2025 RingCentral 2Q 2025 Financial Results

AI Summary

AI Summary

Key Insights

- 📈 Financial Performance: RingCentral's 2Q 2025 showcases strong revenue and subscription growth year-over-year.

- 🤝 Strategic Partnerships: Expanded collaborations with NICE and AT&T aim to broaden market reach.

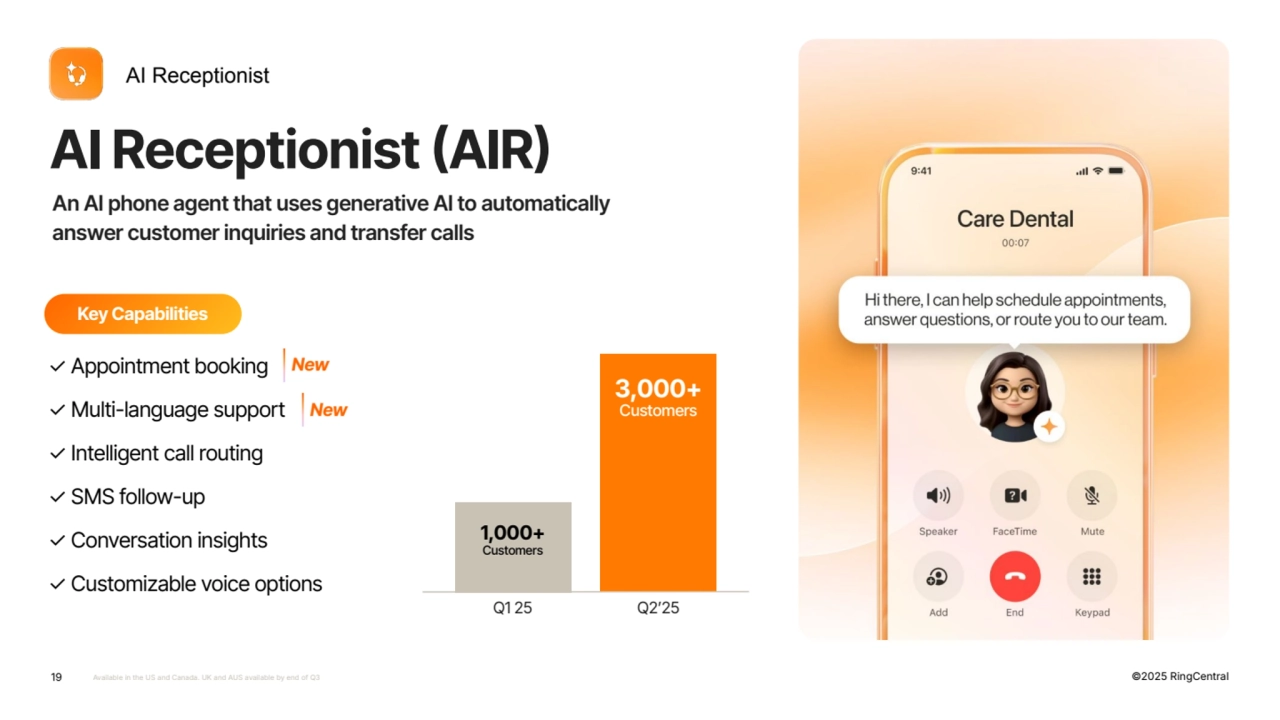

- 🤖 AI-Driven Innovations: AI Receptionist and RingSense are gaining customer traction with AI-powered capabilities.

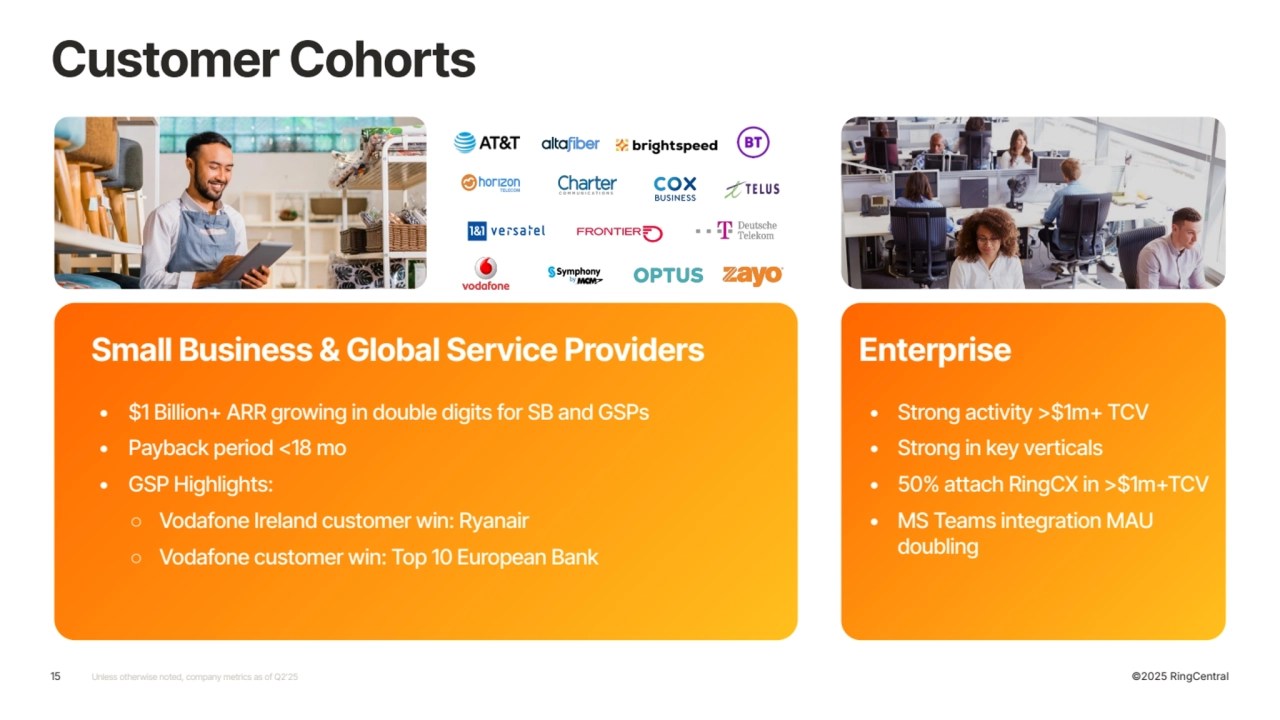

- 💼 Customer Base: Success with both small businesses and enterprise clients, reflected in ARR growth.

- 💰 Financial Outlook: Improved FCF per share, EPS and a strong balance sheet position RingCentral for continued growth.

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

2025 RingCentral 2Q 2025 Financial Results

- 1. ©2025 RingCentral 2Q 2025 Financial Results

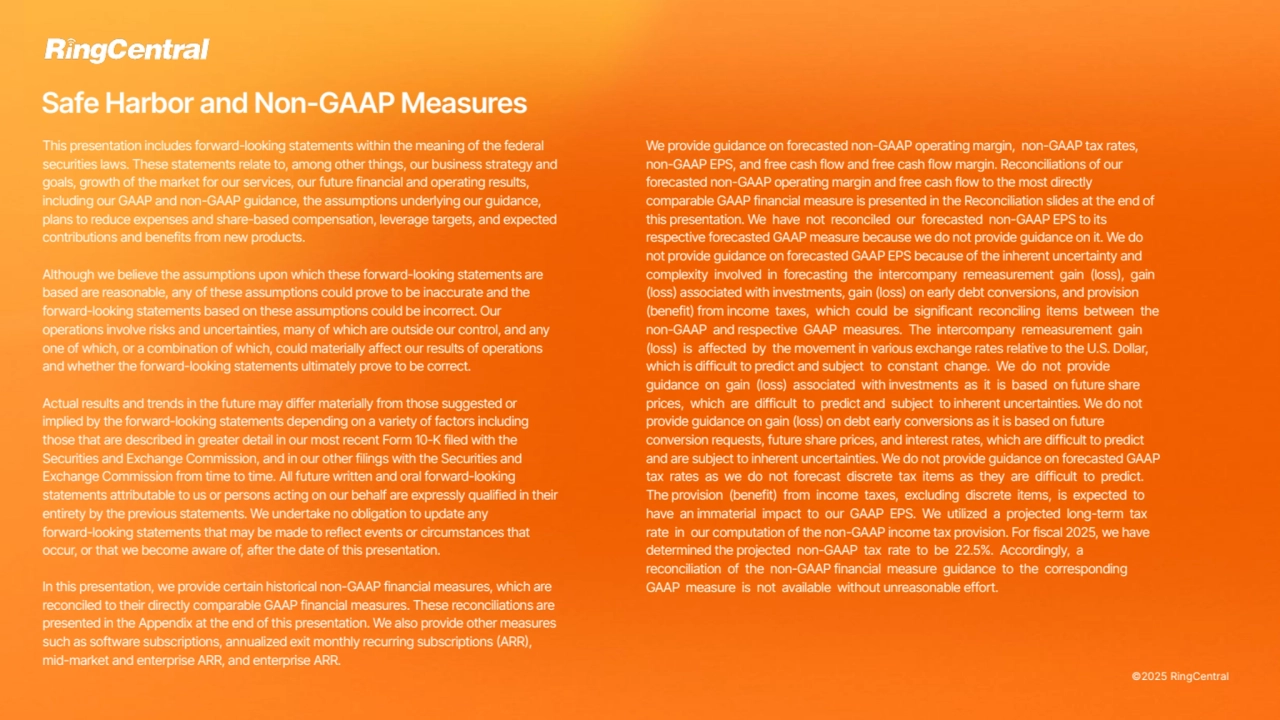

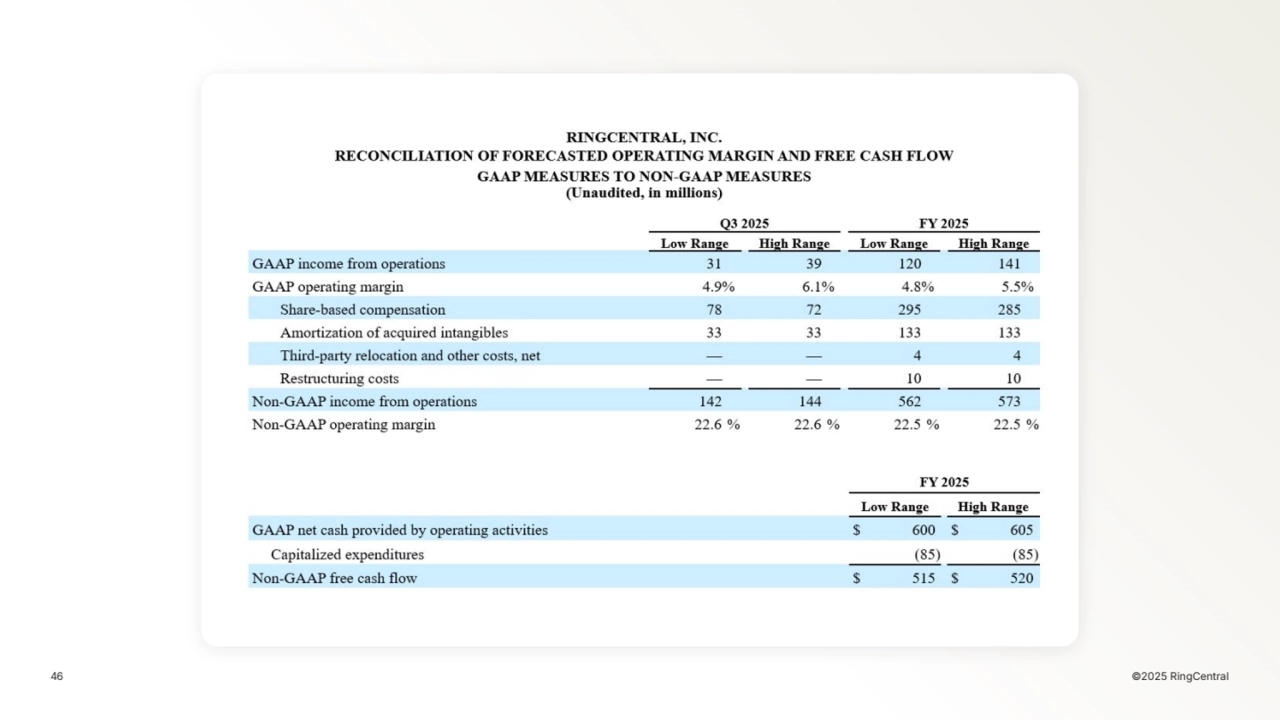

- 2. ©2025 RingCentral This presentation includes forward-looking statements within the meaning of the federal securities laws. These statements relate to, among other things, our business strategy and goals, growth of the market for our services, our future financial and operating results, including our GAAP and non-GAAP guidance, the assumptions underlying our guidance, plans to reduce expenses and share-based compensation, leverage targets, and expected contributions and benefits from new products. Although we believe the assumptions upon which these forward-looking statements are based are reasonable, any of these assumptions could prove to be inaccurate and the forward-looking statements based on these assumptions could be incorrect. Our operations involve risks and uncertainties, many of which are outside our control, and any one of which, or a combination of which, could materially affect our results of operations and whether the forward-looking statements ultimately prove to be correct. Actual results and trends in the future may differ materially from those suggested or implied by the forward-looking statements depending on a variety of factors including those that are described in greater detail in our most recent Form 10-K filed with the Securities and Exchange Commission, and in our other filings with the Securities and Exchange Commission from time to time. All future written and oral forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by the previous statements. We undertake no obligation to update any forward-looking statements that may be made to reflect events or circumstances that occur, or that we become aware of, after the date of this presentation. In this presentation, we provide certain historical non-GAAP financial measures, which are reconciled to their directly comparable GAAP financial measures. These reconciliations are presented in the Appendix at the end of this presentation. We also provide other measures such as software subscriptions, annualized exit monthly recurring subscriptions (ARR), mid-market and enterprise ARR, and enterprise ARR. Safe Harbor and Non-GAAP Measures We provide guidance on forecasted non-GAAP operating margin, non-GAAP tax rates, non-GAAP EPS, and free cash flow and free cash flow margin. Reconciliations of our forecasted non-GAAP operating margin and free cash flow to the most directly comparable GAAP financial measure is presented in the Reconciliation slides at the end of this presentation. We have not reconciled our forecasted non-GAAP EPS to its respective forecasted GAAP measure because we do not provide guidance on it. We do not provide guidance on forecasted GAAP EPS because of the inherent uncertainty and complexity involved in forecasting the intercompany remeasurement gain (loss), gain (loss) associated with investments, gain (loss) on early debt conversions, and provision (benefit) from income taxes, which could be significant reconciling items between the non-GAAP and respective GAAP measures. The intercompany remeasurement gain (loss) is affected by the movement in various exchange rates relative to the U.S. Dollar, which is difficult to predict and subject to constant change. We do not provide guidance on gain (loss) associated with investments as it is based on future share prices, which are difficult to predict and subject to inherent uncertainties. We do not provide guidance on gain (loss) on debt early conversions as it is based on future conversion requests, future share prices, and interest rates, which are difficult to predict and are subject to inherent uncertainties. We do not provide guidance on forecasted GAAP tax rates as we do not forecast discrete tax items as they are difficult to predict. The provision (benefit) from income taxes, excluding discrete items, is expected to have an immaterial impact to our GAAP EPS. We utilized a projected long-term tax rate in our computation of the non-GAAP income tax provision. For fiscal 2025, we have determined the projected non-GAAP tax rate to be 22.5%. Accordingly, a reconciliation of the non-GAAP financial measure guidance to the corresponding GAAP measure is not available without unreasonable effort.

