Raising your first round of investment - Are you sure you are investible?

AI Summary

AI Summary

Key Insights

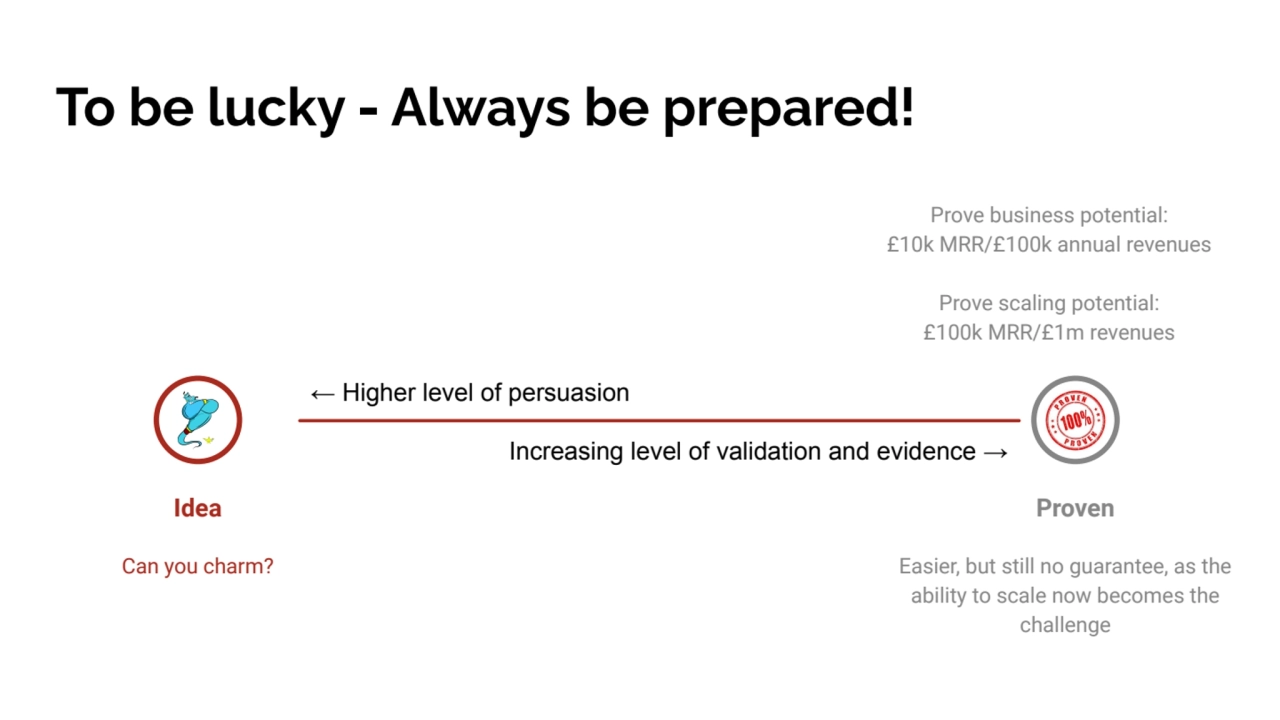

- The journey from idea to a proven business involves increasing levels of validation and evidence to persuade investors.

