AI Summary

AI Summary

Key Insights

- Carbon forestry can be structured as a securitizable asset class, attracting investment and facilitating large-scale forest restoration.

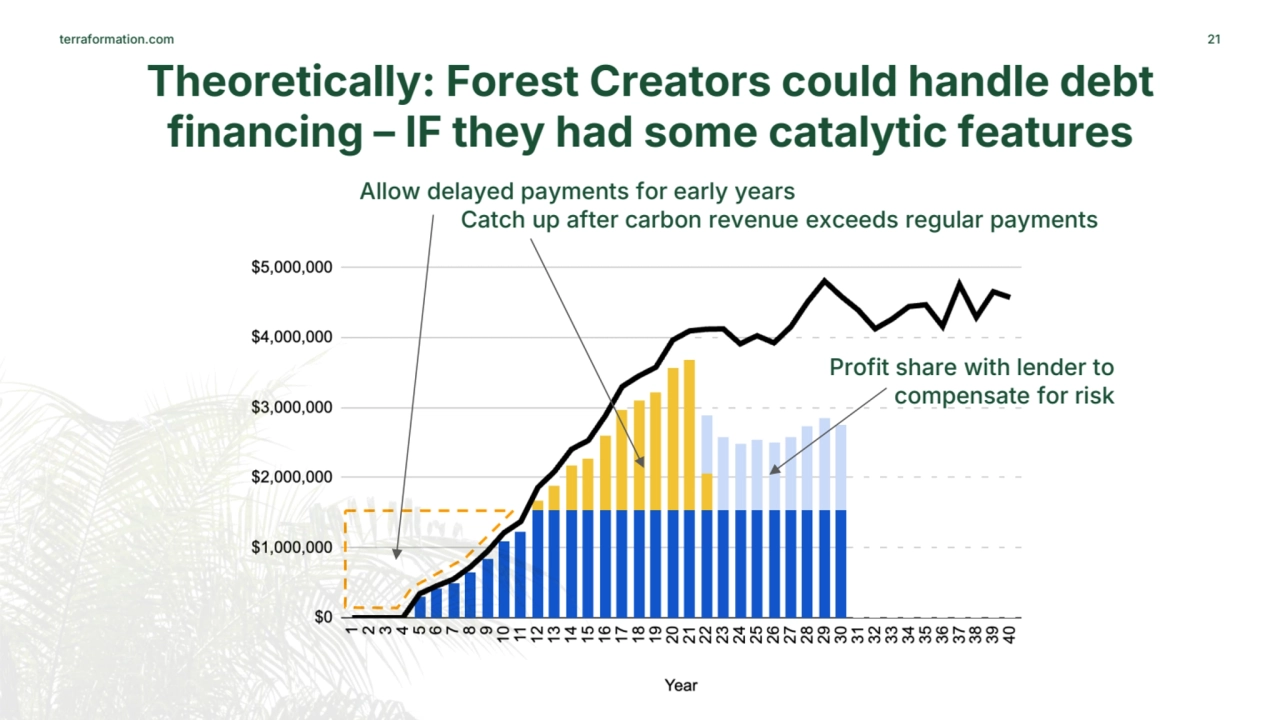

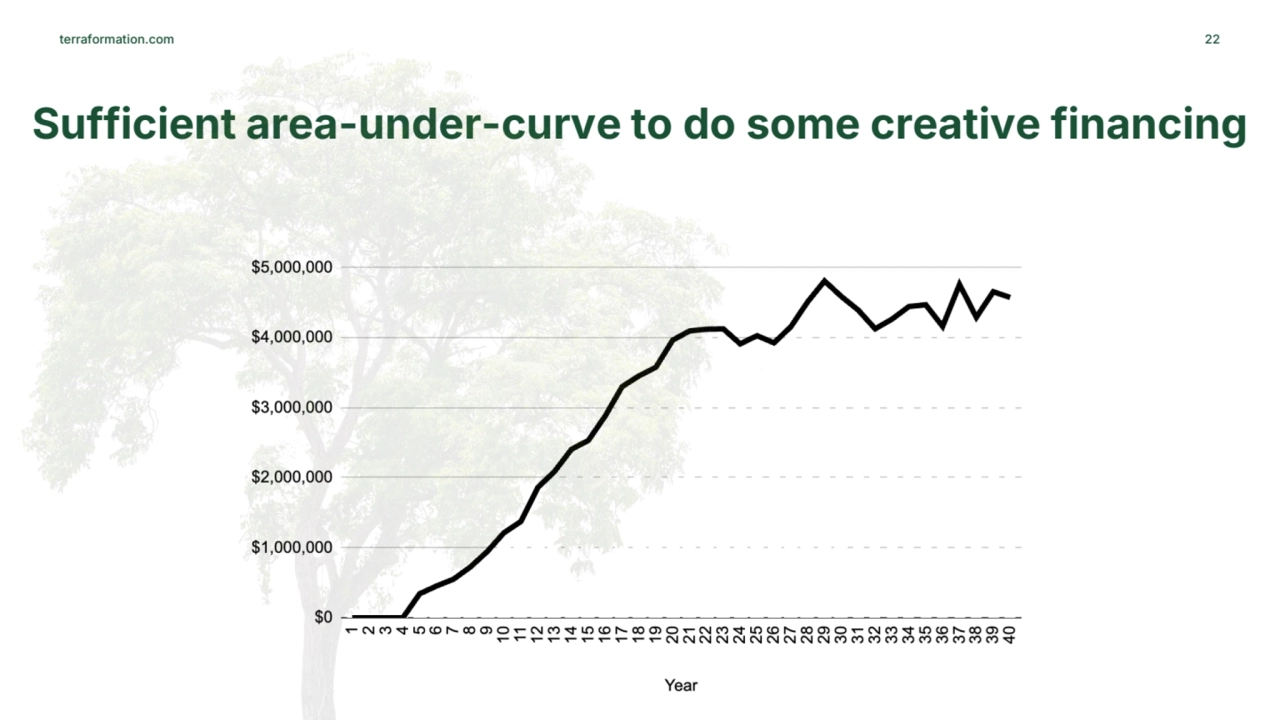

- Creative financing, such as catalytic loans with profit-sharing, is necessary to bridge the early-stage funding gap in forestry investments.