- 3. ©2025 RingCentral Voice of Your Business 3

- 4. We empower businesses of all sizes to communicate effortlessly with their customers, and use the power of AI to help businesses unlock greater opportunities. Our mission

- 5. ©2025 RingCentral Kira Makagon President & COO Vlad Shmunis Founder, Chairman & CEO Vaibhav Agrawal Chief Financial Officer

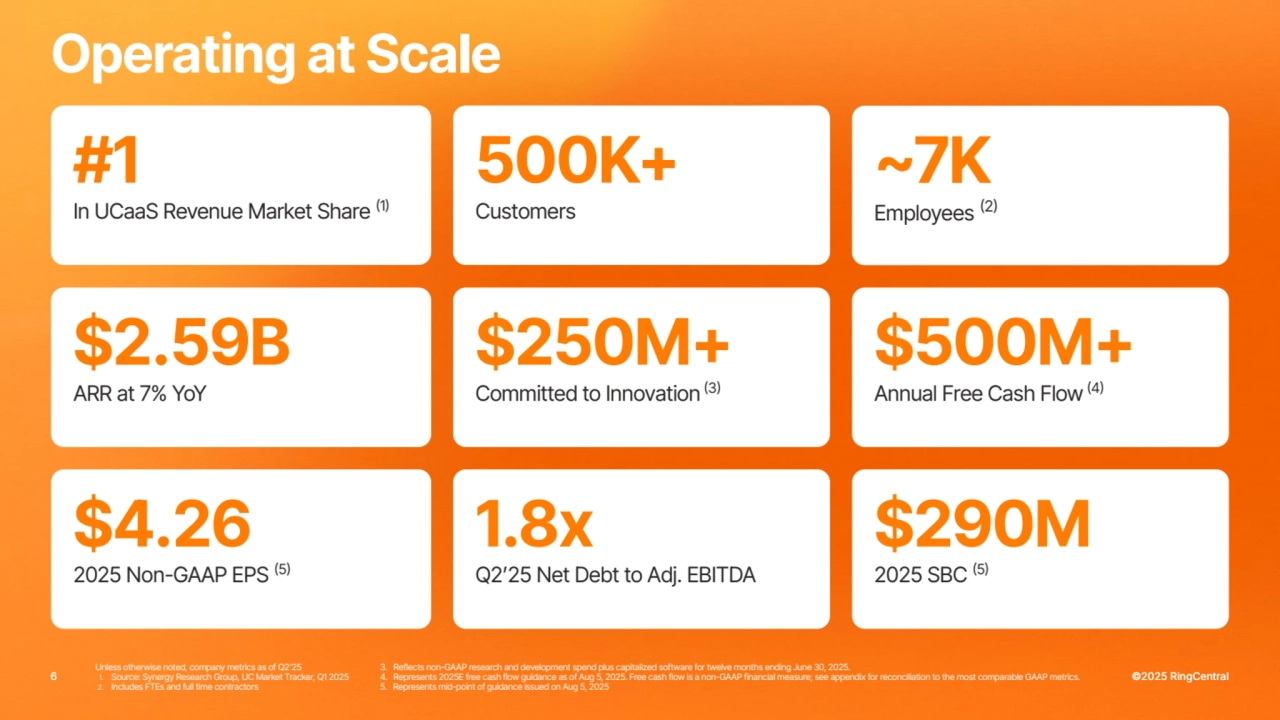

- 6. 6 ©2025 RingCentral Operating at Scale #1 In UCaaS Revenue Market Share (1) $500M+ Annual Free Cash Flow (4) Quarterly record $4.26 2025 Non-GAAP EPS (5) 1.8x Q2ʼ25 Net Debt to Adj. EBITDA $290M 2025 SBC (5) ~7K Employees (2) 500K+ Customers $2.59B ARR at 7% YoY $250M+ Committed to Innovation (3) Unless otherwise noted, company metrics as of Q2ʼ25 1. Source: Synergy Research Group, UC Market Tracker, Q1 2025 2. Includes FTEs and full time contractors 3. Reflects non-GAAP research and development spend plus capitalized software for twelve months ending June 30, 2025. 4. Represents 2025E free cash flow guidance as of Aug 5, 2025. Free cash flow is a non-GAAP financial measure; see appendix for reconciliation to the most comparable GAAP metrics. 5. Represents mid-point of guidance issued on Aug 5, 2025

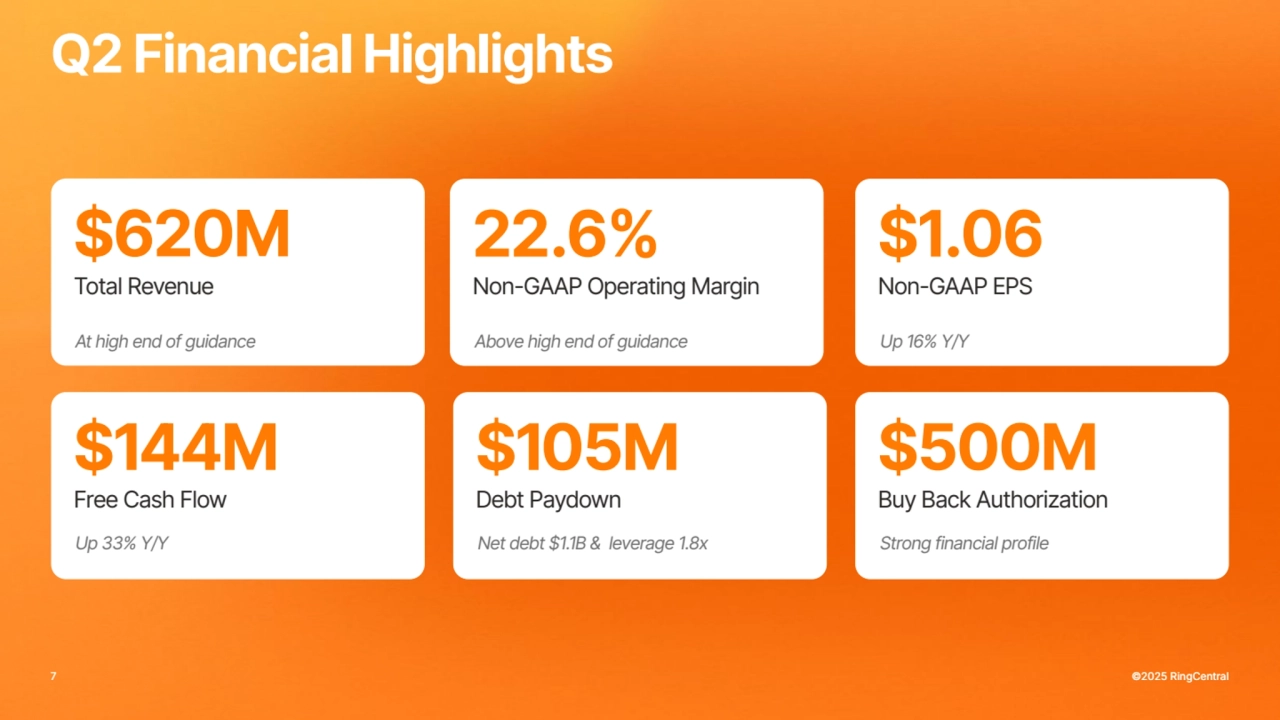

- 7. 7 ©2025 RingCentral $620M Total Revenue $1.06 Non-GAAP EPS Q2 Financial Highlights At high end of guidance Up 16% Y/Y $144M Free Cash Flow $105M Debt Paydown $500M Buy Back Authorization Up 33% Y/Y Net debt $1.1B & leverage 1.8x Strong financial profile 22.6% Non-GAAP Operating Margin Above high end of guidance

- 8. 8 ©2025 RingCentral Extended RingCentral and NiCE Partnership Extended multi-year partnership to focus on go-to-market sales, channel, onboarding, deployment, and post-sales support RingCentral Contact Center powered by NiCE CXOne New

- 9. 9 ©2025 RingCentral Expanded RingCentral AT&T Partnership Office@Hand Contact Center, powered by RingCXTM Office@Hand RingSense, powered by RingCentral AT&T Office@Hand Business Communication Portfolio New New

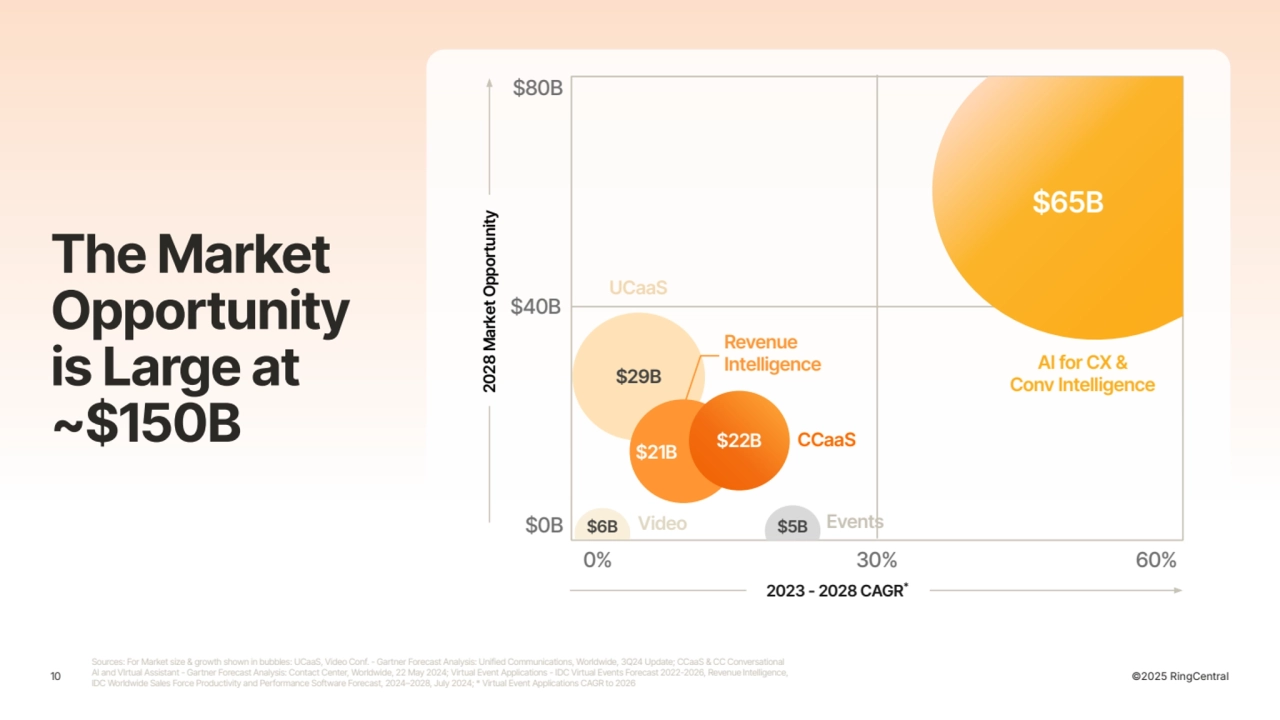

- 10. 10 ©2025 RingCentral $6B $29B $80B $40B $0B 0% 30% 60% UCaaS CCaaS AI for CX & Conv Intelligence $22B Video $5B Events Revenue Intelligence $21B $65B 2028 Market Opportunity 2023 - 2028 CAGR* The Market Opportunity is Large at ~$150B Sources: For Market size & growth shown in bubbles: UCaaS, Video Conf. - Gartner Forecast Analysis: Unified Communications, Worldwide, 3Q24 Update; CCaaS & CC Conversational AI and VIrtual Assistant - Gartner Forecast Analysis: Contact Center, Worldwide, 22 May 2024; Virtual Event Applications - IDC Virtual Events Forecast 2022-2026, Revenue Intelligence, IDC Worldwide Sales Force Productivity and Performance Software Forecast, 2024–2028, July 2024; * Virtual Event Applications CAGR to 2026

