AMD Financials: Q2 2025 Results

AI Summary

AI Summary

Key Insights

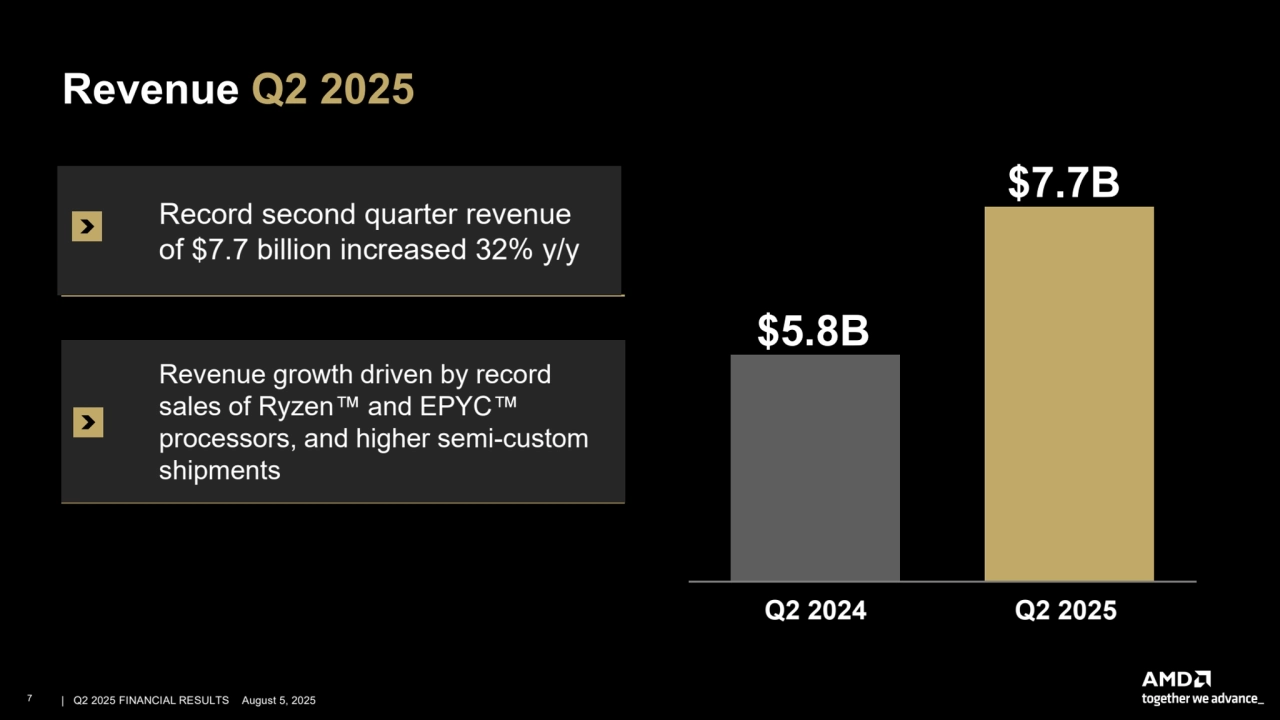

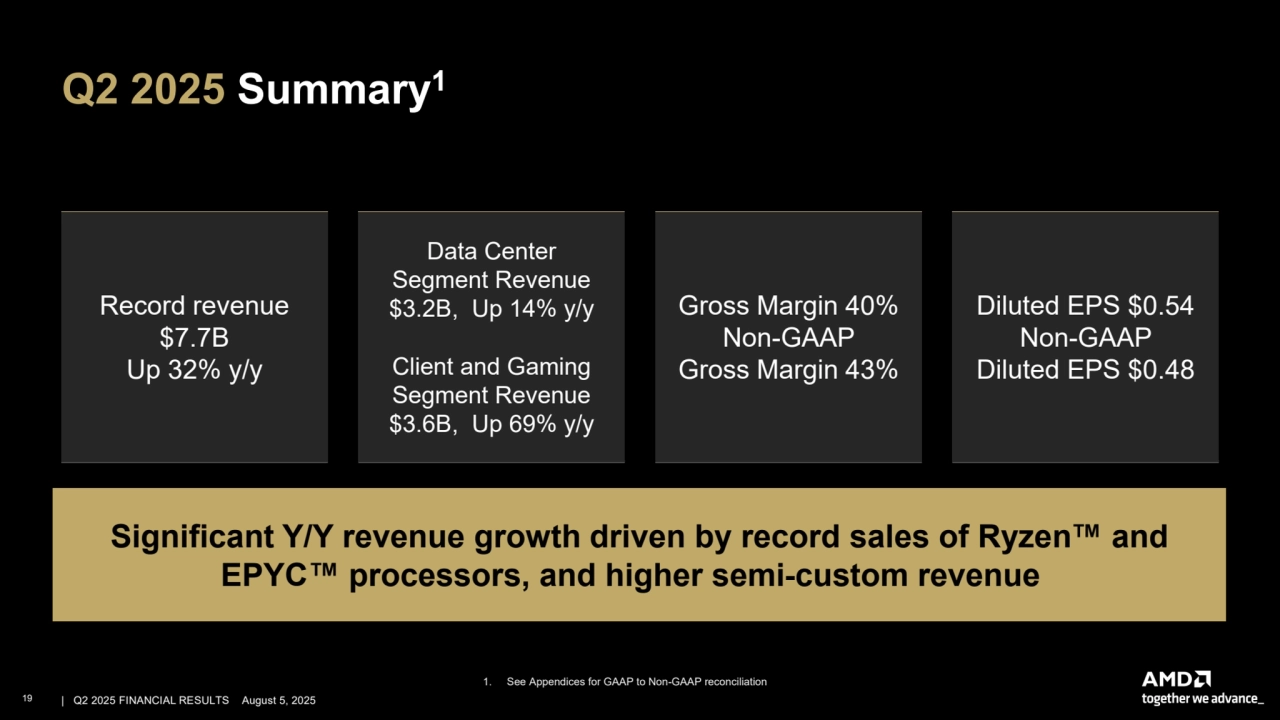

- 📈 Financial Performance: AMD's Q2 2025 revenue reached $7.7 billion, a 32% year-over-year increase.

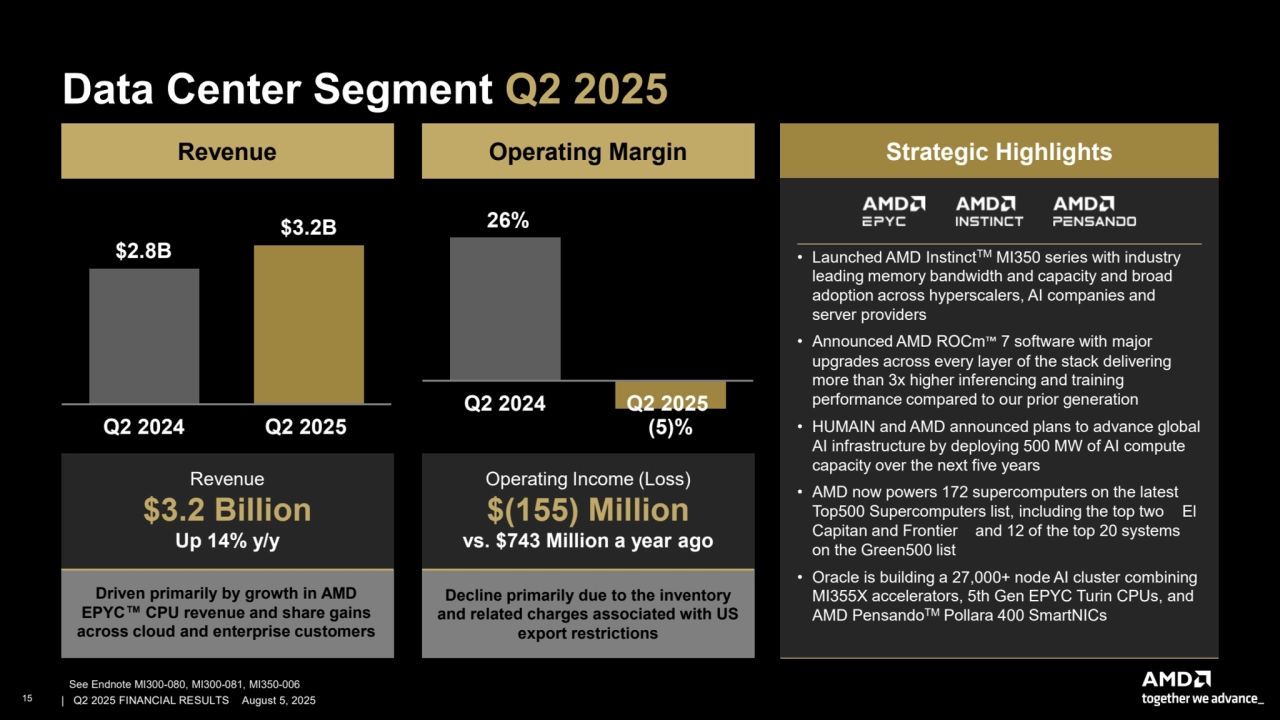

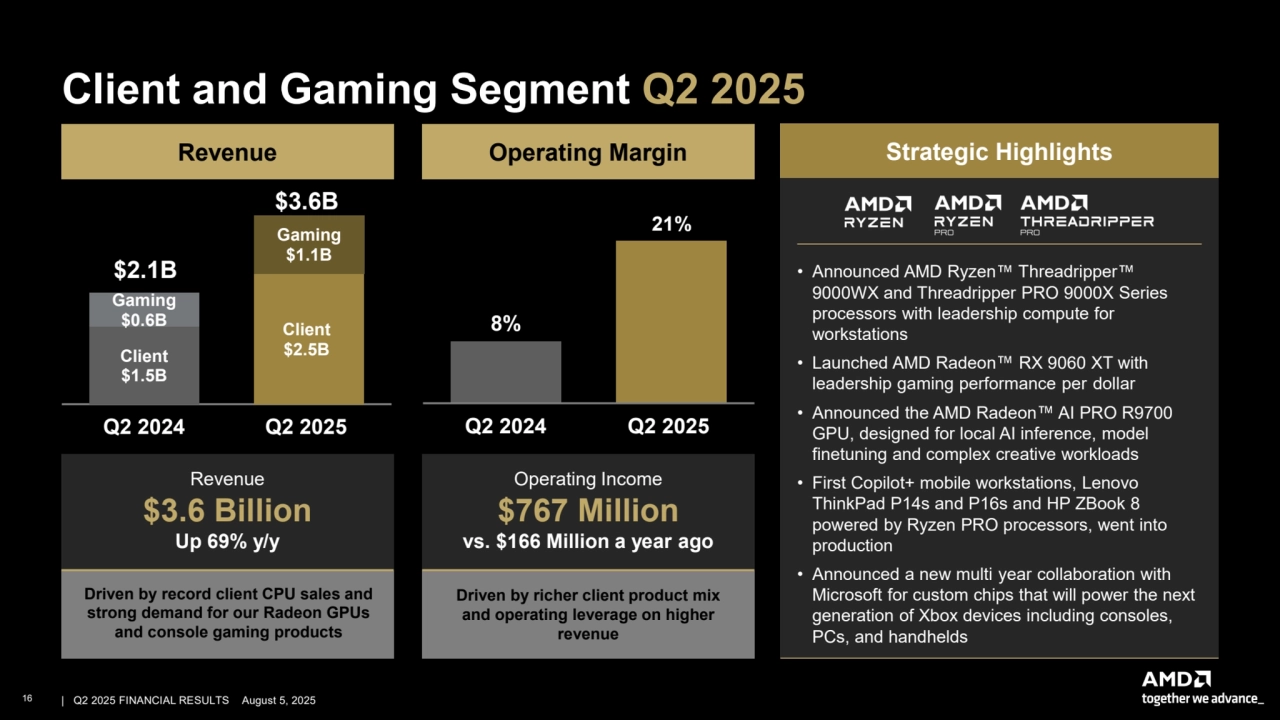

- 💻 Segment Growth: The Data Center segment saw revenue increase by 14%, while the Client and Gaming segment surged by 69%.