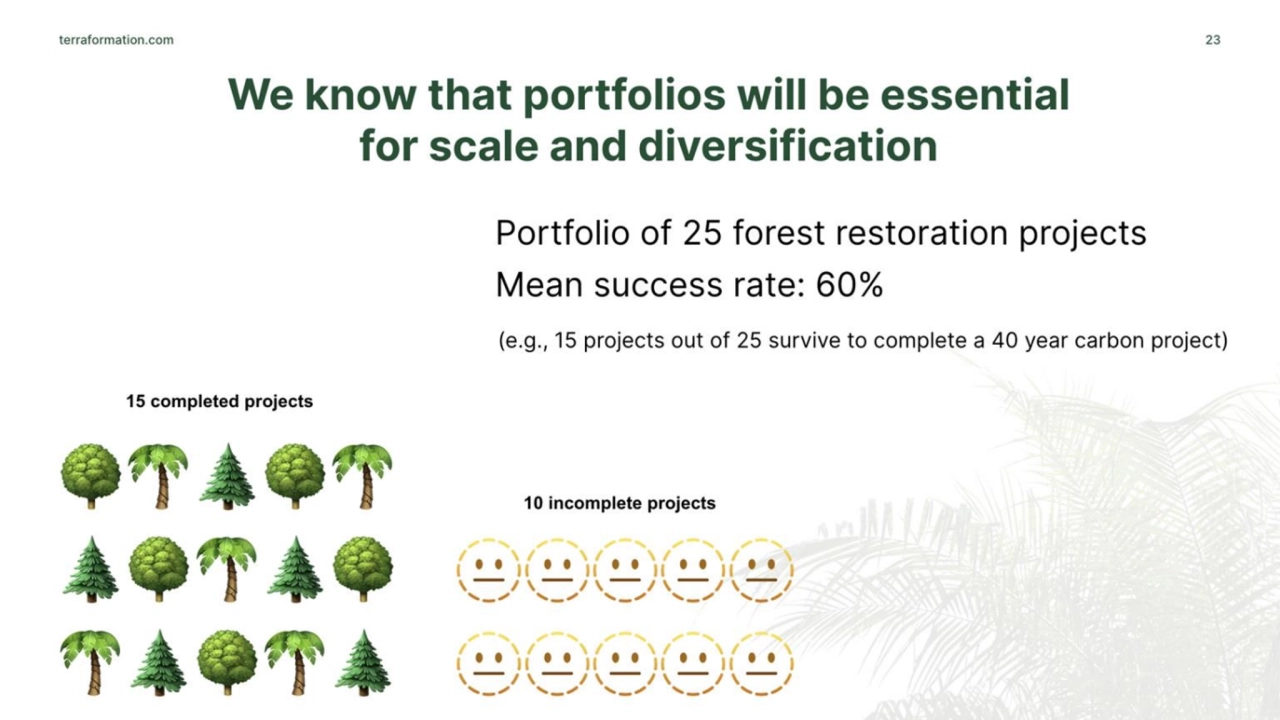

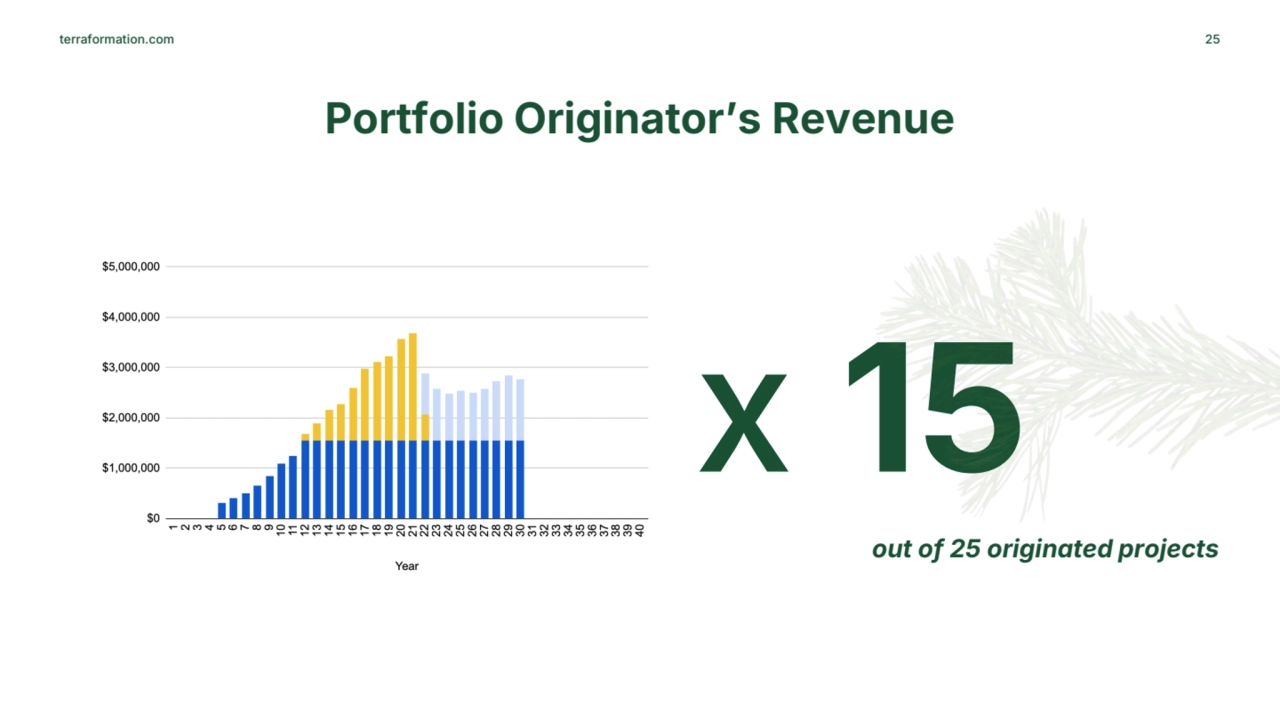

- Portfolio economics, including diversification across multiple projects, is crucial for managing risk and ensuring consistent returns.

- A portfolio approach with securitization can lead to a 'perpetual forestry machine,' generating continuous revenue for reinvestment and scaling restoration efforts.