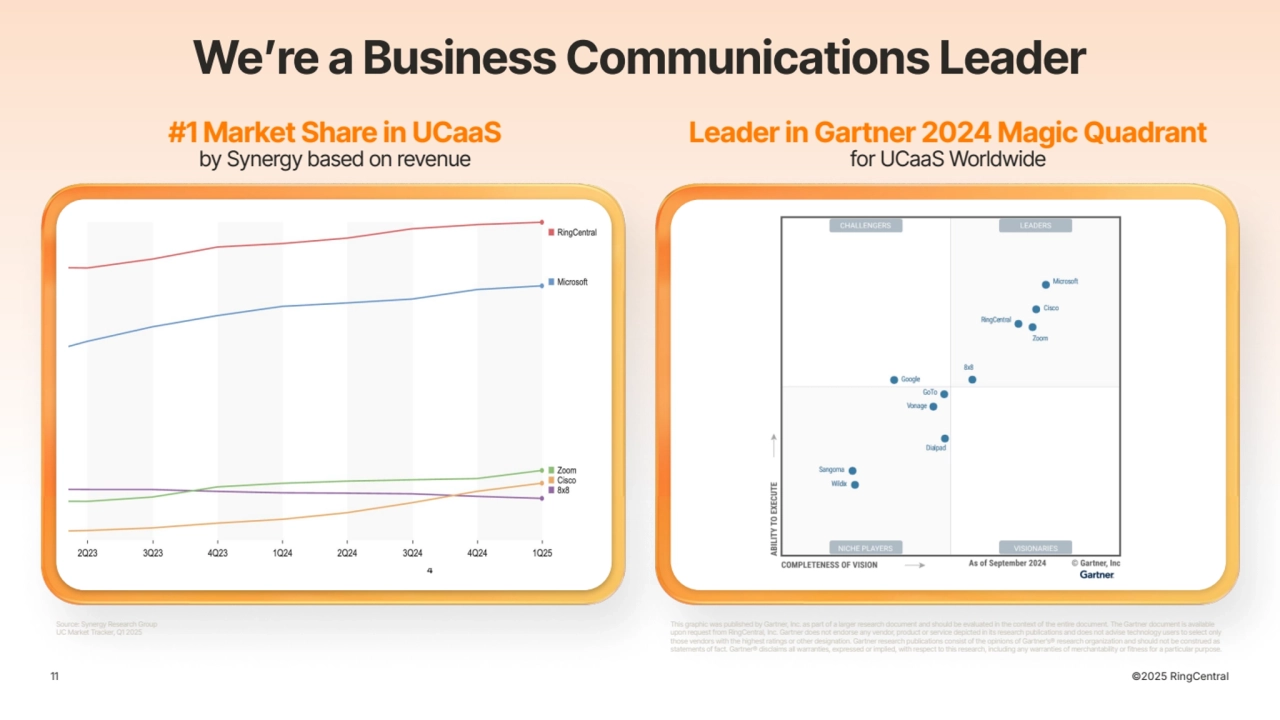

- 11. 11 ©2025 RingCentral Weʼre a Business Communications Leader Leader in Gartner 2024 Magic Quadrant for UCaaS Worldwide #1 Market Share in UCaaS by Synergy based on revenue ~40% 4 Source: Synergy Research Group UC Market Tracker, Q1 2025 This graphic was published by Gartner, Inc. as part of a larger research document and should be evaluated in the context of the entire document. The Gartner document is available upon request from RingCentral, Inc. Gartner does not endorse any vendor, product or service depicted in its research publications and does not advise technology users to select only those vendors with the highest ratings or other designation. Gartner research publications consist of the opinions of Gartnerʼs® research organization and should not be construed as statements of fact. Gartner® disclaims all warranties, expressed or implied, with respect to this research, including any warranties of merchantability or fitness for a particular purpose.

- 12. 12 ©2025 RingCentral RingCentral Seats RingCentral Telephony Minutes Seat growth is strong Telephony minutes usage is strong 4.5M 2021 5.6M 2022 6.6M 2023 7.6M 2020 2024 2Q25 4Q20 4Q21 4Q22 4Q23 4Q24 2Q25* Annualized Strength in Voice

- 13. AI Receptionist Video Collaboration Video Meetings Events Webinars Rooms *Partner provided RingCX Rich Omnichannel Native Contact Center AI Powered & Integrated RingEX Cloud PBX System SMS, Fax Team Messaging AI Assistant RingSense Conversation Intelligence AI Coaching AI Call Scoring AI CX & AI Agents AI Quality Management AI Agent & Supervisor Assist AI Interaction Analytics Intelligent Virtual Assistant* (IVA) AI Communications Platform New AI Phone Agent AIR Everywhere Intelligent Call Handling Appointment Setting Our Multi-Product Portfolio

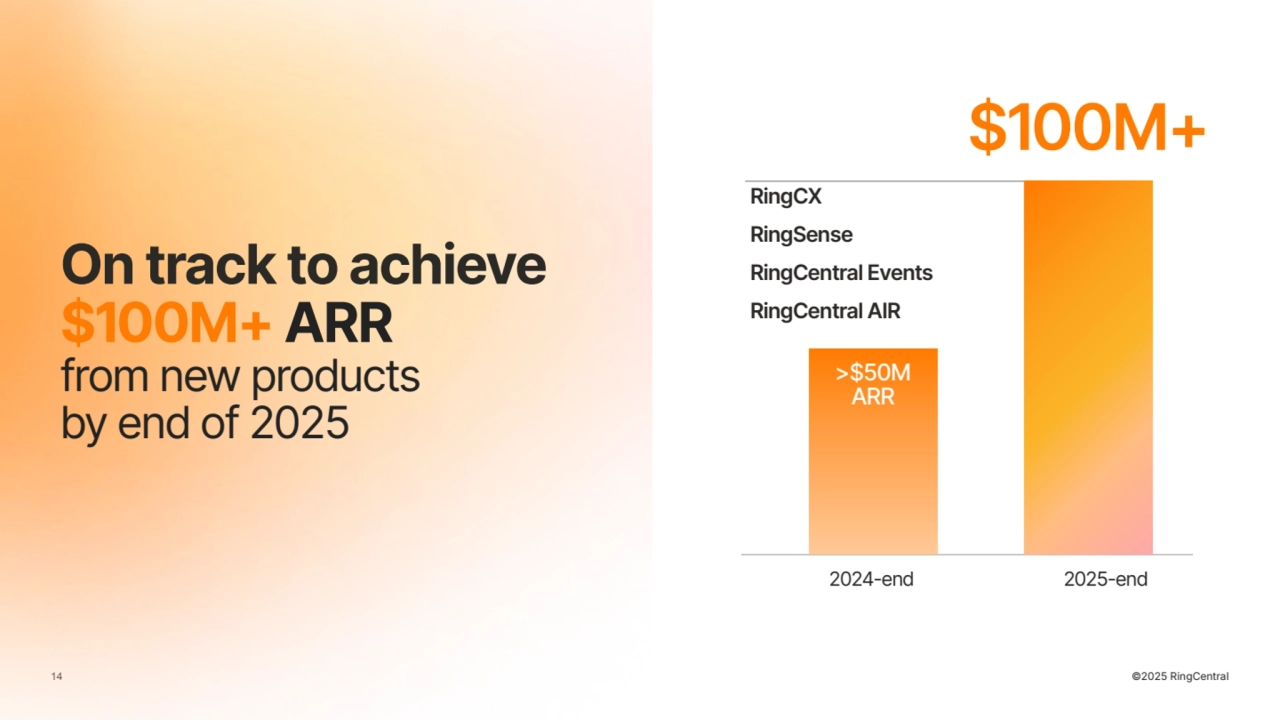

- 14. 14 ©2025 RingCentral On track to achieve $100M+ ARR from new products by end of 2025 $100M+ RingCX RingSense RingCentral Events RingCentral AIR 2024-end 2025-end >$50M ARR ©2025 RingCentral

- 15. 10-20% Average handle time reduction* Enterprise • Strong activity >$1m+ TCV • Strong in key verticals • 50% attach RingCX in >$1m+TCV • MS Teams integration MAU doubling Small Business & Global Service Providers • $1 Billion+ ARR growing in double digits for SB and GSPs • Payback period <18 mo • GSP Highlights: ○ Vodafone Ireland customer win: Ryanair ○ Vodafone customer win: Top 10 European Bank Customer Cohorts 15 Unless otherwise noted, company metrics as of Q2ʼ25 ©2025 RingCentral

- 16. In the advent of AI “Voice is the new UI” Itʼs a fast, expressive, and natural way to interact with AI Our success is rooted in global leadership in cloud business voice ©2025 RingCentral

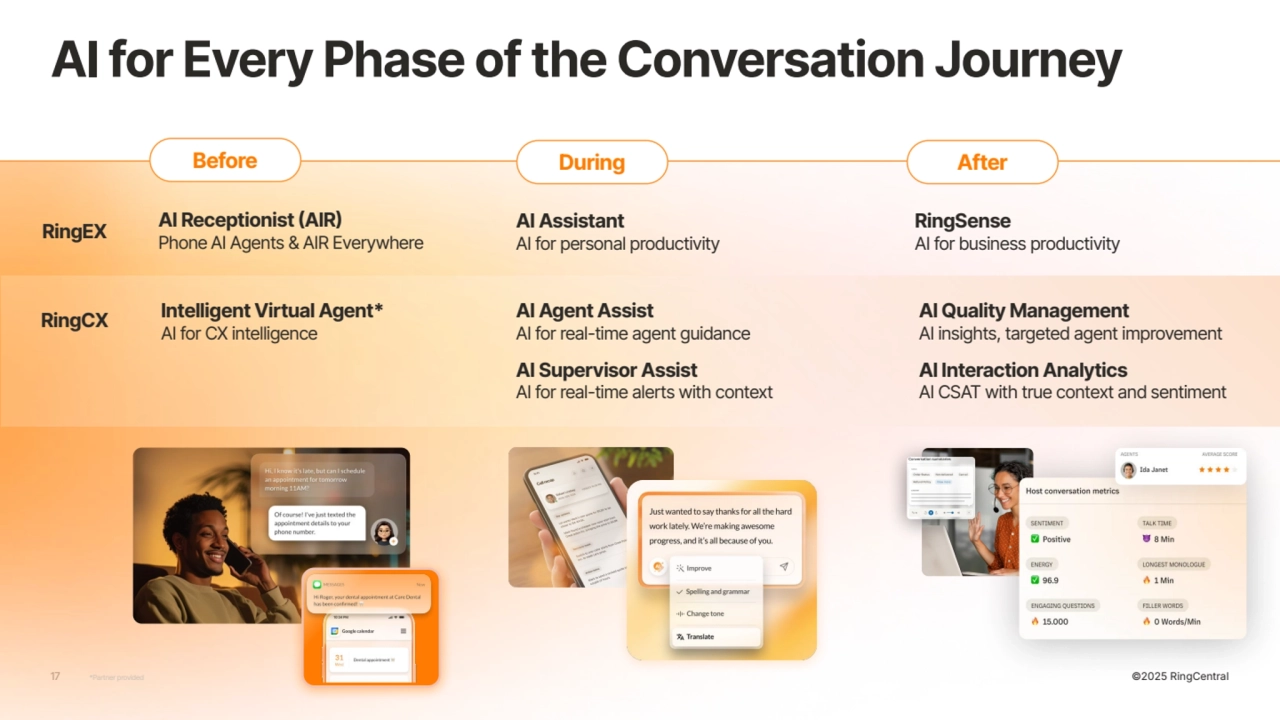

- 17. 17 ©2025 RingCentral AI Receptionist (AIR) Phone AI Agents & AIR Everywhere Before During AI Assistant AI for personal productivity After RingSense AI for business productivity RingCX RingEX Intelligent Virtual Agent* AI for CX intelligence *Partner provided AI Agent Assist AI for real-time agent guidance AI Supervisor Assist AI for real-time alerts with context AI Quality Management AI insights, targeted agent improvement AI Interaction Analytics AI CSAT with true context and sentiment AI for Every Phase of the Conversation Journey

- 18. 18 ©2024 RingCentral ©2025 RingCentral

- 19. 19 Confidential & Proprietary ©2024 RingCentral ©2025 RingCentral AI Receptionist (AIR) AI Receptionist An AI phone agent that uses generative AI to automatically answer customer inquiries and transfer calls 19 Available in the US and Canada. UK and AUS available by end of Q3 Q1 25 Q2ʼ25 1,000+ Customers 3,000+ Customers Key Capabilities ✓ Appointment booking ✓ Multi-language support ✓ Intelligent call routing ✓ SMS follow-up ✓ Conversation insights ✓ Customizable voice options New New

- 20. 20 ©2025 RingCentral Customers Love AI Receptionist 50% resolution rate anticipated on customer calls, cutting answer time to seconds 60% increase in new patient intakes, translating to an additional $1.7M in revenue

