Breaking Bad VC

AI Summary

AI Summary

Key Insights

- 👨🏫 Dave McClure's Background: Introduction to Dave McClure, his background in engineering, early startup experience, and transition to venture capital.

- 📉 Venture Capital's Problems: Highlights the shortcomings of traditional VC, including fundraising difficulties, high valuations, and liquidity issues.

- ⚠️ VC Pitfalls: Focuses on the high failure rate of startups and the challenge for VCs to achieve significant returns, with concerns about IPO market.

- 💡 Un-Breaking VC: Presents alternative approaches to venture capital, emphasizing differentiation, specialization, and the use of new models like Studio Funds.

- ❓ Open Q&A: Encourages discussions with audience, possibly in the form of poorly disguised pitches, and comments.

Loading...

Loading...

Loading...

Loading...

Loading...

![If you insist – 7 ways to UN-Break VC [maybe?]

1. BE DIFFERENT! Most VC funds ALL LOOK SAME. STAND OUT.

2. Be REALLY GOOD at ONE WEIRD THING. “Best in Your Niche”

3. New Models: Studio Funds, Search Funds, “AI-first” VC

4. Raise / Use Philanthropic Capital (DAFs, grants)

5. Use AI to amplify your skills, fill in weak spots.

6. Become a FOUNDER instead of VC (fundraising is easier!)

7. “Skip the J-Curve” – buy secondaries ;)](https://d2z384uprhdr6y.cloudfront.net/M1bA_5XG_caMIurbB1mmfFcqRBaEY2S2-h9YZ1rg7iM/rt:fill/q:100/w:1280/h:0/gravity:sm/czM6Ly9qYXVudC1wcm9kdWN0aW9uLXVwbG9hZHMvMjAyNS8wNy8xNi80MDZhNWIyMi1hY2M3LTQ0Y2YtYTExNC0xYmY1OWVlZjE4OTUvc2xpZGVfNS1sLndlYnA=.webp)

Loading...

Loading...

Loading...

