Evolving investments opportunity - CIO Report Open Session PPT (1)

AI Summary

AI Summary

Key Insights

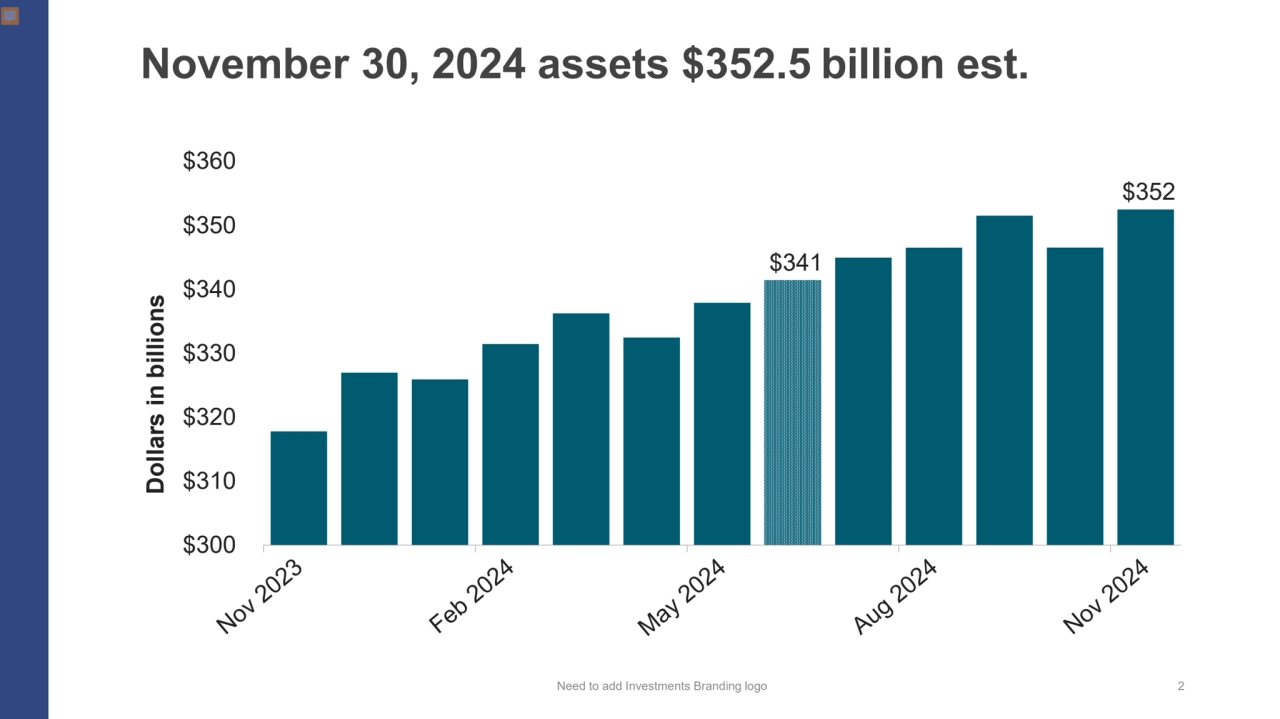

- Assets reached an estimated $352.5 billion by November 30, 2024.