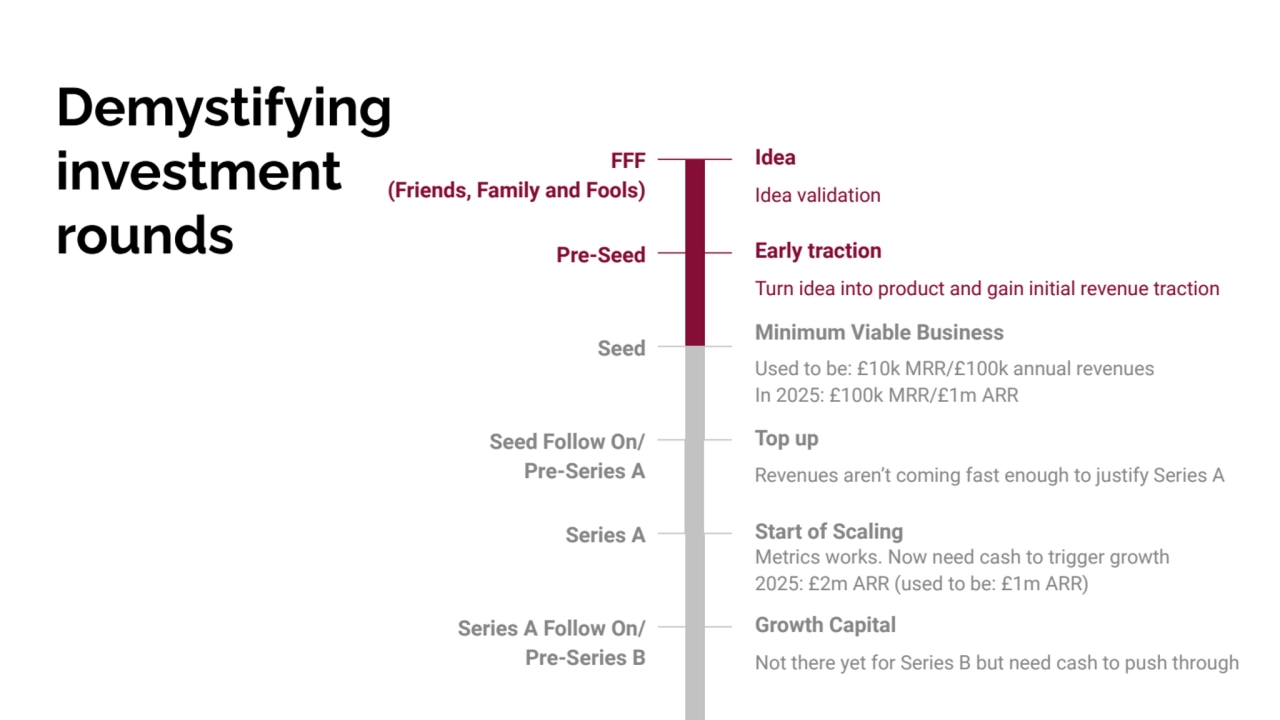

- Investment rounds are classified into stages: FFF, Pre-Seed, Seed, Series A, each with specific traction and revenue targets.

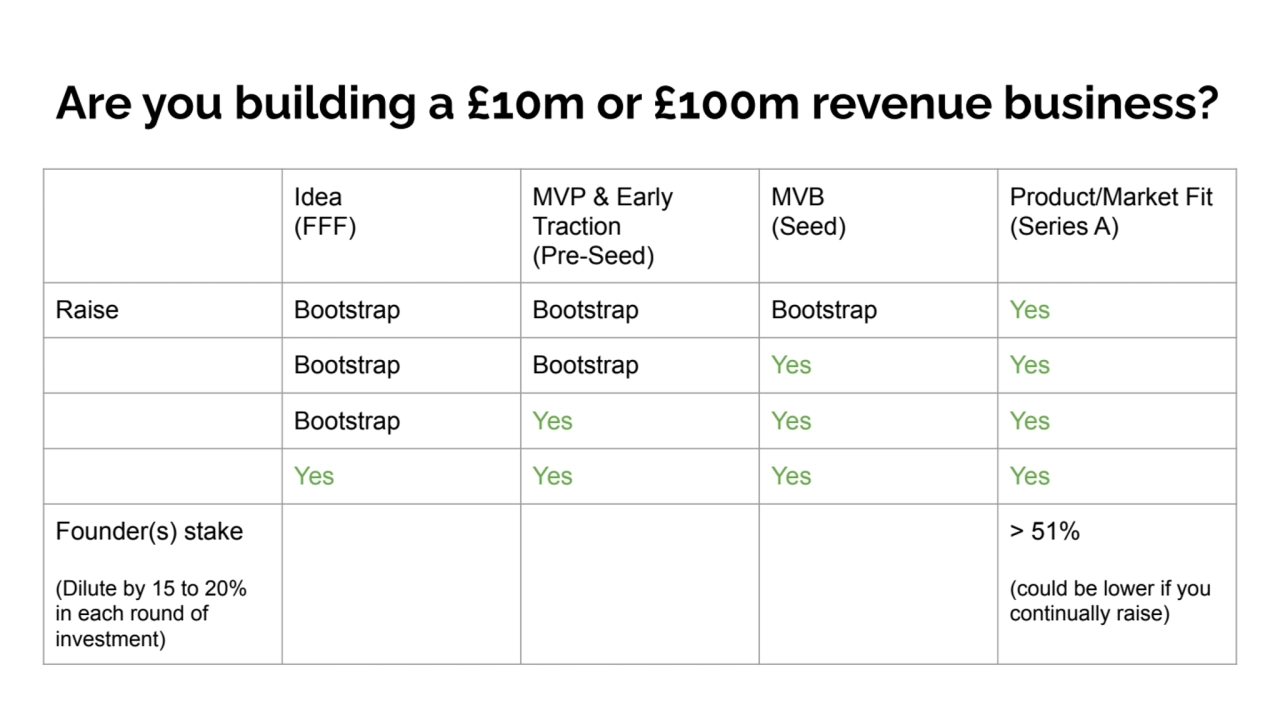

- Building a £10m or £100m revenue business requires strategic decisions about raising capital and managing founders' stake.