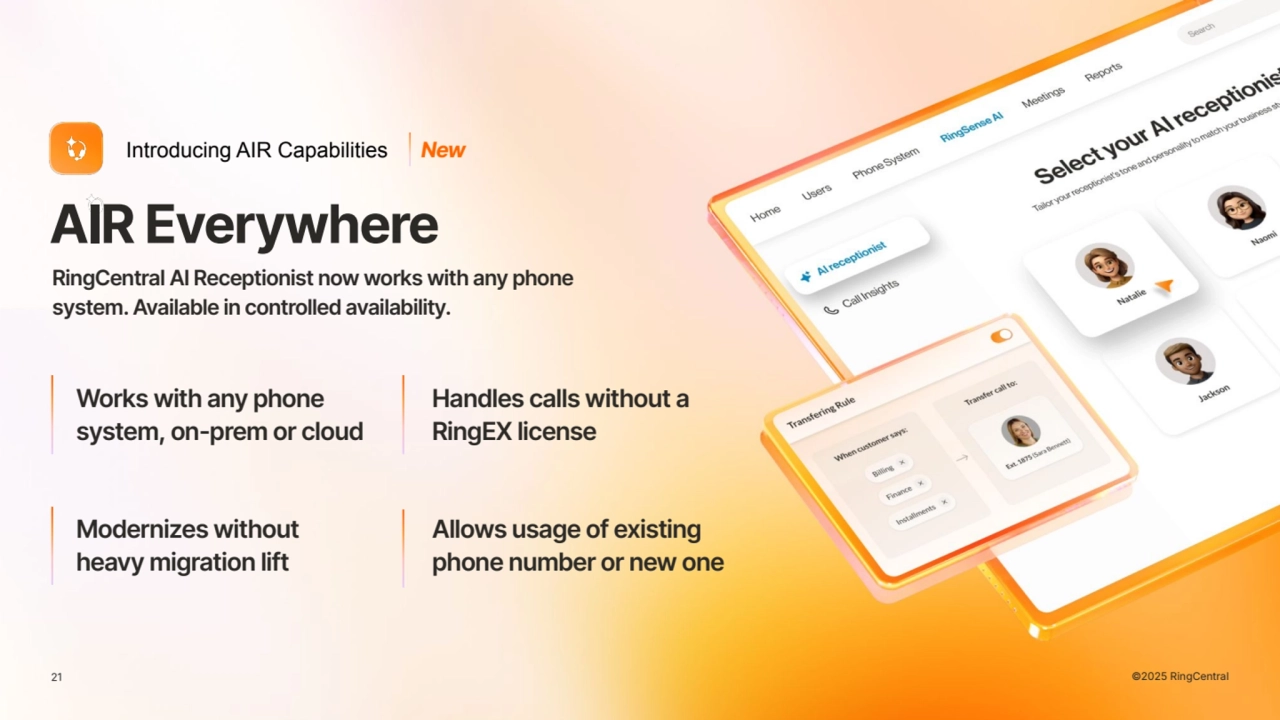

- 21. 21 21 ©2025 RingCentral AIR Everywhere Introducing AIR Capabilities Modernizes without heavy migration lift Allows usage of existing phone number or new one Works with any phone system, on-prem or cloud Handles calls without a RingEX license RingCentral AI Receptionist now works with any phone system. Available in controlled availability. New

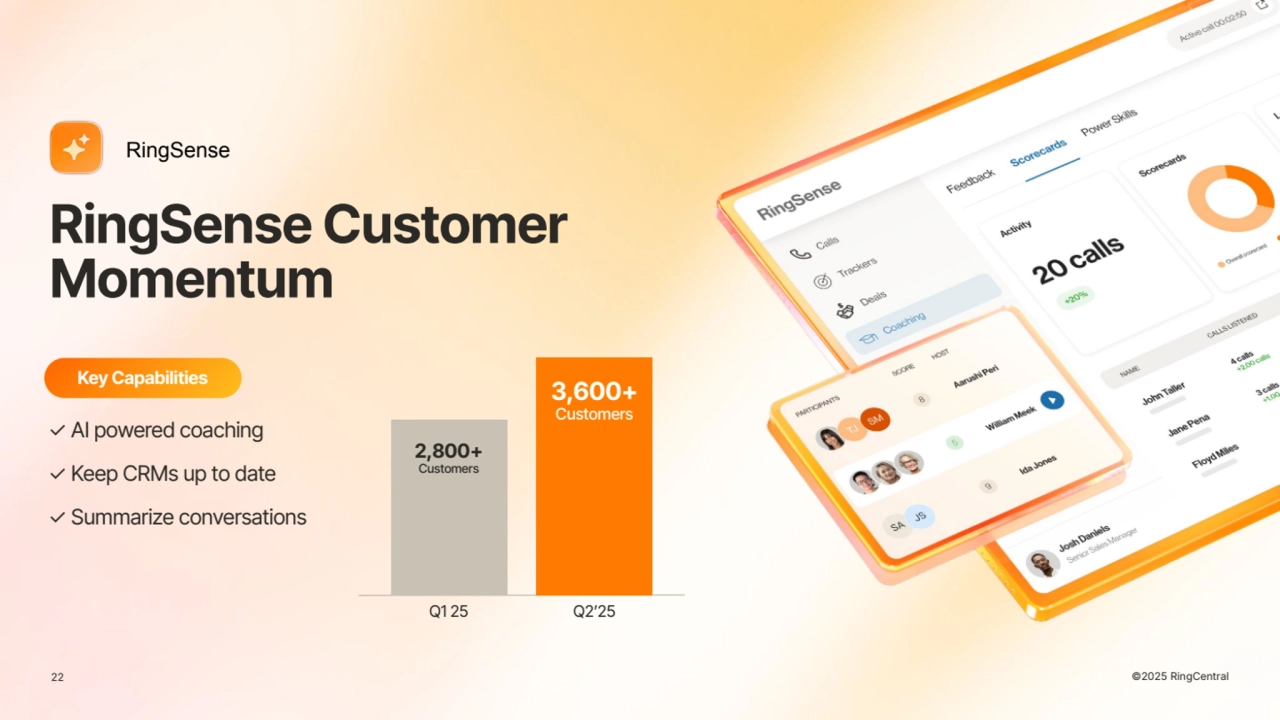

- 22. 22 ©2025 RingCentral RingSense Customer Momentum RingSense Key Capabilities ✓ AI powered coaching ✓ Keep CRMs up to date ✓ Summarize conversations Q1 25 Q2ʼ25 2,800+ Customers 3,600+ Customers 22

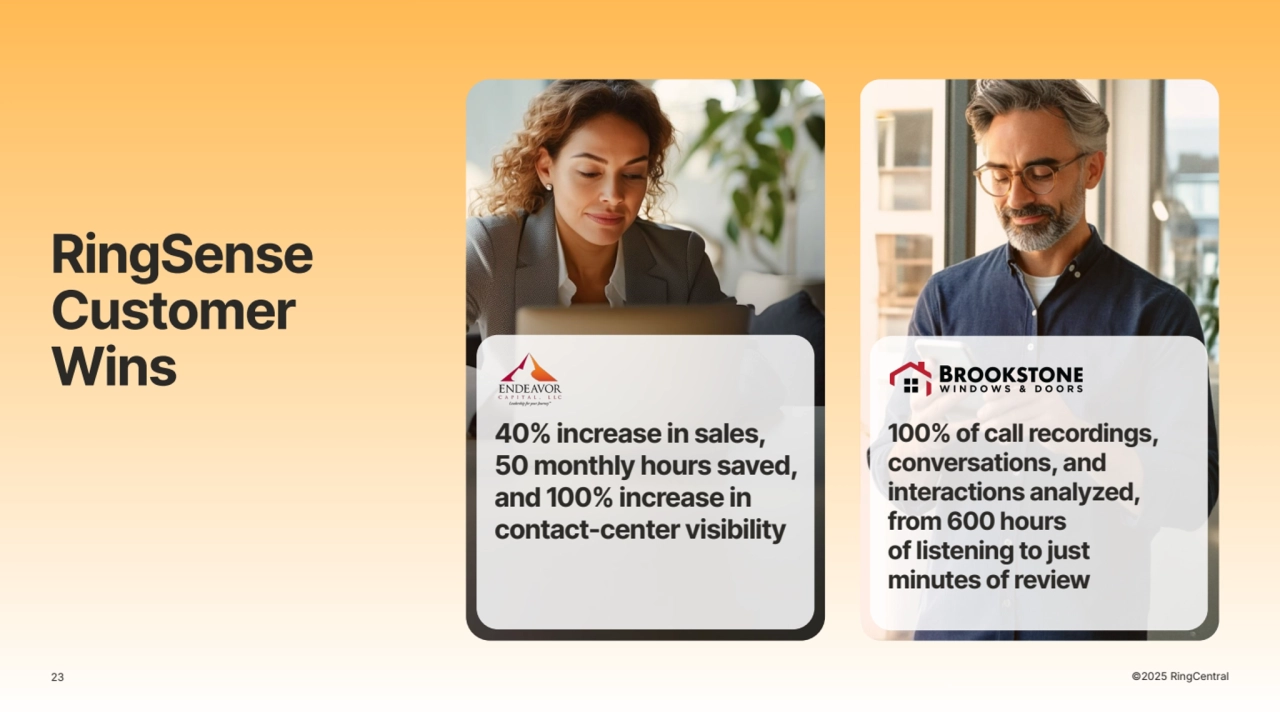

- 23. 100% of call recordings, conversations, and interactions analyzed, from 600 hours of listening to just minutes of review 40% increase in sales, 50 monthly hours saved, and 100% increase in contact-center visibility 23 ©2025 RingCentral RingSense Customer Wins

- 24. 24 ©2025 RingCentral RingCX Strong Traction RingCX 50% Attach Rate for RingCX in the $1M+TCVs 50% of RingCX customers also bought AI Quality Management Key Capabilities ✓ Native, AI powered ✓ Voice + 20 digital channels ✓ Simple & less complex 1200 RingCX Customers

- 25. RingCX Ad Campaign

- 26. 26 ©2025 RingCentral Increasing Customer Experience Wallet Share via AI Attach ©2025 RingCentral Q3 ‘23 Q2ʼ25 +50% Add-ons include: ✓ AI Quality Management ✓ AI Agent Assist ✓ AI Supervisor Assist ✓ Interaction Analytics ✓ WFO ✓ IVA

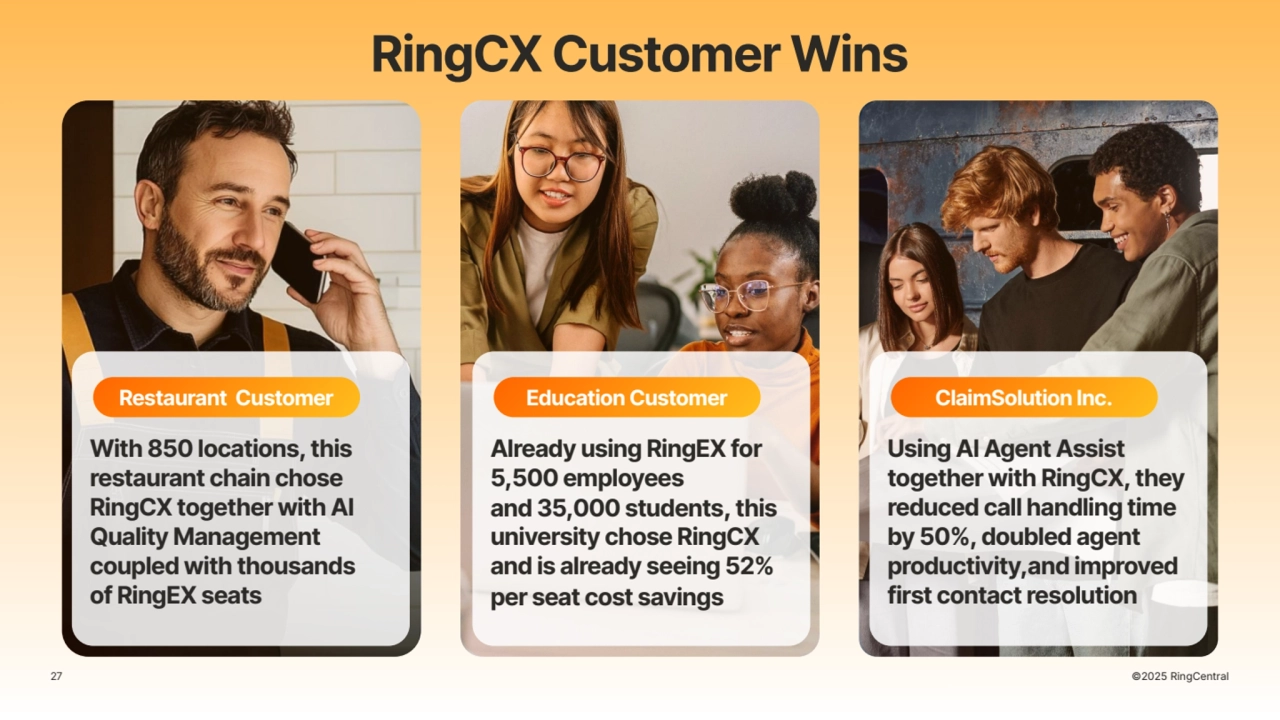

- 27. 27 ©2025 RingCentral Already using RingEX for 5,500 employees and 35,000 students, this university chose RingCX and is already seeing 52% per seat cost savings Using AI Agent Assist together with RingCX, they reduced call handling time by 50%, doubled agent productivity,and improved first contact resolution With 850 locations, this restaurant chain chose RingCX together with AI Quality Management coupled with thousands of RingEX seats Restaurant Customer Education Customer ClaimSolution Inc. RingCX Customer Wins

