Q2 | 2025 Shareholder Letter Fiverr

AI Summary

AI Summary

Key Insights

- [object Object]

- [object Object]

- [object Object]

- [object Object]

- [object Object]

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Q2 | 2025 Shareholder Letter Fiverr

- 1. Q2 | 2025 Shareholder Letter F I V E R R . C O M 1 David Colón, Seller Founder ColonFilm.com Spain

- 2. Q2 | 2025 Shareholder Letter ON THE COVER David Colón, Seller Founder ColonFilm.com Spain 2 David Colón is the Founder of ColonFilm.com, a creative agency that specializes in high-quality movie posters and book covers. His award-winning graphic designs and cinematography have allowed him to work with clients worldwide to tell captivating stories. Davidʼs work has been recognized internationally, winning accolades such as Best Film Poster at the International Film Festival in Rome and Best Web Design in Zaragoza, Spain. David joined Fiverr in 2016, while studying video and image editing at a professional film academy. He started off offering a wider range of services with accessible prices, including logos and social media graphics, but over time realized his business was strongest in narrative design. Joining Fiverr Pro was his turning point, as he re-invested his earnings into improving his tools, organizing workflow, building a clear visual portfolio, and quickly made this his full-time job. His typical clients are indie authors, filmmakers and producers who work on larger projects. He handles most of the work solo, but also relies on a close circle of trusted collaborators for specific value add tasks. Some notable works include a book cover for one of Appleʼs founders and artwork for a documentary linked to high-profile film Platoon. Since joining Fiverr, he has completed over 1,400 orders and helped more than 1,000 clients, with typical project size ranging from $300 to $2K. David is a Top Rated Seller and Fiverr is his main international channel, with about 80% of his projects coming through the platform. “Fiverr allowed me to build a freelancing career, connect with people from different countries, and grow through creative projects. The global reach and built-in trust have been essential to scaling without having to chase work. As the platform developed new categories and attracted more diverse clients, it pushed me to raise the bar of my services and skills continuously.”

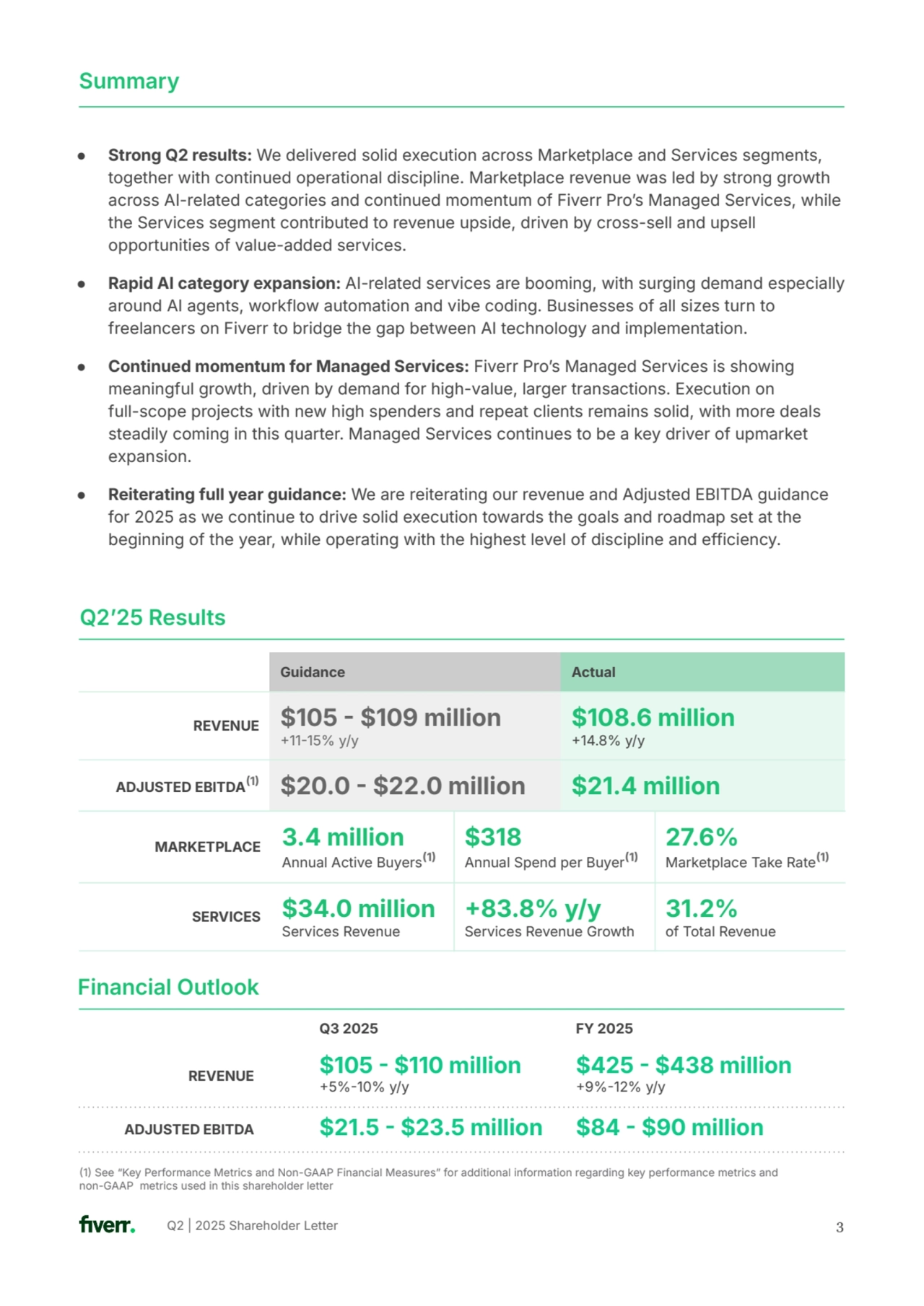

- 3. Q2 | 2025 Shareholder Letter ● Strong Q2 results: We delivered solid execution across Marketplace and Services segments, together with continued operational discipline. Marketplace revenue was led by strong growth across AI-related categories and continued momentum of Fiverr Proʼs Managed Services, while the Services segment contributed to revenue upside, driven by cross-sell and upsell opportunities of value-added services. ● Rapid AI category expansion: AI-related services are booming, with surging demand especially around AI agents, workflow automation and vibe coding. Businesses of all sizes turn to freelancers on Fiverr to bridge the gap between AI technology and implementation. ● Continued momentum for Managed Services: Fiverr Proʼs Managed Services is showing meaningful growth, driven by demand for high-value, larger transactions. Execution on full-scope projects with new high spenders and repeat clients remains solid, with more deals steadily coming in this quarter. Managed Services continues to be a key driver of upmarket expansion. ● Reiterating full year guidance: We are reiterating our revenue and Adjusted EBITDA guidance for 2025 as we continue to drive solid execution towards the goals and roadmap set at the beginning of the year, while operating with the highest level of discipline and efficiency. Summary Q2ʼ25 Results 3 Guidance Actual REVENUE $105 $109 million 1115% y/y $108.6 million 14.8% y/y ADJUSTED EBITDA1 $20.0 $22.0 million $21.4 million MARKETPLACE 3.4 million Annual Active Buyers1 $318 Annual Spend per Buyer1 27.6% Marketplace Take Rate1 SERVICES $34.0 million Services Revenue 83.8% y/y Services Revenue Growth 31.2% of Total Revenue 1 See “Key Performance Metrics and Non-GAAP Financial Measuresˮ for additional information regarding key performance metrics and non-GAAP metrics used in this shareholder letter Q3 2025 FY 2025 REVENUE $105 $110 million 5%10% y/y $425 $438 million 9%12% y/y ADJUSTED EBITDA $21.5 $23.5 million $84 $90 million Financial Outlook