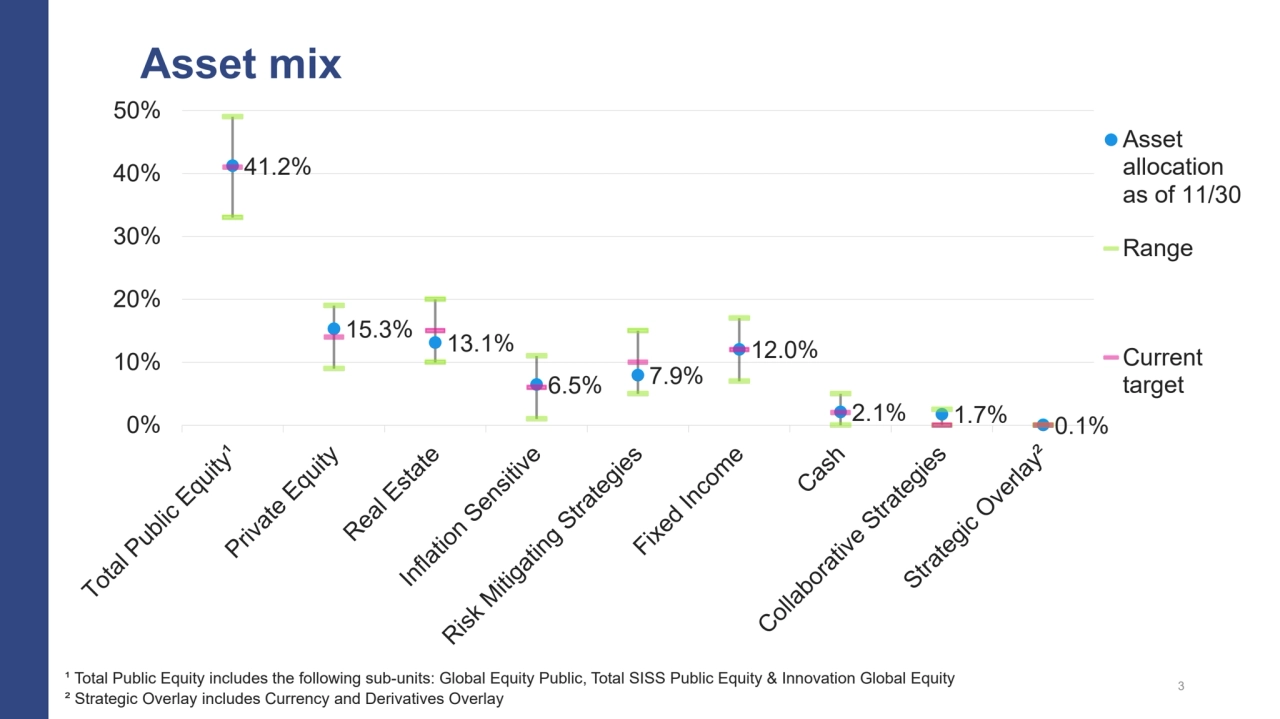

- The asset mix includes allocations to total public equity, private equity, real estate, inflation-sensitive assets, and fixed income, among others.

- Key themes for 2025 include inflation, potential Fed rate cuts, policy changes, geopolitics, and the impact of artificial intelligence.

- Mega-themes encompass investment opportunities in private credit, the low carbon transition (Net Zero), and digitization/AI revolution.

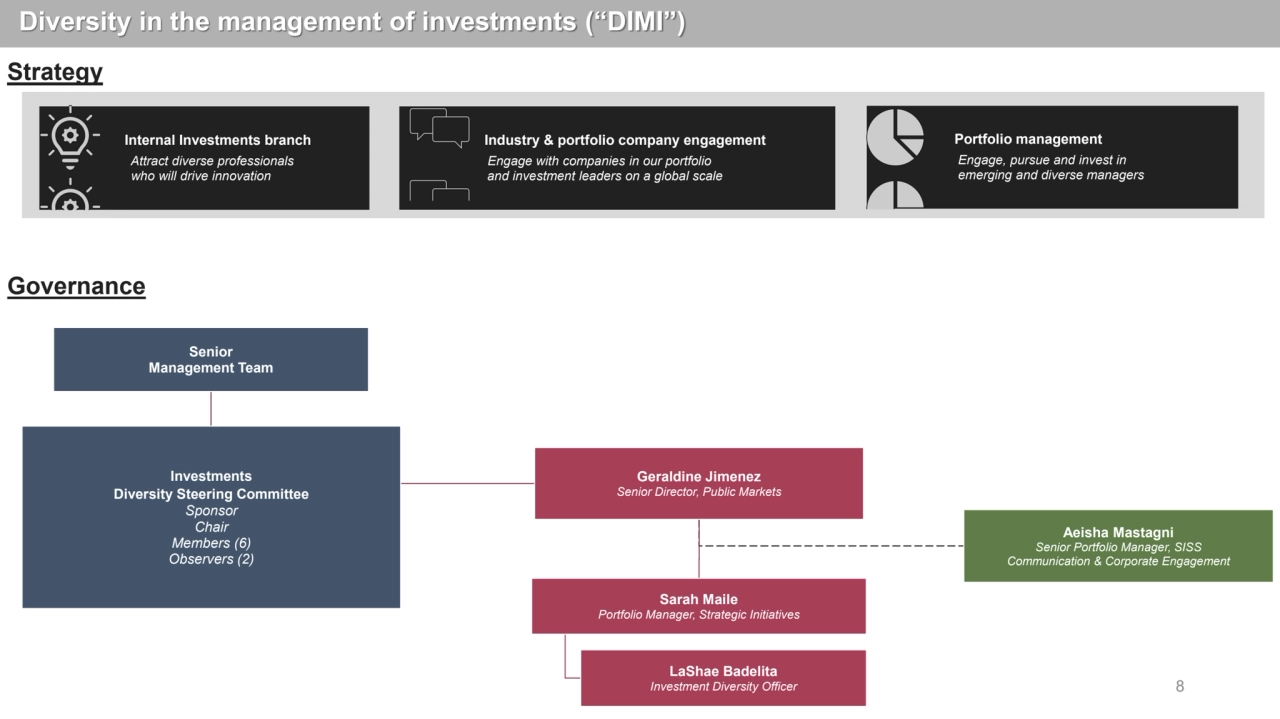

- There is an emphasis on diversity in the management of investments, with a dedicated steering committee and strategic initiatives.

