Blink Charging: Q2 2025 Earnings Results

AI Summary

AI Summary

Key Insights

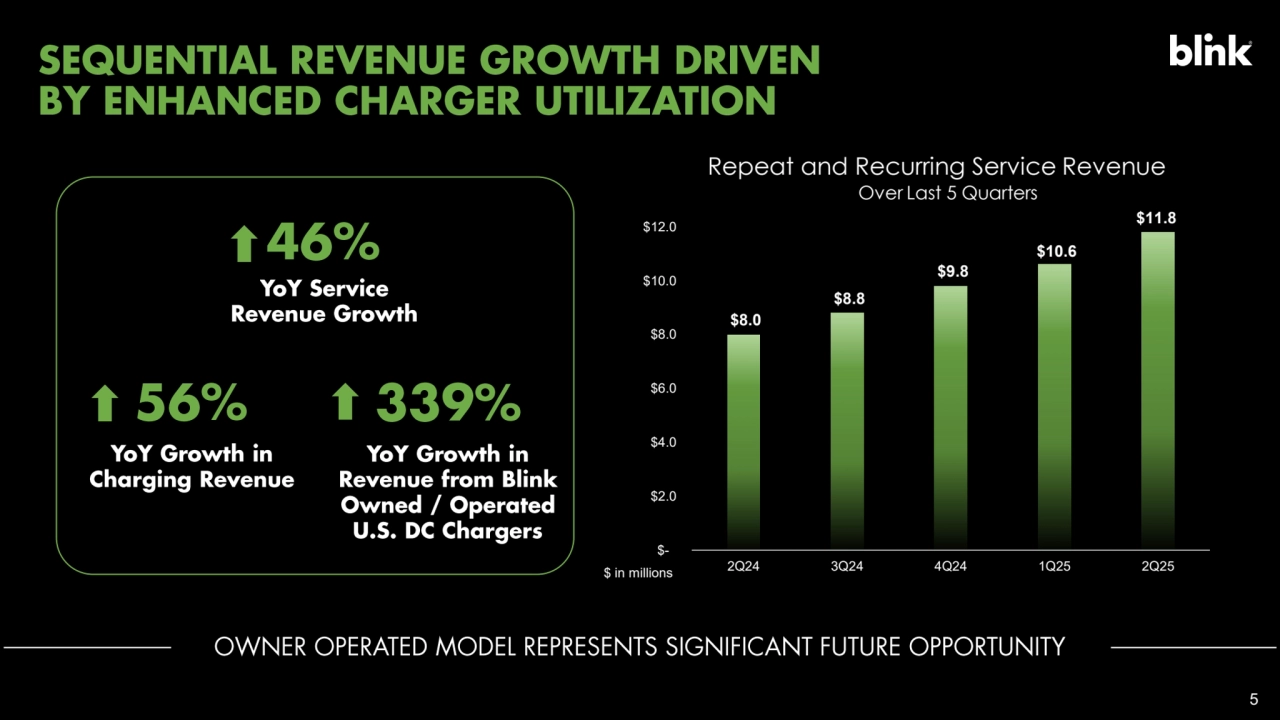

- 📈 Revenue Growth: Blink Charging demonstrates increased YoY service revenue, charging revenue, and revenue from Blink-owned DC chargers.

- 🤝 Strategic Acquisition: Blink acquires Zemetric, Inc., expanding L2 product offerings and incorporating Zemetric's team.

- 🇬🇧 UK Expansion: Agreement with Axxeltrova Capital supports growth in UK EV charging development through a £100M SPV.

- ✅ Envoy Agreement: Amended agreement provides a clear path forward with stock and performance-based warrants.