- 4. Q2 | 2025 Shareholder Letter Halfway through 2025, Iʼm incredibly proud of what our team has accomplished. We are closely tracking with the goals we set at the beginning of the year, delivering 15% y/y revenue growth and a 20% Adjusted EBITDA margin for the second quarter. We unlocked pockets of growth through catalog expansion, upmarket enablement and services upsell, despite the relatively slow hiring environment. We continue to operate with discipline and efficiency. We understand the importance of a strong cash position and growing cash flow, and believe that discipline is not a constraint for growth, rather it empowers us to do what we love, which is building and innovating. AI is fundamentally reshaping how work gets done, both on our marketplace and within Fiverr. Our 11th Annual Business Trends Index reveals surging demand for AI agents and workflow automation across industries. Amid a crowded AI tool landscape, Fiverr freelancers are increasingly essential in bridging the gap between technology and implementation, delivering customized, high-impact solutions for our customers. Whether it's embedding GenAI into branded content workflows, building marketing automation funnels, or debugging early-stage prototypes, our talent pool is empowering our customers to harness the real potential of AI. Our investment in AI-related categories and deep bench of AI skilled freelancers have translated into growth momentum in verticals such as Programming & Tech, Video & Animation, and Digital Marketing. Weʼre also making rapid progress on product innovation and infrastructure. Fiverr Goʼs Personal Assistant continues to gain traction, and we're expanding its capabilities beyond admin support to help sellers market their services and reach more buyers. We've significantly upgraded our Dynamic Matching engine to integrate advanced LLMs and enriched seller data, leading to continued improvement in the offer to order conversion. On the tech infrastructure side, we're building a new MCP layer internally to accelerate AI tool deployment, and we are already seeing impact in areas like marketplace intelligence and support ticket resolution. As we look to the future, we see AI as a continued tailwind for our business, providing ample opportunity for us to expand our catalog, enhance the marketplace experience and deepen our product and operational excellence. We continue to believe that real-world impact comes not from AI alone, but from the dynamic collaboration between human expertise and intelligent tools. Fiverr is distinctly positioned to be the platform of choice for AI talent. Recently, I had the privilege of celebrating with our Fiverr sellers who crossed the $1 million earnings milestone. Listening to their journeys and success makes me feel insanely proud. They are the reason we exist: to be a platform that empowers people to chase dreams, become independent, and deliver top-notch service to clients. Itʼs whatʼs driving us forward. Thank you for your continued trust and support. 4 To Our Shareholders AI Categories and Managed Services Led Marketplace Growth For Q2 2025, Marketplace revenue was $74.7 million, driven by 3.4 million annual active buyers, $318 annual spend per buyer, and a 27.6% marketplace take rate. We continued to execute amid a stable macro environment, and the success of our investments in AI and upmarket shines through. While overall GMV growth remains muted, when we look at the underlying

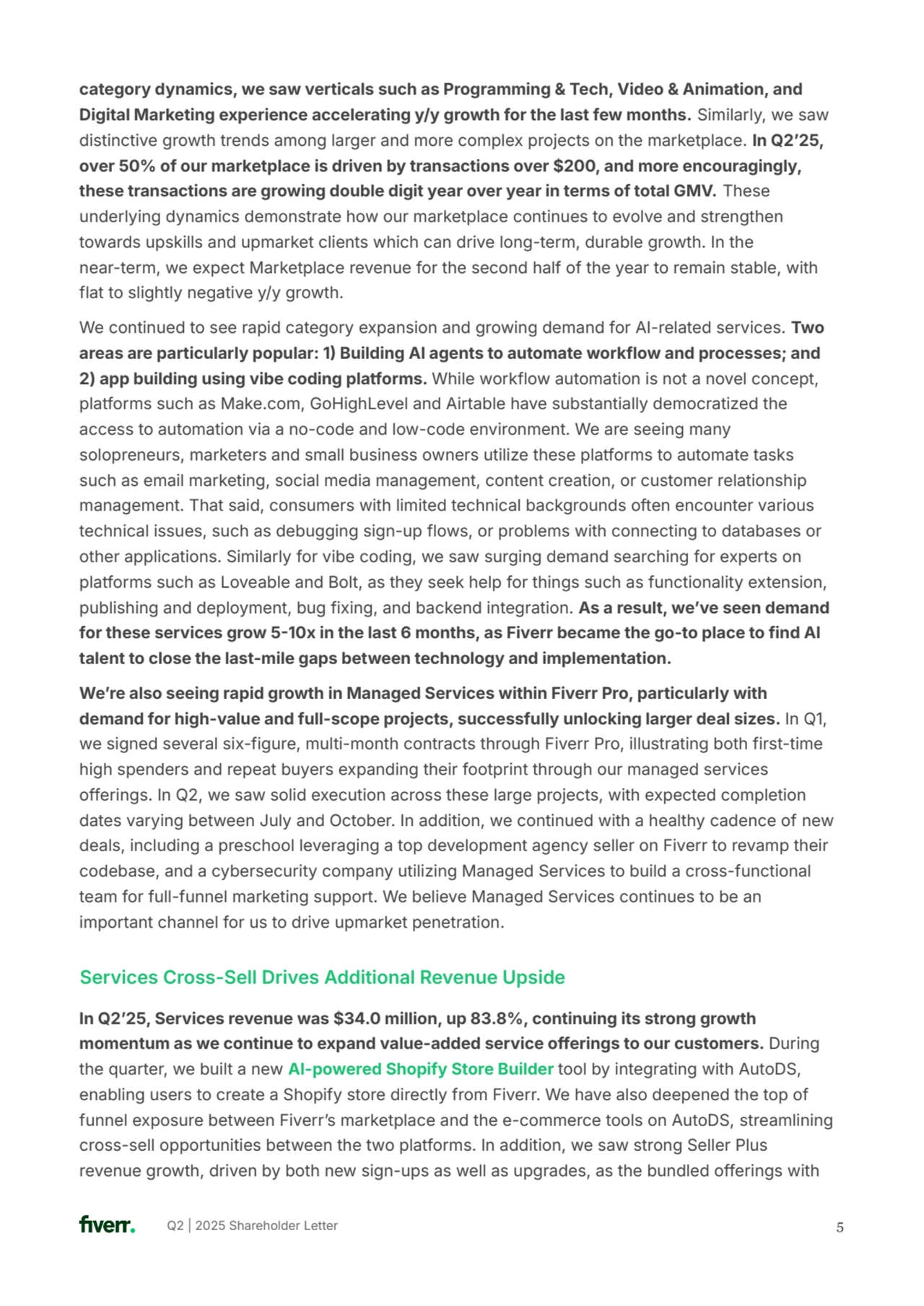

- 5. Q2 | 2025 Shareholder Letter category dynamics, we saw verticals such as Programming & Tech, Video & Animation, and Digital Marketing experience accelerating y/y growth for the last few months. Similarly, we saw distinctive growth trends among larger and more complex projects on the marketplace. In Q2ʼ25, over 50% of our marketplace is driven by transactions over $200, and more encouragingly, these transactions are growing double digit year over year in terms of total GMV. These underlying dynamics demonstrate how our marketplace continues to evolve and strengthen towards upskills and upmarket clients which can drive long-term, durable growth. In the near-term, we expect Marketplace revenue for the second half of the year to remain stable, with flat to slightly negative y/y growth. We continued to see rapid category expansion and growing demand for AI-related services. Two areas are particularly popular: 1 Building AI agents to automate workflow and processes; and 2) app building using vibe coding platforms. While workflow automation is not a novel concept, platforms such as Make.com, GoHighLevel and Airtable have substantially democratized the access to automation via a no-code and low-code environment. We are seeing many solopreneurs, marketers and small business owners utilize these platforms to automate tasks such as email marketing, social media management, content creation, or customer relationship management. That said, consumers with limited technical backgrounds often encounter various technical issues, such as debugging sign-up flows, or problems with connecting to databases or other applications. Similarly for vibe coding, we saw surging demand searching for experts on platforms such as Loveable and Bolt, as they seek help for things such as functionality extension, publishing and deployment, bug fixing, and backend integration. As a result, weʼve seen demand for these services grow 510x in the last 6 months, as Fiverr became the go-to place to find AI talent to close the last-mile gaps between technology and implementation. Weʼre also seeing rapid growth in Managed Services within Fiverr Pro, particularly with demand for high-value and full-scope projects, successfully unlocking larger deal sizes. In Q1, we signed several six-figure, multi-month contracts through Fiverr Pro, illustrating both first-time high spenders and repeat buyers expanding their footprint through our managed services offerings. In Q2, we saw solid execution across these large projects, with expected completion dates varying between July and October. In addition, we continued with a healthy cadence of new deals, including a preschool leveraging a top development agency seller on Fiverr to revamp their codebase, and a cybersecurity company utilizing Managed Services to build a cross-functional team for full-funnel marketing support. We believe Managed Services continues to be an important channel for us to drive upmarket penetration. 5 In Q2ʼ25, Services revenue was $34.0 million, up 83.8%, continuing its strong growth momentum as we continue to expand value-added service offerings to our customers. During the quarter, we built a new AI-powered Shopify Store Builder tool by integrating with AutoDS, enabling users to create a Shopify store directly from Fiverr. We have also deepened the top of funnel exposure between Fiverrʼs marketplace and the e-commerce tools on AutoDS, streamlining cross-sell opportunities between the two platforms. In addition, we saw strong Seller Plus revenue growth, driven by both new sign-ups as well as upgrades, as the bundled offerings with Services Cross-Sell Drives Additional Revenue Upside

