VC Marketing and Branding 101.pdf

VC Marketing and Branding 101.pdf

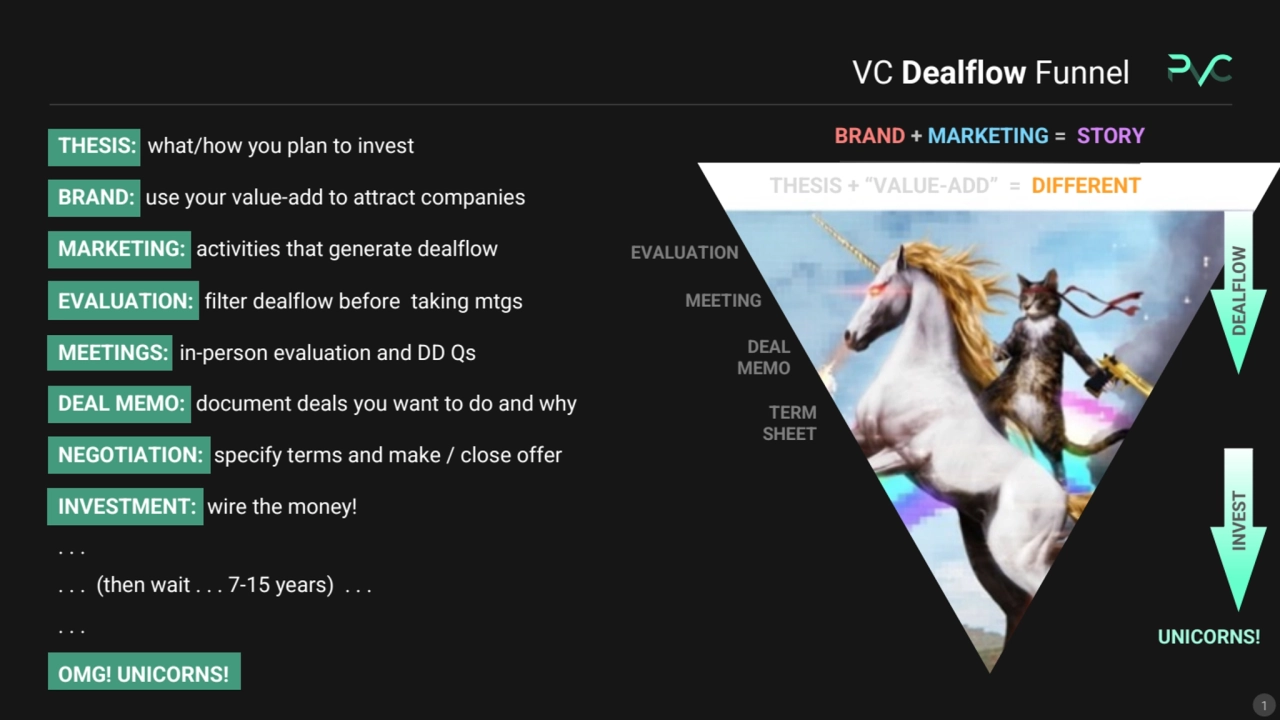

- The document outlines a VC dealflow funnel, emphasizing the importance of Brand + Marketing = Story and Thesis + Value-Add = Differentiation