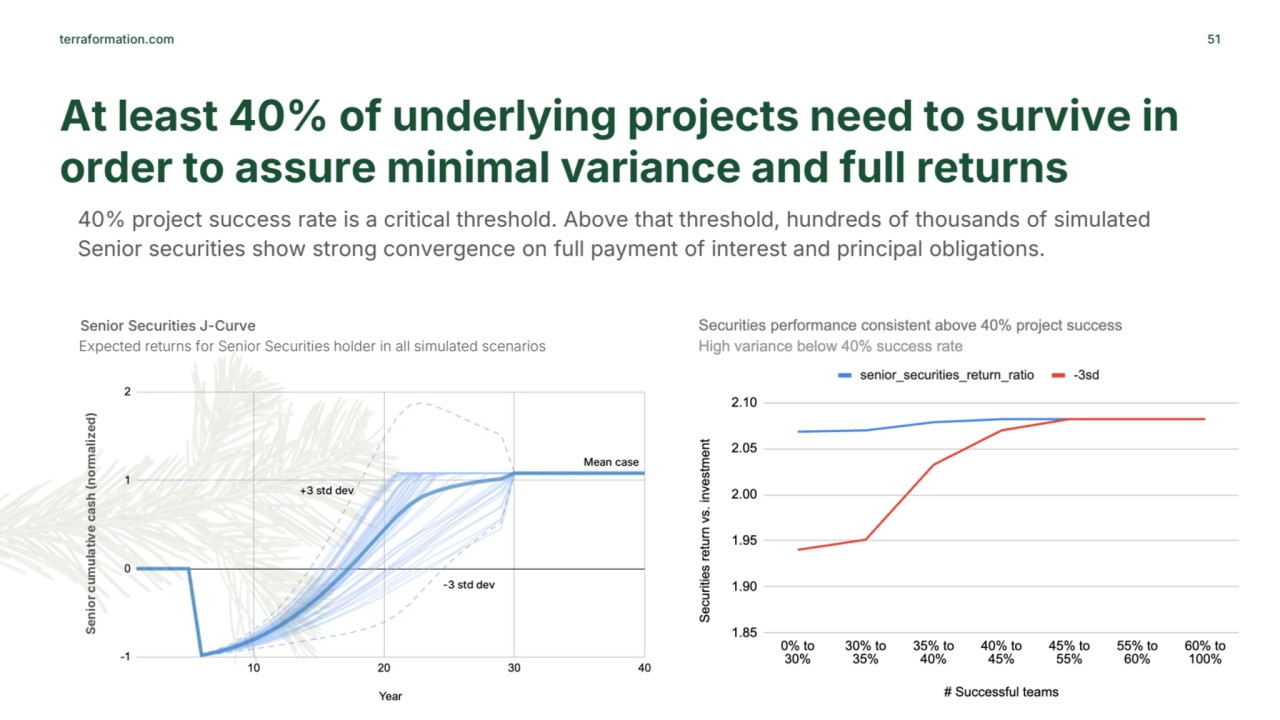

- Achieving a project success rate of at least 40% is essential for assuring minimal variance and full returns on senior securities in forest creator projects.

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Terraformation Workshop at NOAH 2023.pptx

- 1. Carbon Forestry as a Securitizable Asset Class Yee Lee yee@terraformation.com @yeeguy NOAH 2023

- 2. THIS IS NOT AN INVESTMENT SOLICITATION

- 3. Hi, my name is Yee Lee

- 4. 25 years working on fintech and ecommerce Last 4 years working on global carbon forestry

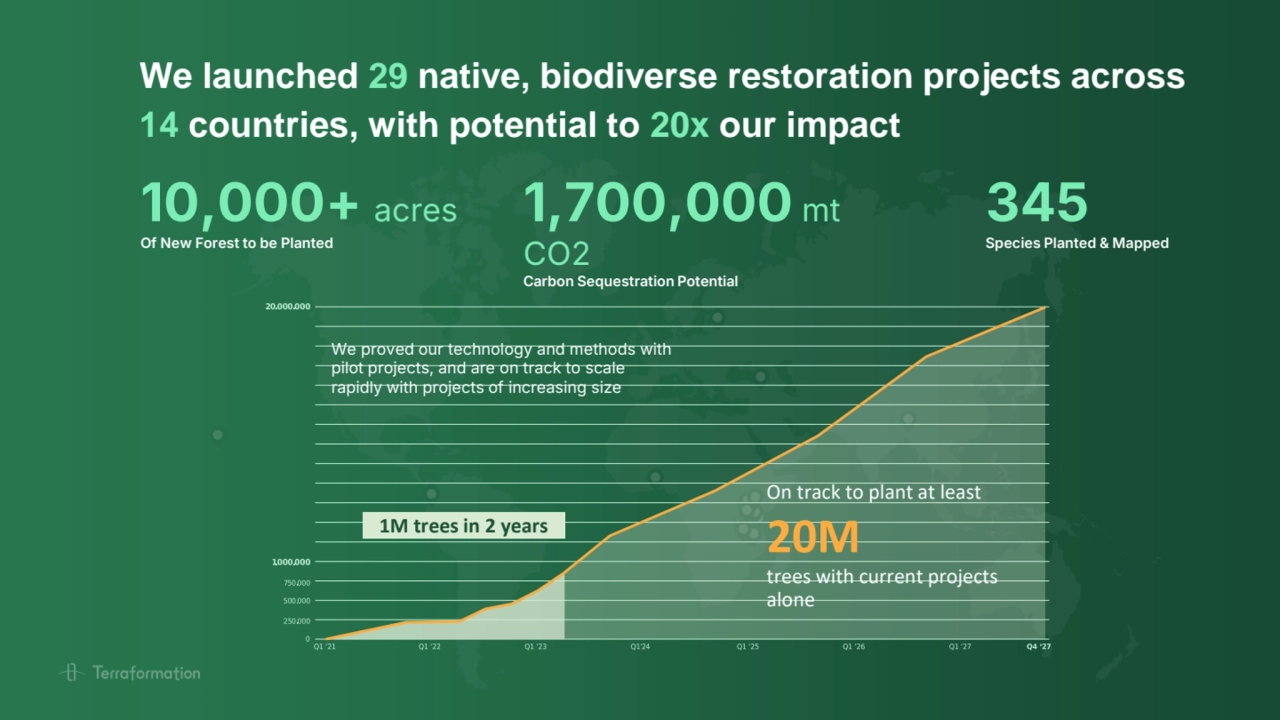

- 5. We launched 29 native, biodiverse restoration projects across 14 countries, with potential to 20x our impact 10,000+ acres Of New Forest to be Planted 345 Species Planted & Mapped 1,700,000 mt CO2 Carbon Sequestration Potential 1M trees in 2 years On track to plant at least 20M trees with current projects alone We proved our technology and methods with pilot projects, and are on track to scale rapidly with projects of increasing size