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Evolving investments opportunity - CIO Report Open Session PPT (1)

- 1. CHIEF INVESTMENT OFFICER REPORT January 2025

- 2. Need to add Investments Branding logo 2 November 30, 2024 assets $352.5 billion est. $341 $352 $300 $310 $320 $330 $340 $350 $360 Dollars in billions

- 3. Asset mix 3 ¹ Total Public Equity includes the following sub-units: Global Equity Public, Total SISS Public Equity & Innovation Global Equity ² Strategic Overlay includes Currency and Derivatives Overlay 41.2% 15.3% 13.1% 6.5% 7.9% 12.0% 2.1% 1.7% 0% 0.1% 10% 20% 30% 40% 50% Asset allocation as of 11/30 Range Current target

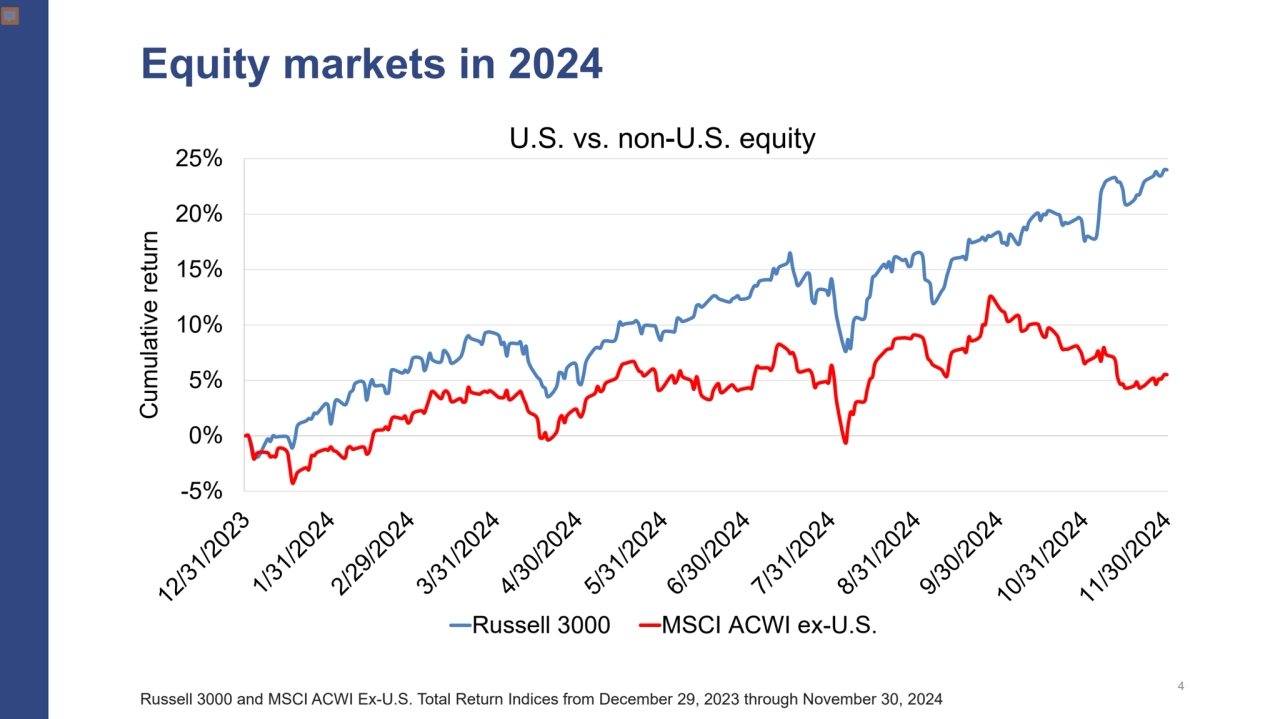

- 4. Equity markets in 2024 4 Russell 3000 and MSCI ACWI Ex-U.S. Total Return Indices from December 29, 2023 through November 30, 2024 -5% 0% 5% 10% 15% 20% 25% Cumulative return U.S. vs. non-U.S. equity Russell 3000 MSCI ACWI ex-U.S.