Breaking Bad VC

- 1. Dave McClure PracticalVC.com

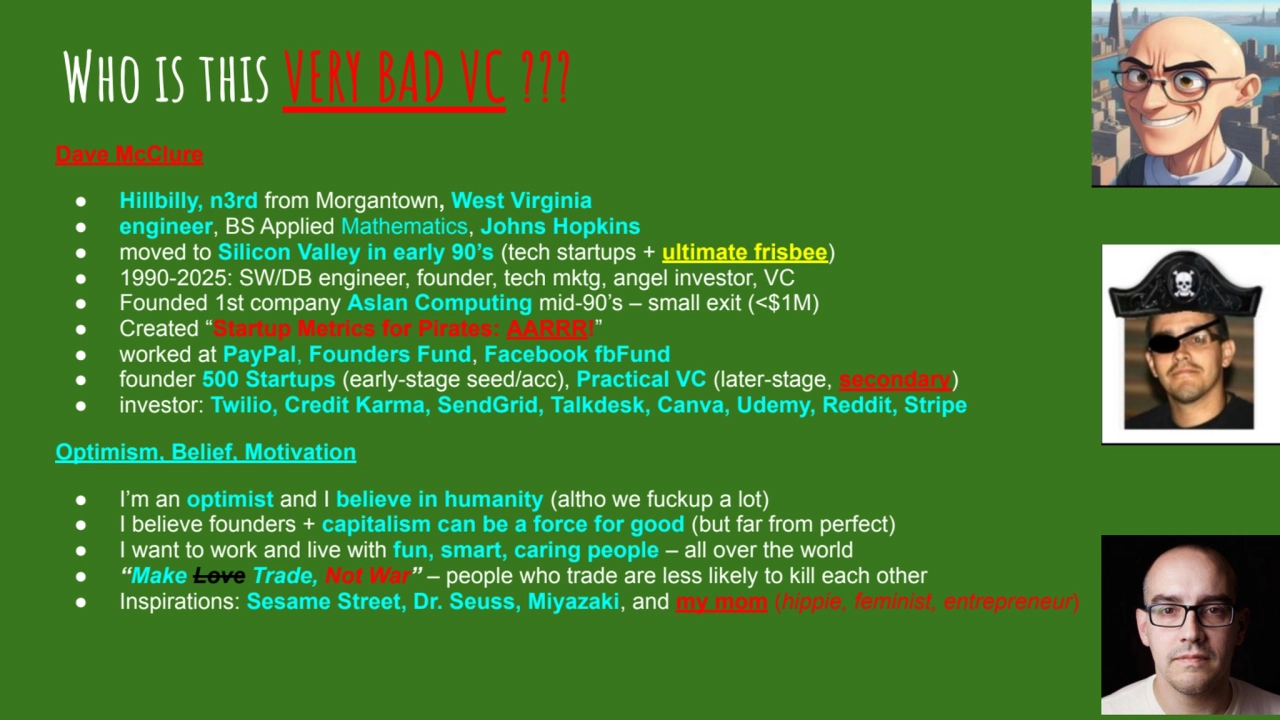

- 2. Who is this VERY BAD VC ??? Dave McClure ● Hillbilly, n3rd from Morgantown, West Virginia ● engineer, BS Applied Mathematics, Johns Hopkins ● moved to Silicon Valley in early 90’s (tech startups + ultimate frisbee) ● 1990-2025: SW/DB engineer, founder, tech mktg, angel investor, VC ● Founded 1st company Aslan Computing mid-90’s – small exit (<$1M) ● Created “Startup Metrics for Pirates: AARRR!” ● worked at PayPal, Founders Fund, Facebook fbFund ● founder 500 Startups (early-stage seed/acc), Practical VC (later-stage, secondary) ● investor: Twilio, Credit Karma, SendGrid, Talkdesk, Canva, Udemy, Reddit, Stripe Optimism, Belief, Motivation ● I’m an optimist and I believe in humanity (altho we fuckup a lot) ● I believe founders + capitalism can be a force for good (but far from perfect) ● I want to work and live with fun, smart, caring people – all over the world ● “Make Love Trade, Not War” – people who trade are less likely to kill each other ● Inspirations: Sesame Street, Dr. Seuss, Miyazaki, and my mom (hippie, feminist, entrepreneur)

- 3. Venture Capital is… BAD BUSTED BROKEN so please – don’t do it.

- 4. Top 7 Reasons why VC is the worst 1. Fundraising is a bitch for rookie VCs. 2. VC comp sucks for small funds <$25M. 3. Early-stage valuations are crazy expensive; too much dumb $$$ chasing AI, crypto, other “HOT” trends. 4. Most startups fail, and most VCs fail to return 2X net, or beat public market index returns. 5. VC has terrible liquidity — IPOs now take 12-14+ years; seed funds can easily take 15+ yrs to return capital. 6. There are Lies, Damn Lies, and then there’s TVPI. 7. The IPO market has been dead for >3 years.

- 5. If you insist – 7 ways to UN-Break VC [maybe?] 1. BE DIFFERENT! Most VC funds ALL LOOK SAME. STAND OUT. 2. Be REALLY GOOD at ONE WEIRD THING. “Best in Your Niche” 3. New Models: Studio Funds, Search Funds, “AI-first” VC 4. Raise / Use Philanthropic Capital (DAFs, grants) 5. Use AI to amplify your skills, fill in weak spots. 6. Become a FOUNDER instead of VC (fundraising is easier!) 7. “Skip the J-Curve” – buy secondaries ;)

- 6. Other Bad VC Stuff I TALK ABoUT ● Marketing & Branding for VCs ● VC Portfolio Construction + Example Portfolio Models ● Valuation Markups / Markdowns and Reporting ● Portfolio Diversification vs. Concentration ● “Help Framework” for Value-Added VCs ● Reserving for Follow-on (or not?), Recycling ● Optimizing for Liquidity vs. Returns

- 7. Q&A! (or…) Pitches, poorly disguised as Qs Smart-Ass Comments Inspired Heckling Lunch?

- 8. Dave McClure PracticalVC.com