- 6. Forest Restoration Econ 101

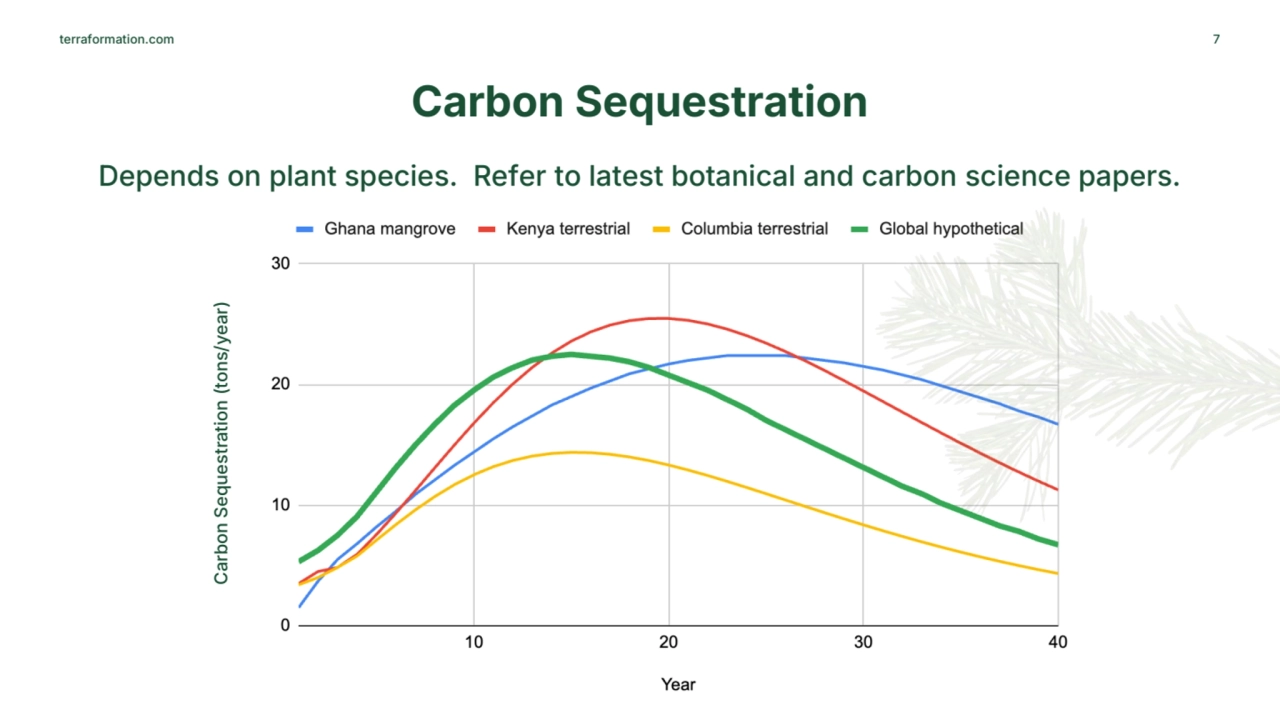

- 7. terraformation.com Carbon Sequestration 7 Depends on plant species. Refer to latest botanical and carbon science papers. Carbon Sequestration (tons/year)

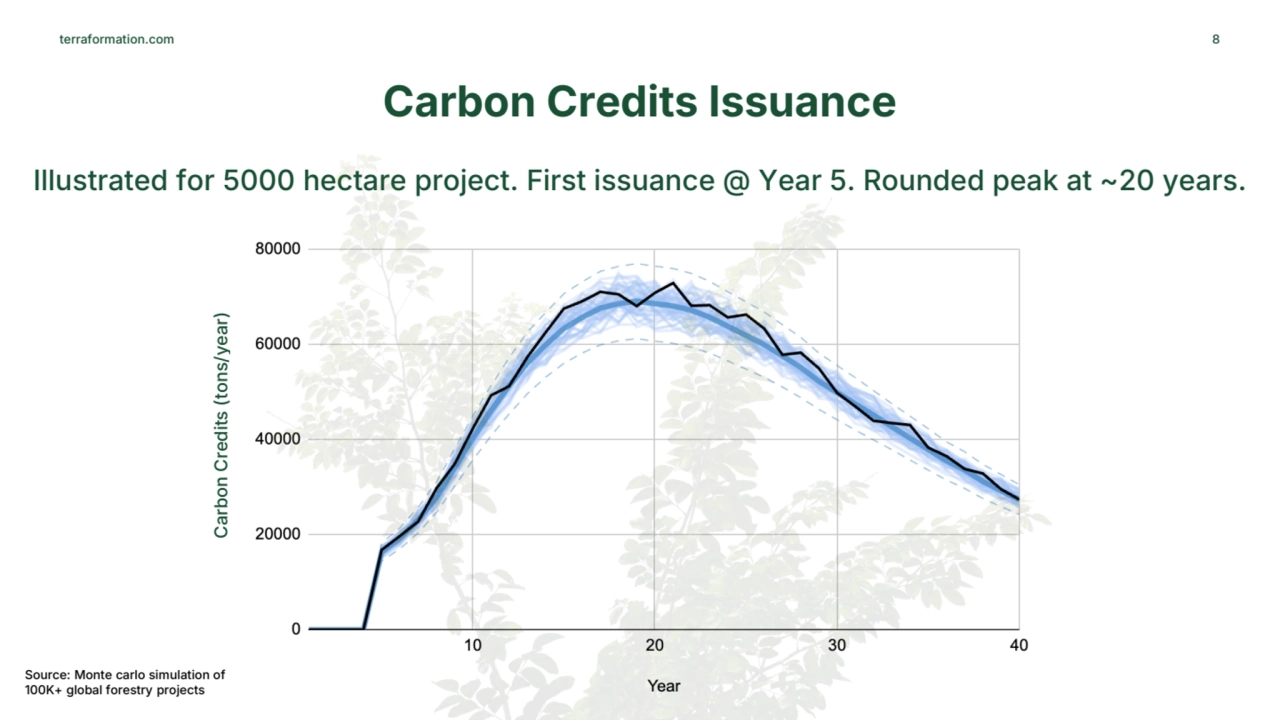

- 8. terraformation.com Carbon Credits Issuance 8 Illustrated for 5000 hectare project. First issuance @ Year 5. Rounded peak at ~20 years. Carbon Credits (tons/year) Source: Monte carlo simulation of 100K+ global forestry projects