- 28. Financials 28 ©2025 RingCentral

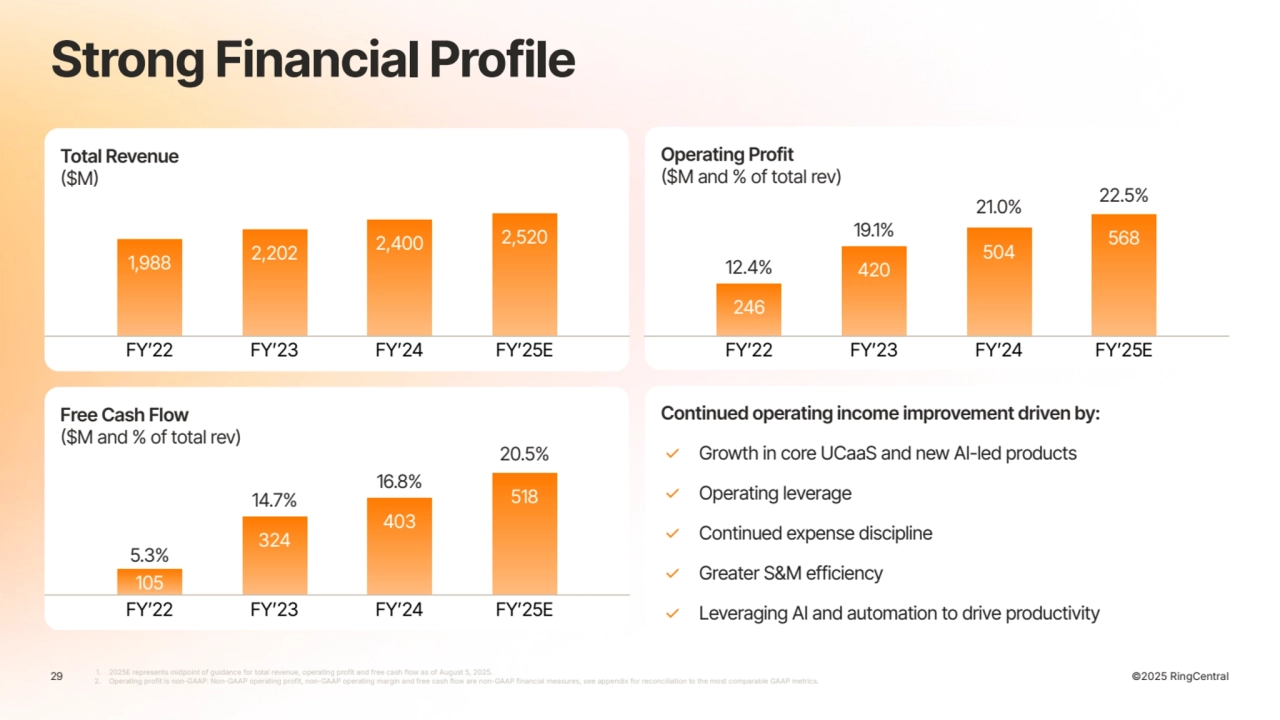

- 29. ©2025 RingCentral Total Revenue ($M) Free Cash Flow ($M and % of total rev) Operating Profit ($M and % of total rev) Continued operating income improvement driven by: ✓ Growth in core UCaaS and new AI-led products ✓ Operating leverage ✓ Continued expense discipline ✓ Greater S&M efficiency ✓ Leveraging AI and automation to drive productivity Revenue & Profit 1,988 2,202 2,400 2,520 FYʼ22 FYʼ23 FYʼ24 FYʼ25E 105 324 403 518 FYʼ22 FYʼ23 FYʼ24 FYʼ25E 5.3% 14.7% 16.8% 246 420 504 568 FYʼ22 FYʼ23 FYʼ24 FYʼ25E 12.4% 19.1% 21.0% 22.5% 20.5% 29 Strong Financial Profile 1. 2025E represents midpoint of guidance for total revenue, operating profit and free cash flow as of August 5, 2025. 2. Operating profit is non-GAAP. Non-GAAP operating profit, non-GAAP operating margin and free cash flow are non-GAAP financial measures, see appendix for reconciliation to the most comparable GAAP metrics.

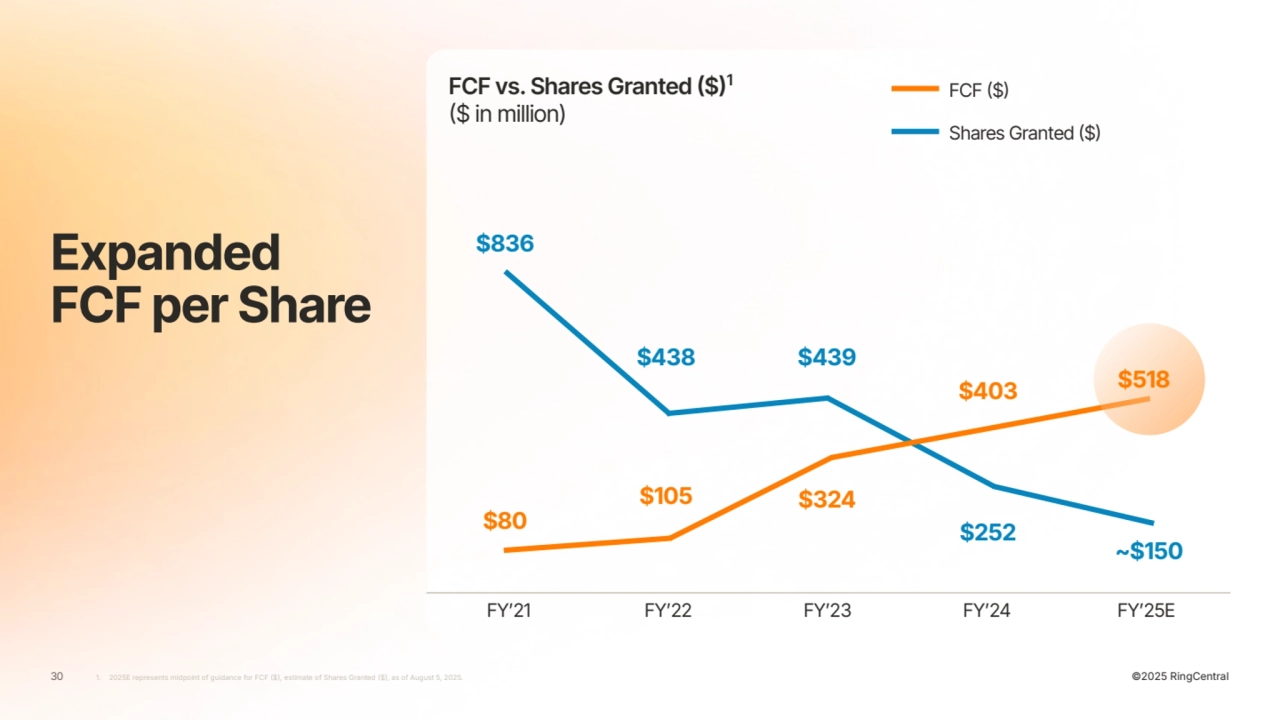

- 30. 30 ©2025 RingCentral Expanded FCF per Share FCF vs. Shares Granted ($)1 ($ in million) FCF ($) Shares Granted ($) FYʼ22 FYʼ24 $80 $105 $324 $252 ~$150 $836 $438 $439 $403 FYʼ21 FYʼ23 FYʼ25E 1. 2025E represents midpoint of guidance for FCF $, estimate of Shares Granted $, as of August 5, 2025. $518

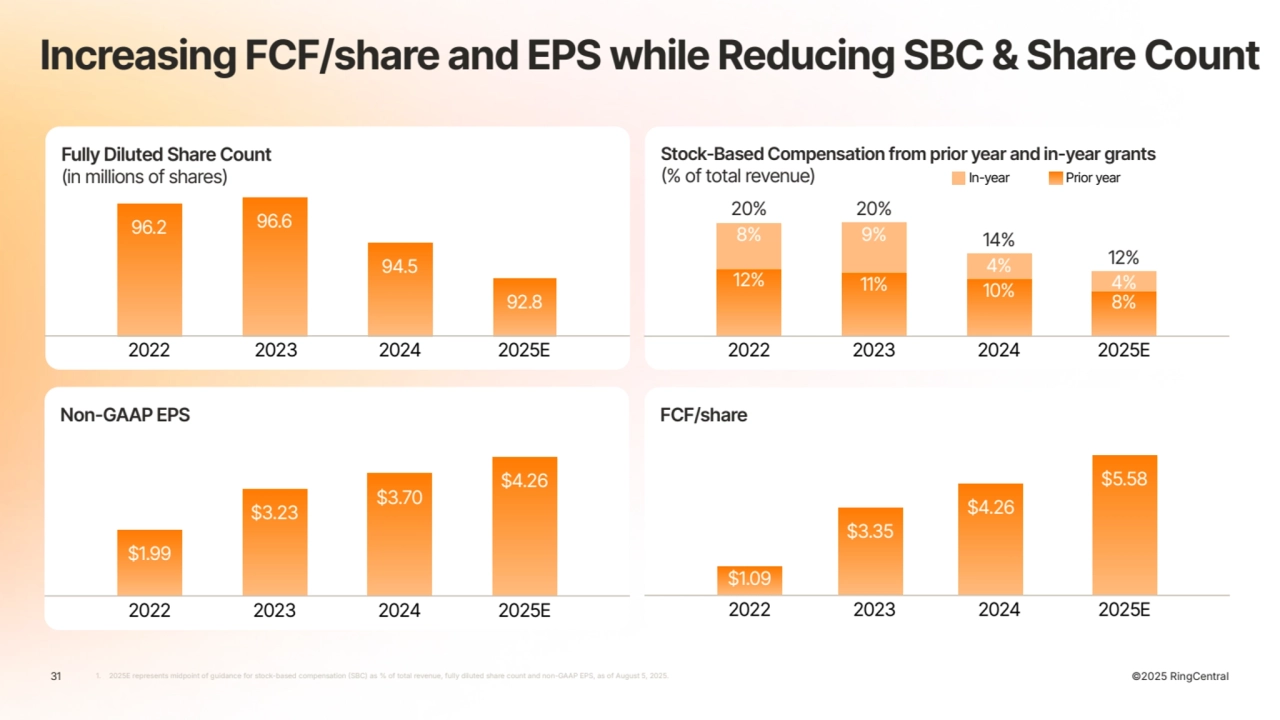

- 31. ©2025 RingCentral Non-GAAP EPS Stock-Based Compensation from prior year and in-year grants (% of total revenue) 31 Increasing FCF/share and EPS while Reducing SBC & Share Count 1. 2025E represents midpoint of guidance for stock-based compensation SBC) as % of total revenue, fully diluted share count and non-GAAP EPS, as of August 5, 2025. $1.99 $3.23 $3.70 $4.26 2022 2023 2024 2025E 12% 8% 20% 11% 9% 20% 10% 4% 14% 8% 4% 12% 2022 2023 2024 2025E In-year Prior year FCF/share 2022 2023 2024 2025E $1.09 $3.35 $4.26 $5.58 Fully Diluted Share Count (in millions of shares) 2022 2023 2024 2025E 96.2 96.6 94.5 92.8

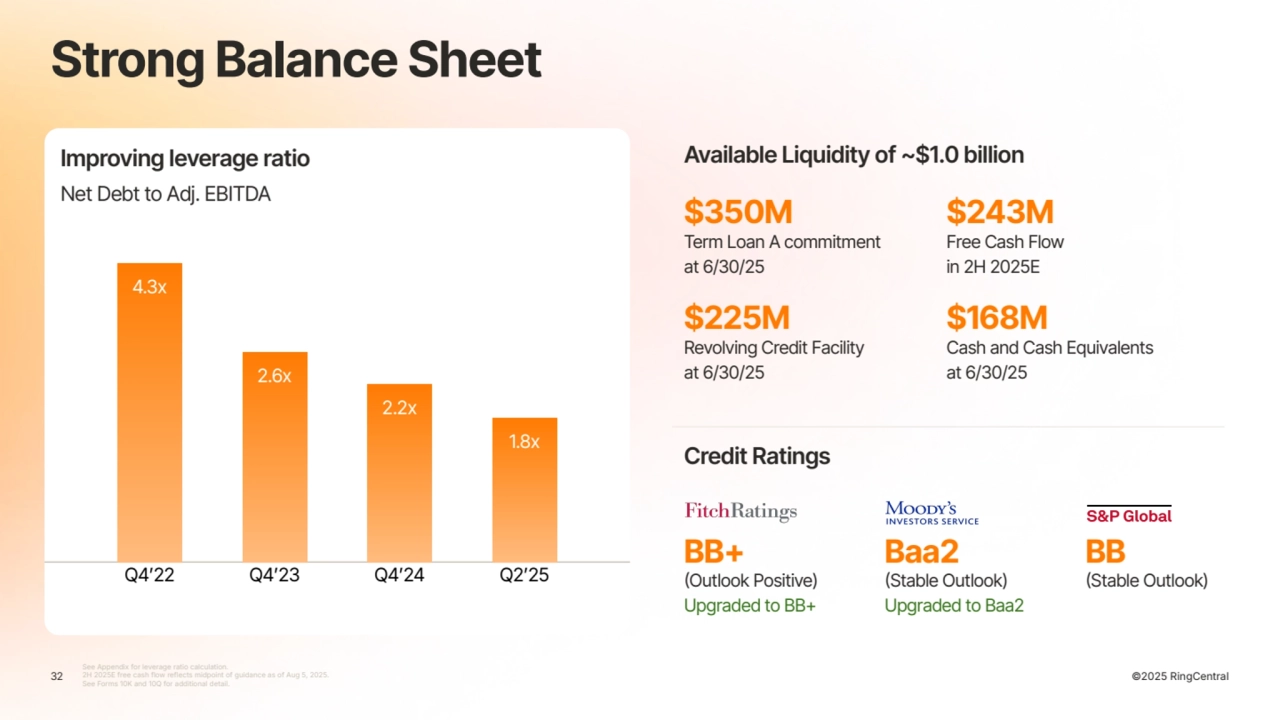

- 32. ©2025 RingCentral Strong Balance Sheet Improving leverage ratio Net Debt to Adj. EBITDA 32 See Appendix for leverage ratio calculation. 2H 2025E free cash flow reflects midpoint of guidance as of Aug 5, 2025. See Forms 10K and 10Q for additional detail. Q4ʼ22 Q4ʼ23 Q4ʼ24 Q2ʼ25 4.3x 2.6x 2.2x 1.8x Available Liquidity of ~$1.0 billion Credit Ratings $350M Term Loan A commitment at 6/30/25 $243M Free Cash Flow in 2H 2025E $225M Revolving Credit Facility at 6/30/25 $168M Cash and Cash Equivalents at 6/30/25 BB+ (Outlook Positive) Upgraded to BB+ Baa2 (Stable Outlook) Upgraded to Baa2 BB (Stable Outlook)