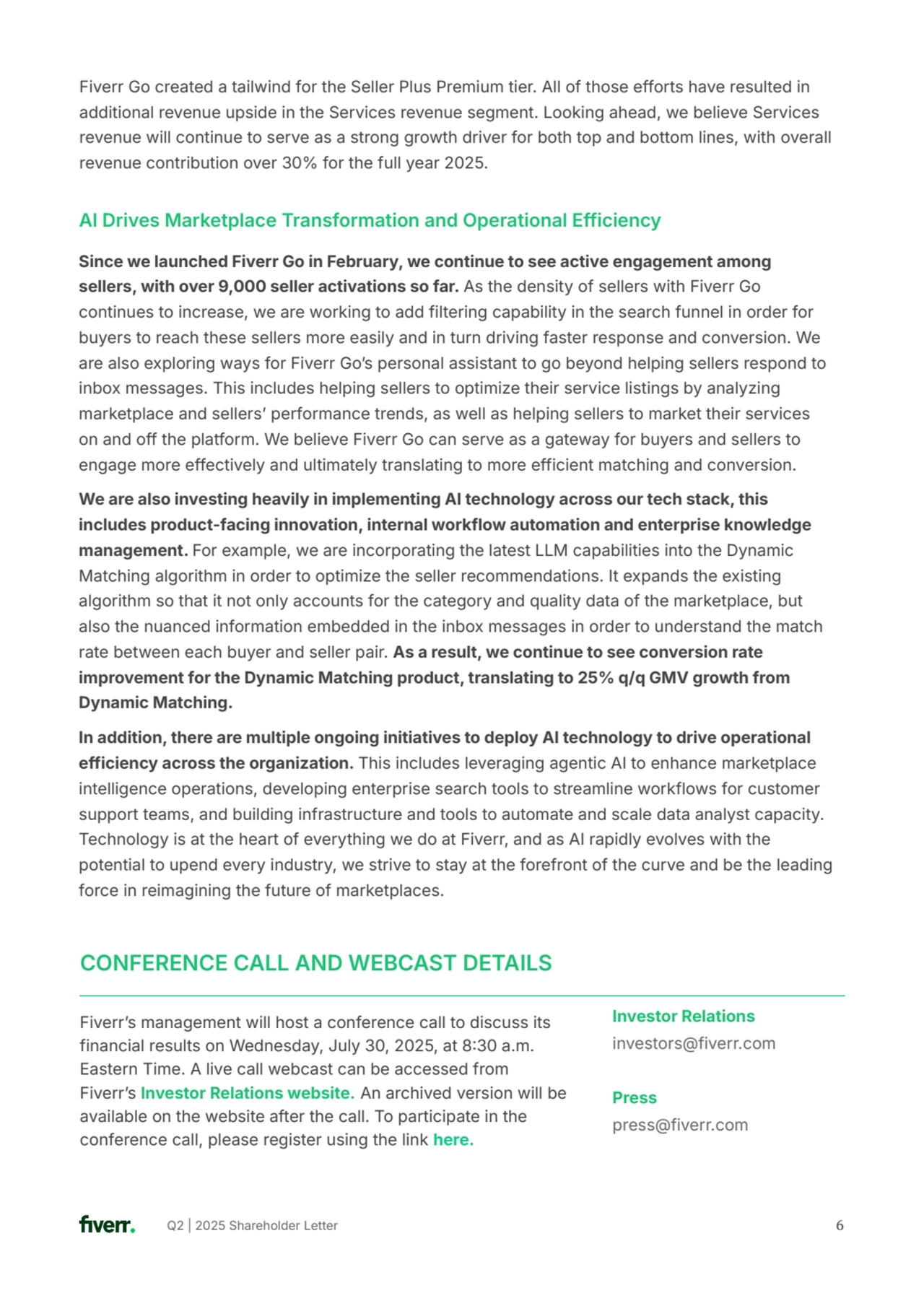

- 6. Q2 | 2025 Shareholder Letter 6 Since we launched Fiverr Go in February, we continue to see active engagement among sellers, with over 9,000 seller activations so far. As the density of sellers with Fiverr Go continues to increase, we are working to add filtering capability in the search funnel in order for buyers to reach these sellers more easily and in turn driving faster response and conversion. We are also exploring ways for Fiverr Goʼs personal assistant to go beyond helping sellers respond to inbox messages. This includes helping sellers to optimize their service listings by analyzing marketplace and sellersʼ performance trends, as well as helping sellers to market their services on and off the platform. We believe Fiverr Go can serve as a gateway for buyers and sellers to engage more effectively and ultimately translating to more efficient matching and conversion. We are also investing heavily in implementing AI technology across our tech stack, this includes product-facing innovation, internal workflow automation and enterprise knowledge management. For example, we are incorporating the latest LLM capabilities into the Dynamic Matching algorithm in order to optimize the seller recommendations. It expands the existing algorithm so that it not only accounts for the category and quality data of the marketplace, but also the nuanced information embedded in the inbox messages in order to understand the match rate between each buyer and seller pair. As a result, we continue to see conversion rate improvement for the Dynamic Matching product, translating to 25% q/q GMV growth from Dynamic Matching. In addition, there are multiple ongoing initiatives to deploy AI technology to drive operational efficiency across the organization. This includes leveraging agentic AI to enhance marketplace intelligence operations, developing enterprise search tools to streamline workflows for customer support teams, and building infrastructure and tools to automate and scale data analyst capacity. Technology is at the heart of everything we do at Fiverr, and as AI rapidly evolves with the potential to upend every industry, we strive to stay at the forefront of the curve and be the leading force in reimagining the future of marketplaces. AI Drives Marketplace Transformation and Operational Efficiency Fiverr Go created a tailwind for the Seller Plus Premium tier. All of those efforts have resulted in additional revenue upside in the Services revenue segment. Looking ahead, we believe Services revenue will continue to serve as a strong growth driver for both top and bottom lines, with overall revenue contribution over 30% for the full year 2025. Fiverrʼs management will host a conference call to discuss its financial results on Wednesday, July 30, 2025, at 830 a.m. Eastern Time. A live call webcast can be accessed from Fiverrʼs Investor Relations website. An archived version will be available on the website after the call. To participate in the conference call, please register using the link here. Investor Relations investors@fiverr.com Press press@fiverr.com CONFERENCE CALL AND WEBCAST DETAILS