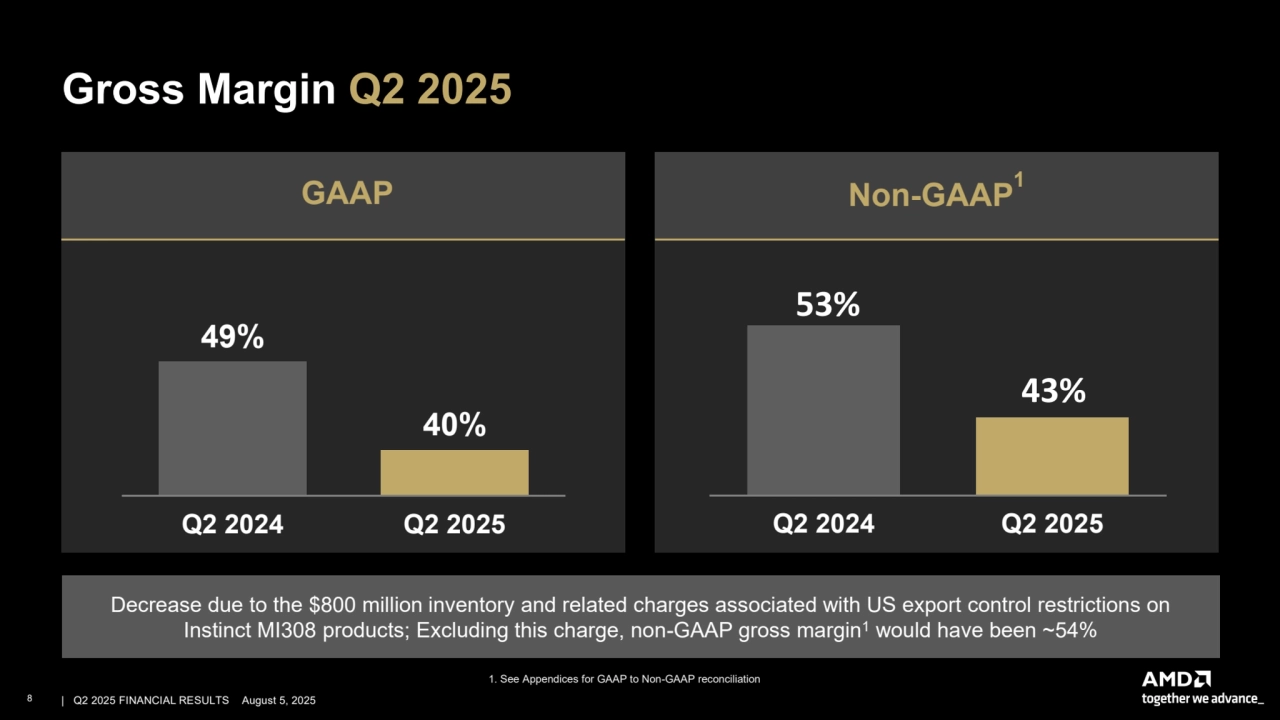

- 💰 Gross Margin: The GAAP gross margin was 40%, and the non-GAAP gross margin was 43%.

- 🚀 Strategic Highlights: AMD launched the Instinct™ MI350 series and announced ROCm™ 7 software improvements.

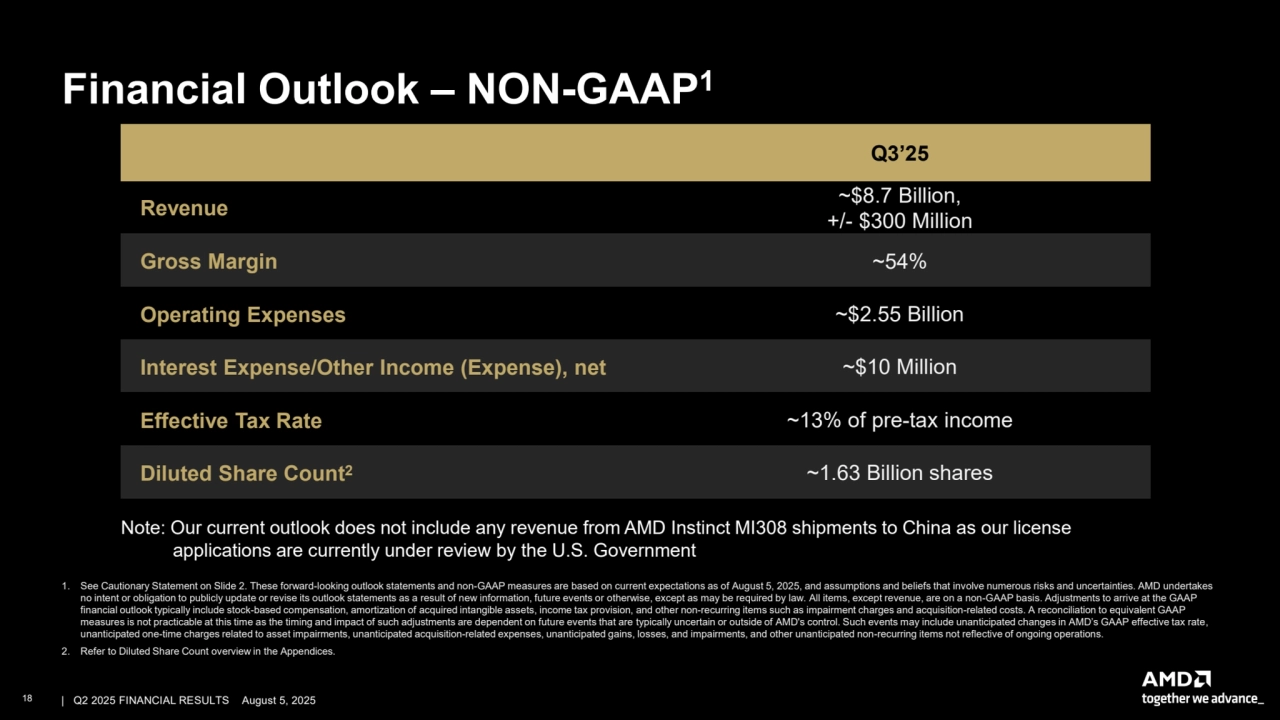

- 🌐 Future Outlook: Q3 2025 revenue is projected to be approximately $8.7 billion, with a gross margin of around 54%.

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

AMD Financials: Q2 2025 Results

- 1. AMD Financial Results Second Quarter 2025 August 5, 2025

- 2. – - ' ' ' ' - - - - ’ ' - - " " " " " " " " " " " " " " - ' - ' ' ' ’ ' - ’ - ' - ' ' ’ - - - - ' ' - ' ' ’ ’ - - - - - - - - - - - - - - - - - - - ’ - - - - - - - Cautionary Statement This presentation contains forward looking statements concerning Advanced Micro Devices, Inc. (AMD), such as the features, functionality, performance, availability, timing and expected benefits of future AMD products; AMD s large growth opportunities across diverse set of markets; AMD s data center AI accelerator opportunity; AMD s anticipated sale of ZT Systems data center infrastructure manufacturing business and expected benefits and timing of the transaction; AMD’s expected third quarter 2025 financial outlook, including revenue, non GAAP gross margin, non GAAP operating expenses, non GAAP Interest Expense/Other Income (Expense), net, non GAAP tax rate and diluted share count; AMD’s large and compelling TAM; AMD s ability to expand Data Center and AI leadership; AMD s financial and operating performance; the impact of export licensing requirements on AMD; and AMD’s ability to drive long term shareholder returns, which are made pursuant to the Safe Harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward looking statements are commonly identified by words such as would, may, expects, believes, plans, intends, projects and other terms with similar meaning. Investors are cautioned that the forward looking statements in this presentation are based on current beliefs, assumptions and expectations, speak only as of the date of this presentation and involve risks and uncertainties that could cause actual results to differ materially from current expectations. Such statements are subject to certain known and unknown risks and uncertainties, many of which are difficult to predict and generally beyond AMD s control, that could cause actual results and other future events to differ materially from those expressed in, or implied or projected by, the forward looking information and statements. Material factors that could cause actual results to differ materially from current expectations include, without limitation, the following: impact of government actions and regulations such as export regulations, tariffs and trade protection measures, and licensing requirements; competitive markets in which AMD’s products are sold; the cyclical nature of the semiconductor industry; market conditions of the industries in which AMD products are sold; AMD s ability to introduce products on a timely basis with expected features and performance levels; loss of a significant customer; economic and market uncertainty; quarterly and seasonal sales patterns; AMD s ability to adequately protect its technology or other intellectual property; unfavorable currency exchange rate fluctuations; ability of third party manufacturers to manufacture AMD s products on a timely basis in sufficient quantities and using competitive technologies; availability of essential equipment, materials, substrates or manufacturing processes; ability to achieve expected manufacturing yields for AMD s products; AMD s ability to generate revenue from its semi custom SoC products; potential security vulnerabilities; potential security incidents including IT outages, data loss, data breaches and cyberattacks; uncertainties involving the ordering and shipment of AMD’s products; AMD s reliance on third party intellectual property to design and introduce new products; AMD s reliance on third party companies for design, manufacture and supply of motherboards, software, memory and other computer platform components; AMD s reliance on Microsoft and other software vendors support to design and develop software to run on AMD’s products; AMD s reliance on third party distributors and add in board partners; impact of modification or interruption of AMD’s internal business processes and information systems; compatibility of AMD’s products with some or all industry standard software and hardware; costs related to defective products; efficiency of AMD s supply chain; AMD s ability to rely on third party supply chain logistics functions; AMD’s ability to effectively control sales of its products on the gray market; impact of climate change on AMD’s business; AMD’s ability to realize its deferred tax assets; potential tax liabilities; current and future claims and litigation; impact of environmental laws, conflict minerals related provisions and other laws or regulations; evolving expectations from governments, investors, customers and other stakeholders regarding corporate responsibility matters; issues related to the responsible use of AI; restrictions imposed by agreements governing AMD’s notes, the guarantees of Xilinx’s notes, the revolving credit agreement and the ZT Systems credit agreement; impact of acquisitions, joint ventures and/or strategic investments on AMD’s business and AMD’s ability to integrate acquired businesses, including ZT Systems; AMD s ability to complete the sale of ZT Systems manufacturing business; impact of any impairment of the combined company’s assets; political, legal and economic risks and natural disasters; future impairments of technology license purchases; AMD s ability to attract and retain qualified personnel; and AMD’s stock price volatility. Investors are urged to review in detail the risks and uncertainties in AMD s Securities and Exchange Commission filings, including but not limited to AMD’s most recent reports on Forms 10 K and 10 Q. This presentation also contains estimates and other statistical data made by independent parties and by us relating to market size and other data about our industry. This data involves a number of assumptions and limitations, and you are cautioned not to give undue weight to such estimates. NON GAAP Financial Measures In this presentation, in addition to GAAP financial results, AMD has provided non GAAP financial measures including non GAAP gross profit, non GAAP gross margin, non GAAP operating expenses, non GAAP operating expenses/revenue percent, non GAAP operating income, non GAAP operating margin, non GAAP net income and non GAAP diluted earnings per share. AMD uses a normalized tax rate in its computation of the non GAAP income tax provision to provide better consistency across the reporting periods. For fiscal 2025, AMD uses a projected non GAAP tax rate of 13%, which excludes the tax impact of pre tax non GAAP adjustments. Additionally, AMD has provided an adjusted non GAAP gross profit and gross margin which excludes the inventory and related charges associated with U.S. export restrictions. AMD also provides adjusted free cash flow as supplemental non GAAP measures of its performance. AMD is providing these financial measures because it believes this non GAAP presentation makes it easier for investors to compare its operating results for current and historical periods and also because AMD believes it assists investors in comparing AMD s performance across reporting periods on a consistent basis by excluding items that it does not believe are indicative of its core operating performance. The non GAAP financial measures disclosed in this presentation should be viewed in addition to and not as a substitute for or superior to AMD’s reported results prepared in accordance with GAAP and should be read only in conjunction with AMD’s Consolidated Financial Statements prepared in accordance with GAAP. These non GAAP financial measures referenced are reconciled to their most directly comparable GAAP financial measures in the Appendices at the end of this presentation. This presentation also contains forward looking non GAAP measures concerning AMD’s financial outlook such as gross margin, operating expenses, interest expense/other income (expense), net, tax rate and share count. These forward looking non GAAP measures are based on current expectations as of August 5, 2025, and assumptions and beliefs that involve numerous risks and uncertainties. AMD undertakes no intent or obligation to publicly update or revise its forward looking statements made in this presentation except as may be required by law. 2 | | Q2 2025 FINANCIAL RESULTS August 5, 2025