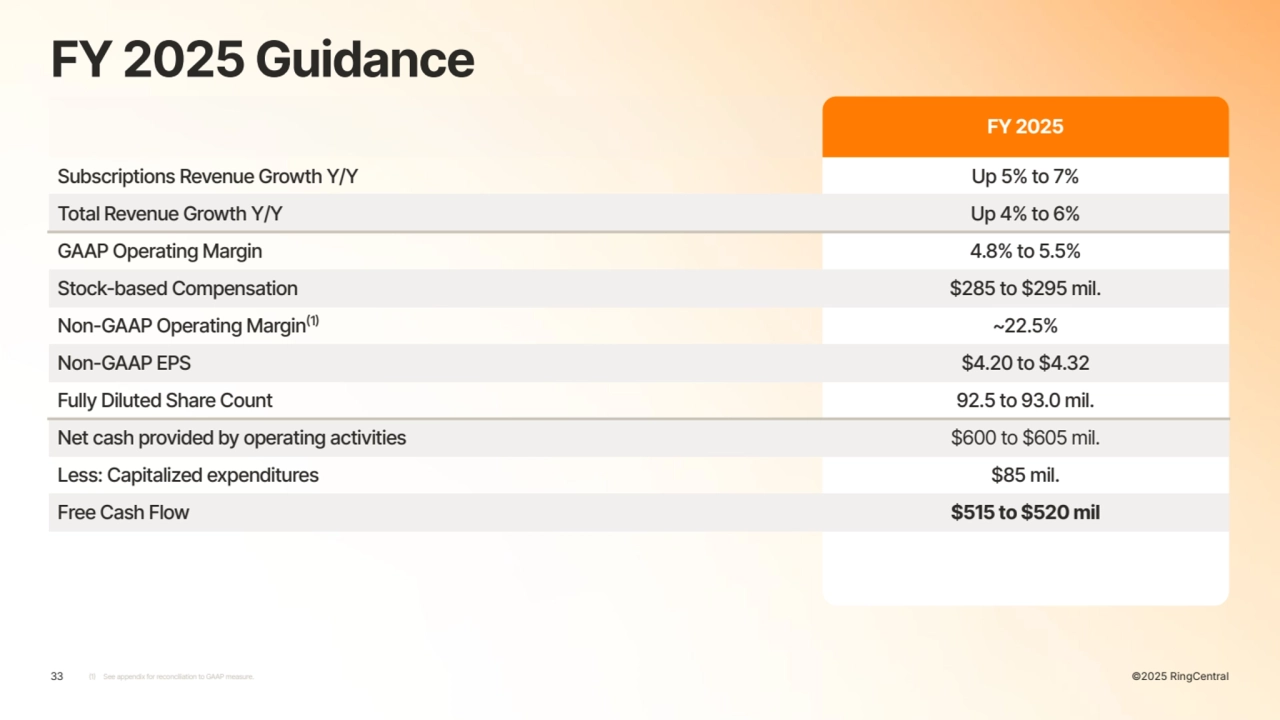

- 33. ©2025 RingCentral FY 2025 Subscriptions Revenue Growth Y/Y Up 5% to 7% Total Revenue Growth Y/Y Up 4% to 6% GAAP Operating Margin 4.8% to 5.5% Stock-based Compensation $285 to $295 mil. Non-GAAP Operating Margin(1) ~22.5% Non-GAAP EPS $4.20 to $4.32 Fully Diluted Share Count 92.5 to 93.0 mil. Net cash provided by operating activities $600 to $605 mil. Less: Capitalized expenditures $85 mil. Free Cash Flow $515 to $520 mil 33 (1) See appendix for reconciliation to GAAP measure. ©2025 RingCentral FY 2025 Guidance

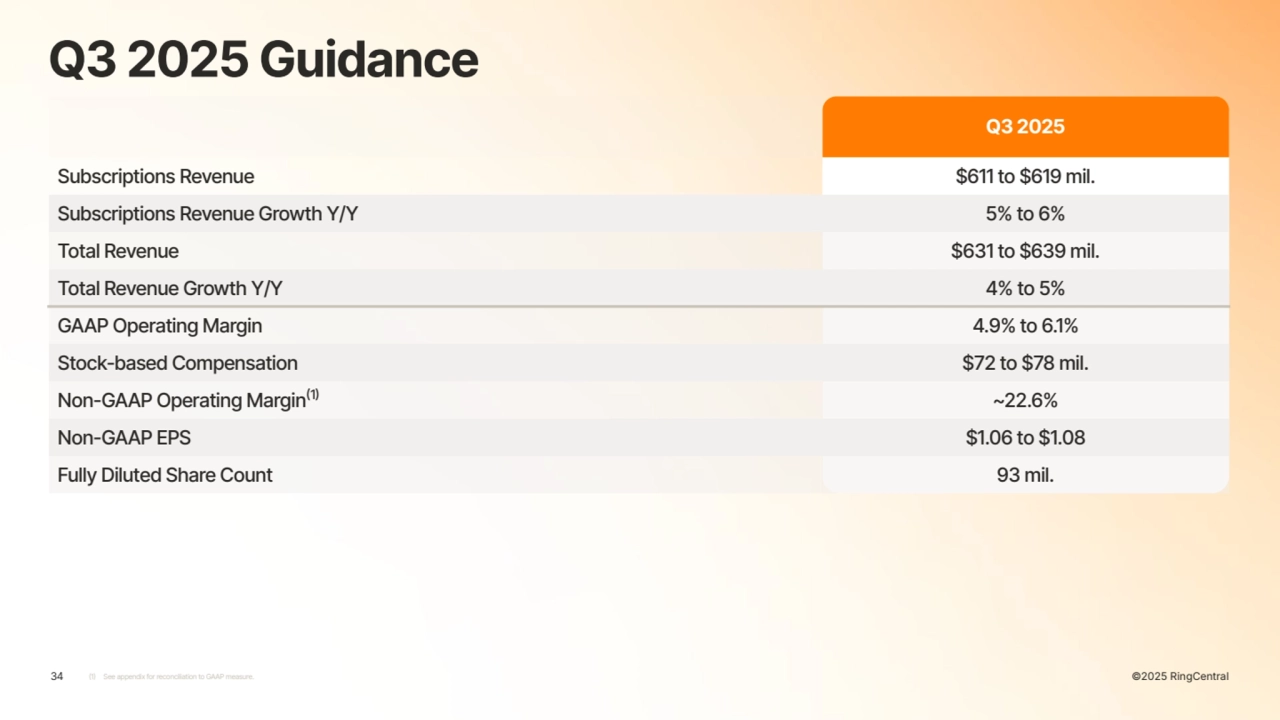

- 34. ©2025 RingCentral (1) See appendix for reconciliation to GAAP measure. Q3 2025 Subscriptions Revenue $611 to $619 mil. Subscriptions Revenue Growth Y/Y 5% to 6% Total Revenue $631 to $639 mil. Total Revenue Growth Y/Y 4% to 5% GAAP Operating Margin 4.9% to 6.1% Stock-based Compensation $72 to $78 mil. Non-GAAP Operating Margin(1) ~22.6% Non-GAAP EPS $1.06 to $1.08 Fully Diluted Share Count 93 mil. ©2025 RingCentral Q3 2025 Guidance 34

- 35. Appendix 35 ©2025 RingCentral

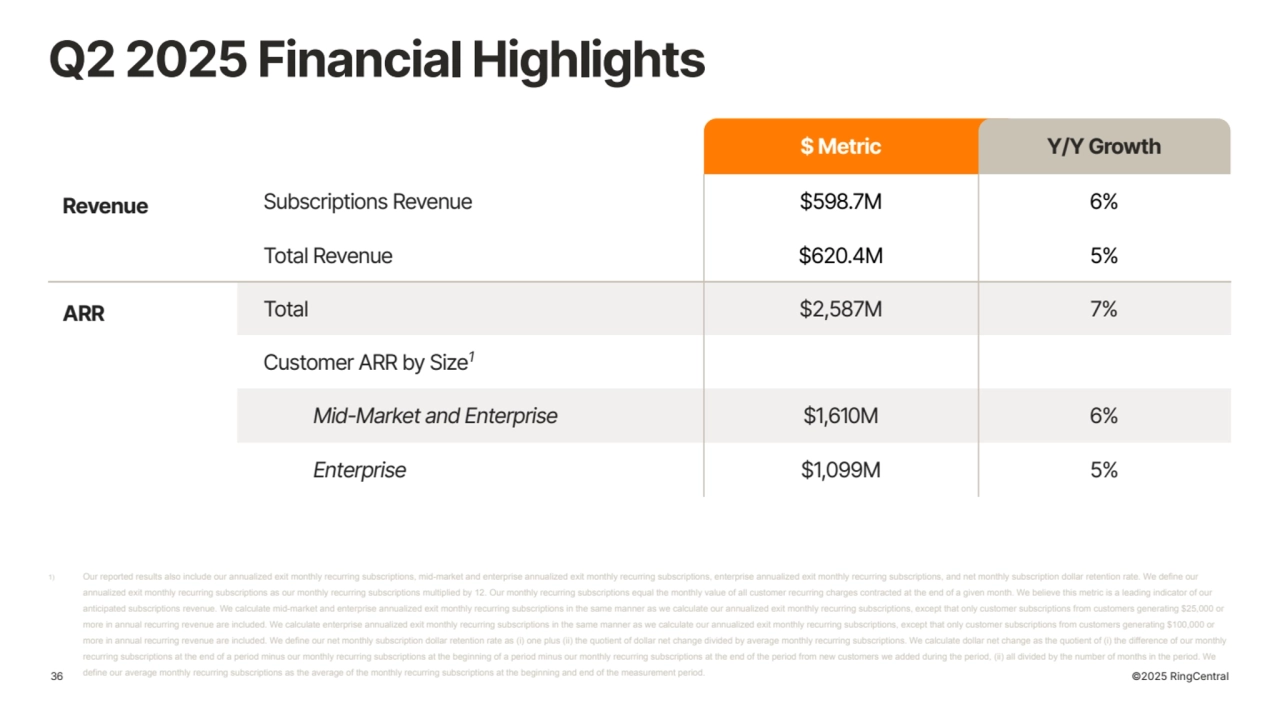

- 36. $ Metric Y/Y Growth Revenue Subscriptions Revenue $598.7M 6% Total Revenue $620.4M 5% ARR Total $2,587M 7% Customer ARR by Size1 Mid-Market and Enterprise $1,610M 6% Enterprise $1,099M 5% Q2 2025 Financial Highlights 36 ©2025 RingCentral 1) Our reported results also include our annualized exit monthly recurring subscriptions, mid-market and enterprise annualized exit monthly recurring subscriptions, enterprise annualized exit monthly recurring subscriptions, and net monthly subscription dollar retention rate. We define our annualized exit monthly recurring subscriptions as our monthly recurring subscriptions multiplied by 12. Our monthly recurring subscriptions equal the monthly value of all customer recurring charges contracted at the end of a given month. We believe this metric is a leading indicator of our anticipated subscriptions revenue. We calculate mid-market and enterprise annualized exit monthly recurring subscriptions in the same manner as we calculate our annualized exit monthly recurring subscriptions, except that only customer subscriptions from customers generating $25,000 or more in annual recurring revenue are included. We calculate enterprise annualized exit monthly recurring subscriptions in the same manner as we calculate our annualized exit monthly recurring subscriptions, except that only customer subscriptions from customers generating $100,000 or more in annual recurring revenue are included. We define our net monthly subscription dollar retention rate as (i) one plus (ii) the quotient of dollar net change divided by average monthly recurring subscriptions. We calculate dollar net change as the quotient of (i) the difference of our monthly recurring subscriptions at the end of a period minus our monthly recurring subscriptions at the beginning of a period minus our monthly recurring subscriptions at the end of the period from new customers we added during the period, (ii) all divided by the number of months in the period. We define our average monthly recurring subscriptions as the average of the monthly recurring subscriptions at the beginning and end of the measurement period.