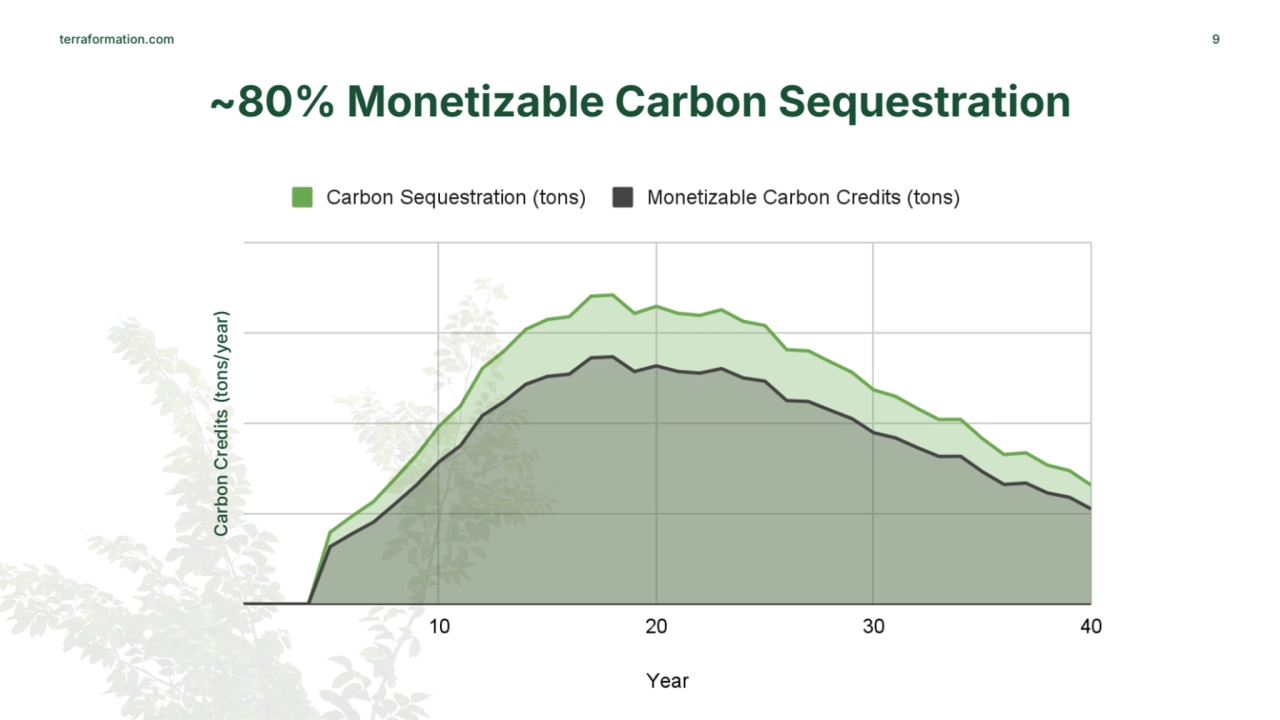

- 9. terraformation.com ~80% Monetizable Carbon Sequestration 9 Carbon Credits (tons/year)

- 10. terraformation.com Wide range $1000/ha – “just plant” (e.g., mangrove) $4000/ha – fully loaded land prep, soil enhancement, removing invasive species, seed collection & banking, nursery infra setup, outplanting, community benefits, alternative livelihoods Project Development Costs 10

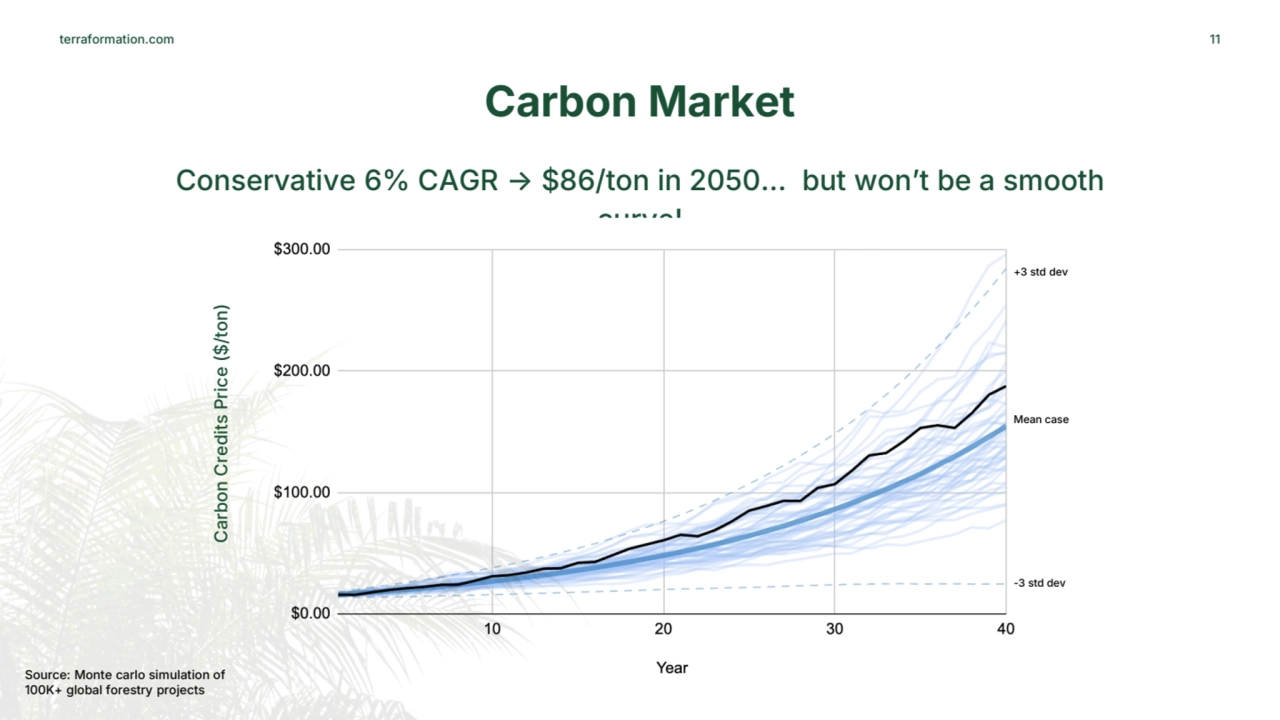

- 11. terraformation.com Carbon Market 11 Conservative 6% CAGR → $86/ton in 2050… but won’t be a smooth curve! +3 std dev -3 std dev Mean case Source: Monte carlo simulation of 100K+ global forestry projects Carbon Credits Price ($/ton)

