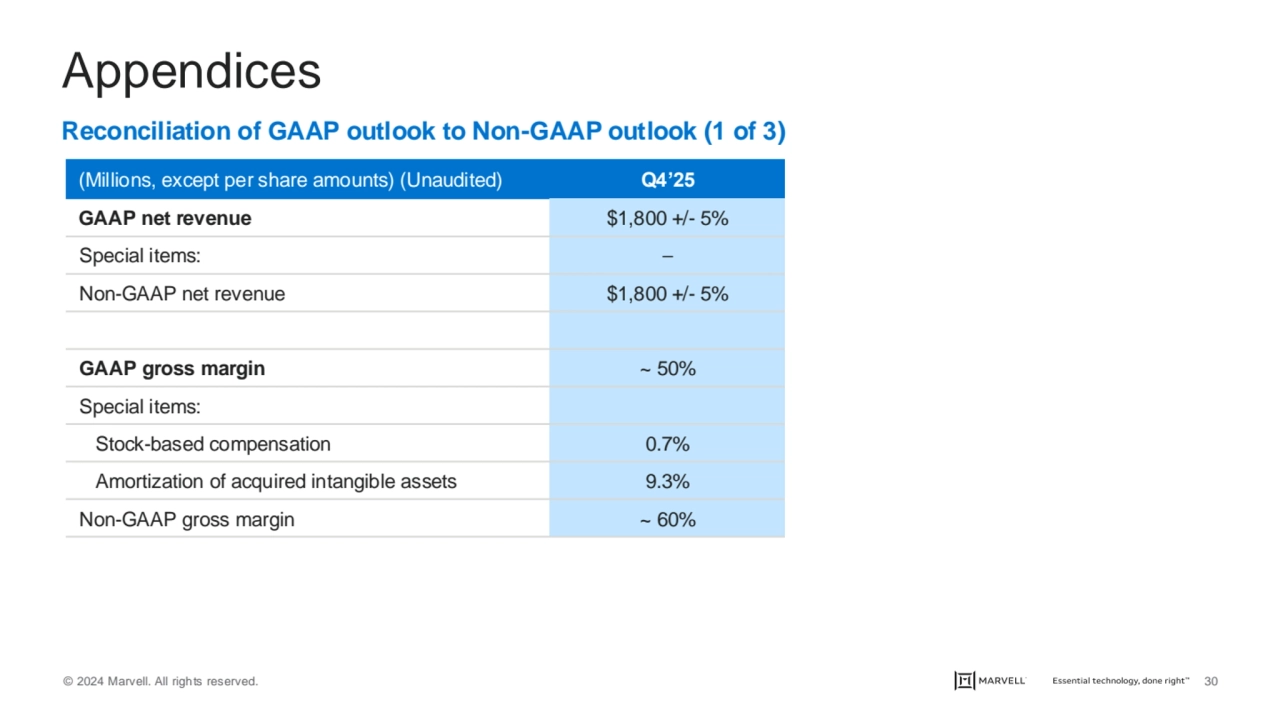

- 30. © 2024 Marvell. All rights reserved. 30 Appendices Reconciliation of GAAP outlook to Non-GAAP outlook (1 of 3) (Millions, except per share amounts) (Unaudited) Q4’25 GAAP net revenue $1,800 +/- 5% Special items: ⎯ Non-GAAP net revenue $1,800 +/- 5% GAAP gross margin ~ 50% Special items: Stock-based compensation 0.7% Amortization of acquired intangible assets 9.3% Non-GAAP gross margin ~ 60%