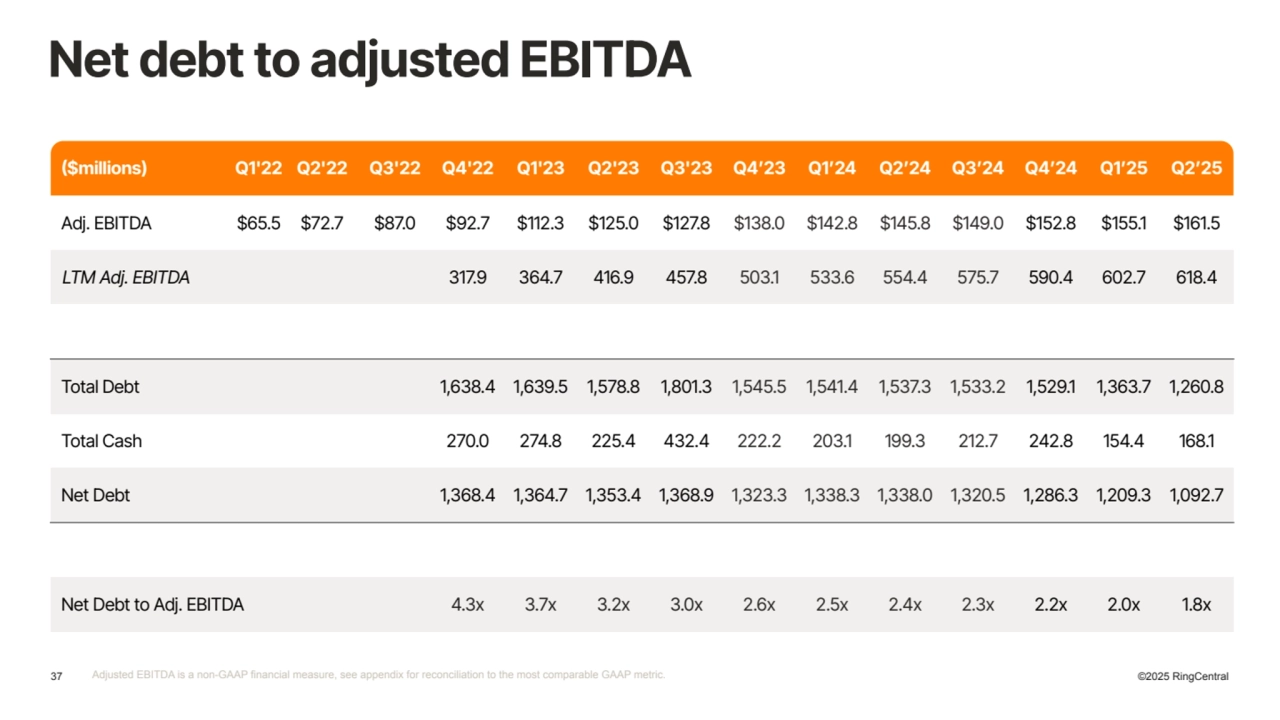

- 37. 37 ©2025 RingCentral Net debt to adjusted EBITDA ($millions) Q1'22 Q2'22 Q3'22 Q4'22 Q1'23 Q2'23 Q3'23 Q4ʼ23 Q1ʼ24 Q2ʼ24 Q3ʼ24 Q4ʼ24 Q1ʼ25 Q2ʼ25 Adj. EBITDA $65.5 $72.7 $87.0 $92.7 $112.3 $125.0 $127.8 $138.0 $142.8 $145.8 $149.0 $152.8 $155.1 $161.5 LTM Adj. EBITDA 317.9 364.7 416.9 457.8 503.1 533.6 554.4 575.7 590.4 602.7 618.4 Total Debt 1,638.4 1,639.5 1,578.8 1,801.3 1,545.5 1,541.4 1,537.3 1,533.2 1,529.1 1,363.7 1,260.8 Total Cash 270.0 274.8 225.4 432.4 222.2 203.1 199.3 212.7 242.8 154.4 168.1 Net Debt 1,368.4 1,364.7 1,353.4 1,368.9 1,323.3 1,338.3 1,338.0 1,320.5 1,286.3 1,209.3 1,092.7 Net Debt to Adj. EBITDA 4.3x 3.7x 3.2x 3.0x 2.6x 2.5x 2.4x 2.3x 2.2x 2.0x 1.8x Adjusted EBITDA is a non-GAAP financial measure, see appendix for reconciliation to the most comparable GAAP metric.

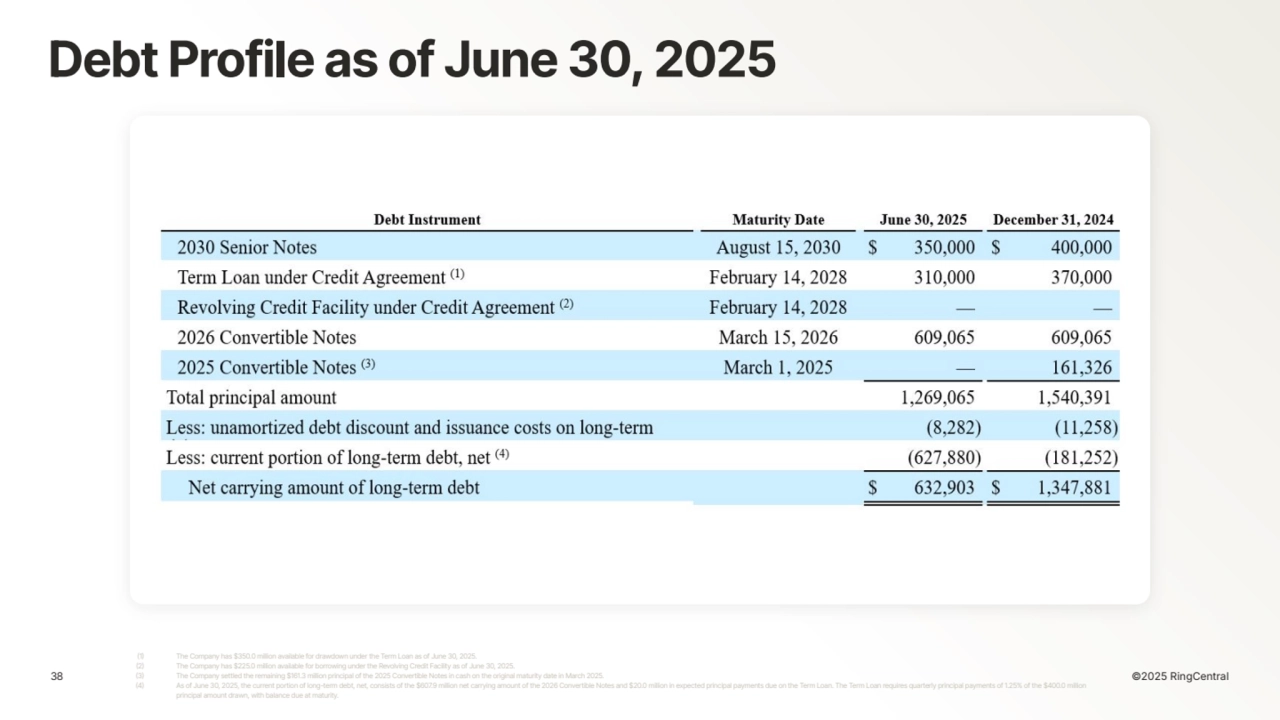

- 38. 38 ©2025 RingCentral Debt Profile as of June 30, 2025 (1) The Company has $350.0 million available for drawdown under the Term Loan as of June 30, 2025. (2) The Company has $225.0 million available for borrowing under the Revolving Credit Facility as of June 30, 2025. (3) The Company settled the remaining $161.3 million principal of the 2025 Convertible Notes in cash on the original maturity date in March 2025. (4) As of June 30, 2025, the current portion of long-term debt, net, consists of the $607.9 million net carrying amount of the 2026 Convertible Notes and $20.0 million in expected principal payments due on the Term Loan. The Term Loan requires quarterly principal payments of 1.25% of the $400.0 million principal amount drawn, with balance due at maturity.