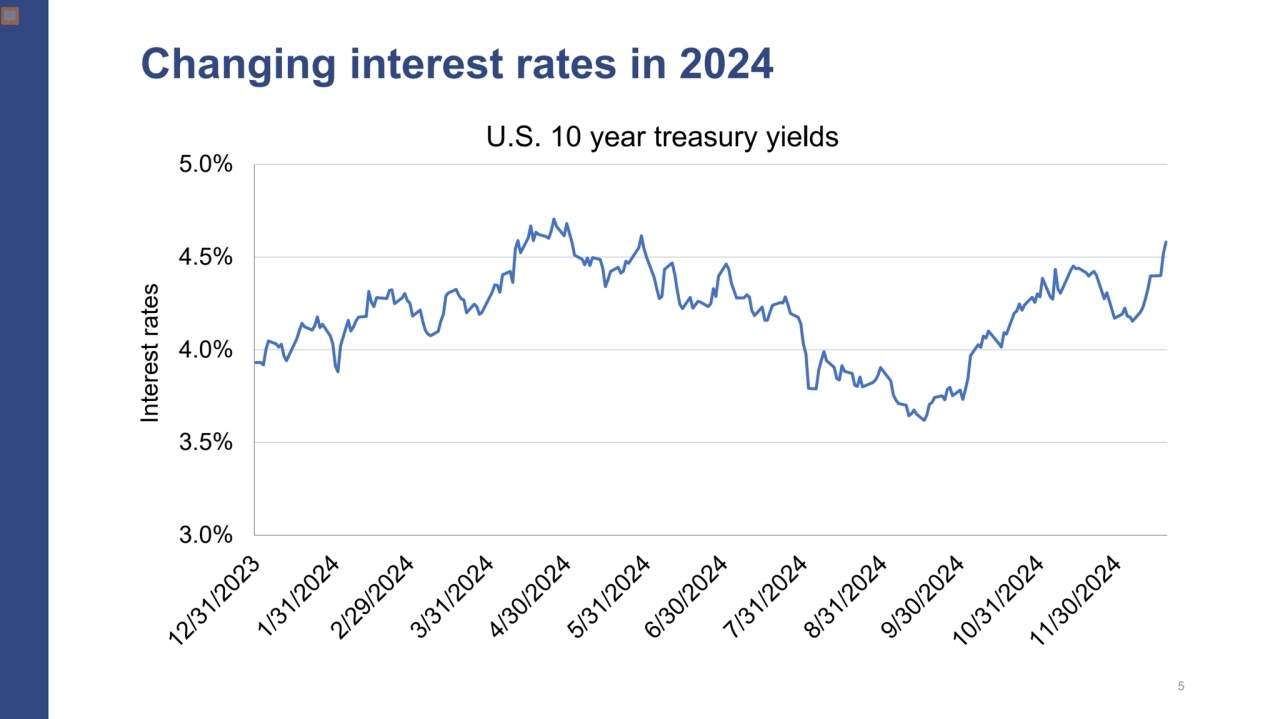

- 5. Changing interest rates in 2024 5 3.0% 3.5% 4.0% 4.5% 5.0% Interest rates U.S. 10 year treasury yields

- 6. o Inflation o Fed rate cuts o Policy changes o Fiscal spending o Tariffs o Immigration restrictions o Geopolitics o Artificial intelligence Key themes for 2025 6

- 7. o Private credit & the shift of lending away from banks Mega themes: risk & opportunity 7 $2-7 trillion market size o Net zero & the investment opportunity in the low carbon transition o Digitization of economy & the infrastructure needed to support AI revolution $4 trillion of investment by 2030 $2-9 trillion investment per year through 2050

- 8. 8 Senior Management Team Geraldine Jimenez Senior Director, Public Markets Sarah Maile Portfolio Manager, Strategic Initiatives LaShae Badelita Investment Diversity Officer Aeisha Mastagni Senior Portfolio Manager, SISS Communication & Corporate Engagement Investments Diversity Steering Committee Sponsor Chair Members (6) Observers (2) Diversity in the management of investments (“DIMI”) Strategy Governance Internal Investments branch Attract diverse professionals who will drive innovation Industry & portfolio company engagement Engage with companies in our portfolio and investment leaders on a global scale Portfolio management Engage, pursue and invest in emerging and diverse managers

- 9. Thank you.