- 3. – Leadership Product Portfolio Expanding Customer & Partner Ecosystem Our Journey Data Center and AI Growth Strong Financial Foundation 3 | Q2 2025 FINANCIAL RESULTS August 5, 2025 |

- 4. – High Performance & Adaptive Computing Leadership Accelerating innovation in silicon architecture, advanced packaging and software Scaling compute engines from cloud to edge to endpoints with leadership performance per watt Delivering a robust software stack and flexibility, transparency and choice to developers Computing partner of choice across AI, data center, embedded, PCs and gaming Leadership Foundational IP Breadth and Depth of Portfolio Open, Proven Software Ecosystem Deep, Collaborative Partnerships 4 | | Q2 2025 FINANCIAL RESULTS August 5, 2025

- 5. – Large Growth Opportunities Across a Diverse Set of Markets Data Center Client and Gaming Embedded Industry’s broadest portfolio of adaptive and embedded computing platforms Leadership performance and TCO across cloud, enterprise and AI workloads Performance, efficiency and AI capabilities for commercial and consumer PC and gaming experiences 5 | | Q2 2025 FINANCIAL RESULTS August 5, 2025

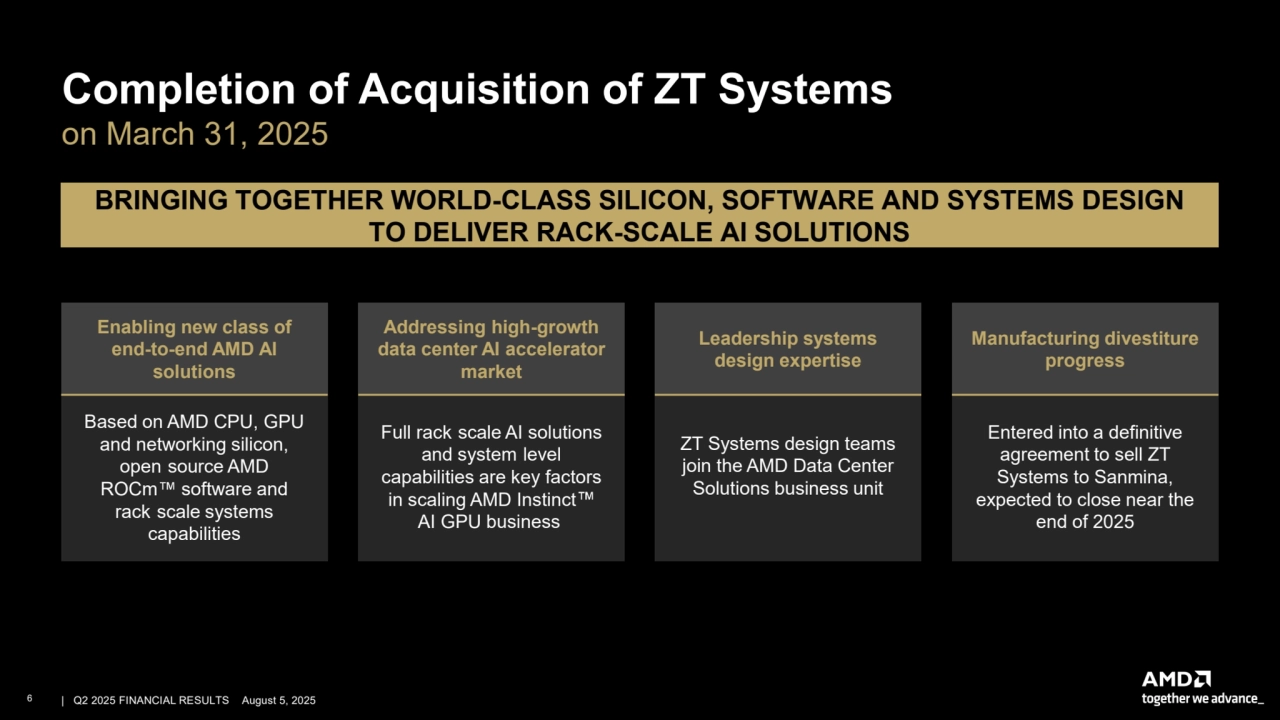

- 6. – - - - - Completion of Acquisition of ZT Systems on March 31, 2025 BRINGING TOGETHER WORLD-CLASS SILICON, SOFTWARE AND SYSTEMS DESIGN TO DELIVER RACK-SCALE AI SOLUTIONS Full rack scale AI solutions and system level capabilities are key factors in scaling AMD Instinct AI GPU business ZT Systems design teams join the AMD Data Center Solutions business unit Entered into a definitive agreement to sell ZT Systems to Sanmina, expected to close near the end of 2025 Enabling new class of end-to-end AMD AI solutions Addressing high-growth data center AI accelerator market Leadership systems design expertise Manufacturing divestiture progress Based on AMD CPU, GPU and networking silicon, open ROCm source AMD software and rack scale systems capabilities 6 | | Q2 2025 FINANCIAL RESULTS August 5, 2025

- 7. – Revenue Q2 2025 Record second quarter revenue of $7.7 billion increased 32% y/y Revenue growth driven by record sales of Ryzen and EPYC processors, and higher semi-custom shipments $7.7B $5.8B Q2 2024 Q2 2025 7 | | Q2 2025 FINANCIAL RESULTS August 5, 2025

- 8. – GAAP 49% Q2 2024 40% Q2 2025 Non-GAAP 1 53% 43% Q2 2024 Q2 2025 Gross Margin Q2 2025 Decrease due to the $800 million inventory and related charges associated with US export control restrictions on Instinct MI308 products; Excluding this charge, non-GAAP gross margin1 would have been ~54% 1. See Appendices for GAAP to Non-GAAP reconciliation 8 | | Q2 2025 FINANCIAL RESULTS August 5, 2025

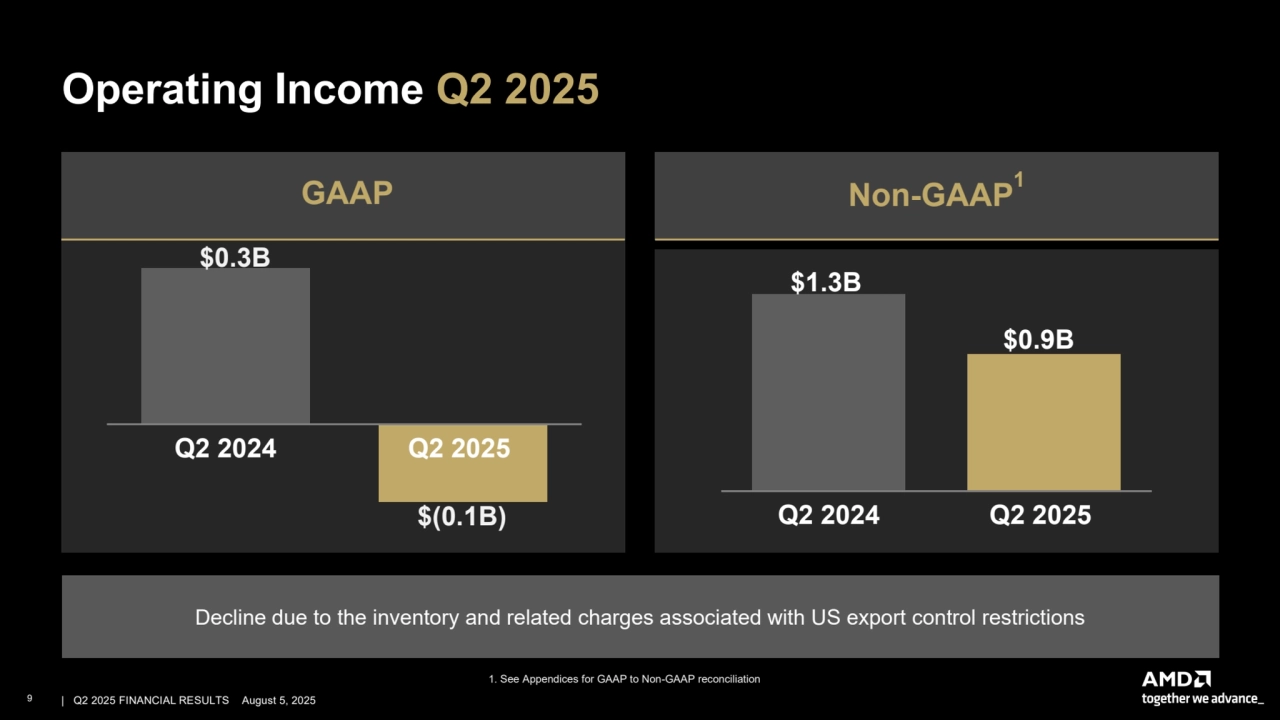

- 9. Operating Income Q2 2025 GAAP Non-GAAP 1 Decline due to the inventory and related charges associated with US export control restrictions Q2 2024 Q2 2025 $0.3B $(0.1B) $1.3B $0.9B Q2 2024 Q2 2025 – 1. See Appendices for GAAP to Non-GAAP reconciliation 9 | | Q2 2025 FINANCIAL RESULTS August 5, 2025

