AMD 3Q24-Earnings- highlights

AI Summary

AI Summary

Key Insights

- Bullet points not available for this slide.

Loading...

AMD 3Q24-Earnings- highlights

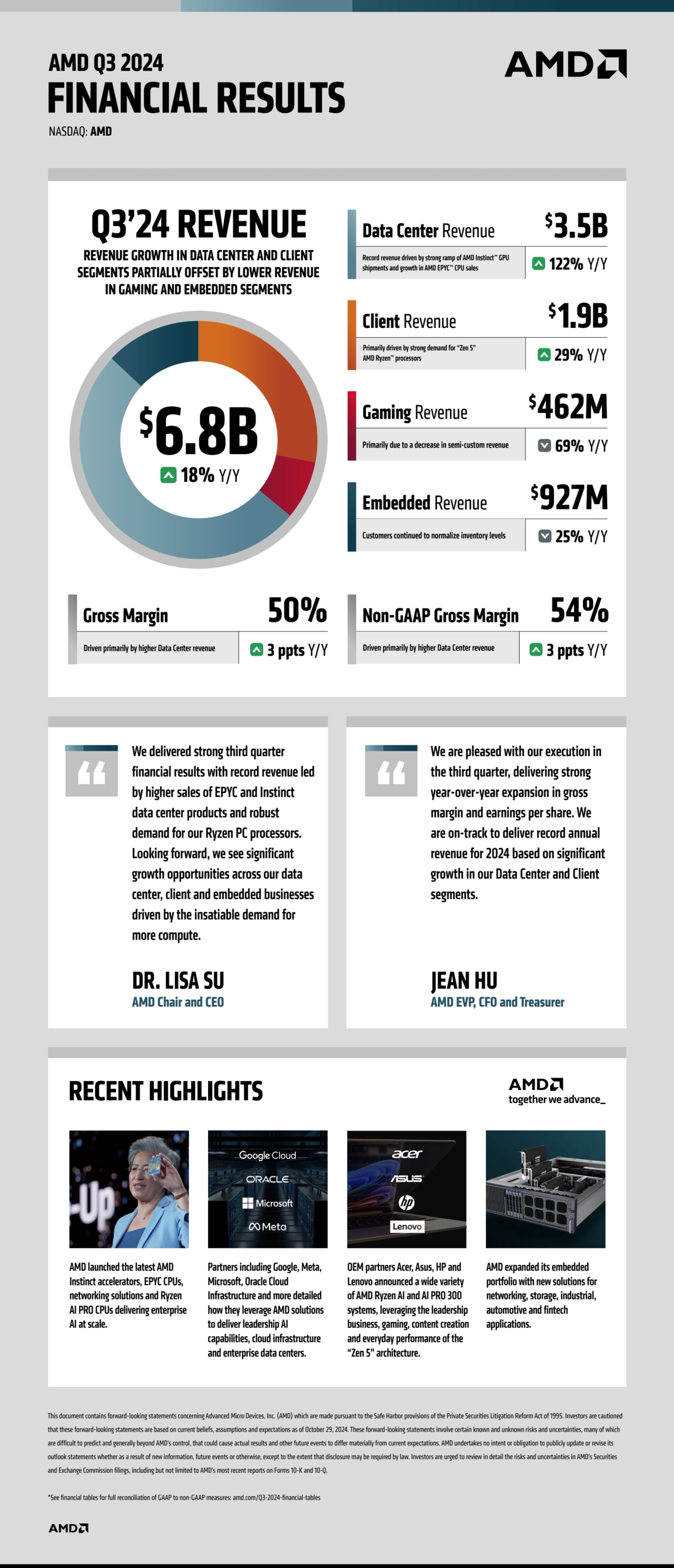

- 1. NASDAQ: AMD AMD Q3 2024 FINANCIAL RESULTS This document contains forward-looking statements concerning Advanced Micro Devices, Inc. (AMD) which are made pursuant to the Safe Harbor provisions of the Private Securities Litigation Reform Act of 1995. Investors are cautioned that these forward-looking statements are based on current beliefs, assumptions and expectations as of October 29, 2024. These forward-looking statements involve certain known and unknown risks and uncertainties, many of which are difficult to predict and generally beyond AMD’s control, that could cause actual results and other future events to differ materially from current expectations. AMD undertakes no intent or obligation to publicly update or revise its outlook statements whether as a result of new information, future events or otherwise, except to the extent that disclosure may be required by law. Investors are urged to review in detail the risks and uncertainties in AMD’s Securities and Exchange Commission filings, including but not limited to AMD’s most recent reports on Forms 10-K and 10-Q. *See financial tables for full reconciliation of GAAP to non-GAAP measures: amd.com/Q3-2024-financial-tables AMD Chair and CEO DR. LISA SU We delivered strong third quarter financial results with record revenue led by higher sales of EPYC and Instinct data center products and robust demand for our Ryzen PC processors. Looking forward, we see significant growth opportunities across our data center, client and embedded businesses driven by the insatiable demand for more compute. AMD EVP, CFO and Treasurer JEAN HU We are pleased with our execution in the third quarter, delivering strong year-over-year expansion in gross margin and earnings per share. We are on-track to deliver record annual revenue for 2024 based on significant growth in our Data Center and Client segments. AMD launched the latest AMD Instinct accelerators, EPYC CPUs, networking solutions and Ryzen AI PRO CPUs delivering enterprise AI at scale. Partners including Google, Meta, Microsoft, Oracle Cloud Infrastructure and more detailed how they leverage AMD solutions to deliver leadership AI capabilities, cloud infrastructure and enterprise data centers. OEM partners Acer, Asus, HP and Lenovo announced a wide variety of AMD Ryzen AI and AI PRO 300 systems, leveraging the leadership business, gaming, content creation and everyday performance of the “Zen 5” architecture. AMD expanded its embedded portfolio with new solutions for networking, storage, industrial, automotive and fintech applications. RECENT HIGHLIGHTS Q3’24 REVENUE REVENUE GROWTH IN DATA CENTER AND CLIENT SEGMENTS PARTIALLY OFFSET BY LOWER REVENUE IN GAMING AND EMBEDDED SEGMENTS Data Center Revenue 3.5B $ Client Revenue 1.9B $ Primarily driven by strong demand for “Zen 5” AMD Ryzen™ processors Gaming Revenue $ 462M Primarily due to a decrease in semi-custom revenue Record revenue driven by strong ramp of AMD Instinct™ GPU shipments and growth in AMD EPYC™ CPU sales 69% Y/Y 29% Y/Y Embedded Revenue $ 927M Customers continued to normalize inventory levels 25% Y/Y Non-GAAP Gross Margin 54% Driven primarily by higher Data Center revenue 3 ppts Y/Y Driven primarily by higher Data Center revenue 3 ppts Y/Y 122% Y/Y Gross Margin 50% 6.8B $ 18% Y/Y