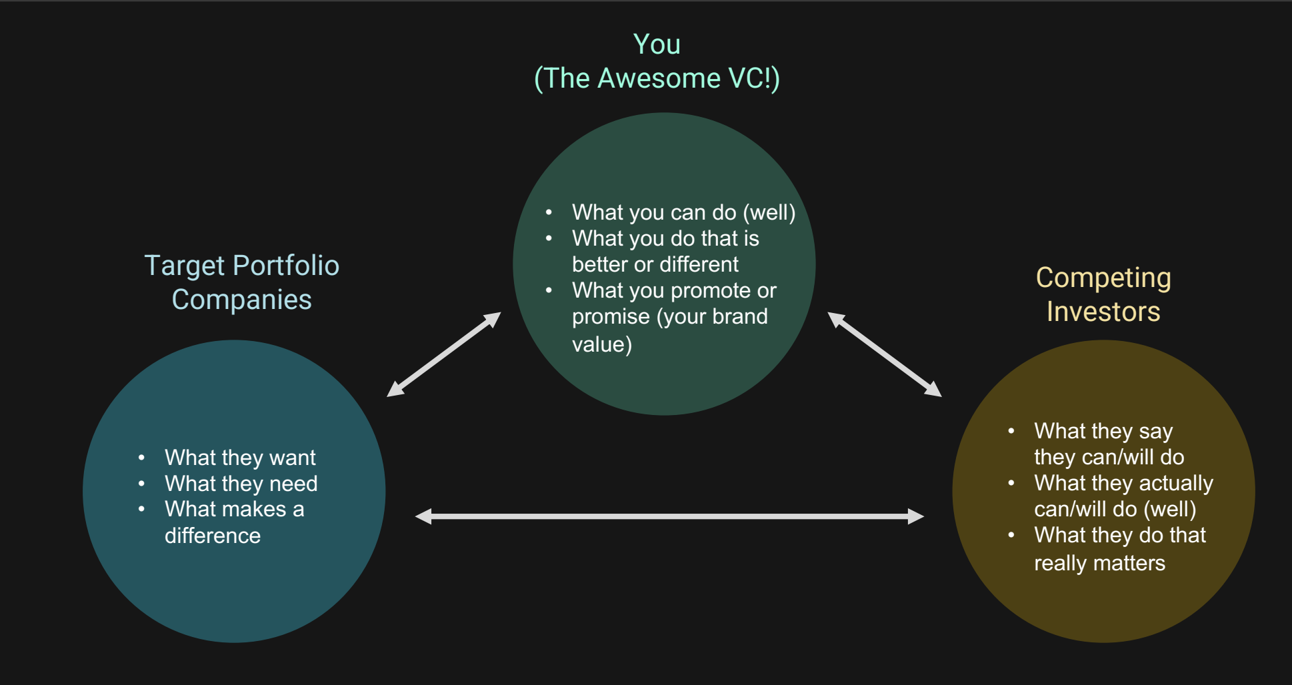

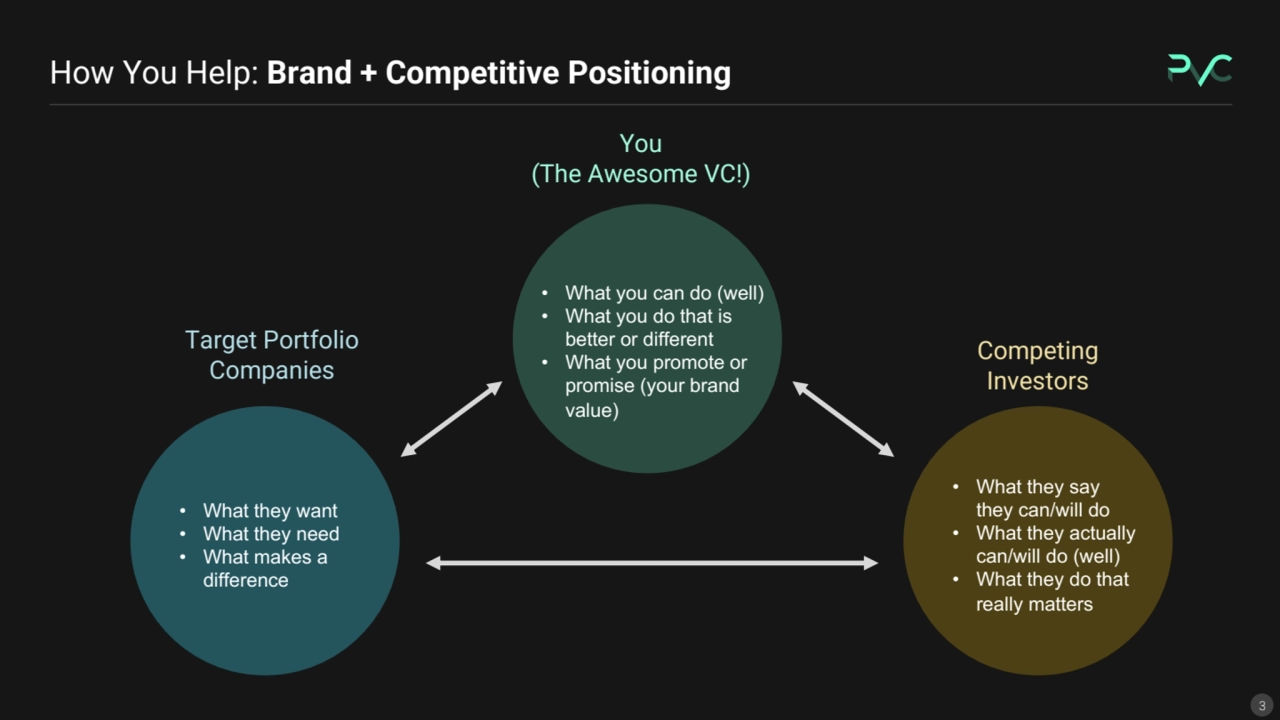

- It highlights the need for defining your investment thesis, competitive positioning, and how you plan to help portfolio companies.