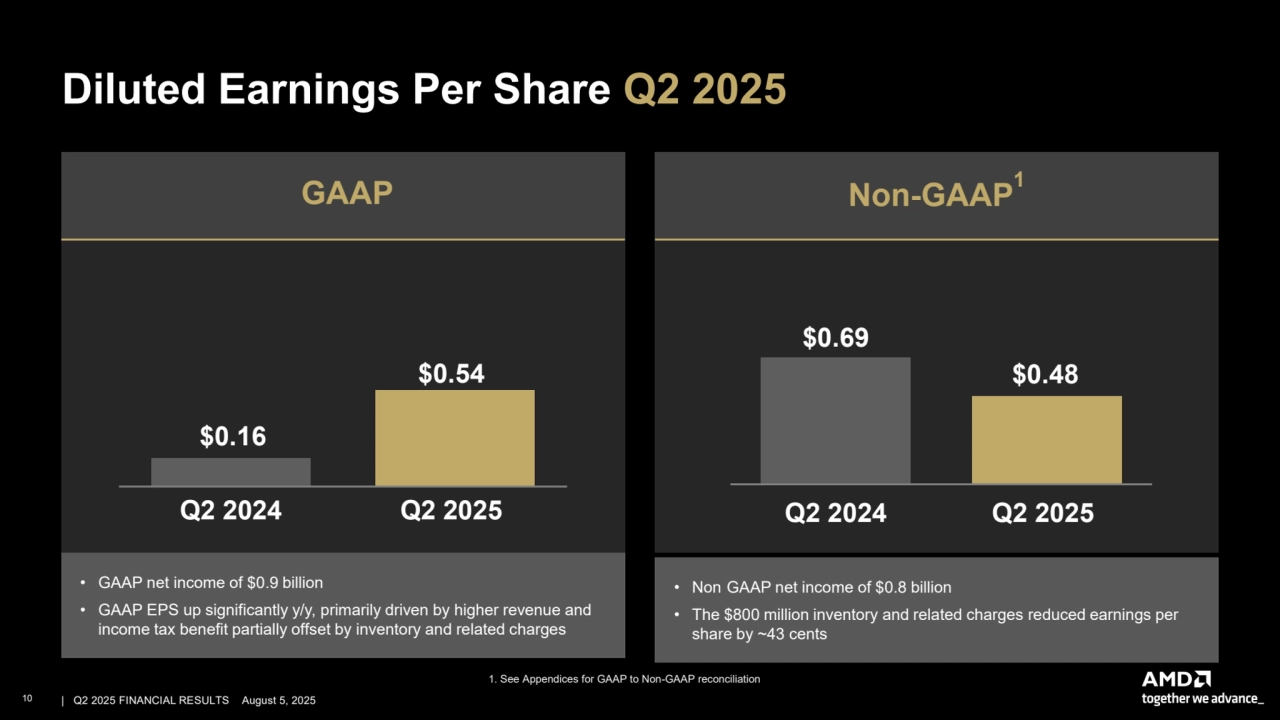

- 10. Diluted Earnings Per Share Q2 2025 GAAP Non-GAAP 1 $0.69 $0.48 Q2 2024 Q2 2025 – - $0.54 $0.16 Q2 2024 Q2 2025 • GAAP net income of $0.9 billion • Non GAAP net income of $0.8 billion • GAAP EPS up significantly y/y, primarily driven by higher revenue and • The $800 million inventory and related charges reduced earnings per income tax benefit partially offset by inventory and related charges share by ~43 cents 1. See Appendices for GAAP to Non-GAAP reconciliation 10 | | Q2 2025 FINANCIAL RESULTS August 5, 2025

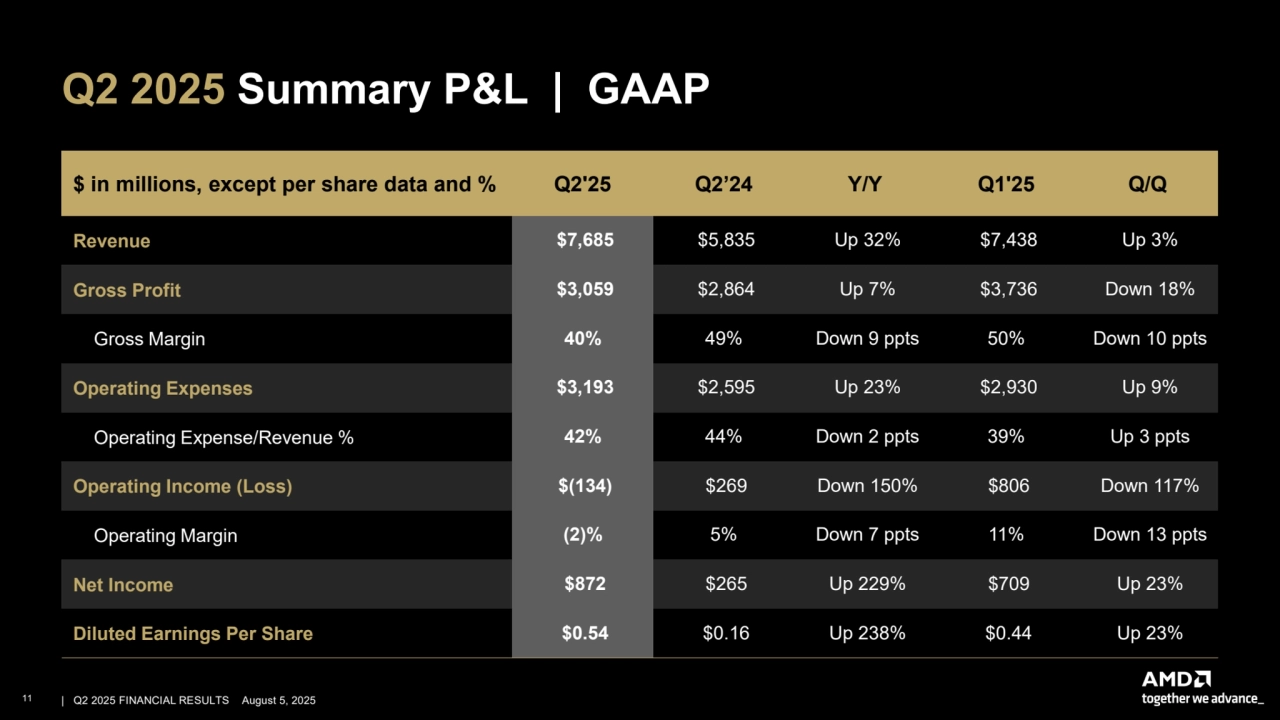

- 11. – Q2 2025 Summary P&L | GAAP $ in millions, except per share data and % Q2'25 Q2’24 Y/Y Q1'25 Q/Q Revenue $7,685 $5,835 Up 32% $7,438 Up 3% Gross Profit $3,059 $2,864 Up 7% $3,736 Down 18% Gross Margin 40% 49% Down 9 ppts 50% Down 10 ppts Operating Expenses $3,193 $2,595 Up 23% $2,930 Up 9% Operating Expense/Revenue % 42% 44% Down 2 ppts 39% Up 3 ppts Operating Income (Loss) $(134) $269 Down 150% $806 Down 117% Operating Margin (2)% 5% Down 7 ppts 11% Down 13 ppts Net Income $872 $265 Up 229% $709 Up 23% Diluted Earnings Per Share $0.54 $0.16 Up 238% $0.44 Up 23% 11 | | Q2 2025 FINANCIAL RESULTS August 5, 2025

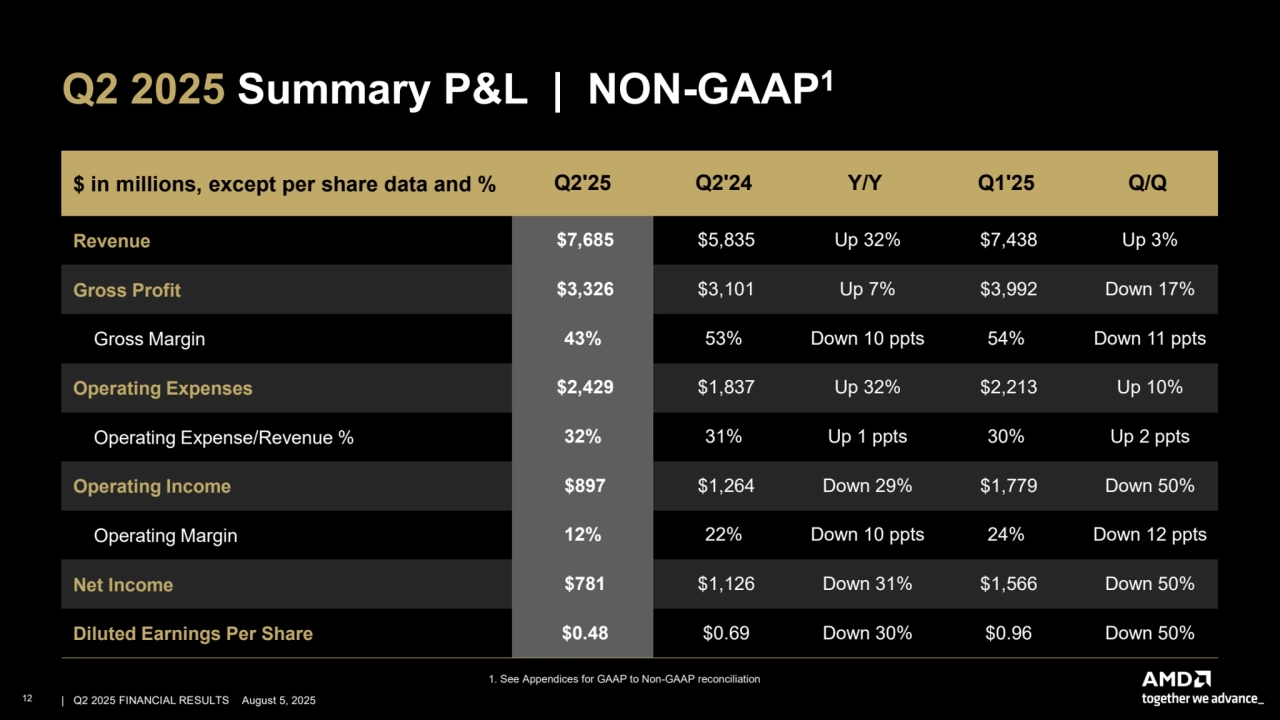

- 12. – Q2 2025 Summary P&L | NON-GAAP1 1. See Appendices for GAAP to Non-GAAP reconciliation 12 | | Q2 2025 FINANCIAL RESULTS August 5, 2025 $ in millions, except per share data and % Q2'25 Q2'24 Y/Y Q1'25 Q/Q Revenue $7,685 $5,835 Up 32% $7,438 Up 3% Gross Profit $3,326 $3,101 Up 7% $3,992 Down 17% Gross Margin 43% 53% Down 10 ppts 54% Down 11 ppts Operating Expenses $2,429 $1,837 Up 32% $2,213 Up 10% Operating Expense/Revenue % 32% 31% Up 1 ppts 30% Up 2 ppts Operating Income $897 $1,264 Down 29% $1,779 Down 50% Operating Margin 12% 22% Down 10 ppts 24% Down 12 ppts Net Income $781 $1,126 Down 31% $1,566 Down 50% Diluted Earnings Per Share $0.48 $0.69 Down 30% $0.96 Down 50%