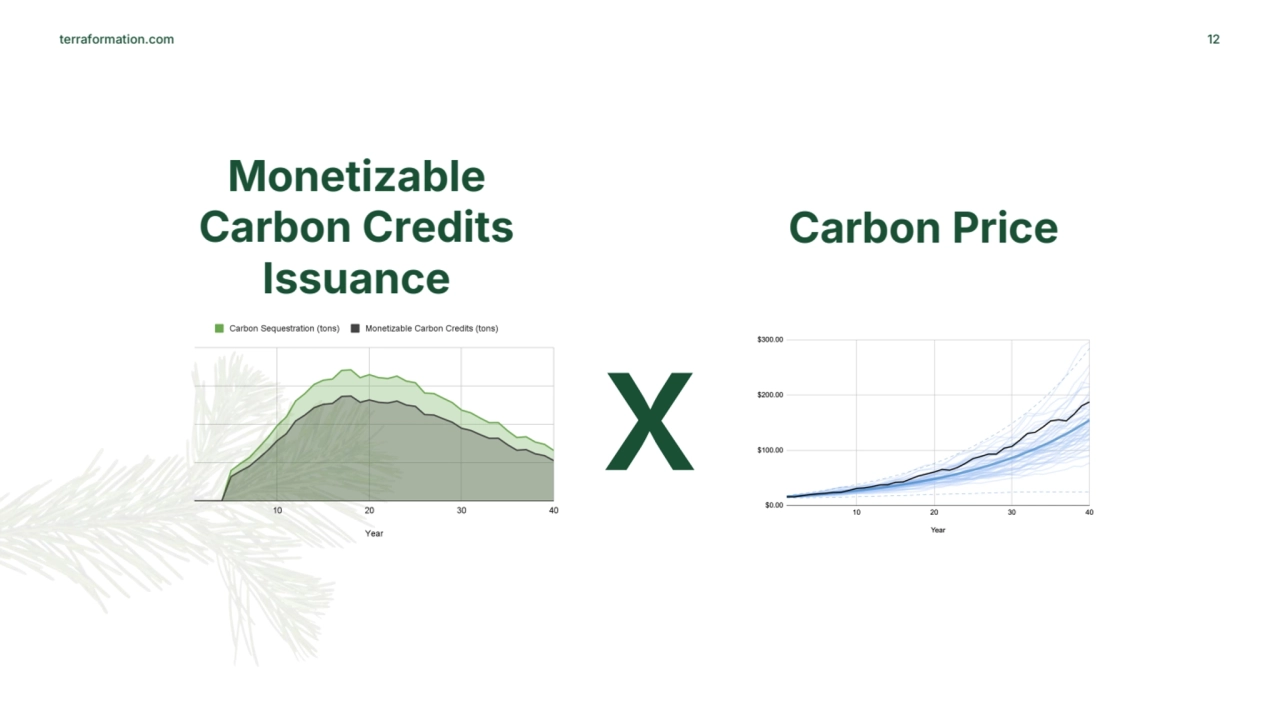

- 12. terraformation.com 12 x Monetizable Carbon Credits Issuance Carbon Price

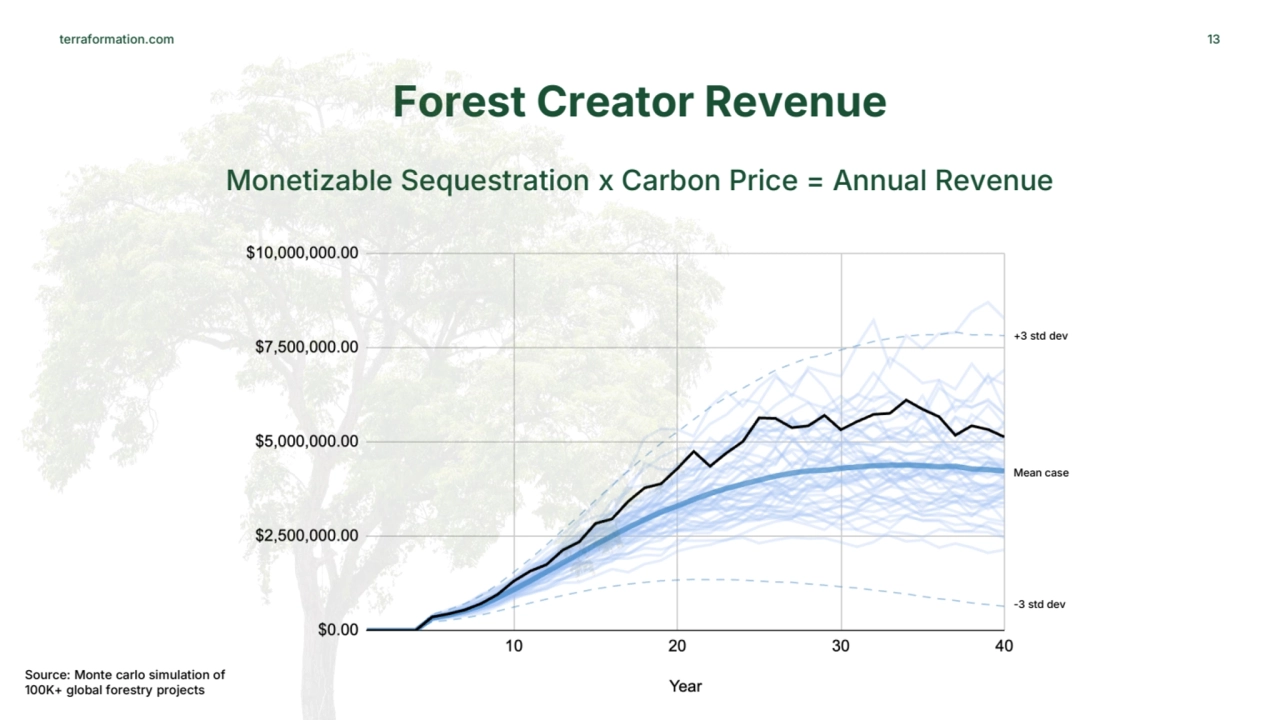

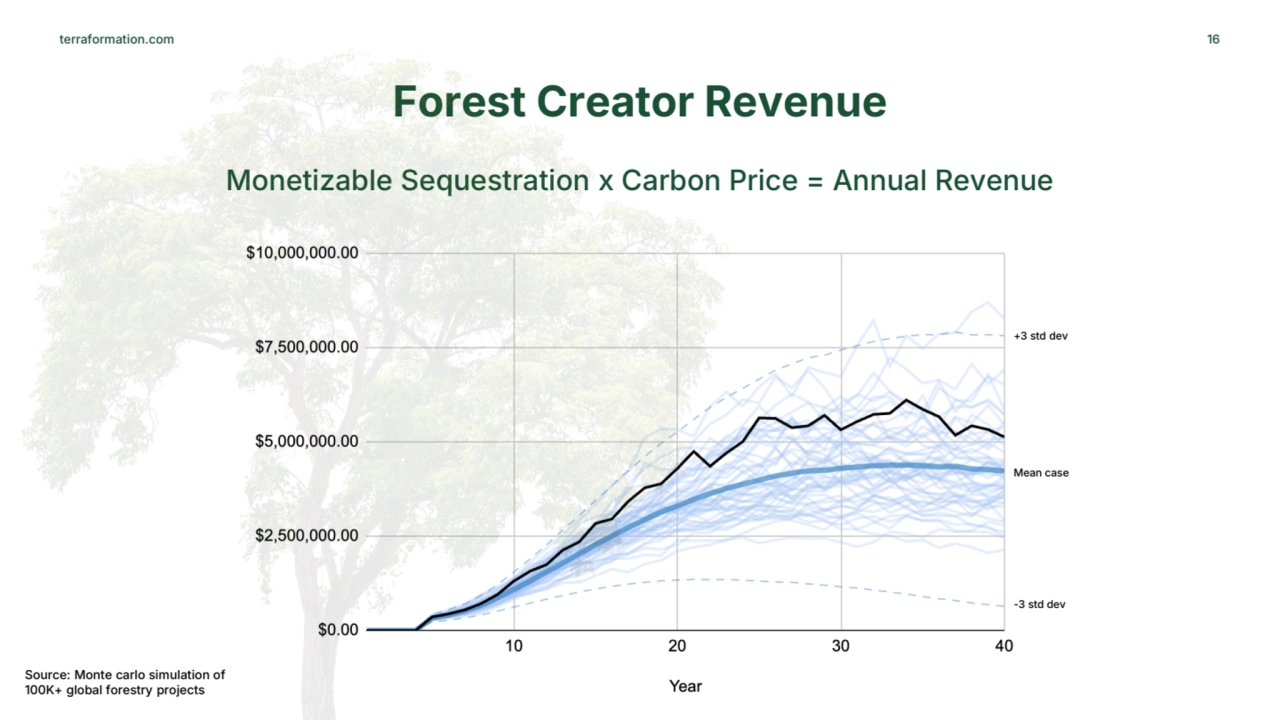

- 13. terraformation.com Forest Creator Revenue 13 Monetizable Sequestration x Carbon Price = Annual Revenue +3 std dev -3 std dev Mean case Source: Monte carlo simulation of 100K+ global forestry projects

- 14. terraformation.com Operating Margin 14 5000 hectare project $3000-$4000 dev cost per ha (conservative) ~$15M-20M all-in development cost ~$110M-120M carbon revenue 40 years

- 15. Forestry Investments Require Creativity