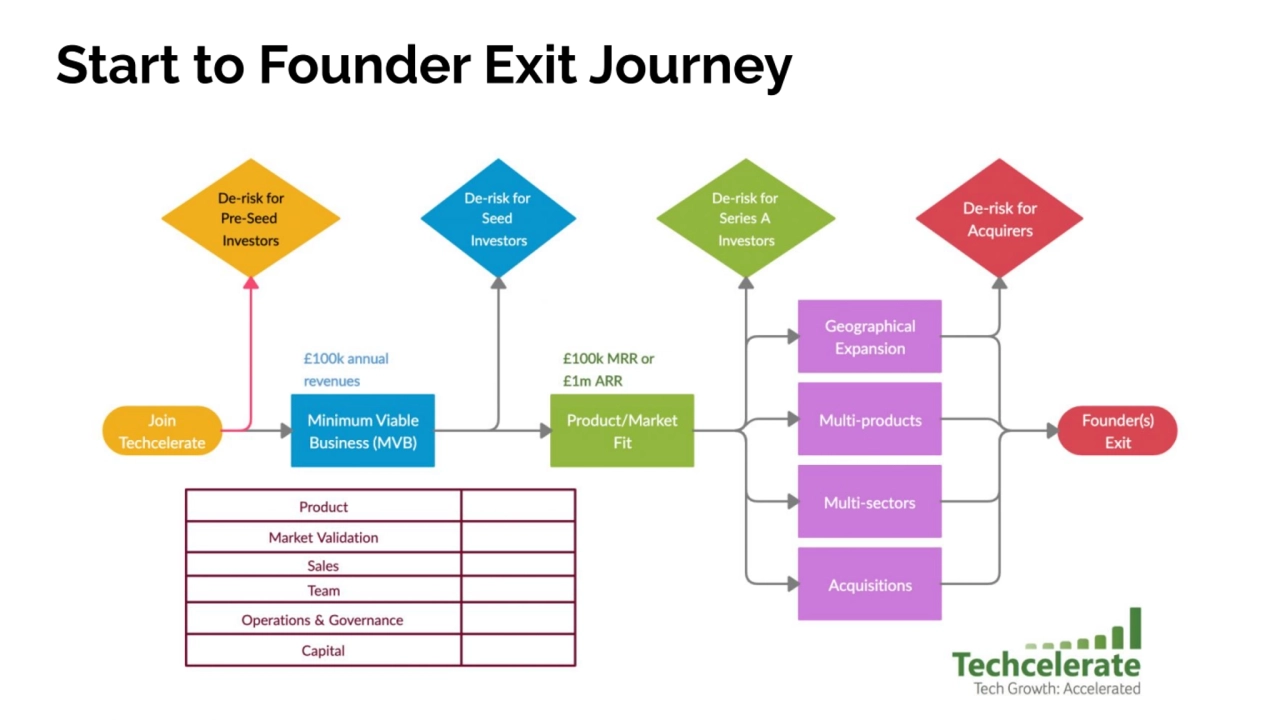

- The exit journey involves de-risking for various investor types (Pre-Seed, Seed, Series A, Acquirers) through achieving milestones like minimum viable business, product-market fit, and strategic expansion.

Raising your first round of investment - Are you sure you are investible?

- 1. Workshop 26 Raising your first round Manoj Ranaweera manoj.ranaweera@techcelerate.ventures | +44 7769734491 https://techcelerate.ventures

- 2. To be lucky - Always be prepared! ← Higher level of persuasion Increasing level of validation and evidence → Idea Can you charm? Proven Easier, but still no guarantee, as the ability to scale now becomes the challenge Prove business potential: £10k MRR/£100k annual revenues Prove scaling potential: £100k MRR/£1m revenues

- 3. Demystifying investment rounds Idea Idea validation FFF (Friends, Family and Fools) Early traction Turn idea into product and gain initial revenue traction Pre-Seed Minimum Viable Business Used to be: £10k MRR/£100k annual revenues In 2025: £100k MRR/£1m ARR Seed Top up Revenues aren’t coming fast enough to justify Series A Seed Follow On/ Pre-Series A Start of Scaling Metrics works. Now need cash to trigger growth 2025: £2m ARR (used to be: £1m ARR) Series A Growth Capital Not there yet for Series B but need cash to push through Series A Follow On/ Pre-Series B

- 4. Are you building a £10m or £100m revenue business? Idea (FFF) MVP & Early Traction (Pre-Seed) MVB (Seed) Product/Market Fit (Series A) Raise Bootstrap Bootstrap Bootstrap Yes Bootstrap Bootstrap Yes Yes Bootstrap Yes Yes Yes Yes Yes Yes Yes Founder(s) stake (Dilute by 15 to 20% in each round of investment) > 51% (could be lower if you continually raise)

- 5. Start to Founder Exit Journey