President Trump issues executive order to advance digital assets

AI Summary

AI Summary

Key Insights

- President Trump issues an Executive Order (EO) to advance the regulatory framework for digital assets, stablecoins, and blockchains.

- The EO establishes a President's Working Group on Digital Asset Markets, composed of various agency heads, to identify and recommend regulations affecting the digital asset sector.

- The EO prohibits federal agencies from developing or promoting Central Bank Digital Currencies (CBDCs) within the U.S. or abroad.

- The EO expresses support for stablecoins and fair access to banking services for digital asset companies, signaling potential legislative advancements and regulatory changes.

- The EO suggests a move toward promoting open and permissionless blockchains and signals a more permissive regulatory and supervisory environment for financial institutions to engage with digital assets.

Loading...

Loading...

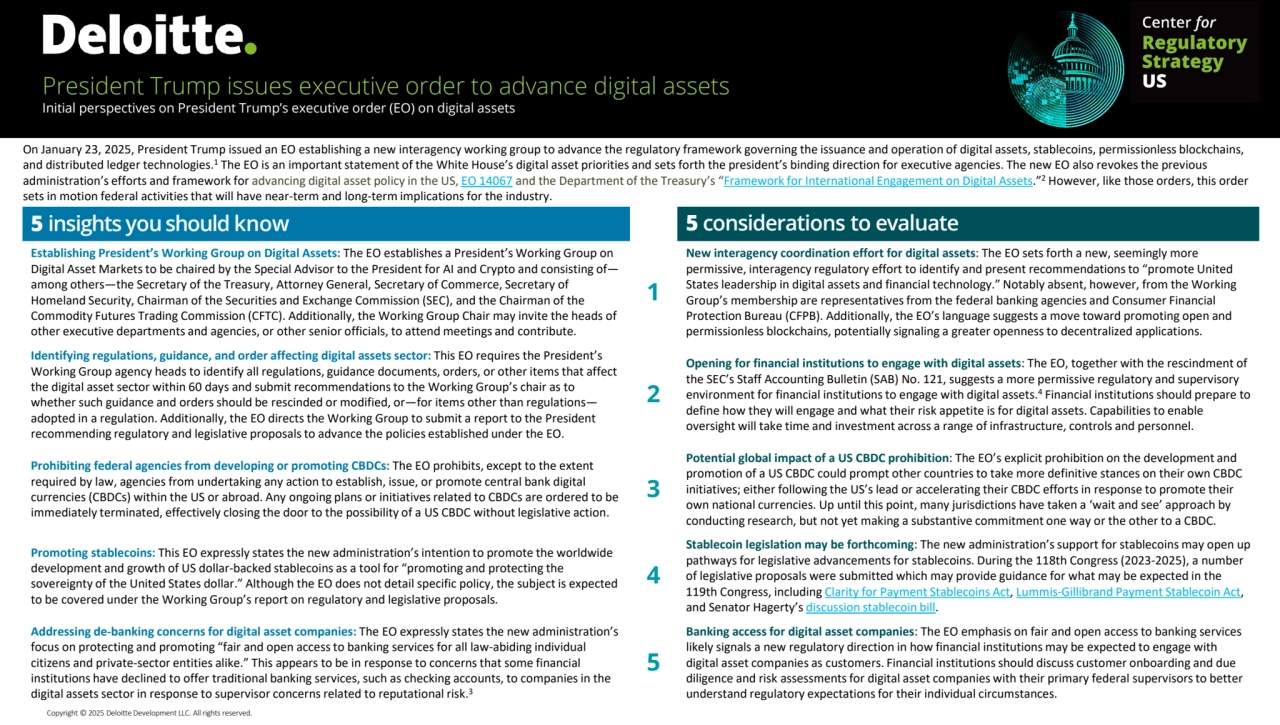

President Trump issues executive order to advance digital assets

- 1. 5 insights youshould know 5 considerations to evaluate Establishing President’s Working Group on Digital Assets: The EO establishes a President’s Working Group on Digital Asset Markets to be chaired by the Special Advisor to the President for AI and Crypto and consisting of— among others—the Secretary of the Treasury, Attorney General, Secretary of Commerce, Secretary of Homeland Security, Chairman of the Securities and Exchange Commission (SEC), and the Chairman of the Commodity Futures Trading Commission (CFTC). Additionally, the Working Group Chair may invite the heads of other executive departments and agencies, or other senior officials, to attend meetings and contribute. 1 New interagency coordination effort for digital assets: The EO sets forth a new, seemingly more permissive, interagency regulatory effort to identify and present recommendations to “promote United States leadership in digital assets and financial technology.” Notably absent, however, from the Working Group’s membership are representatives from the federal banking agencies and Consumer Financial Protection Bureau (CFPB). Additionally, the EO’s language suggests a move toward promoting open and permissionless blockchains, potentially signaling a greater openness to decentralized applications. Identifying regulations, guidance, and order affecting digital assets sector: This EO requires the President’s Working Group agency heads to identify all regulations, guidance documents, orders, or other items that affect the digital asset sector within 60 days and submit recommendations to the Working Group’s chair as to whether such guidance and orders should be rescinded or modified, or—for items other than regulations— adopted in a regulation. Additionally, the EO directs the Working Group to submit a report to the President recommending regulatory and legislative proposals to advance the policies established under the EO. 2 Opening for financial institutions to engage with digital assets: The EO, together with the rescindment of the SEC’s Staff Accounting Bulletin (SAB) No. 121, suggests a more permissive regulatory and supervisory environment for financial institutions to engage with digital assets.4 Financial institutions should prepare to define how they will engage and what their risk appetite is for digital assets. Capabilities to enable oversight will take time and investment across a range of infrastructure, controls and personnel. Prohibiting federal agencies from developing or promoting CBDCs: The EO prohibits, except to the extent required by law, agencies from undertaking any action to establish, issue, or promote central bank digital currencies (CBDCs) within the US or abroad. Any ongoing plans or initiatives related to CBDCs are ordered to be immediately terminated, effectively closing the door to the possibility of a US CBDC without legislative action. 3 Potential global impact of a US CBDC prohibition: The EO’s explicit prohibition on the development and promotion of a US CBDC could prompt other countries to take more definitive stances on their own CBDC initiatives; either following the US’s lead or accelerating their CBDC efforts in response to promote their own national currencies. Up until this point, many jurisdictions have taken a ‘wait and see’ approach by conducting research, but not yet making a substantive commitment one way or the other to a CBDC. Promoting stablecoins: This EO expressly states the new administration’s intention to promote the worldwide development and growth of US dollar-backed stablecoins as a tool for “promoting and protecting the sovereignty of the United States dollar.” Although the EO does not detail specific policy, the subject is expected to be covered under the Working Group’s report on regulatory and legislative proposals. 