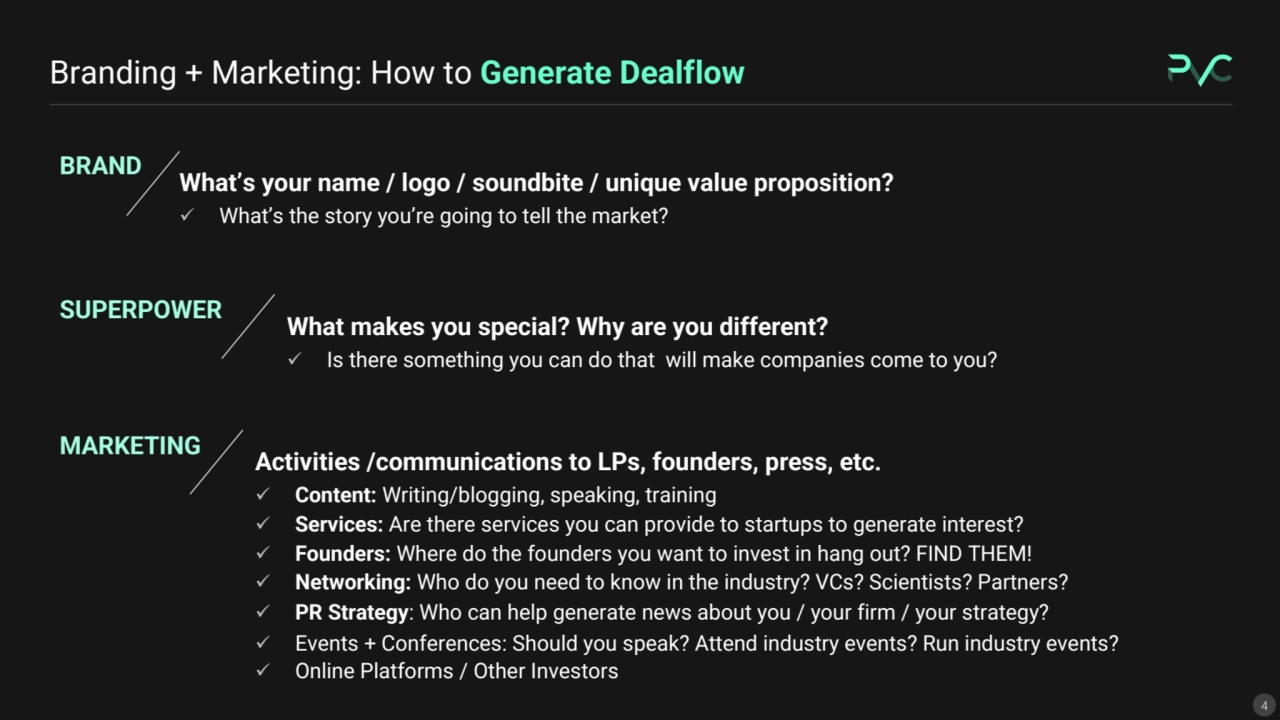

- The document emphasizes that branding and marketing are essential to generate dealflow, focusing on unique value propositions and communication strategies.