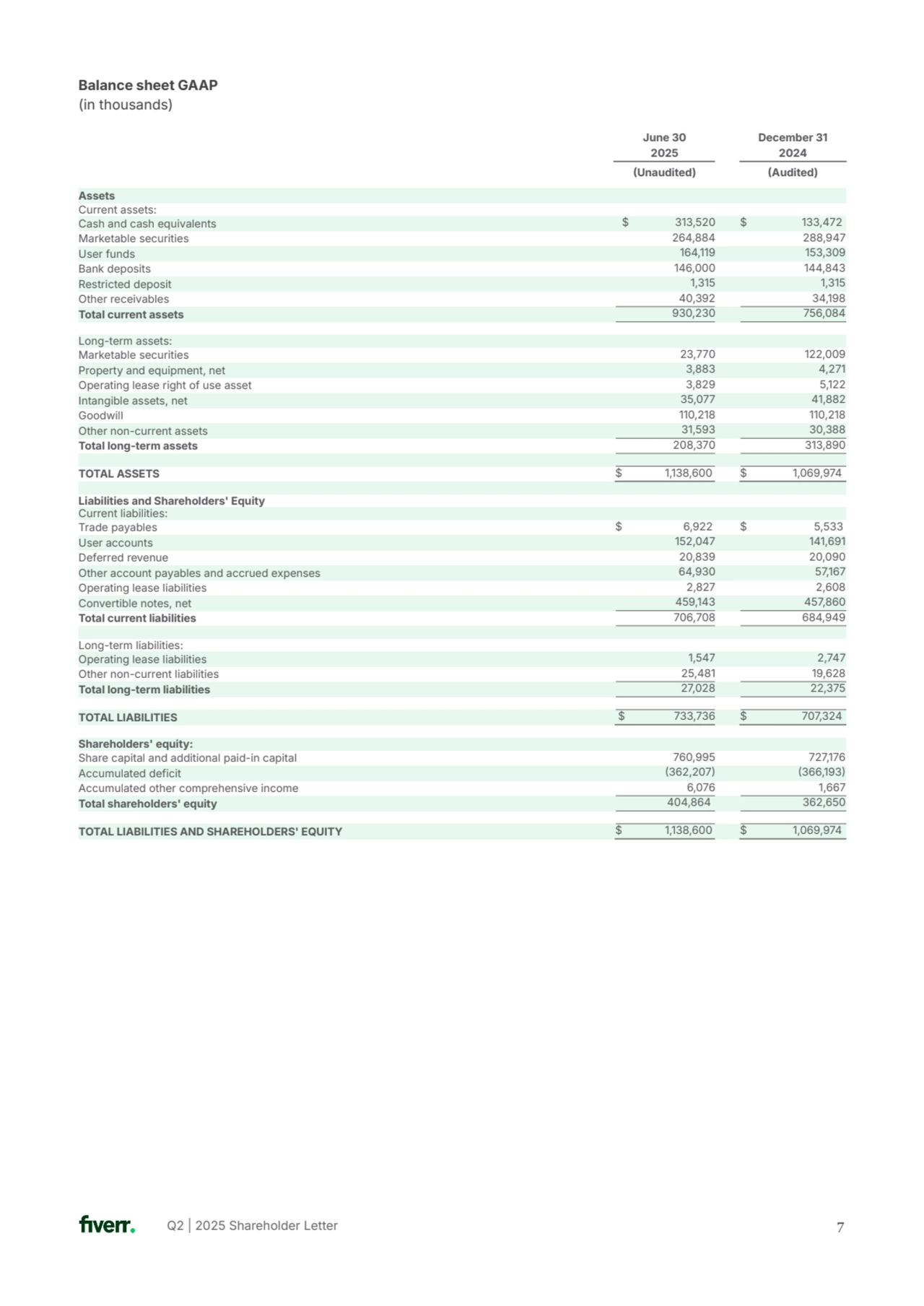

- 7. Q2 | 2025 Shareholder Letter 7 Assets Current assets: Cash and cash equivalents $ 313,520 $ 133,472 Marketable securities 264,884 288,947 User funds 164,119 153,309 Bank deposits 146,000 144,843 Restricted deposit 1,315 1,315 Other receivables 40,392 34,198 Total current assets 930,230 756,084 Long-term assets: Marketable securities 23,770 122,009 Property and equipment, net 3,883 4,271 Operating lease right of use asset 3,829 5,122 Intangible assets, net 35,077 41,882 Goodwill 110,218 110,218 Other non-current assets 31,593 30,388 Total long-term assets 208,370 313,890 TOTAL ASSETS $ 1,138,600 $ 1,069,974 Liabilities and Shareholders' Equity Current liabilities: Trade payables $ 6,922 $ 5,533 User accounts 152,047 141,691 Deferred revenue 20,839 20,090 Other account payables and accrued expenses 64,930 57,167 Operating lease liabilities 2,827 2,608 Convertible notes, net 459,143 457,860 Total current liabilities 706,708 684,949 Long-term liabilities: Operating lease liabilities 1,547 2,747 Other non-current liabilities 25,481 19,628 Total long-term liabilities 27,028 22,375 TOTAL LIABILITIES $ 733,736 $ 707,324 Shareholders' equity: Share capital and additional paid-in capital 760,995 727,176 Accumulated deficit 362,207 366,193 Accumulated other comprehensive income 6,076 1,667 Total shareholders' equity 404,864 362,650 TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY $ 1,138,600 $ 1,069,974 Balance sheet GAAP (in thousands) June 30 December 31 2025 2024 Unaudited) Audited)