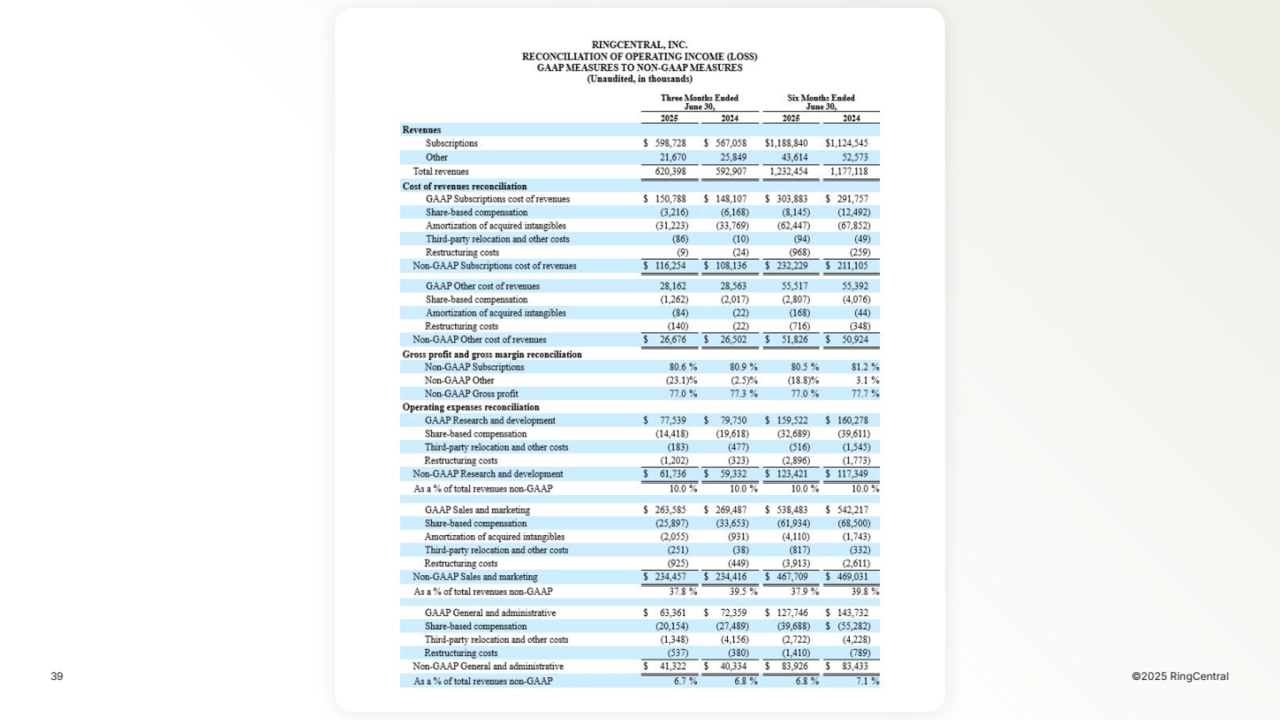

- 39. 39 ©2025 RingCentral

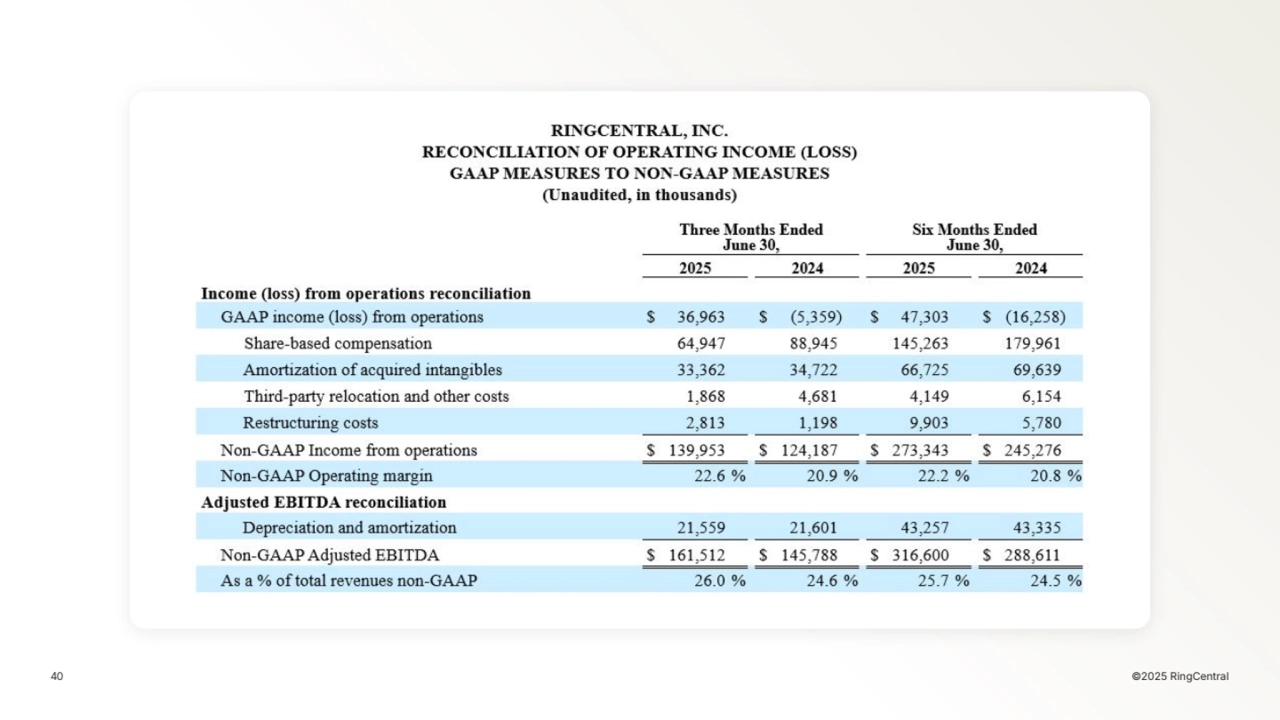

- 40. 40 ©2025 RingCentral

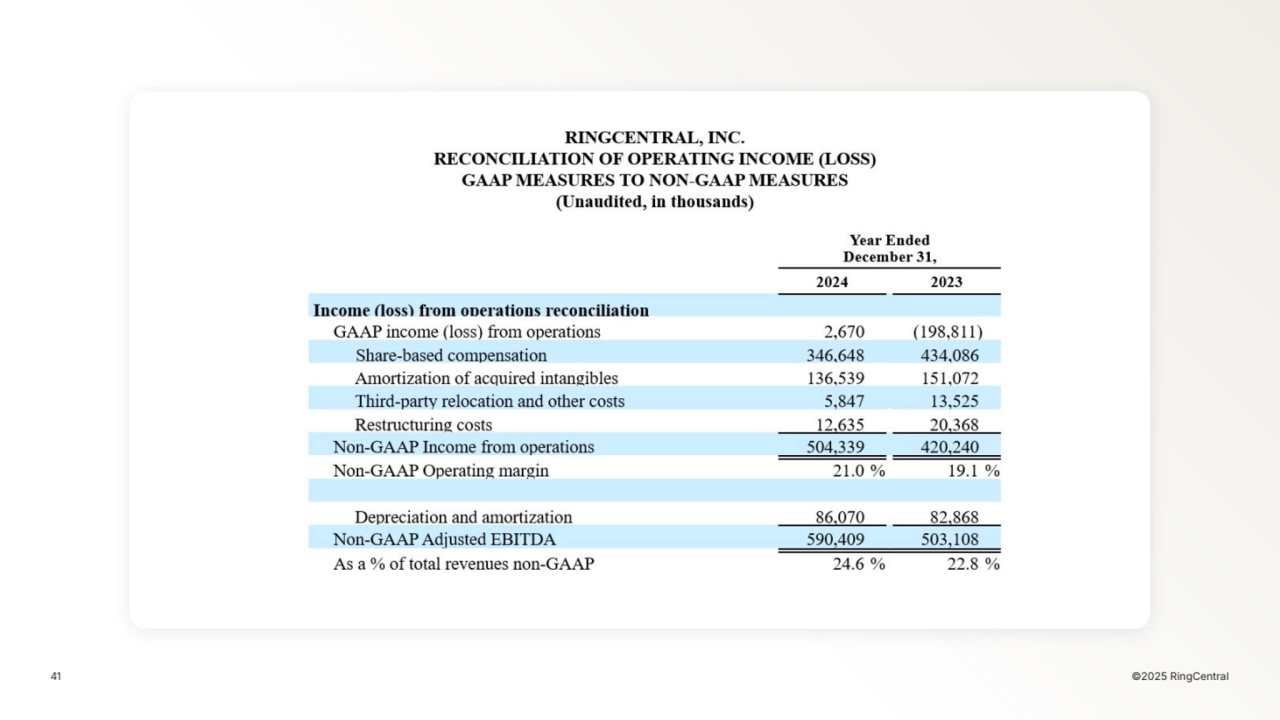

- 41. 41 ©2025 RingCentral

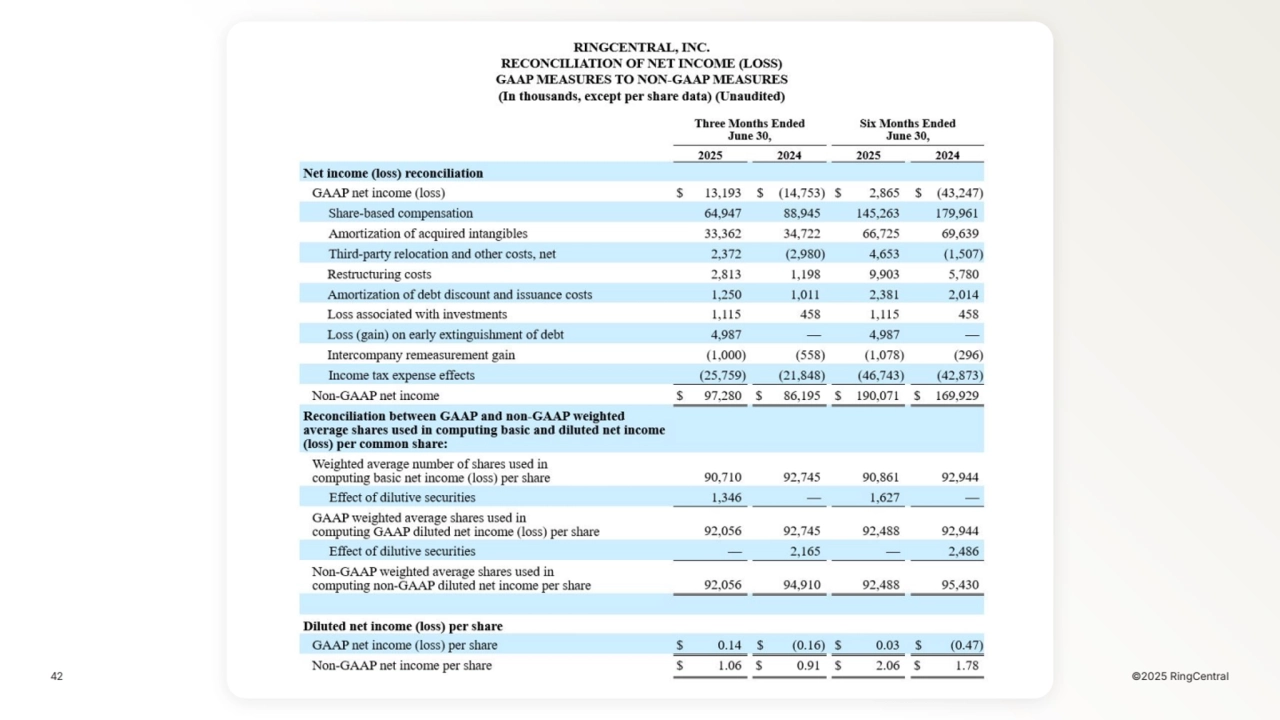

- 42. 42 ©2025 RingCentral

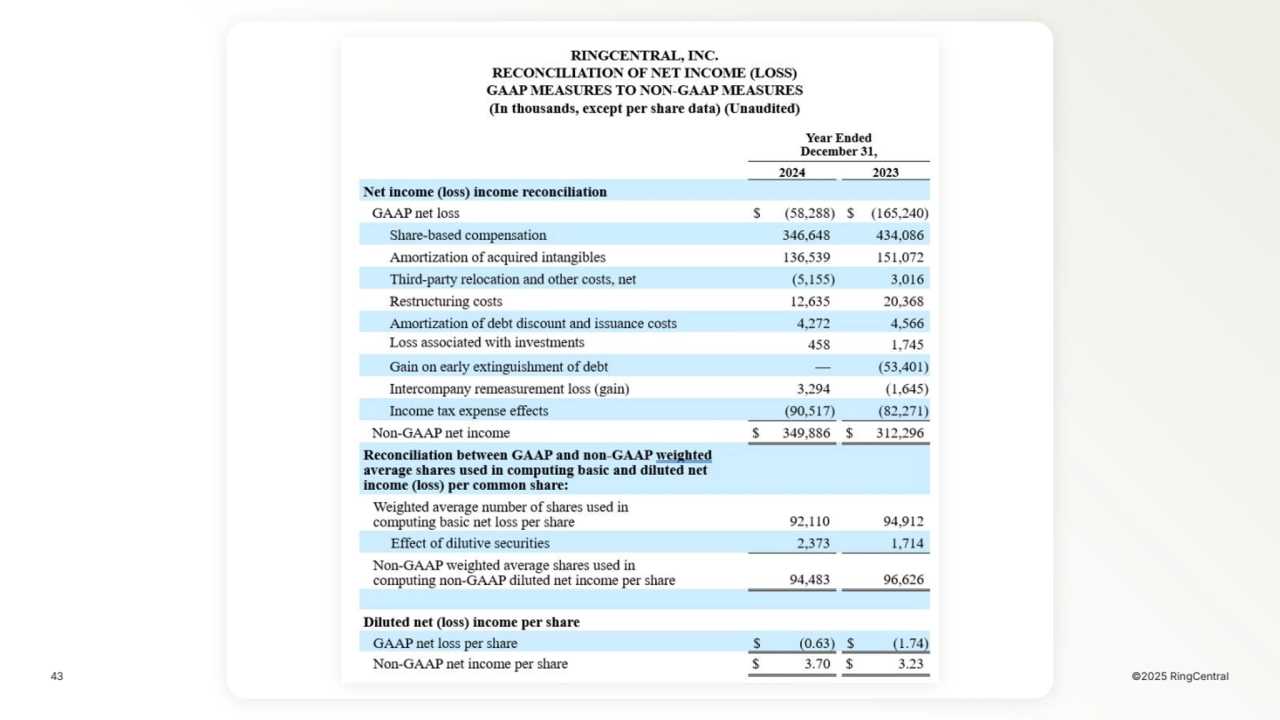

- 43. 43 ©2025 RingCentral

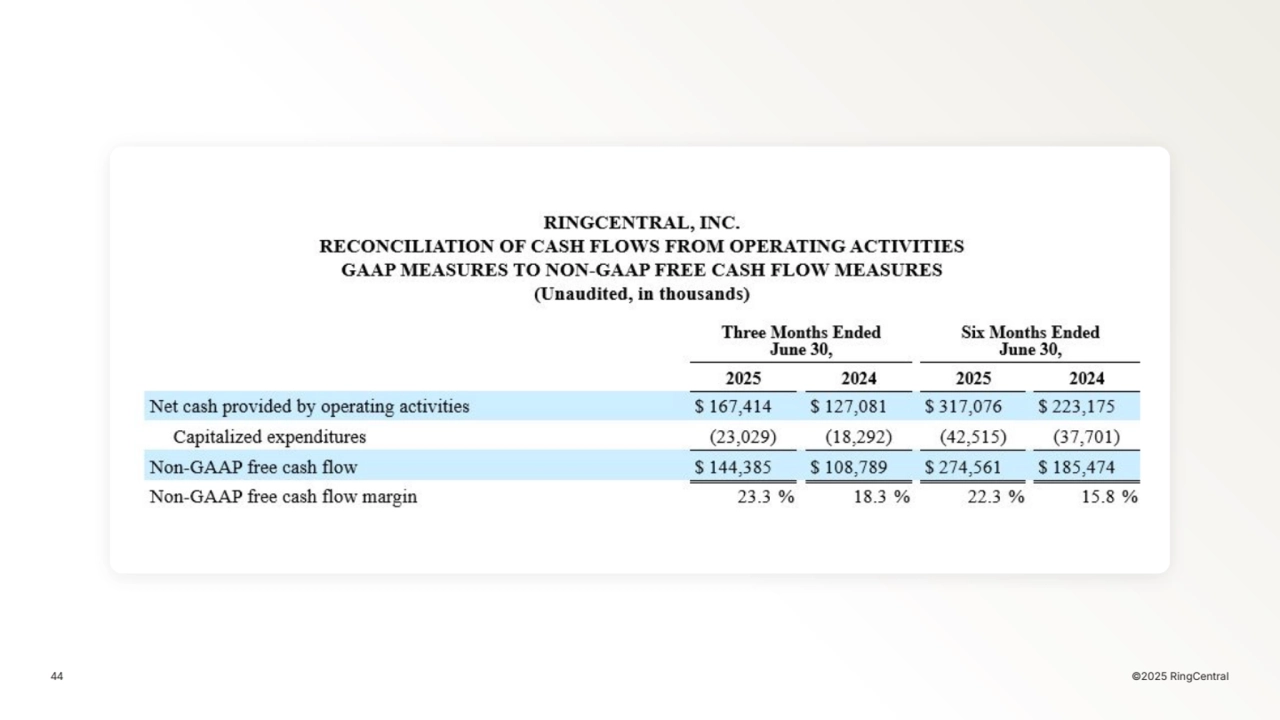

- 44. 44 ©2025 RingCentral

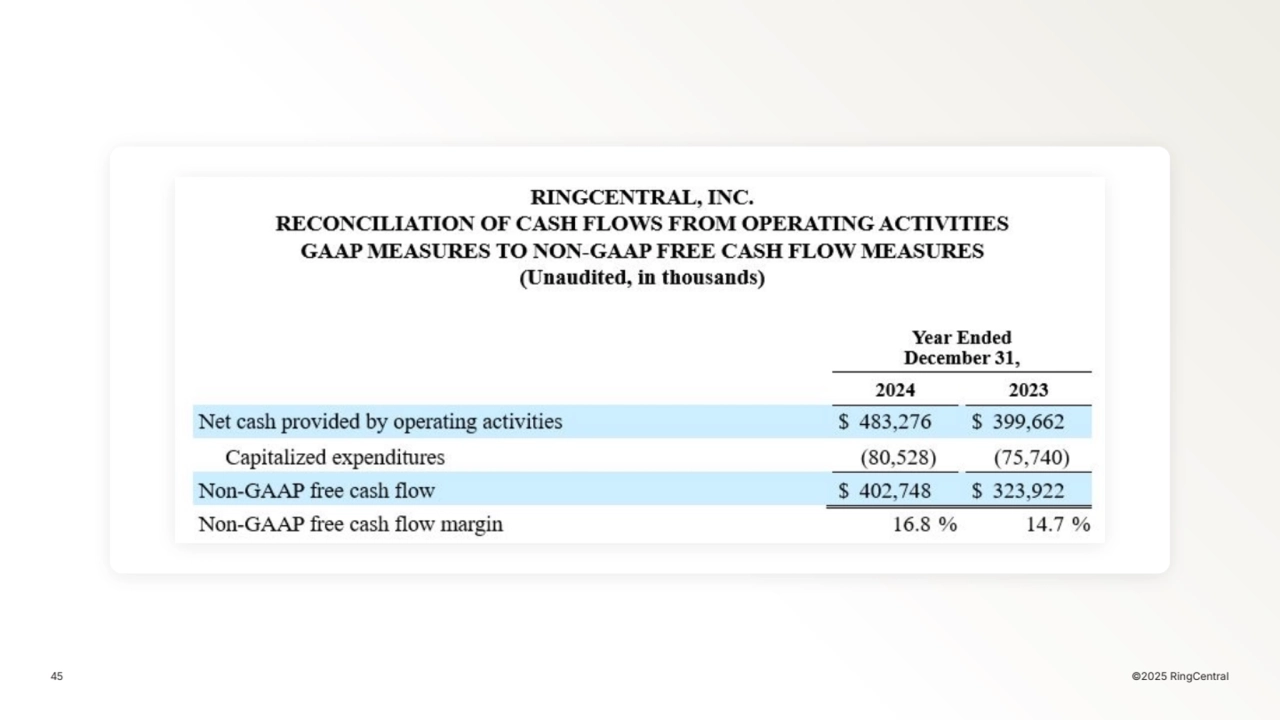

- 45. 45 ©2025 RingCentral

- 46. 46 ©2025 RingCentral

- 47. Thank You 47 ©2025 RingCentral