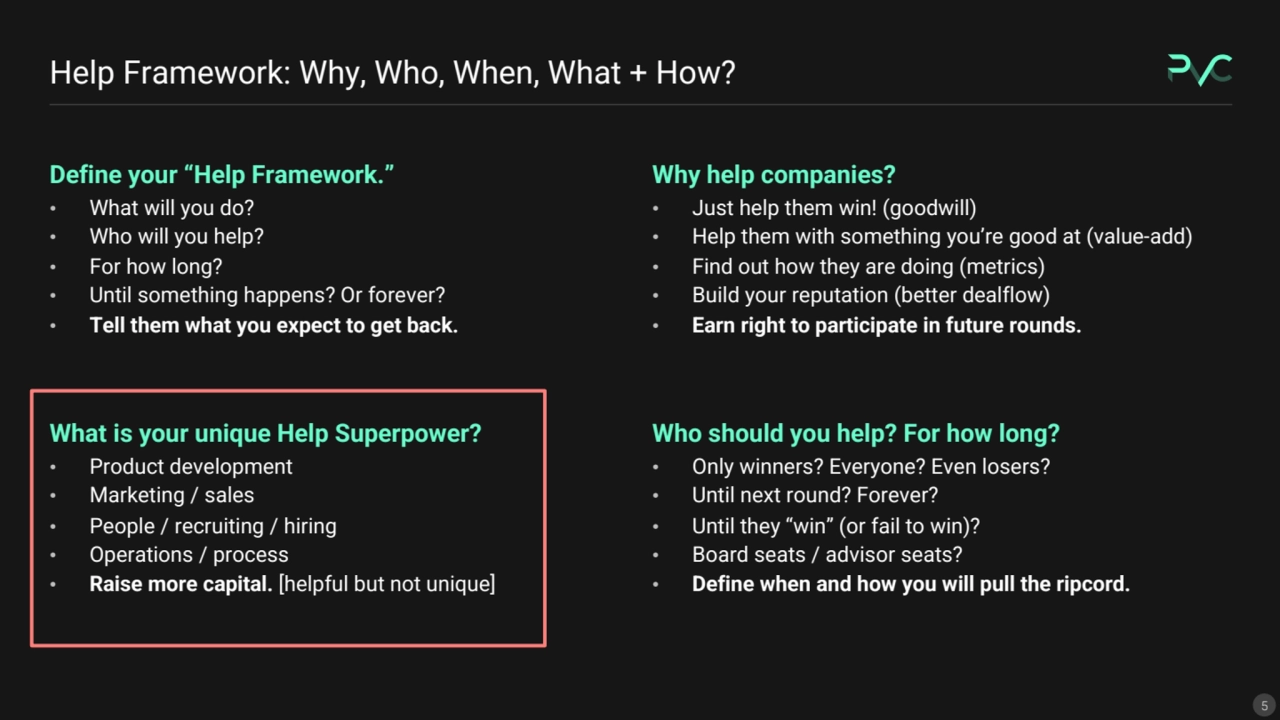

- It touches on the importance of a help framework for portfolio companies, detailing unique help superpowers and how to effectively support them.