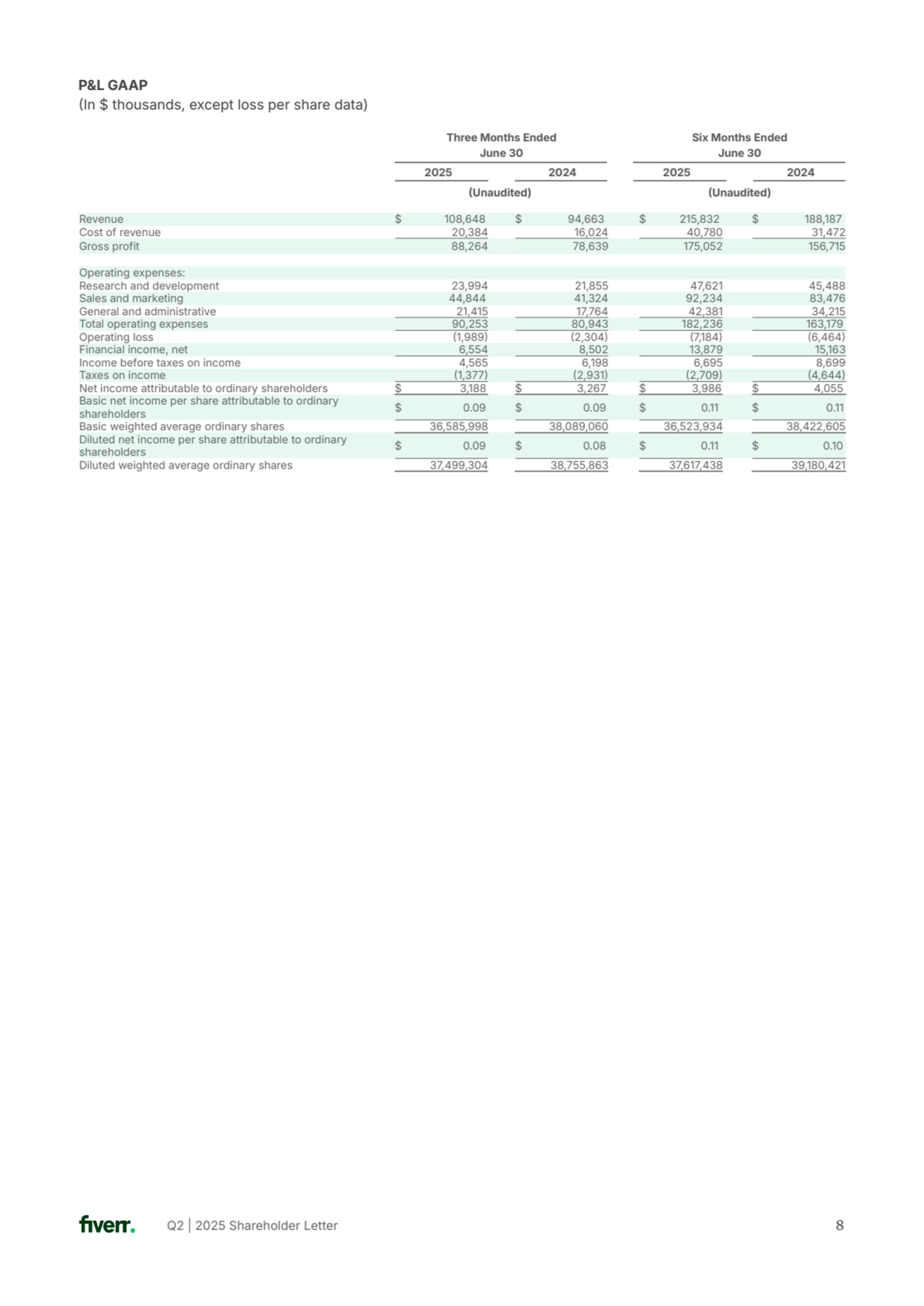

- 8. Q2 | 2025 Shareholder Letter 8 P&L GAAP In $ thousands, except loss per share data) Six Months Ended June 30 2025 2024 Unaudited) Unaudited) Three Months Ended June 30 2025 2024 Revenue $ 108,648 $ 94,663 $ 215,832 $ 188,187 Cost of revenue 20,384 16,024 40,780 31,472 Gross profit 88,264 78,639 175,052 156,715 Operating expenses: Research and development 23,994 21,855 47,621 45,488 Sales and marketing 44,844 41,324 92,234 83,476 General and administrative 21,415 17,764 42,381 34,215 Total operating expenses 90,253 80,943 182,236 163,179 Operating loss 1,989 2,304 7,184 6,464 Financial income, net 6,554 8,502 13,879 15,163 Income before taxes on income 4,565 6,198 6,695 8,699 Taxes on income 1,377 2,931 2,709 4,644 Net income attributable to ordinary shareholders $ 3,188 $ 3,267 $ 3,986 $ 4,055 Basic net income per share attributable to ordinary shareholders $ 0.09 $ 0.09 $ 0.11 $ 0.11 Basic weighted average ordinary shares 36,585,998 38,089,060 36,523,934 38,422,605 Diluted net income per share attributable to ordinary shareholders $ 0.09 $ 0.08 $ 0.11 $ 0.10 Diluted weighted average ordinary shares 37,499,304 38,755,863 37,617,438 39,180,421

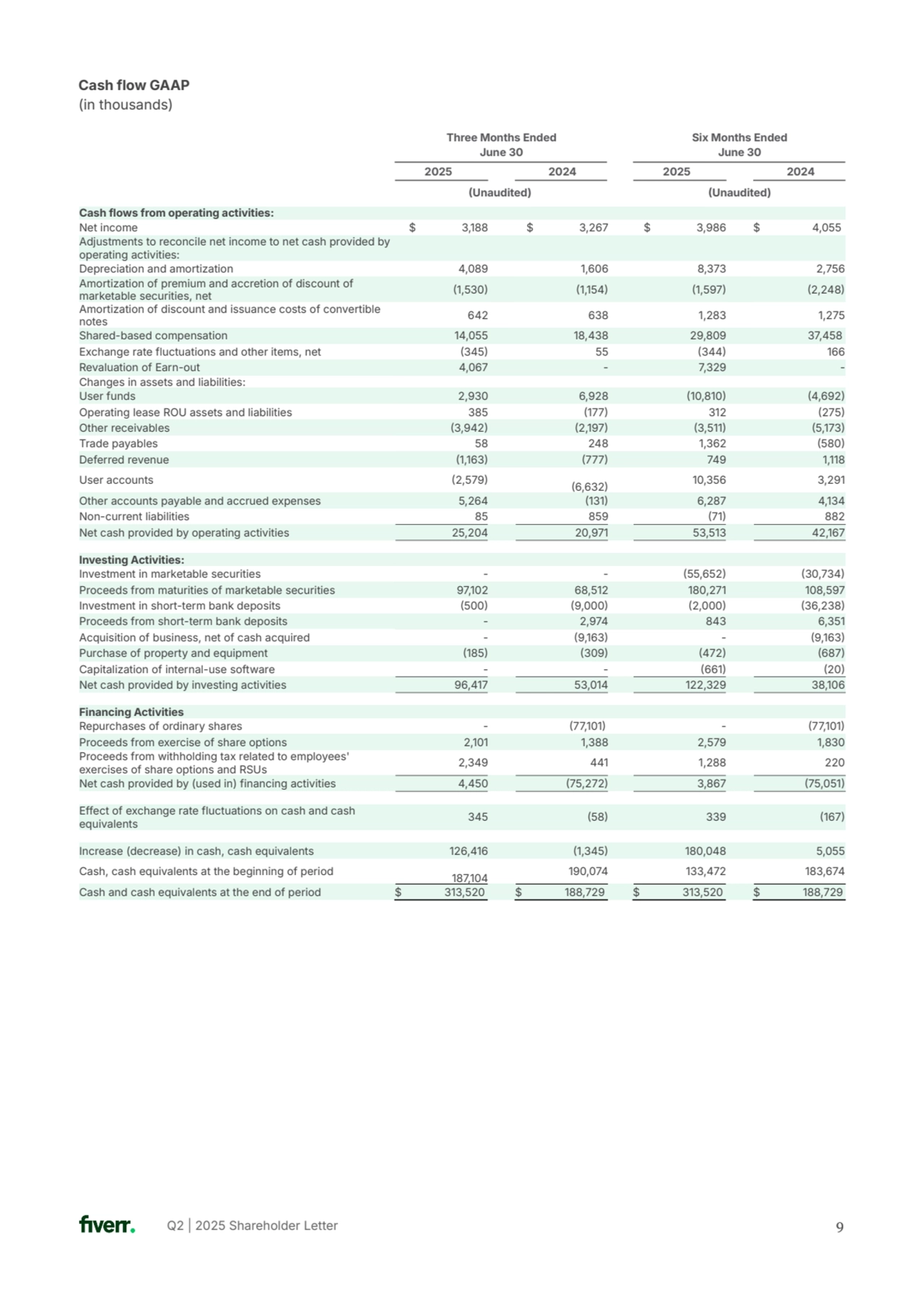

- 9. Q2 | 2025 Shareholder Letter 9 Cash flow GAAP (in thousands) Six Months Ended June 30 2025 2024 Unaudited) Unaudited) Three Months Ended June 30 2025 2024 Cash flows from operating activities: Net income $ 3,188 $ 3,267 $ 3,986 $ 4,055 Adjustments to reconcile net income to net cash provided by operating activities: Depreciation and amortization 4,089 1,606 8,373 2,756 Amortization of premium and accretion of discount of marketable securities, net 1,530 1,154 1,597 2,248 Amortization of discount and issuance costs of convertible notes 642 638 1,283 1,275 Shared-based compensation 14,055 18,438 29,809 37,458 Exchange rate fluctuations and other items, net 345 55 344 166 Revaluation of Earn-out 4,067 - 7,329 - Changes in assets and liabilities: User funds 2,930 6,928 10,810 4,692 Operating lease ROU assets and liabilities 385 177 312 275 Other receivables 3,942 2,197 3,511 5,173 Trade payables 58 248 1,362 580 Deferred revenue 1,163 777 749 1,118 User accounts 2,579 6,632 10,356 3,291 Other accounts payable and accrued expenses 5,264 131 6,287 4,134 Non-current liabilities 85 859 71 882 Net cash provided by operating activities 25,204 20,971 53,513 42,167 Investing Activities: Investment in marketable securities - - 55,652 30,734 Proceeds from maturities of marketable securities 97,102 68,512 180,271 108,597 Investment in short-term bank deposits 500 9,000 2,000 36,238 Proceeds from short-term bank deposits - 2,974 843 6,351 Acquisition of business, net of cash acquired - 9,163 - 9,163 Purchase of property and equipment 185 309 472 687 Capitalization of internal-use software - - 661 20 Net cash provided by investing activities 96,417 53,014 122,329 38,106 Financing Activities Repurchases of ordinary shares - 77,101 - 77,101 Proceeds from exercise of share options 2,101 1,388 2,579 1,830 Proceeds from withholding tax related to employees' exercises of share options and RSUs 2,349 441 1,288 220 Net cash provided by (used in) financing activities 4,450 75,272 3,867 75,051 Effect of exchange rate fluctuations on cash and cash equivalents 345 58 339 167 Increase (decrease) in cash, cash equivalents 126,416 1,345 180,048 5,055 Cash, cash equivalents at the beginning of period 187,104 190,074 133,472 183,674 Cash and cash equivalents at the end of period $ 313,520 $ 188,729 $ 313,520 $ 188,729