- 16. terraformation.com Forest Creator Revenue 16 Monetizable Sequestration x Carbon Price = Annual Revenue +3 std dev -3 std dev Mean case Source: Monte carlo simulation of 100K+ global forestry projects

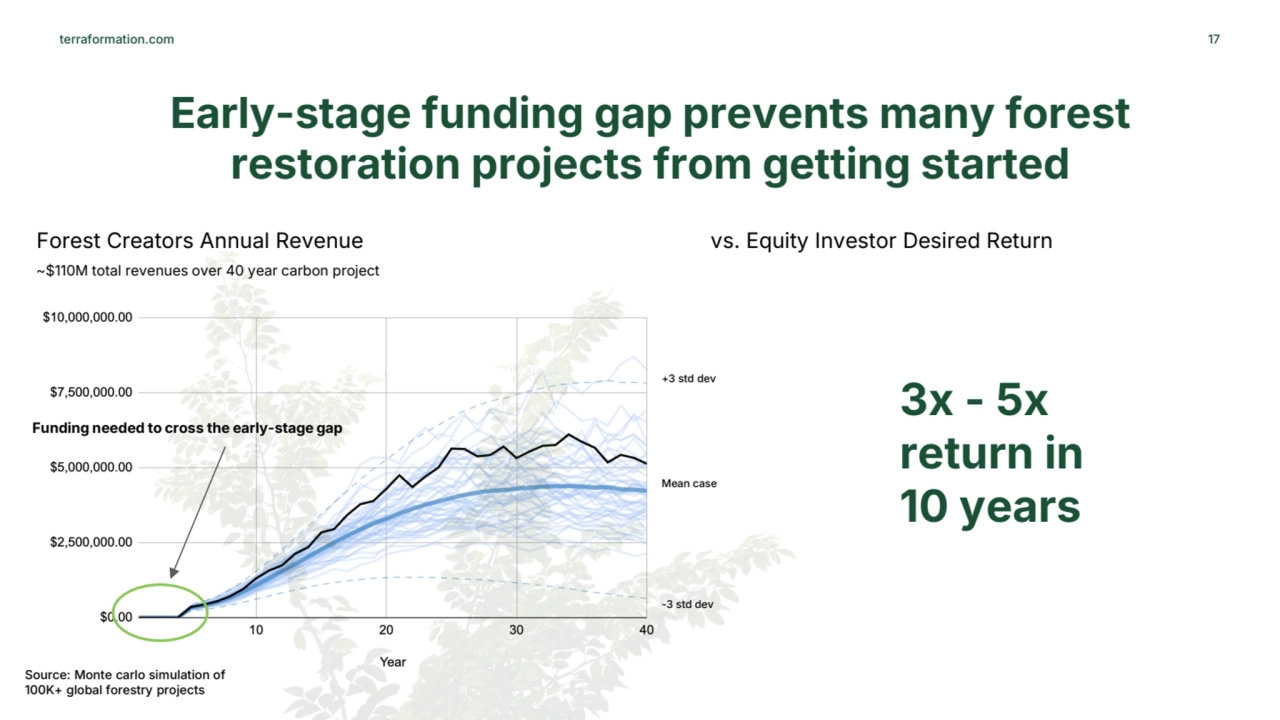

- 17. terraformation.com 17 Early-stage funding gap prevents many forest restoration projects from getting started +3 std dev -3 std dev Mean case Source: Monte carlo simulation of 100K+ global forestry projects Funding needed to cross the early-stage gap Forest Creators Annual Revenue ~$110M total revenues over 40 year carbon project vs. Equity Investor Desired Return 3x - 5x return in 10 years