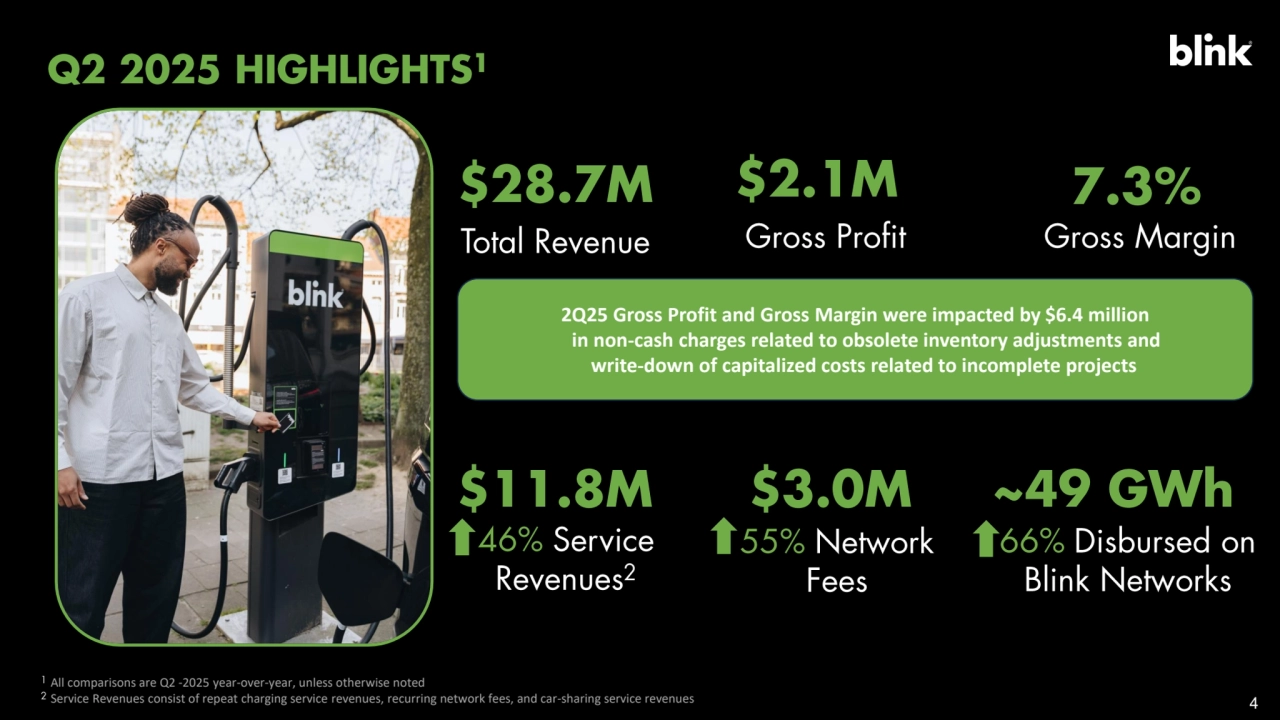

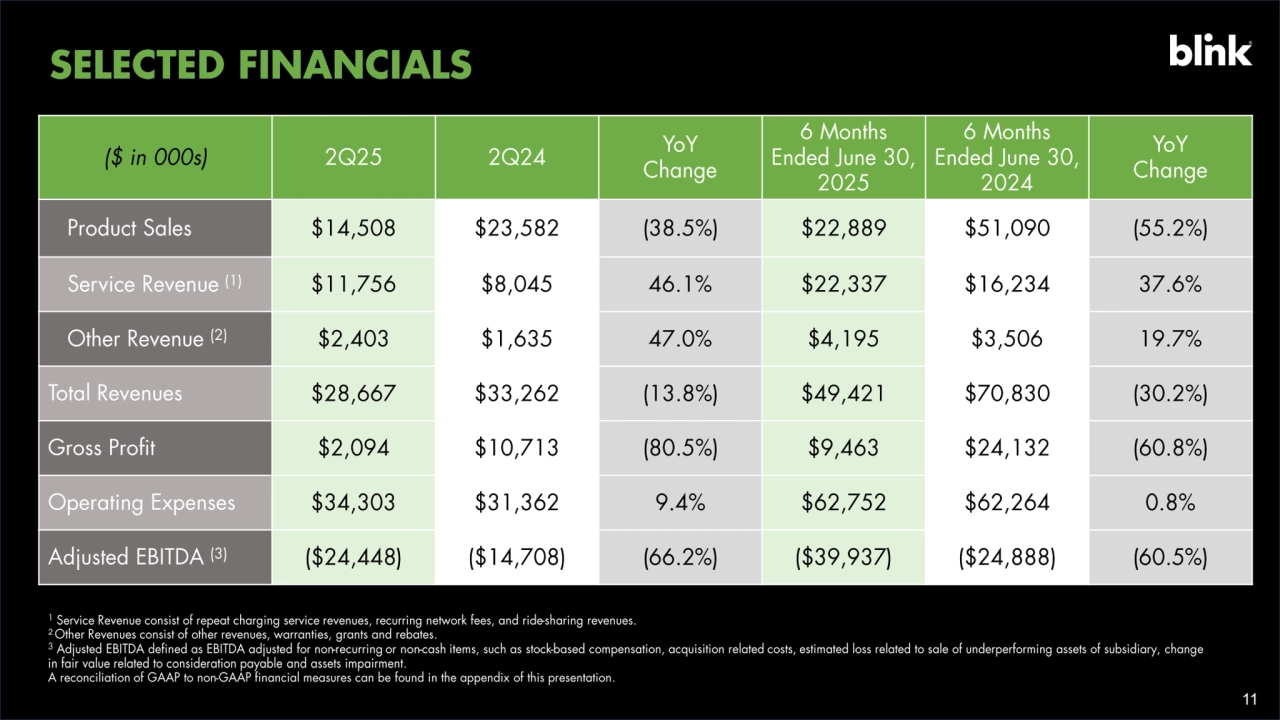

- 💰 Financials Overview: Selected financial data shows Total Revenues of $28.7M but a negative Adjusted EBITDA of -$24.448.

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Blink Charging: Q2 2025 Earnings Results

- 2. 2

- 3. 3 3

- 4. All comparisons are Q2 -2025 year-over-year, unless otherwise noted Service Revenues consist of repeat charging service revenues, recurring network fees, and car-sharing service revenues 4 4 2Q25 Gross Profit and Gross Margin were impacted by $6.4 million in non-cash charges related to obsolete inventory adjustments and write-down of capitalized costs related to incomplete projects

- 5. 5 $8.0 $8.8 $9.8 $10.6 $11.8 $- $2.0 $4.0 $6.0 $8.0 $10.0 $12.0 2Q24 3Q24 4Q24 1Q25 2Q25 $ in millions Repeat and Recurring Service Revenue Over Last 5 Quarters

- 6. 6 6 6

- 7. BlinkCharging.com • (888) 998.2546 CONFIDENTIAL BlinkCharging.com • (888) 998.2546 CONFIDENTIAL • • • • • ••• 7

- 8. BlinkCharging.com • (888) 998.2546 CONFIDENTIAL BlinkCharging.com • (888) 998.2546 CONFIDENTIAL • • • 8

- 9. BlinkCharging.com • (888) 998.2546 CONFIDENTIAL BlinkCharging.com • (888) 998.2546 CONFIDENTIAL • Amends the merger agreement and releases Blink from its payment obligations and liability in exchange for stock and performance-based warrants • Sole remaining payment obligation is satisfied upon issuance of $10 million in shares of Company common stock, and warrants exercisable for shares of Company common stock for an aggregate notional value of $11 million, divided into three tranches: ‣ $2.5 million worth of warrants vesting upon common stock reaching a price per share of $1.70 for seven consecutive days ‣ $2.5 million worth of warrants vesting upon common stock reaching a price per share of $2.10 consecutive days ‣ $6 million worth of warrants vesting upon common stock reaching a price per share of $4.85 for seven consecutive days • These warrants will expire 20 months after the issuance date 9

- 10. 10 Futura Std Book (bold)