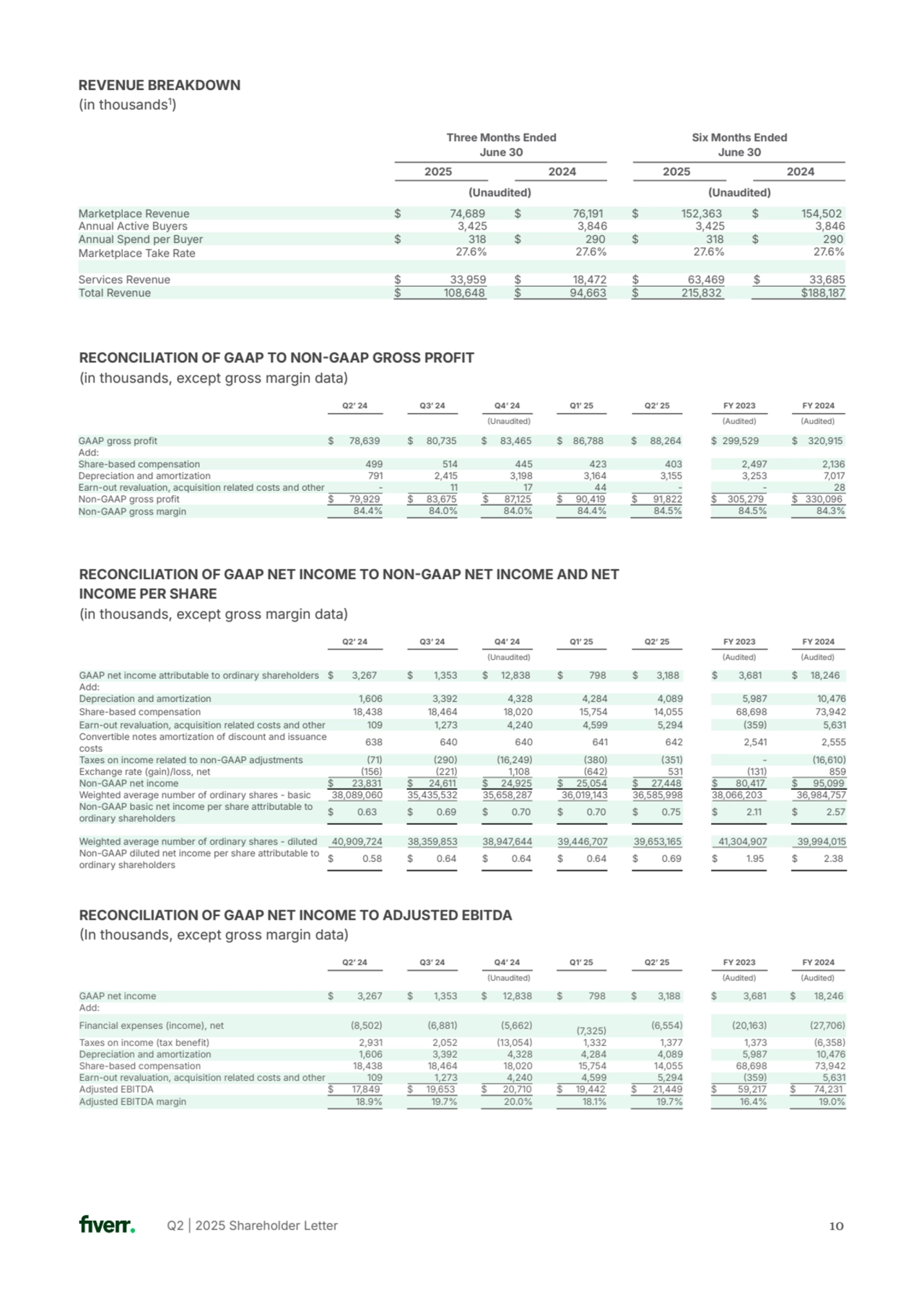

- 10. Q2 | 2025 Shareholder Letter 10 Marketplace Revenue $ 74,689 $ 76,191 $ 152,363 $ 154,502 Annual Active Buyers 3,425 3,846 3,425 3,846 Annual Spend per Buyer $ 318 $ 290 $ 318 $ 290 Marketplace Take Rate 27.6% 27.6% 27.6% 27.6% Services Revenue $ 33,959 $ 18,472 $ 63,469 $ 33,685 Total Revenue $ 108,648 $ 94,663 $ 215,832 $188,187 REVENUE BREAKDOWN (in thousands1) Six Months Ended June 30 2025 2024 Unaudited) Unaudited) Three Months Ended June 30 2025 2024 GAAP gross profit $ 78,639 $ 80,735 $ 83,465 $ 86,788 $ 88,264 $ 299,529 $ 320,915 Add: Share-based compensation 499 514 445 423 403 2,497 2,136 Depreciation and amortization 791 2,415 3,198 3,164 3,155 3,253 7,017 Earn-out revaluation, acquisition related costs and other - 11 17 44 - - 28 Non-GAAP gross profit $ 79,929 $ 83,675 $ 87,125 $ 90,419 $ 91,822 $ 305,279 $ 330,096 Non-GAAP gross margin 84.4% 84.0% 84.0% 84.4% 84.5% 84.5% 84.3% RECONCILIATION OF GAAP TO NONGAAP GROSS PROFIT (in thousands, except gross margin data) RECONCILIATION OF GAAP NET INCOME TO NONGAAP NET INCOME AND NET INCOME PER SHARE (in thousands, except gross margin data) GAAP net income attributable to ordinary shareholders $ 3,267 $ 1,353 $ 12,838 $ 798 $ 3,188 $ 3,681 $ 18,246 Add: Depreciation and amortization 1,606 3,392 4,328 4,284 4,089 5,987 10,476 Share-based compensation 18,438 18,464 18,020 15,754 14,055 68,698 73,942 Earn-out revaluation, acquisition related costs and other 109 1,273 4,240 4,599 5,294 359 5,631 Convertible notes amortization of discount and issuance costs 638 640 640 641 642 2,541 2,555 Taxes on income related to non-GAAP adjustments 71 290 16,249 380 351 - 16,610 Exchange rate (gain)/loss, net 156 221 1,108 642 531 131 859 Non-GAAP net income $ 23,831 $ 24,611 $ 24,925 $ 25,054 $ 27,448 $ 80,417 $ 95,099 Weighted average number of ordinary shares - basic 38,089,060 35,435,532 35,658,287 36,019,143 36,585,998 38,066,203 36,984,757 Non-GAAP basic net income per share attributable to ordinary shareholders $ 0.63 $ 0.69 $ 0.70 $ 0.70 $ 0.75 $ 2.11 $ 2.57 Weighted average number of ordinary shares - diluted 40,909,724 38,359,853 38,947,644 39,446,707 39,653,165 41,304,907 39,994,015 Non-GAAP diluted net income per share attributable to ordinary shareholders $ 0.58 $ 0.64 $ 0.64 $ 0.64 $ 0.69 $ 1.95 $ 2.38 RECONCILIATION OF GAAP NET INCOME TO ADJUSTED EBITDA In thousands, except gross margin data) GAAP net income $ 3,267 $ 1,353 $ 12,838 $ 798 $ 3,188 $ 3,681 $ 18,246 Add: Financial expenses (income), net 8,502 6,881 5,662 7,325 6,554 20,163 27,706 Taxes on income (tax benefit) 2,931 2,052 13,054 1,332 1,377 1,373 6,358 Depreciation and amortization 1,606 3,392 4,328 4,284 4,089 5,987 10,476 Share-based compensation 18,438 18,464 18,020 15,754 14,055 68,698 73,942 Earn-out revaluation, acquisition related costs and other 109 1,273 4,240 4,599 5,294 359 5,631 Adjusted EBITDA $ 17,849 $ 19,653 $ 20,710 $ 19,442 $ 21,449 $ 59,217 $ 74,231 Adjusted EBITDA margin 18.9% 19.7% 20.0% 18.1% 19.7% 16.4% 19.0% Audited) FY 2024 Audited) Q2ʼ 24 Q3ʼ 24 Q4ʼ 24 Q1ʼ 25 Q2ʼ 25 FY 2023 Unaudited) Audited) FY 2024 Audited) Q2ʼ 24 Q3ʼ 24 Q4ʼ 24 Q1ʼ 25 Q2ʼ 25 FY 2023 Unaudited) Audited) FY 2024 Audited) Q2ʼ 24 Q3ʼ 24 Q4ʼ 24 Q1ʼ 25 Q2ʼ 25 FY 2023 Unaudited)