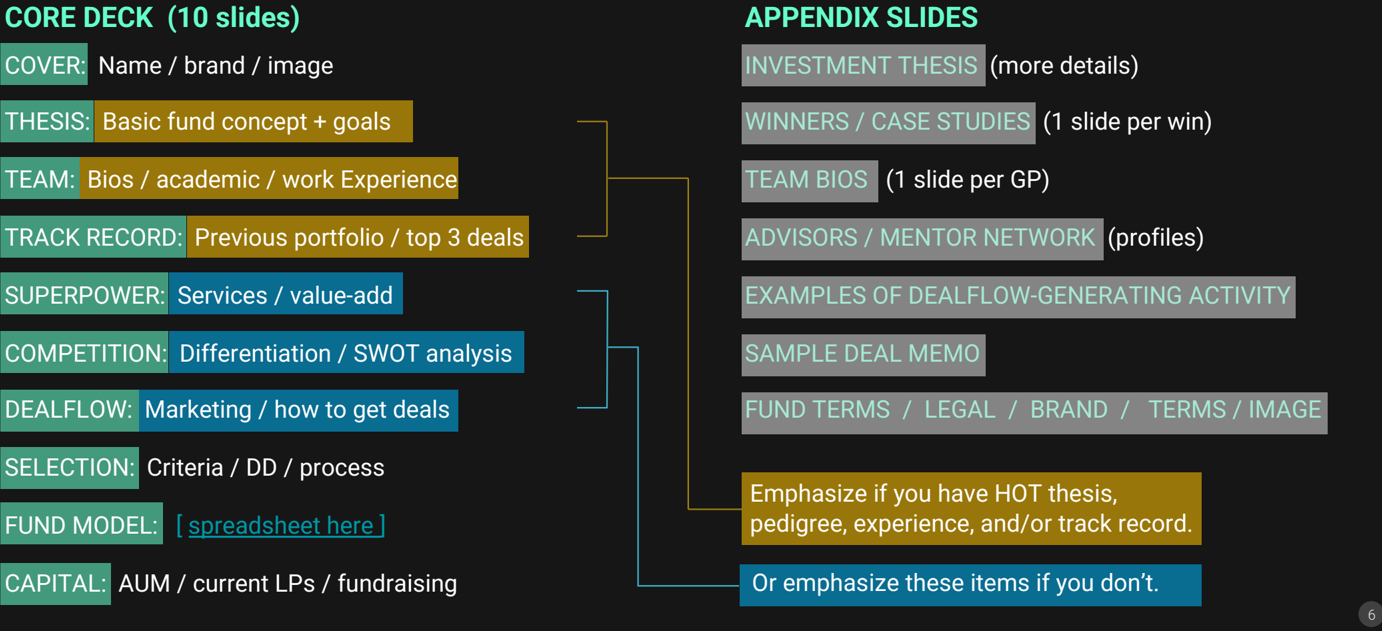

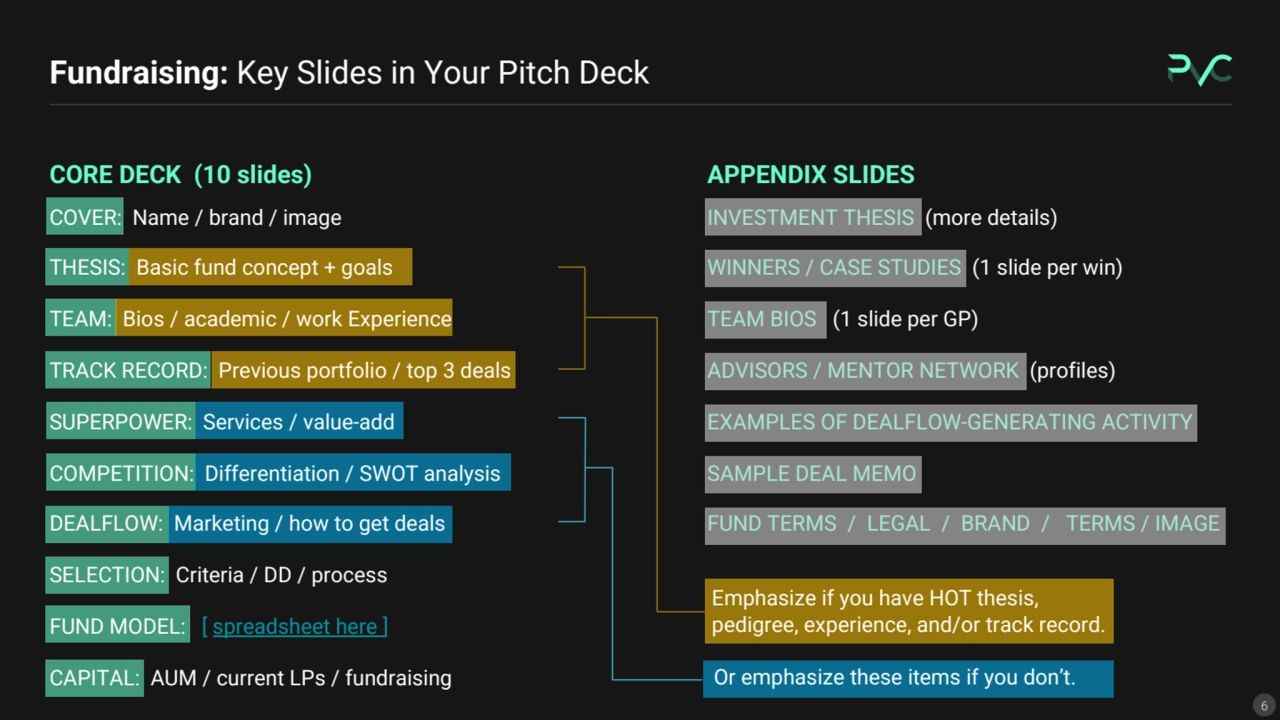

- It provides an overview of essential slides for a fundraising pitch deck, covering core elements like thesis, team, track record, and appendix materials.