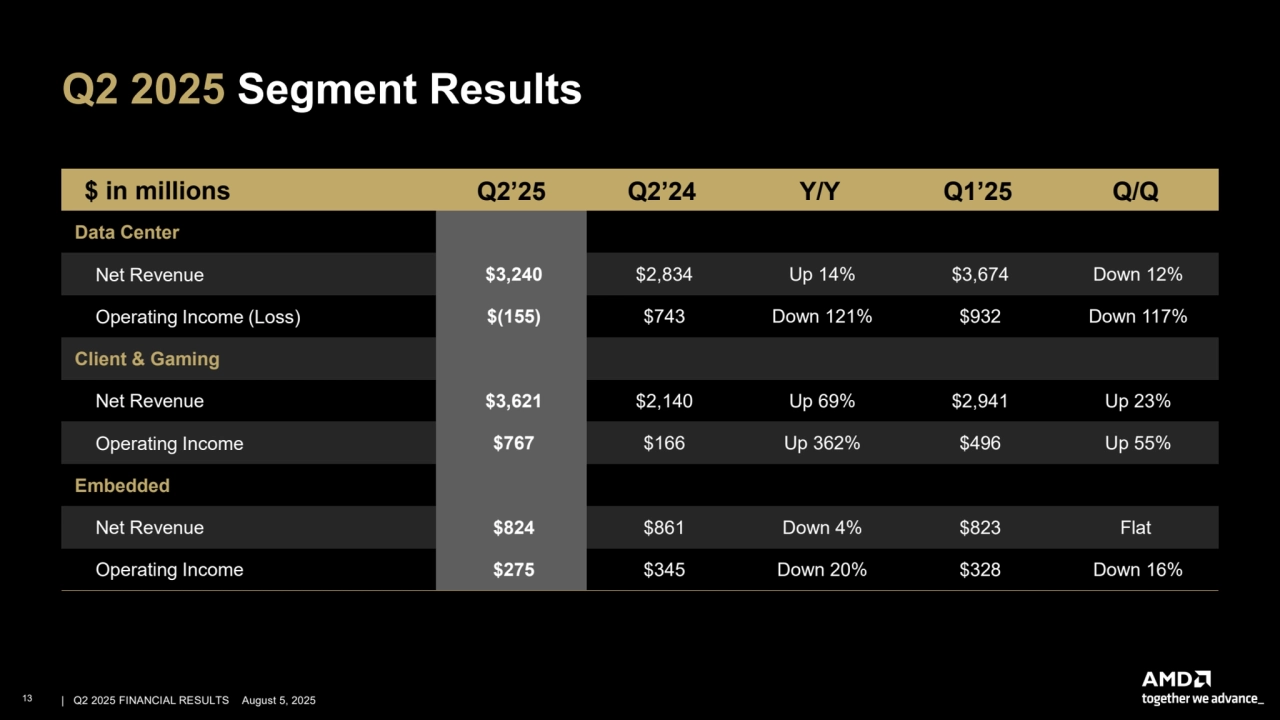

- 13. – Q2 2025 Segment Results $ in millions Q2’25 Q2’24 Y/Y Q1’25 Q/Q Data Center Net Revenue $3,240 $2,834 Up 14% $3,674 Down 12% Operating Income (Loss) $(155) $743 Down 121% $932 Down 117% Client & Gaming Net Revenue $3,621 $2,140 Up 69% $2,941 Up 23% Operating Income $767 $166 Up 362% $496 Up 55% Embedded Net Revenue $824 $861 Down 4% $823 Flat Operating Income $275 $345 Down 20% $328 Down 16% 13 | | Q2 2025 FINANCIAL RESULTS August 5, 2025

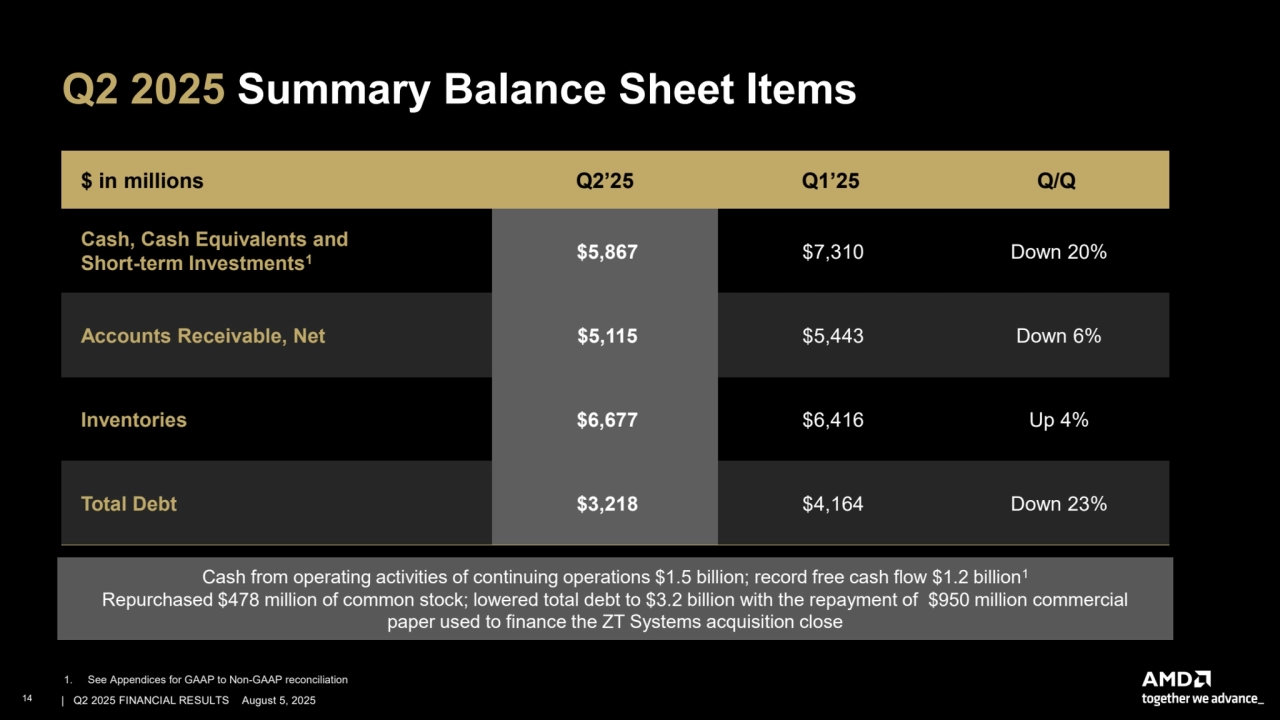

- 14. – Q2 2025 Summary Balance Sheet Items $ in millions Q2’25 Q1’25 Q/Q Cash, Cash Equivalents and Short-term Investments1 $5,867 $7,310 Down 20% Accounts Receivable, Net $5,115 $5,443 Down 6% Inventories $6,677 $6,416 Up 4% Total Debt $3,218 $4,164 Down 23% Cash from operating activities of continuing operations $1.5 billion; record free cash flow $1.2 billion1 Repurchased $478 million of common stock; lowered total debt to $3.2 billion with the repayment of $950 million commercial paper used to finance the ZT Systems acquisition close 1. See Appendices for GAAP to Non-GAAP reconciliation 14 | | Q2 2025 FINANCIAL RESULTS August 5, 2025

- 15. – - – – Data Center Segment Q2 2025 Revenue Operating Margin Strategic Highlights $3.2B 26% (5)% Q2 2024 Q2 2025 $2.8B Q2 2024 Q2 2025 • Launched AMD InstinctTM MI350 series with industry leading memory bandwidth and capacity and broad adoption across hyperscalers, AI companies and server providers • Announced AMD ROCm 7 software with major upgrades across every layer of the stack delivering more than 3x higher inferencing and training performance compared to our prior generation • HUMAIN and AMD announced plans to advance global AI infrastructure by deploying 500 MW of AI compute capacity over the next five years • AMD now powers 172 supercomputers on the latest Top500 Supercomputers list, including the top two El Capitan and Frontier and 12 of the top 20 systems on the Green500 list • Oracle is building a 27,000+ node AI cluster combining MI355X accelerators, 5th Gen EPYC Turin CPUs, and AMD PensandoTM Pollara 400 SmartNICs Driven primarily by growth in AMD EPYC CPU revenue and share gains across cloud and enterprise customers Revenue $3.2 Billion Up 14% y/y Decline primarily due to the inventory and related charges associated with US export restrictions Operating Income (Loss) $(155) Million vs. $743 Million a year ago See Endnote MI300-080, MI300-081, MI350-006 15 | | Q2 2025 FINANCIAL RESULTS August 5, 2025

- 16. – - - - Client and Gaming Segment Q2 2025 Revenue Operating Margin $3.6B Client $2.5B Gaming $1.1B 21% $2.1B Client $1.5B Gaming $0.6B Q2 2024 Q2 2025 8% Q2 2024 Q2 2025 Driven by record client CPU sales and strong demand for our Radeon GPUs and console gaming products Driven by richer client product mix and operating leverage on higher revenue Revenue $3.6 Billion Up 69% y/y Operating Income $767 Million vs. $166 Million a year ago Strategic Highlights • Announced AMD Ryzen Threadripper 9000WX and Threadripper PRO 9000X Series processors with leadership compute for workstations • Announced the AMD Radeon AI PRO R9700 GPU, designed for local AI inference, model finetuning and complex creative workloads • Launched AMD Radeon RX 9060 XT with leadership gaming performance per dollar • First Copilot+ mobile workstations, Lenovo ThinkPad P14s and P16s and HP ZBook 8 powered by Ryzen PRO processors, went into production • Announced a new multi year collaboration with Microsoft for custom chips that will power the next generation of Xbox devices including consoles, PCs, and handhelds 16 | | Q2 2025 FINANCIAL RESULTS August 5, 2025