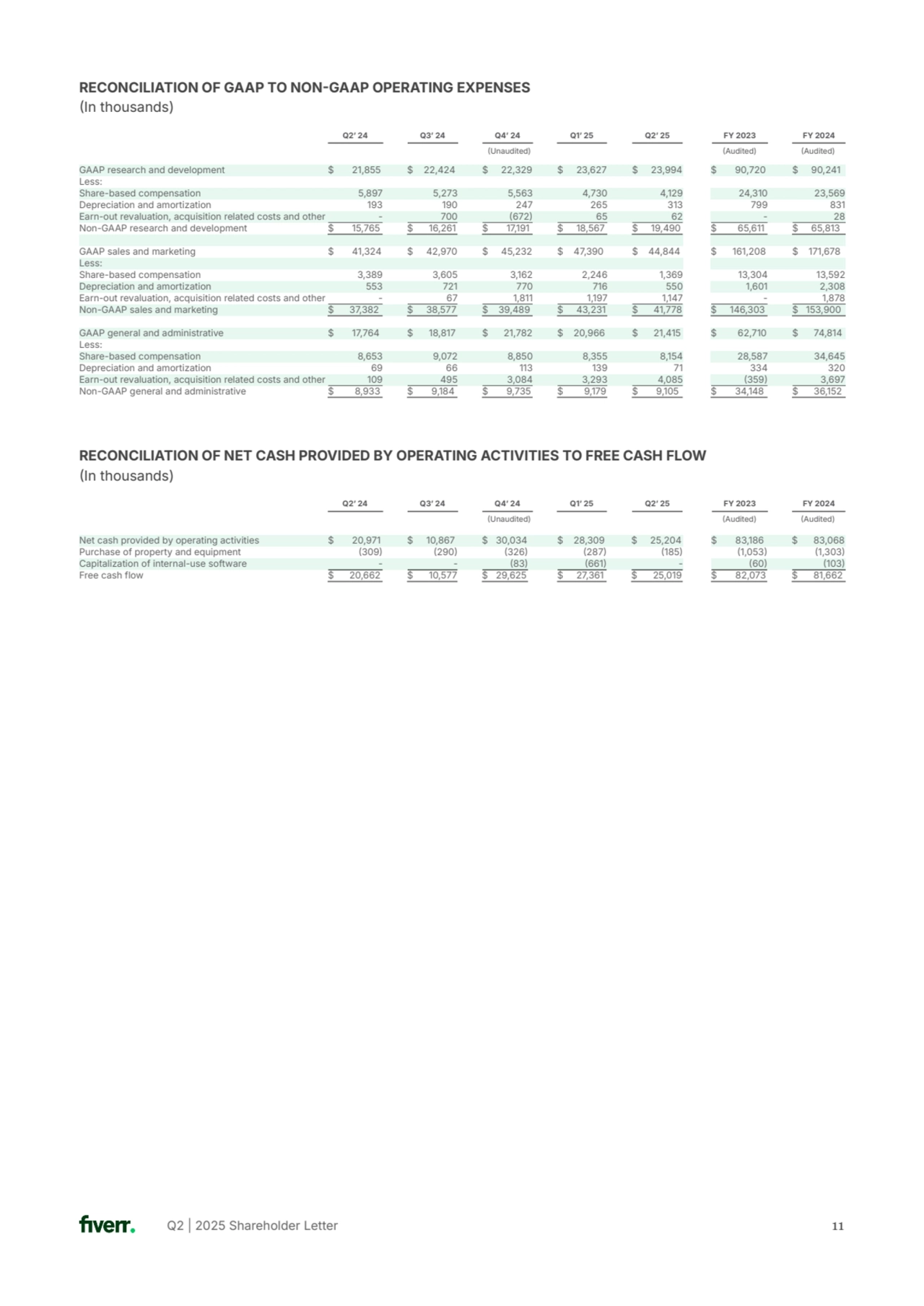

- 11. Q2 | 2025 Shareholder Letter 11 RECONCILIATION OF GAAP TO NONGAAP OPERATING EXPENSES In thousands) GAAP research and development $ 21,855 $ 22,424 $ 22,329 $ 23,627 $ 23,994 $ 90,720 $ 90,241 Less: Share-based compensation 5,897 5,273 5,563 4,730 4,129 24,310 23,569 Depreciation and amortization 193 190 247 265 313 799 831 Earn-out revaluation, acquisition related costs and other - 700 672 65 62 - 28 Non-GAAP research and development $ 15,765 $ 16,261 $ 17,191 $ 18,567 $ 19,490 $ 65,611 $ 65,813 GAAP sales and marketing $ 41,324 $ 42,970 $ 45,232 $ 47,390 $ 44,844 $ 161,208 $ 171,678 Less: Share-based compensation 3,389 3,605 3,162 2,246 1,369 13,304 13,592 Depreciation and amortization 553 721 770 716 550 1,601 2,308 Earn-out revaluation, acquisition related costs and other - 67 1,811 1,197 1,147 - 1,878 Non-GAAP sales and marketing $ 37,382 $ 38,577 $ 39,489 $ 43,231 $ 41,778 $ 146,303 $ 153,900 GAAP general and administrative $ 17,764 $ 18,817 $ 21,782 $ 20,966 $ 21,415 $ 62,710 $ 74,814 Less: Share-based compensation 8,653 9,072 8,850 8,355 8,154 28,587 34,645 Depreciation and amortization 69 66 113 139 71 334 320 Earn-out revaluation, acquisition related costs and other 109 495 3,084 3,293 4,085 359 3,697 Non-GAAP general and administrative $ 8,933 $ 9,184 $ 9,735 $ 9,179 $ 9,105 $ 34,148 $ 36,152 RECONCILIATION OF NET CASH PROVIDED BY OPERATING ACTIVITIES TO FREE CASH FLOW In thousands) Audited) FY 2024 Audited) Q2ʼ 24 Q3ʼ 24 Q4ʼ 24 Q1ʼ 25 Q2ʼ 25 FY 2023 Unaudited) Net cash provided by operating activities $ 20,971 $ 10,867 $ 30,034 $ 28,309 $ 25,204 $ 83,186 $ 83,068 Purchase of property and equipment 309 290 326 287 185 1,053 1,303 Capitalization of internal-use software - - 83 661 - 60 103 Free cash flow $ 20,662 $ 10,577 $ 29,625 $ 27,361 $ 25,019 $ 82,073 $ 81,662 Audited) FY 2024 Audited) Q2ʼ 24 Q3ʼ 24 Q4ʼ 24 Q1ʼ 25 Q2ʼ 25 FY 2023 Unaudited)