4 Stablecoin legislation may be forthcoming: The new administration’s support for stablecoins may open up pathways for legislative advancements for stablecoins. During the 118th Congress (2023-2025), a number of legislative proposals were submitted which may provide guidance for what may be expected in the 119th Congress, including Clarity for Payment Stablecoins Act, Lummis-Gillibrand Payment Stablecoin Act, and Senator Hagerty’s discussion stablecoin bill. Addressing de-banking concerns for digital asset companies: The EO expressly states the new administration’s focus on protecting and promoting “fair and open access to banking services for all law-abiding individual citizens and private-sector entities alike.” This appears to be in response to concerns that some financial institutions have declined to offer traditional banking services, such as checking accounts, to companies in the digital assets sector in response to supervisor concerns related to reputational risk.3 5 Banking access for digital asset companies: The EO emphasis on fair and open access to banking services likely signals a new regulatory direction in how financial institutions may be expected to engage with digital asset companies as customers. Financial institutions should discuss customer onboarding and due diligence and risk assessments for digital asset companies with their primary federal supervisors to better understand regulatory expectations for their individual circumstances. On January 23, 2025, President Trump issued an EO establishing a new interagency working group to advance the regulatory framework governing the issuance and operation of digital assets, stablecoins, permissionless blockchains, and distributed ledger technologies.1 The EO is an important statement of the White House’s digital asset priorities and sets forth the president’s binding direction for executive agencies. The new EO also revokes the previous administration’s efforts and framework for advancing digital asset policy in the US, EO 14067 and the Department of the Treasury’s “Framework for International Engagement on Digital Assets.”2 However, like those orders, this order sets in motion federal activities that will have near-term and long-term implications for the industry. Copyright © 2025 Deloitte Development LLC. All rights reserved. President Trump issues executive order to advance digital assets Initial perspectives on President Trump’s executive order (EO) on digital assets

- 2. This publication contains general information only and Deloitte is not, by means of this publication, rendering accounting, business, financial, investment, legal, tax, or other professional advice or services. This publication is not a substitute for such professional advice or services, nor should it be used as a basis for any decision or action that may affect your business. Before making any decision or taking any action that may affect your business, you should consult a qualified professional advisor. Deloitte shall not be responsible for any loss sustained by any person who relies on this publication. As used in this document, “Deloitte” means Deloitte & Touche LLP and Deloitte Tax LLP, which are separate subsidiaries of Deloitte LLP. Please see www.deloitte.com/us/about for a detailed description of our legal structure. Certain services may not be available to attest clients under the rules and regulations of public accounting. Copyright © 2025 Deloitte Development LLC. All rights reserved. Endnotes 1 The White House, “Strengthening American leadership in digital financial technology,” January 23, 2025. 2 The White House, “Ensuring Responsible Development of Digital Assets,” Federal Register, March 14, 2022; and Treasury Department, “Ensuring Responsible Development of Digital Assets; Request for Comment,” Federal Register, January 8, 2022. 3 See US House of Representatives, Committee on Oversight and Government Reform, “Letter to Mr. Adams, Mr. Andreessen, Mr. Armstrong, Mr. Marcus, Mr. Ripley, and Ms. Smith,” January 24, 2025. 4 Securities and Exchange Commission (SEC), “Staff Accounting Bulletin No. 122,” January 23, 2025. Connectwith us Deloitte Center for Regulatory Strategy, US Aaron Salerno Manager Deloitte Services LP asalerno@deloitte.com Irena Gecas-McCarthy FSI Director, Deloitte Center for Regulatory Strategy, US Principal Deloitte & Touche LLP igecasmccarthy@deloitte.com Kyle Cooke Manager Deloitte Services LP kycooke@deloitte.com Meghan Burns Manager Deloitte Services LP megburns@deloitte.com Richard Rosenthal Banking and Digital Assets Regulatory Leader Principal Deloitte & Touche LLP rirosenthal@deloitte.com Tim Davis US Advisory Blockchain & Digital Assets Leader Principal Deloitte & Touche LLP timdavis@deloitte.com Rob Massey US Tax Blockchain & Digital Assets Leader Partner Deloitte Tax LLP rmassey@deloitte.com Rich Mumford Independent Senior Advisor to Deloitte & Touche LLP rmumford@deloitte.com Brian Hansen US Audit Blockchain & Digital Assets Leader Audit & Assurance Partner Deloitte & Touche LLP brianhansen@deloitte.com Roy Ben-Hur Managing Director Deloitte & Touche LLP rbenhur@deloitte.com