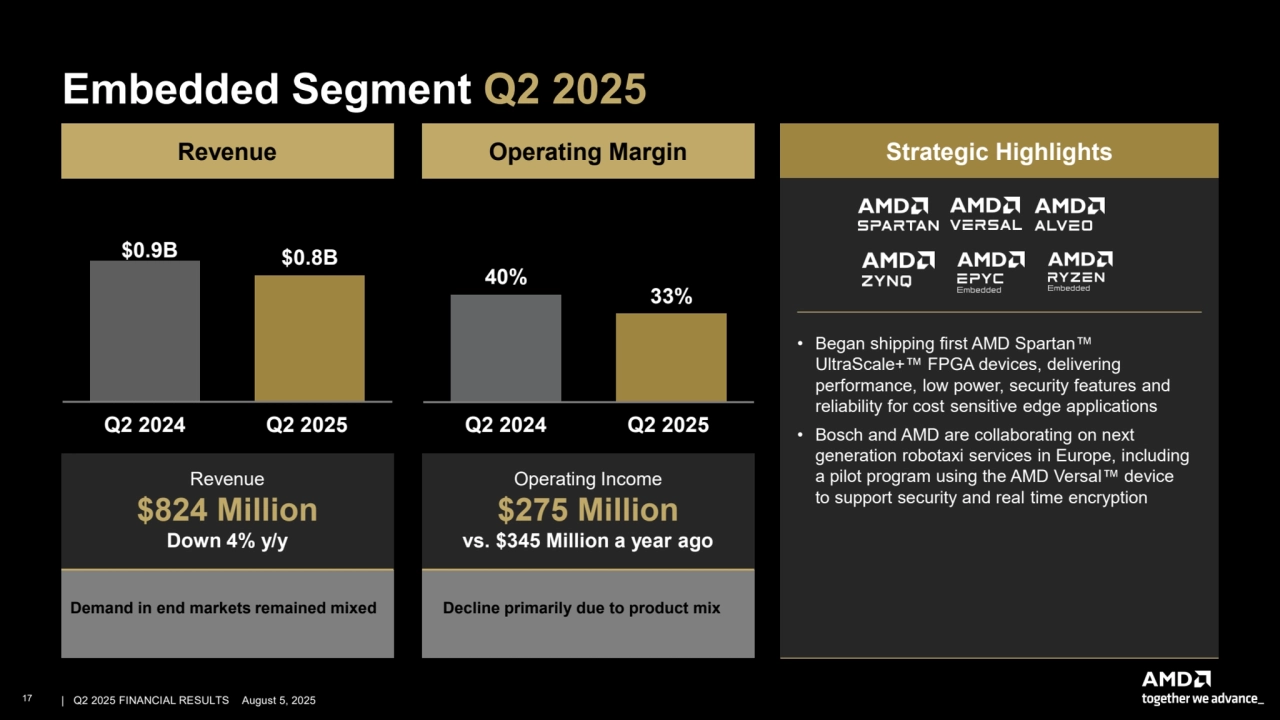

- 17. – - - - Embedded Segment Q2 2025 Revenue Operating Margin $0.9B $0.8B Q2 2024 Q2 2025 40% 33% Q2 2024 Q2 2025 Demand in end markets remained mixed Decline primarily due to product mix Revenue $824 Million Down 4% y/y Operating Income $275 Million vs. $345 Million a year ago Strategic Highlights • Began shipping + first AMD Spartan UltraScale FPGA devices, delivering performance, low power, security features and reliability for cost sensitive edge applications • Bosch and AMD are collaborating on next generation robotaxi services in Europe, including a pilot program using the AMD Versal device to support security and real time encryption 17 | | Q2 2025 FINANCIAL RESULTS August 5, 2025

- 18. – Financial Outlook – NON-GAAP1 Q3’25 ~$8.7 Billion, Revenue +/- $300 Million Gross Margin ~54% Operating Expenses ~$2.55 Billion Interest Expense/Other Income (Expense), net ~$10 Million Effective Tax Rate ~13% of pre-tax income Diluted Share Count2 ~1.63 Billion shares Note: Our current outlook does not include any revenue from AMD Instinct MI308 shipments to China as our license applications are currently under review by the U.S. Government 1. See Cautionary Statement on Slide 2. These forward-looking outlook statements and non-GAAP measures are based on current expectations as of August 5, 2025, and assumptions and beliefs that involve numerous risks and uncertainties. AMD undertakes no intent or obligation to publicly update or revise its outlook statements as a result of new information, future events or otherwise, except as may be required by law. All items, except revenue, are on a non-GAAP basis. Adjustments to arrive at the GAAP financial outlook typically include stock-based compensation, amortization of acquired intangible assets, income tax provision, and other non-recurring items such as impairment charges and acquisition-related costs. A reconciliation to equivalent GAAP measures is not practicable at this time as the timing and impact of such adjustments are dependent on future events that are typically uncertain or outside of AMD's control. Such events may include unanticipated changes in AMD’s GAAP effective tax rate, unanticipated one-time charges related to asset impairments, unanticipated acquisition-related expenses, unanticipated gains, losses, and impairments, and other unanticipated non-recurring items not reflective of ongoing operations. 2. Refer to Diluted Share Count overview in the Appendices. 18 | | Q2 2025 FINANCIAL RESULTS August 5, 2025

- 19. – Q2 2025 Summary1 Record revenue $7.7B Up 32% y/y Gross Margin 40% Non-GAAP Gross Margin 43% Data Center Segment Revenue $3.2B, Up 14% y/y Client and Gaming Segment Revenue $3.6B, Up 69% y/y Diluted EPS $0.54 Non-GAAP Diluted EPS $0.48 Significant Y/Y EPYC revenue growth driven by record sales of Ryzen and processors, and higher semi-custom revenue 1. See Appendices for GAAP to Non-GAAP reconciliation 19 | | Q2 2025 FINANCIAL RESULTS August 5, 2025

- 20. – Corporate Responsibility at AMD Environmental Advancing environmental solutions in our products, supply chain and operations, while accelerating energy efficiency for IT users Social Fostering a culture of diversity, belonging and inclusion, partnering with suppliers and positively impacting our communities Governance Integrating corporate responsibility and governance across product design, supply chain, operations and external engagement 20 | | Q2 2025 FINANCIAL RESULTS August 5, 2025

- 21. – Our Momentum Large and Compelling TAM Technology Leadership Expanding Data Center and AI Leadership World-Class Execution and Focus Strong Balance Sheet DRIVING LONG-TERM SHAREHOLDER RETURNS 21 | | Q2 2025 FINANCIAL RESULTS August 5, 2025

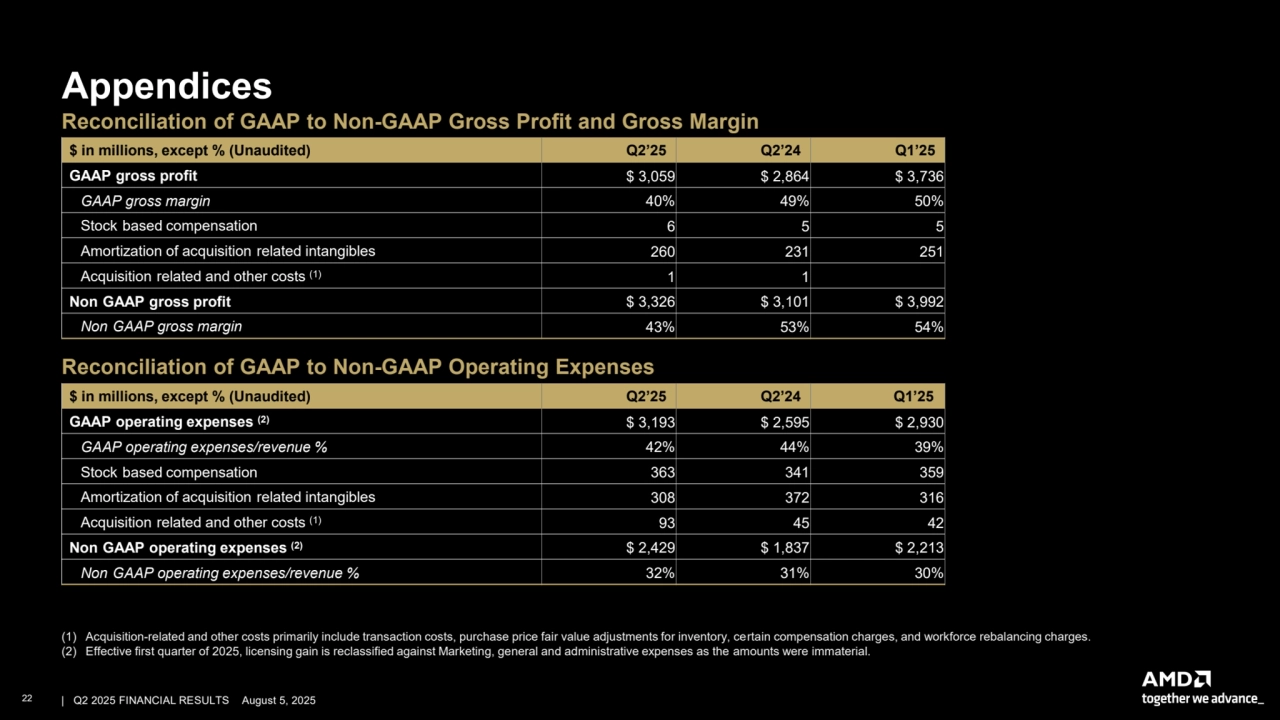

- 22. – - - - - - - - - - - - Appendices Reconciliation of GAAP to Non-GAAP Gross Profit and Gross Margin $ in millions, except % (Unaudited) Q2’25 Q2’24 Q1’25 GAAP gross profit $ 3,059 $ 2,864 $ 3,736 GAAP gross margin 40% 49% 50% Stock based compensation 6 5 5 Amortization of acquisition related intangibles 260 231 251 Acquisition related and other costs (1) 1 1 Non GAAP gross profit $ 3,326 $ 3,101 $ 3,992 Non GAAP gross margin 43% 53% 54% Reconciliation of GAAP to Non-GAAP Operating Expenses $ in millions, except % (Unaudited) Q2’25 Q2’24 Q1’25 GAAP operating expenses (2) $ 3,193 $ 2,595 $ 2,930 GAAP operating expenses/revenue % 42% 44% 39% Stock based compensation 363 341 359 Amortization of acquisition related intangibles 308 372 316 Acquisition related and other costs (1) 93 45 42 Non GAAP operating expenses (2) $ 2,429 $ 1,837 $ 2,213 Non GAAP operating expenses/revenue % 32% 31% 30% (1) Acquisition-related and other costs primarily include transaction costs, purchase price fair value adjustments for inventory, certain compensation charges, and workforce rebalancing charges. (2) Effective first quarter of 2025, licensing gain is reclassified against Marketing, general and administrative expenses as the amounts were immaterial. 22 | | Q2 2025 FINANCIAL RESULTS August 5, 2025