- 12. Q2 | 2025 Shareholder Letter 12 This shareholder letter includes certain key performance metrics and financial measures not based on GAAP, including Adjusted EBITDA, Adjusted EBITDA margin, non-GAAP gross profit, non-GAAP gross margin, non-GAAP operating expenses, non-GAAP net income (loss), non-GAAP net income (loss) per share and free cash flow, as well as operating metrics, including GMV, annual active buyers, annual spend per buyer and marketplace take rate. Some amounts in this shareholder letter may not total due to rounding. All percentages have been calculated using unrounded amounts. We updated the definitions of annual active buyers, GMV, annual spend per buyer and marketplace take rate to align with additional revenue disclosure, which now distinguishes between marketplace revenue and services revenue. These metrics will now exclusively reflect the marketplace, as amounts related to services previously included in these metrics are deemed immaterial. We define each of our non-GAAP measures of financial performance, as the respective GAAP balances shown in the above tables, adjusted for, as applicable, depreciation and amortization, share-based compensation expenses, contingent consideration revaluation, acquisition related costs and other, income taxes, amortization of discount and issuance costs of convertible note, financial (income) expenses, net. Non-GAAP gross profit margin represents non-GAAP gross profit expressed as a percentage of revenue. We define non-GAAP net income (loss) per share as non-GAAP net income (loss) divided by GAAP weighted-average number of ordinary shares basic and diluted. We use free cash flow as a liquidity measure and define it as a net cash provided by operating activities less capital expenditures. We define GMV or marketplace Gross Merchandise Value as the total value of transactions ordered through our marketplace, excluding value added tax, goods and services tax, service chargebacks and refunds. Annual active buyers on any given date is defined as buyers who have ordered a Gig on our marketplace within the last 12-month period, irrespective of cancellations. Annual spend per buyer on any given date is calculated by dividing our GMV within the last 12-month period by the number of annual active buyers as of such date. Marketplace take rate for a given period means marketplace revenue for such period divided by GMV for such period. When we refer in this shareholder letter to the marketplace we refer to transactions conducted between buyers and freelancers on Fiverr.com. When we refer to the platform we refer to the marketplace and our additional services. Management and our board of directors use certain metrics as supplemental measures of our performance that is not required by, or presented in accordance with GAAP because they assist us in comparing our operating performance on a consistent basis, as they remove the impact of items not directly resulting from our core operations. We also use these metrics for planning purposes, including the preparation of our internal annual operating budget and financial projections, to evaluate the performance and effectiveness of our strategic initiatives and capital expenditures and to evaluate our capacity to expand our business. In addition, we believe that free cash flow, which we use as a liquidity measure, is useful in evaluating our business because free cash flow reflects the cash surplus available or used to fund the expansion of our business after the payment of capital expenditures relating to the necessary components of ongoing operations. Capital expenditures consist primarily of property and equipment purchases and capitalized software costs. Free cash flow should not be used as an alternative to, or superior to, cash from operating activities. In addition, Adjusted EBITDA, Adjusted EBITDA margin, non-GAAP gross profit, non-GAAP gross margin, non-GAAP operating expenses, non-GAAP net income (loss) and non-GAAP net income (loss) per share as well as operating metrics, including GMV, annual active buyers, annual spend per buyer, marketplace take rate and tROI should not be considered in isolation, as an alternative to, or superior to net income (loss), revenue, cash flows or other performance measure derived in accordance with GAAP. These metrics are frequently used by analysts, investors and other interested parties to evaluate companies in our industry. Key Performance Metrics and Non-GAAP Financial Measures

- 13. Q2 | 2025 Shareholder Letter 13 Management believes that the presentation of non-GAAP metrics is an appropriate measure of operating performance because they eliminate the impact of expenses that do not relate directly to the performance of our underlying business. These non-GAAP metrics should not be construed as an inference that our future results will be unaffected by unusual or other items. Additionally, Adjusted EBITDA and other non-GAAP metrics used herein are not intended to be a measure of free cash flow for managementʼs discretionary use, as they do not reflect our tax payments and certain other cash costs that may recur in the future, including, among other things, cash requirements for costs to replace assets being depreciated and amortized. Management compensates for these limitations by relying on our GAAP results in addition to using Adjusted EBITDA and other non-GAAP metrics as supplemental measures of our performance. Our measure of Adjusted EBITDA, free cash flow and other non-GAAP metrics used herein is not necessarily comparable to similarly titled captions of other companies due to different methods of calculation. See the tables above regarding reconciliations of these non-GAAP financial measures to the most directly comparable GAAP measures. We are not able to provide a reconciliation of Adjusted EBITDA and Adjusted EBITDA margin guidance for the third quarter of 2025 and the fiscal year ending December 31, 2025, and long term to net income (loss), the nearest comparable GAAP measure, because certain items that are excluded from Adjusted EBITDA and Adjusted EBITDA margin cannot be reasonably predicted or are not in our control. We are also not able to provide a reconciliation of free cash flow guidance for the three year period from 20242027 to cash from operating activities, the nearest comparable GAAP measure, because certain items that are reflected in free cash flow cannot be reasonably predicted or are not in our control. In particular, in the case of Adjusted EBITDA and Adjusted EBITDA margin, we are unable to forecast the timing or magnitude of share based compensation, amortization of intangible assets, impairment of intangible assets, income or loss on revaluation of contingent consideration, other acquisition-related costs, convertible notes amortization of discount and issuance costs and exchange rate income or loss, and in the case of free cash flow, we are unable to forecast property and equipment purchases and capitalized software costs, in each case, as applicable without unreasonable efforts, and these items could significantly impact, either individually or in the aggregate, GAAP measures in the future. Forward Looking Statements This shareholder letter contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. All statements contained in this shareholder letter that do not relate to matters of historical fact should be considered forward-looking statements, including, without limitation, statements regarding our expected financial performance and operational performance, our business plans and strategy, the growth of our business, AI services and developments, our product portfolio, our customer relationships and experiences, the expected completion of some of our projects as well as statements that include the words “expect,ˮ “intend,ˮ “plan,ˮ “believe,ˮ “project,ˮ “forecast,ˮ “estimate,ˮ “may,ˮ “should,ˮ “anticipateˮ and similar statements of a future or forward-looking nature. These forward-looking statements are based on managementʼs current expectations. These statements are neither promises nor guarantees, but involve known and unknown risks, uncertainties and other important factors that may cause actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements, including, but not limited to: our ability to successfully implement our business plan within adverse economic conditions that may impact consumers, business spending and the demand for our services or have a material adverse impact on our business, financial condition and results of operations; our ability to attract and retain a large community of buyers

- 14. Q2 | 2025 Shareholder Letter and freelancers; our ability to generate sufficient revenue to maintain profitability and our net cash flow generated by operating activities; our ability to maintain and enhance our brand; our dependence on the continued growth and expansion of the market for freelancers and the services they offer; our dependence on traffic to our website; our ability to maintain user engagement on our website and to maintain and improve the quality of our platform; our operations within a competitive market; political, economic and military instability in Israel, including related to the war in Israel; our ability and the ability of third parties to protect our usersʼ personal or other data from a security breach and to comply with laws and regulations relating to data privacy, data protection and cybersecurity; our ability to manage our current and potential future growth; our dependence on decisions and developments in the mobile device industry, over which we do not have control; our ability to detect errors, defects or disruptions in our platform; our ability to comply with the terms of underlying licenses of open source software components on our platform; our ability to expand into markets outside the United States and our ability to manage the business and economic risks of international expansion and operations; our ability to achieve desired operating margins; our ability to comply with a wide variety of U.S. and international laws and regulations, including with regulatory frameworks around the development and use of AI; our ability to attract, recruit, retain and develop qualified employees; our reliance on Amazon Web Services; our ability to mitigate payment and fraud risks; our dependence on relationships with payment partners, banks and disbursement partners; and the other important factors discussed under the caption “Risk Factorsˮ in our annual report on Form 20F filed with the U.S. Securities and Exchange Commission (“SECˮ) on February 19, 2025 as such factors may be updated from time to time in our other filings with the SEC, which are accessible on the SECʼs website at www.sec.gov. In addition, we operate in a very competitive and rapidly changing environment. New risks emerge from time to time. It is not possible for our management to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements that we may make. In light of these risks, uncertainties and assumptions, the forward-looking events and circumstances discussed in this shareholder letter are inherently uncertain and may not occur, and actual results could differ materially and adversely from those anticipated or implied in the forward-looking statements. Accordingly, you should not rely upon forward-looking statements as predictions of future events. In addition, the forward-looking statements made in this shareholder letter relate only to events or information as of the date on which the statements are made in this shareholder letter. Except as required by law, we undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise, after the date on which the statements are made or to reflect the occurrence of unanticipated events. 14