- 11. 11 11 2

- 12. 12 12

- 13. 13 Q&A 13

- 14. 14 APPENDIX

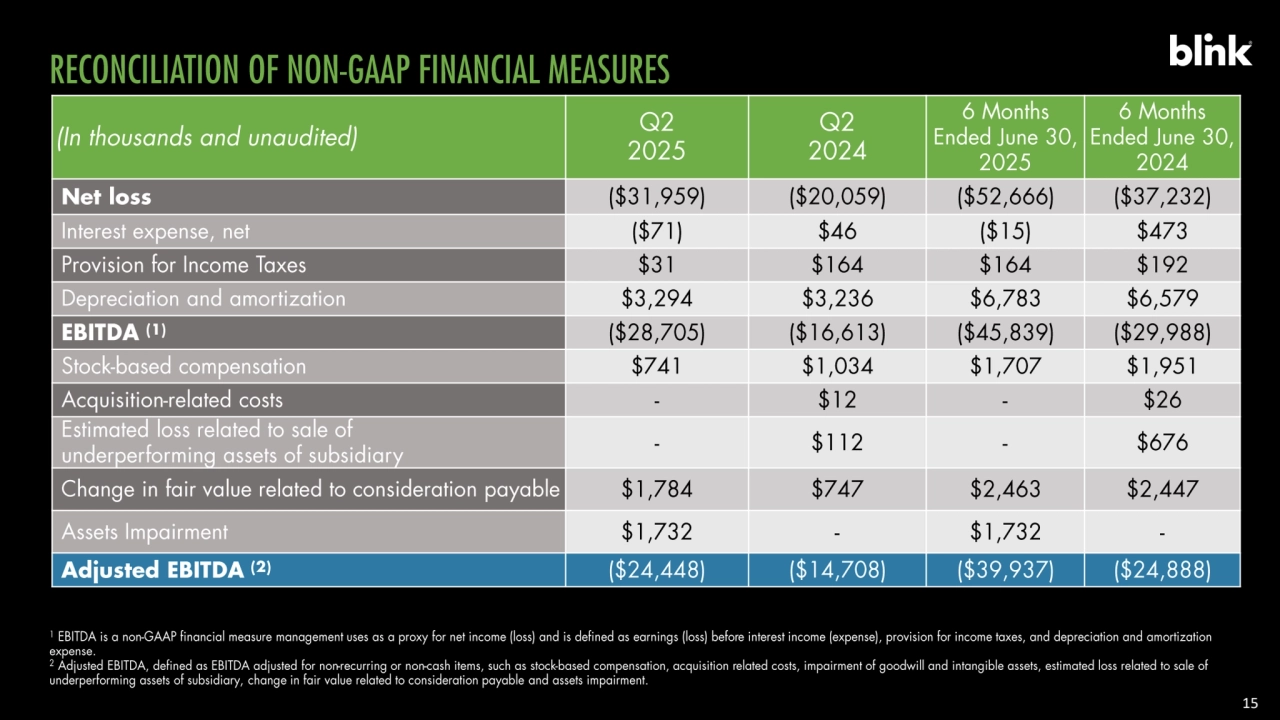

- 15. 15

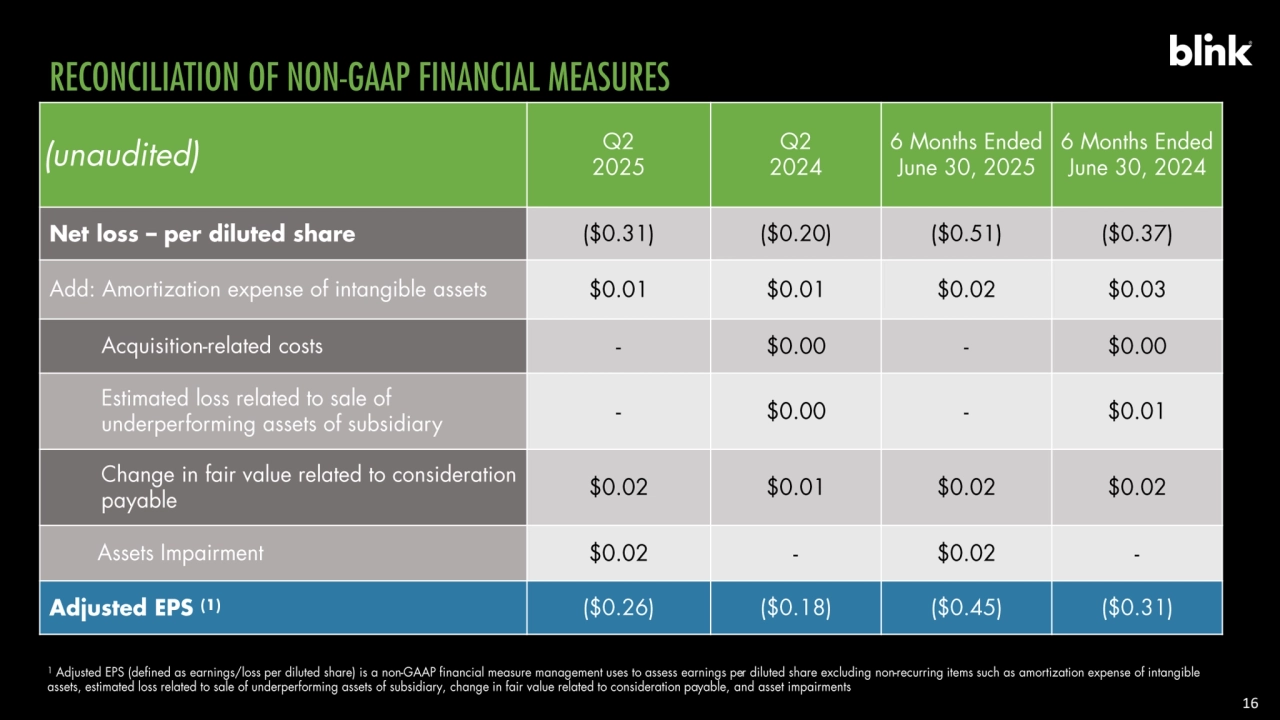

- 16. 16 16