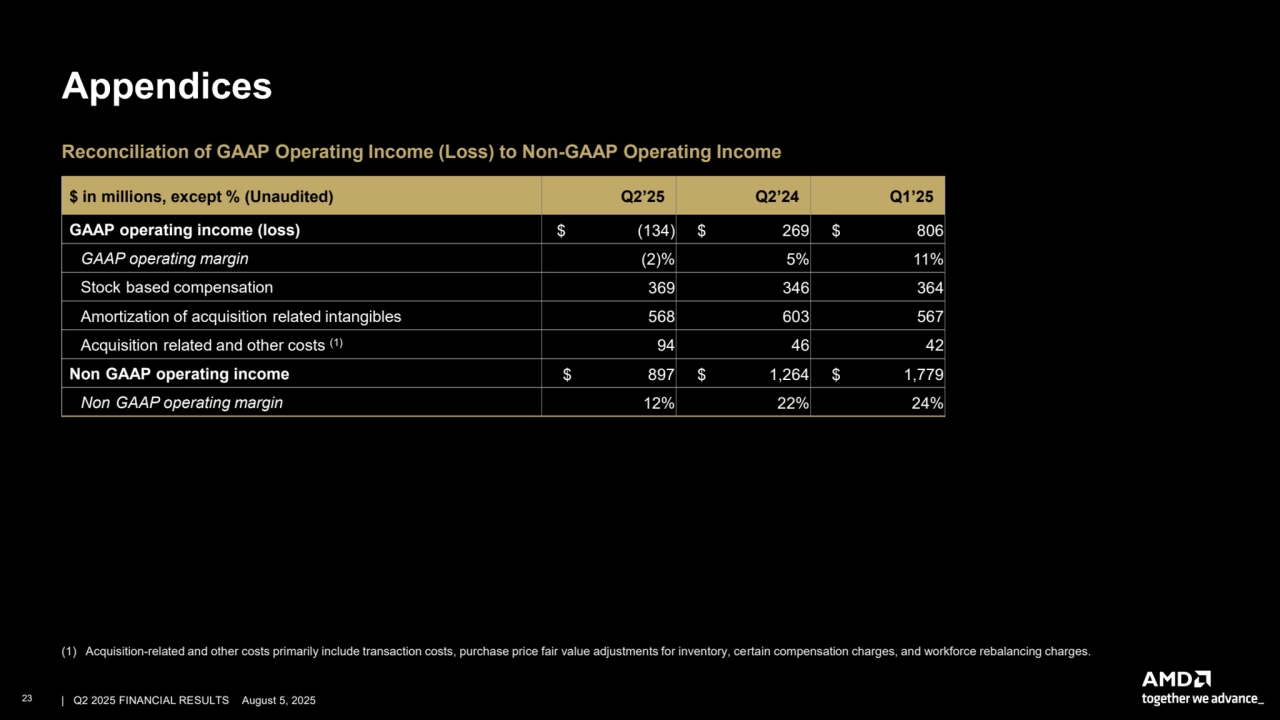

- 23. – - - - - - Appendices Reconciliation of GAAP Operating Income (Loss) to Non-GAAP Operating Income $ in millions, except % (Unaudited) Q2’25 Q2’24 Q1’25 GAAP operating income (loss) $ (134) $ 269 $ 806 GAAP operating margin (2)% 5% 11% Stock based compensation 369 346 364 Amortization of acquisition related intangibles 568 603 567 Acquisition related and other costs (1) 94 46 42 Non GAAP operating income $ 897 $ 1,264 $ 1,779 Non GAAP operating margin 12% 22% 24% (1) Acquisition-related and other costs primarily include transaction costs, purchase price fair value adjustments for inventory, certain compensation charges, and workforce rebalancing charges. 23 | | Q2 2025 FINANCIAL RESULTS August 5, 2025

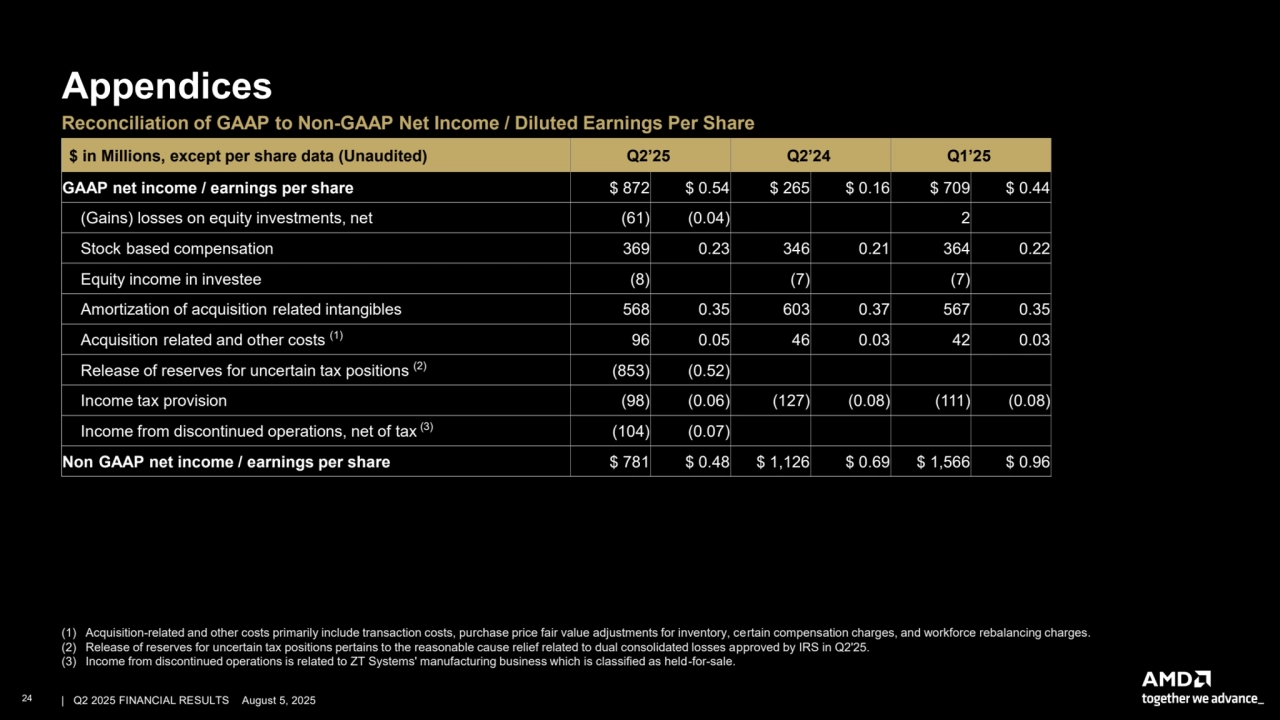

- 24. – - - - - - - - - - - - - - - - - - - Appendices Reconciliation of GAAP to Non-GAAP Net Income / Diluted Earnings Per Share $ in Millions, except per share data (Unaudited) Q2’25 Q2’24 Q1’25 GAAP net income / earnings per share $ 872 $ 0.54 $ 265 $ 0.16 $ 709 $ 0.44 (Gains) losses on equity investments, net (61) (0.04) 2 Stock based compensation 369 0.23 346 0.21 364 0.22 Equity income in investee (8) (7) (7) Amortization of acquisition related intangibles 568 0.35 603 0.37 567 0.35 (1) Acquisition related and other costs 96 0.05 46 0.03 42 0.03 Release of reserves for uncertain tax positions (2) (853) (0.52) Income tax provision (98) (0.06) (127) (0.08) (111) (0.08) (3) Income from discontinued operations, net of tax (104) (0.07) Non GAAP net income / earnings per share $ 781 $ 0.48 $ 1,126 $ 0.69 $ 1,566 $ 0.96 (1) Acquisition-related and other costs primarily include transaction costs, purchase price fair value adjustments for inventory, certain compensation charges, and workforce rebalancing charges. (2) Release of reserves for uncertain tax positions pertains to the reasonable cause relief related to dual consolidated losses approved by IRS in Q2'25. (3) Income from discontinued operations is related to ZT Systems' manufacturing business which is classified as held-for-sale. 24 | | Q2 2025 FINANCIAL RESULTS August 5, 2025

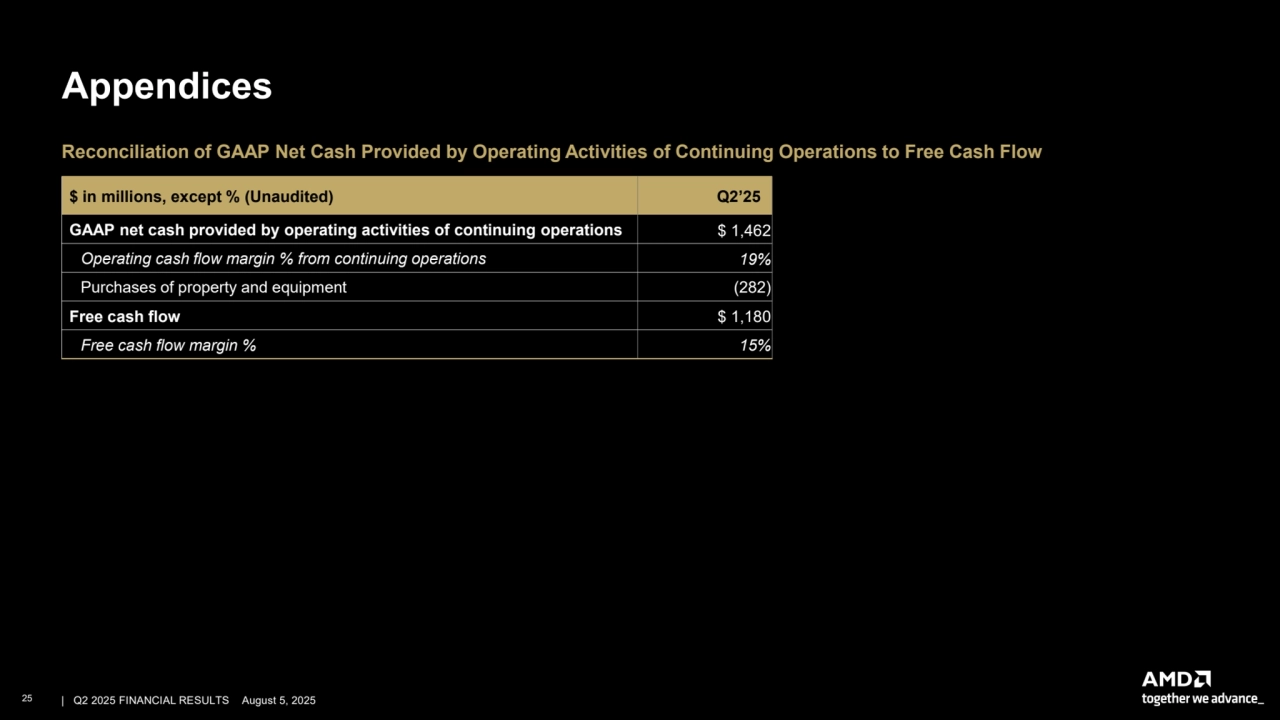

- 25. – Appendices Reconciliation of GAAP Net Cash Provided by Operating Activities of Continuing Operations to Free Cash Flow $ in millions, except % (Unaudited) Q2’25 GAAP net cash provided by operating activities of continuing operations $ 1,462 Operating cash flow margin % from continuing operations 19% Purchases of property and equipment (282) Free cash flow $ 1,180 Free cash flow margin % 15% 25 | | Q2 2025 FINANCIAL RESULTS August 5, 2025