VC Marketing and Branding 101.pdf

@davemcclure2 months ago

DAVE McCLURE FUND BRANDING STRATEGIES 11.18.21

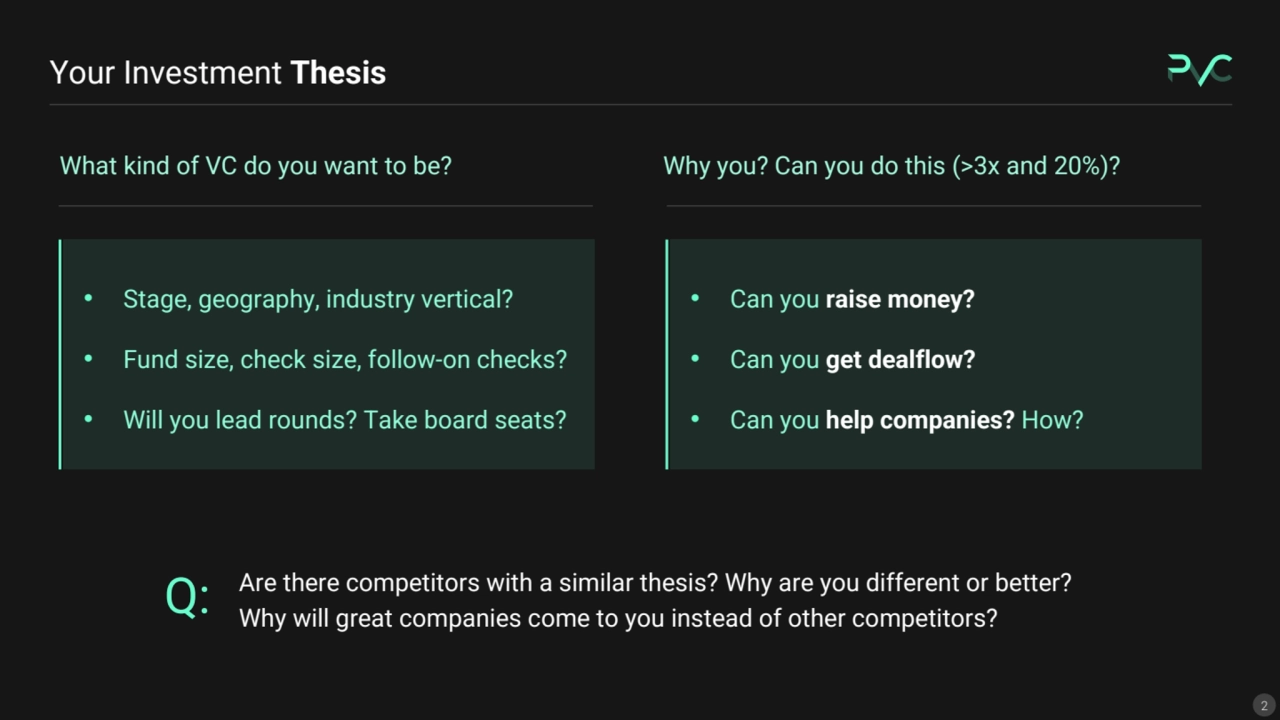

- · Stage, geography, industry vertical?

- · Fund size, check size, follow-on checks?

- · Will you lead rounds? Take board seats?

- · Can you raise money?

- · Can you get dealflow?

- · Can you help companies? How?

- ü What's the story you're going to tell the market?

- ü Is there something you can do that will make companies come to you?

- ü Content: Writing/blogging, speaking, training

- ü Services: Are there services you can provide to startups to generate interest?

- ü Founders: Where do the founders you want to invest in hang out? FIND THEM!

- ü Networking: Who do you need to know in the industry? VCs? Scientists? Partners?

- ü PR Strategy : Who can help generate news about you / your firm / your strategy?

- ü Events + Conferences: Should you speak? Attend industry events? Run industry events?

- ü Online Platforms / Other Investors

- · What will you do?

- · Who will you help?

- · For how long?

- · Until something happens? Or forever?

- · Tell them what you expect to get back.

- · Product development

- · Marketing / sales

- · People / recruiting / hiring

- · Operations / process

- · Raise more capital. [helpful but not unique]

- · Just help them win! (goodwill)

- · Help them with something you're good at (value-add)

- · Find out how they are doing (metrics)

- · Build your reputation (better dealflow)

- · Earn right to participate in future rounds.

- · Only winners? Everyone? Even losers?

- · Until next round? Forever?

- · Until they 'win' (or fail to win)?

- · Board seats / advisor seats?

- · Define when and how you will pull the ripcord.

THESIS:

what/how you plan to invest

BRAND:

use your value-add to attract companies

MARKETING:

activities that generate dealflow

EVALUATION:

filter dealflow before taking mtgs

MEETINGS:

in-person evaluation and DD Qs

DEAL MEMO:

document deals you want to do and why

NEGOTIATION:

specify terms and make / close offer

INVESTMENT:

wire the money!

. . .

. . . (then wait . . . 7-15 years) . . .

. . .

EVALUATION

MEETING

DEAL MEMO

VC Dealflow Funnel

BRAND + MARKETING = STORY

THESIS + 'VALUE-ADD' = DIFFERENT

1

Your Investment Thesis

What kind of VC do you want to be?

Q:

Why you? Can you do this (>3x and 20%)?

Are there competitors with a similar thesis? Why are you different or better? Why will great companies come to you instead of other competitors?

How You Help: Brand + Competitive Positioning

Branding + Marketing: How to Generate Dealflow

BRAND

What's your name / logo / soundbite / unique value proposition?

SUPERPOWER

MARKETING

What makes you special? Why are you different?

Activities /communications to LPs, founders, press, etc.

Help Framework: Why, Who, When, What + How?

Define your 'Help Framework.'

What is your unique Help Superpower?

Why help companies?

Who should you help? For how long?