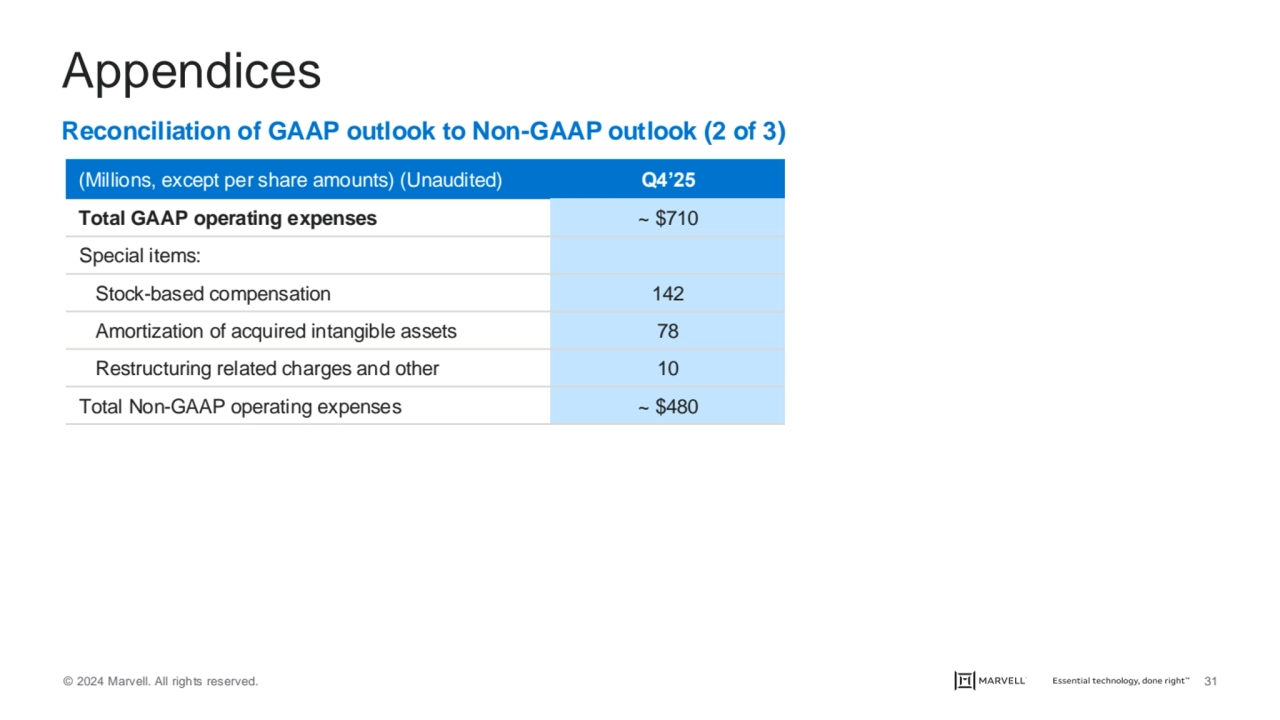

- 31. © 2024 Marvell. All rights reserved. 31 Appendices Reconciliation of GAAP outlook to Non-GAAP outlook (2 of 3) (Millions, except per share amounts) (Unaudited) Q4’25 Total GAAP operating expenses ~ $710 Special items: Stock-based compensation 142 Amortization of acquired intangible assets 78 Restructuring related charges and other 10 Total Non-GAAP operating expenses ~ $480

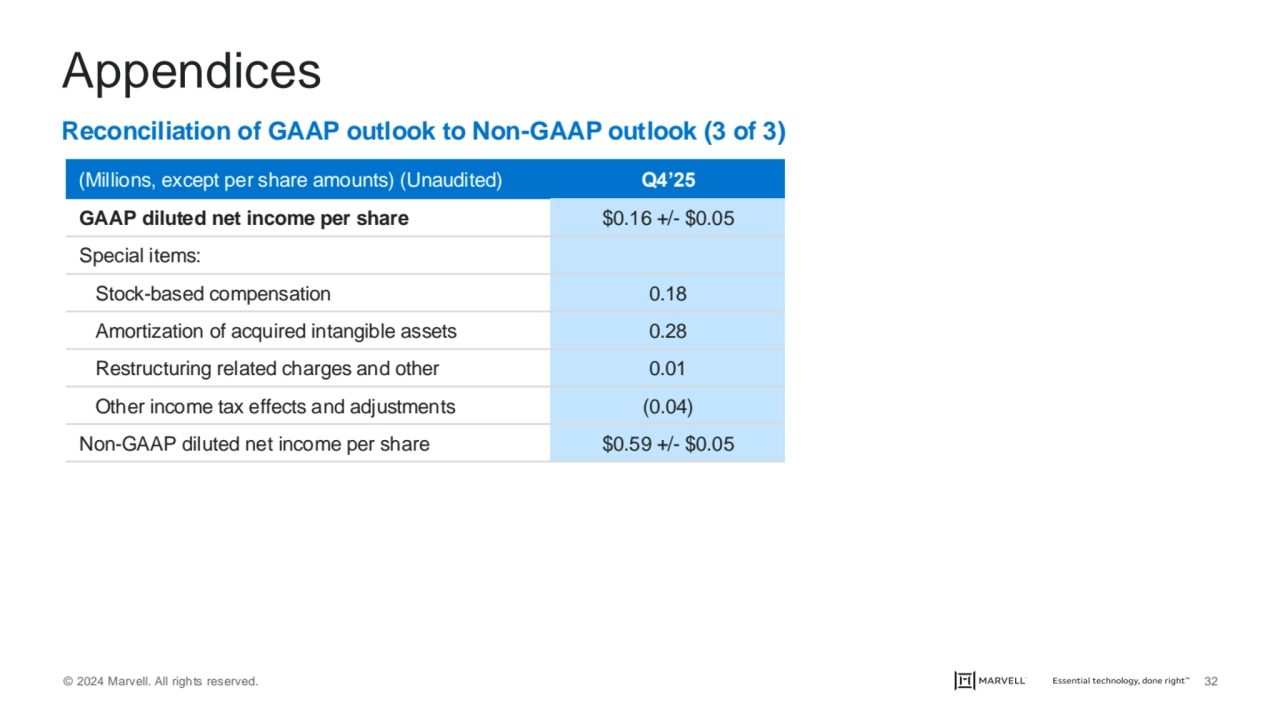

- 32. © 2024 Marvell. All rights reserved. 32 Appendices Reconciliation of GAAP outlook to Non-GAAP outlook (3 of 3) (Millions, except per share amounts) (Unaudited) Q4’25 GAAP diluted net income per share $0.16 +/- $0.05 Special items: Stock-based compensation 0.18 Amortization of acquired intangible assets 0.28 Restructuring related charges and other 0.01 Other income tax effects and adjustments (0.04) Non-GAAP diluted net income per share $0.59 +/- $0.05