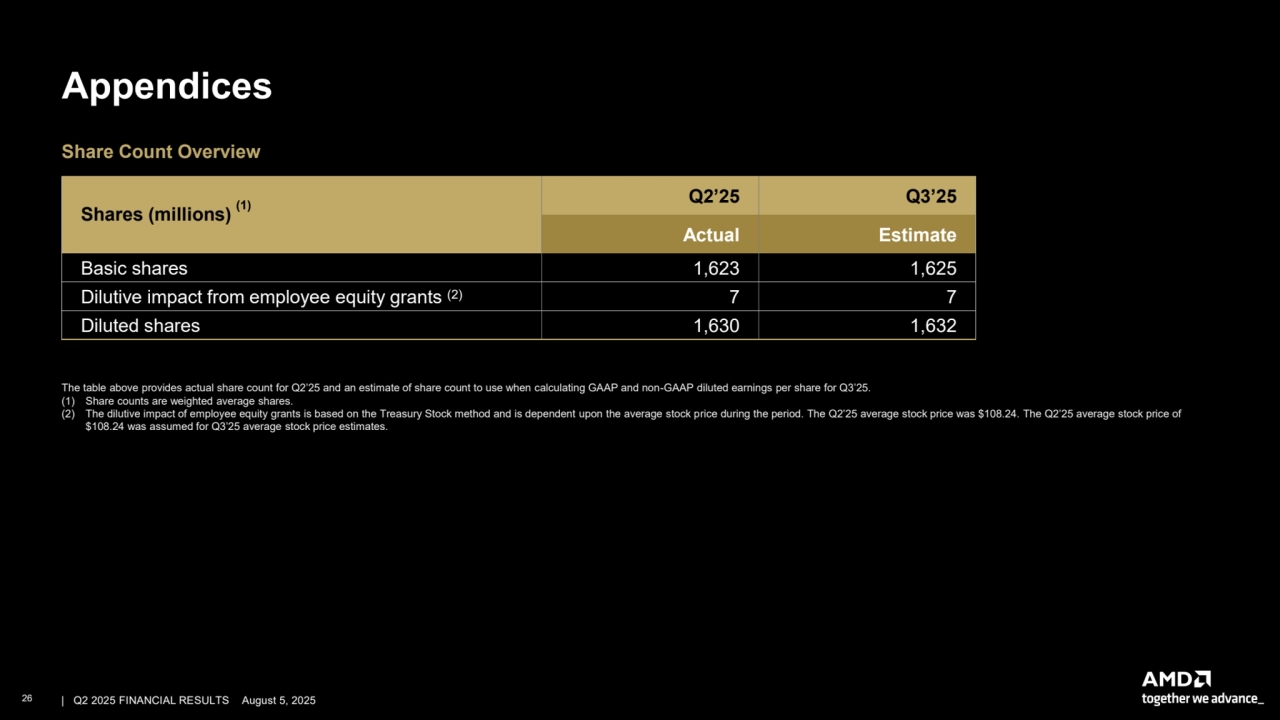

- 26. – Appendices Share Count Overview (1) Shares (millions) Q2’25 Q3’25 Actual Estimate Basic shares 1,623 1,625 Dilutive impact from employee equity grants (2) 7 7 Diluted shares 1,630 1,632 The table above provides actual share count for Q2’25 and an estimate of share count to use when calculating GAAP and non-GAAP diluted earnings per share for Q3’25. (1) Share counts are weighted average shares. (2) The dilutive impact of employee equity grants is based on the Treasury Stock method and is dependent upon the average stock price during the period. The Q2’25 average stock price was $108.24. The Q2’25 average stock price of $108.24 was assumed for Q3’25 average stock price estimates. 26 | | Q2 2025 FINANCIAL RESULTS August 5, 2025

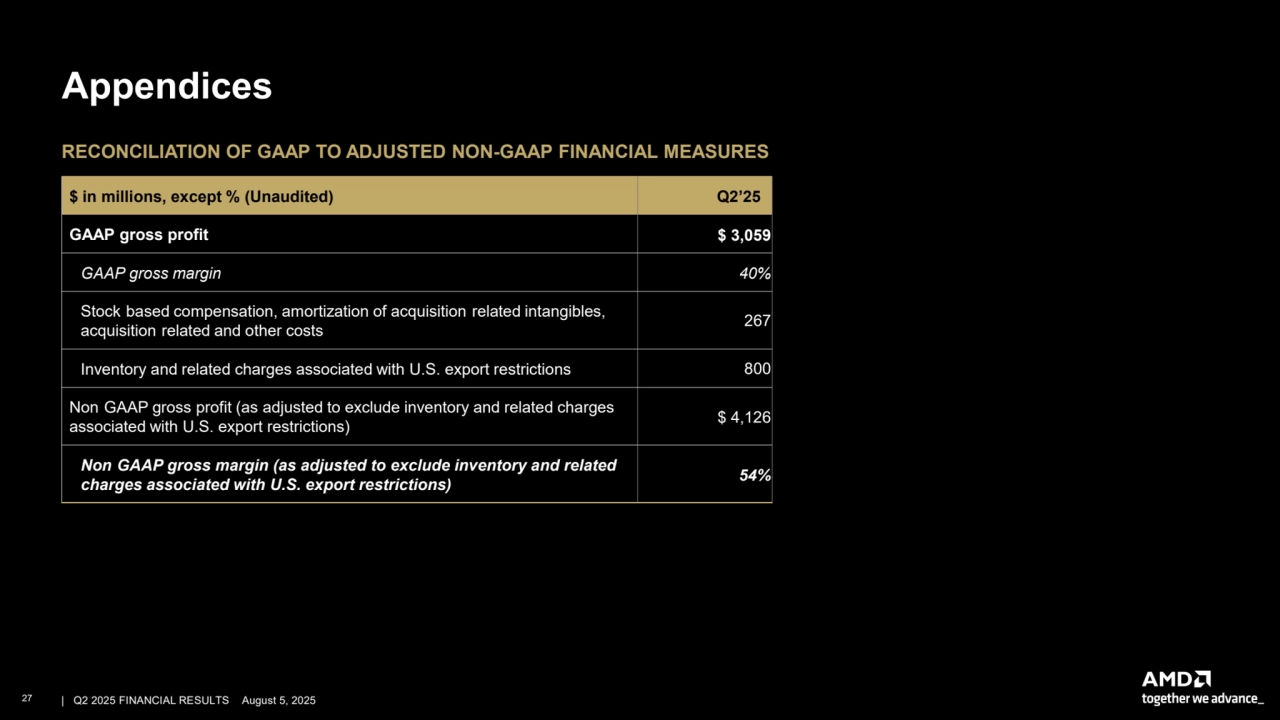

- 27. – - - - - - Appendices RECONCILIATION OF GAAP TO ADJUSTED NON-GAAP FINANCIAL MEASURES $ in millions, except % (Unaudited) Q2’25 GAAP gross profit $ 3,059 GAAP gross margin 40% Stock based compensation, amortization of acquisition related intangibles, acquisition related and other costs 267 Inventory and related charges associated with U.S. export restrictions 800 Non GAAP gross profit (as adjusted to exclude inventory and related charges associated with U.S. export restrictions) $ 4,126 Non GAAP gross margin (as adjusted to exclude inventory and related charges associated with U.S. export restrictions) 54% 27 | | Q2 2025 FINANCIAL RESULTS August 5, 2025

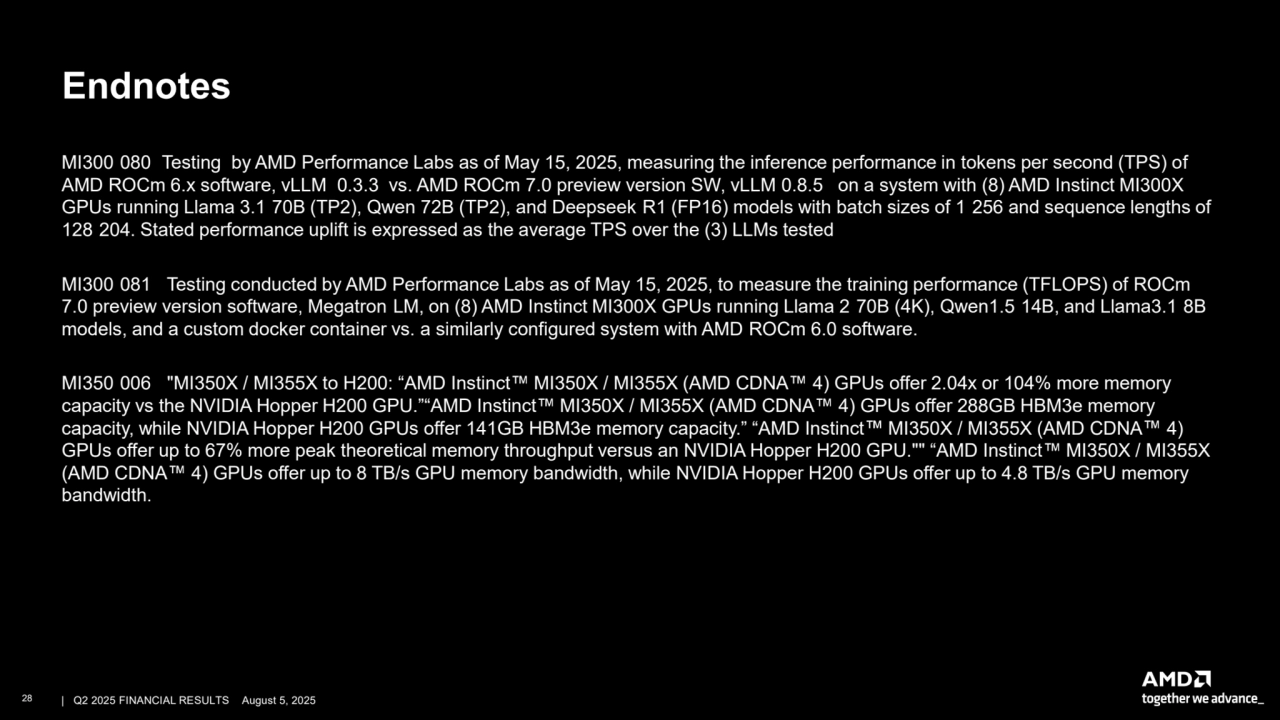

- 28. – - - - - - - - - - - - - - - Endnotes MI300 080 Testing by AMD Performance Labs as of May 15, 2025, measuring the inference performance in tokens per second (TPS) of AMD ROCm 6.x software, vLLM 0.3.3 vs. AMD ROCm 7.0 preview version SW, vLLM 0.8.5 on a system with (8) AMD Instinct MI300X GPUs running Llama 3.1 70B (TP2), Qwen 72B (TP2), and Deepseek R1 (FP16) models with batch sizes of 1 256 and sequence lengths of 128 204. Stated performance uplift is expressed as the average TPS over the (3) LLMs tested MI300 081 Testing conducted by AMD Performance Labs as of May 15, 2025, to measure the training performance (TFLOPS) of ROCm 7.0 preview version software, Megatron LM, on (8) AMD Instinct MI300X GPUs running Llama 2 70B (4K), Qwen1.5 14B, and Llama3.1 8B models, and a custom docker container vs. a similarly configured system with AMD ROCm 6.0 software. MI350 006 (AMD CDNA up to "MI350X / MI355X to H200: “AMD Instinct H200 GPU.”“AMD Instinct MI350X / MI355X (AMD CDNA MI350X / MI355X (AMD CDNA 4) GPUs “AMD Instinct 4) GPUs offer 2.04x or 104% MI350X / MI355X (AMD CDNA “AMD Instinct more memory capacity vs the NVIDIA Hopper offer 288GB HBM3e memory capacity, while NVIDIA Hopper H200 GPUs offer 141GB HBM3e memory capacity.” 4) GPUs offer 67% more peak theoretical memory throughput versus an NVIDIA Hopper H200 GPU."" MI350X / MI355X 4) GPUs offer up to 8 TB/s GPU memory bandwidth, while NVIDIA Hopper H200 GPUs offer up to 4.8 TB/s GPU memory bandwidth. 28 | | Q2 2025 FINANCIAL RESULTS August 5, 2025

- 29. 29 – | | Q2 2025 FINANCIAL RESULTS August 5, 2025