Fundraising: Key Slides in Your Pitch Deck

Related Jaunts

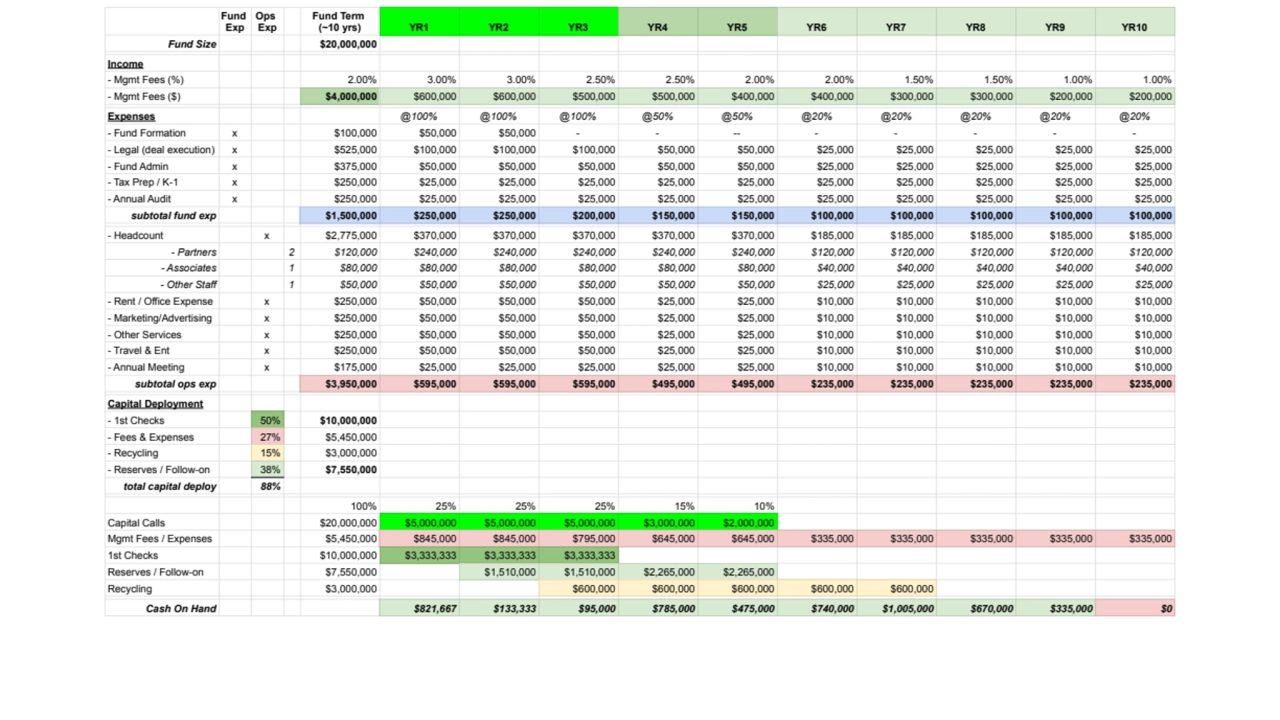

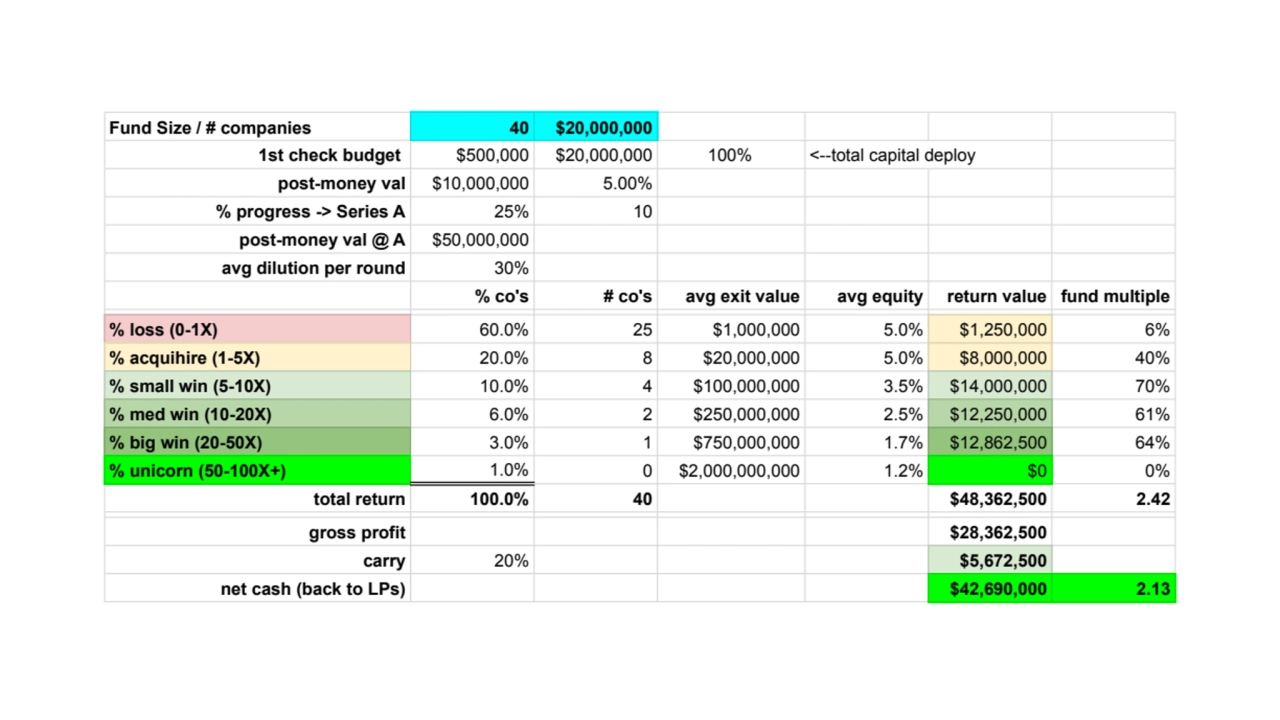

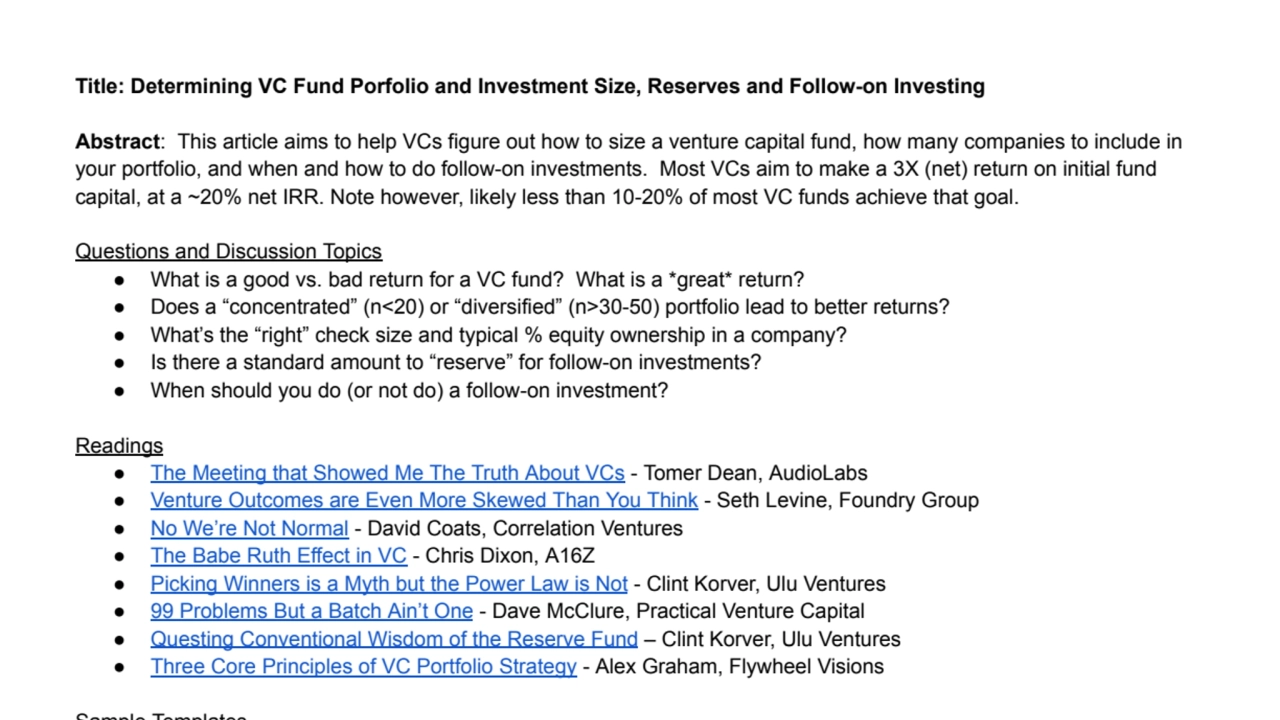

VC Portfolio Modeling: Determining Portfolio & Investment Size

@davemcclure

Raising your first round of investment - Are you sure you are investible?

@techcelerate

De-risking tech startups for pre-seed investors through SkilledUp Life Volunteers

@skilleduplife

More from author