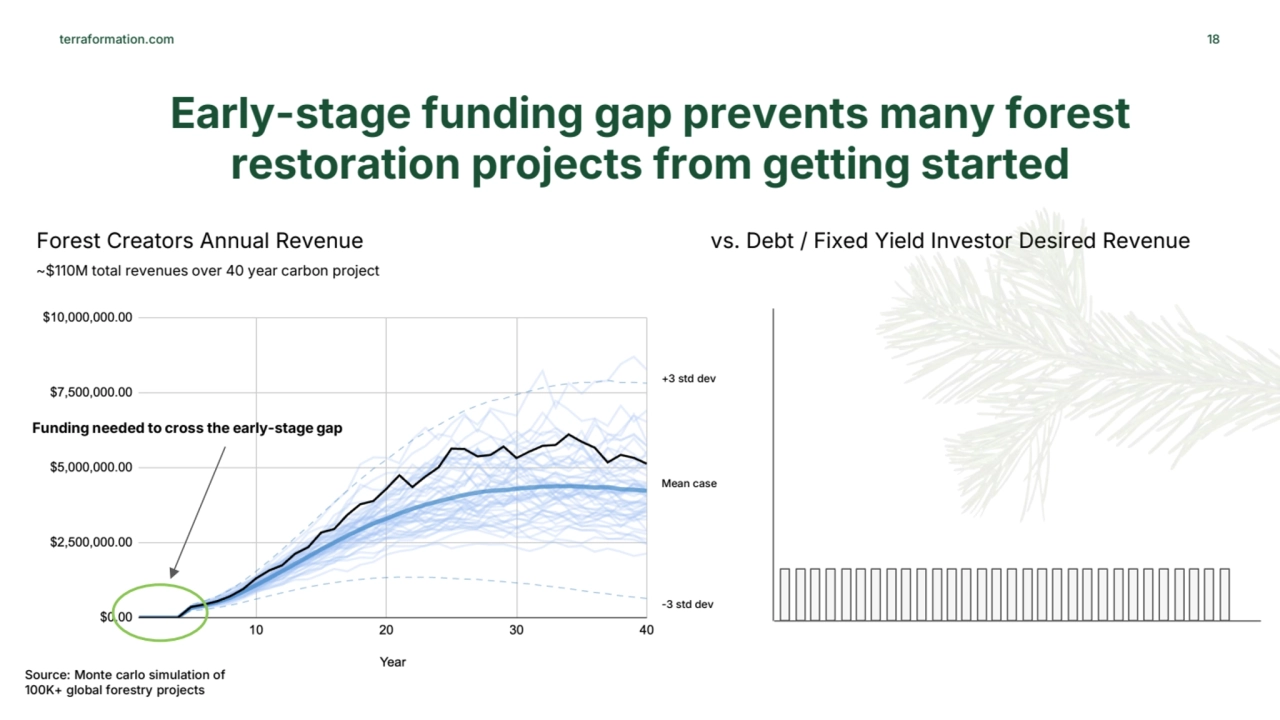

- 18. terraformation.com 18 Early-stage funding gap prevents many forest restoration projects from getting started +3 std dev -3 std dev Mean case Source: Monte carlo simulation of 100K+ global forestry projects Funding needed to cross the early-stage gap Forest Creators Annual Revenue ~$110M total revenues over 40 year carbon project vs. Debt / Fixed Yield Investor Desired Revenue

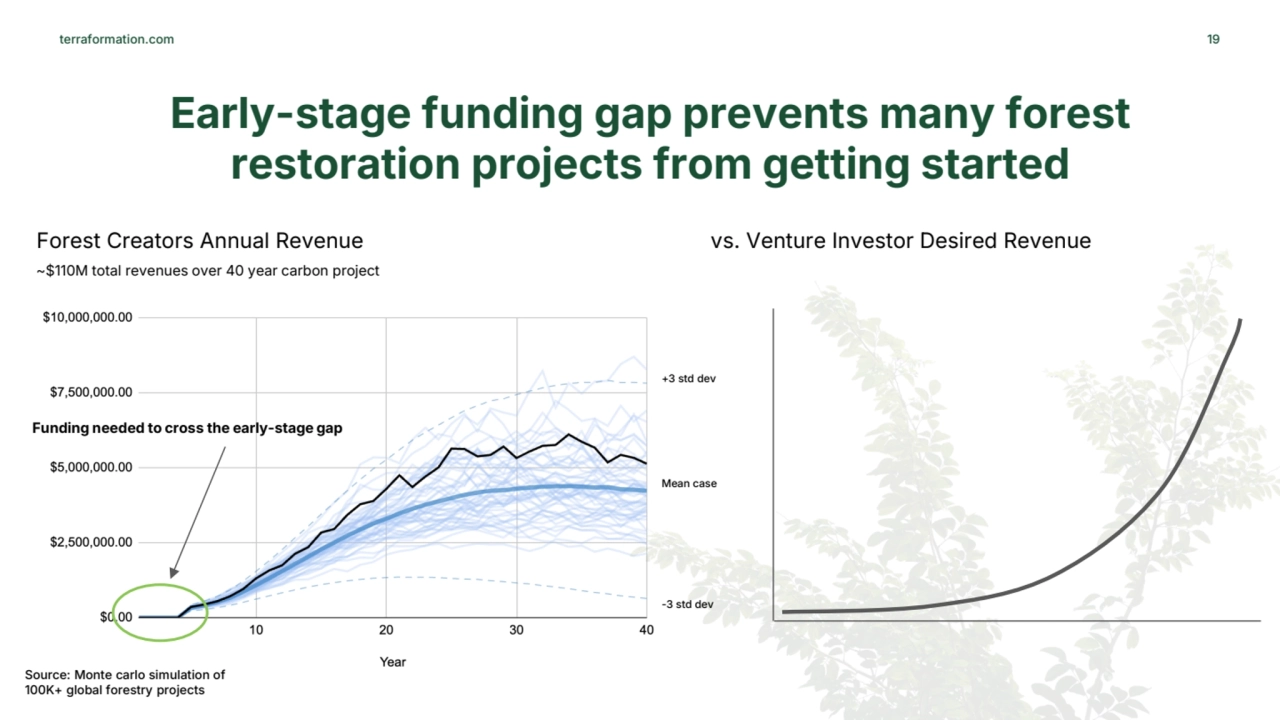

- 19. terraformation.com 19 Early-stage funding gap prevents many forest restoration projects from getting started +3 std dev -3 std dev Mean case Source: Monte carlo simulation of 100K+ global forestry projects Funding needed to cross the early-stage gap Forest Creators Annual Revenue ~$110M total revenues over 40 year carbon project vs. Venture Investor Desired Revenue

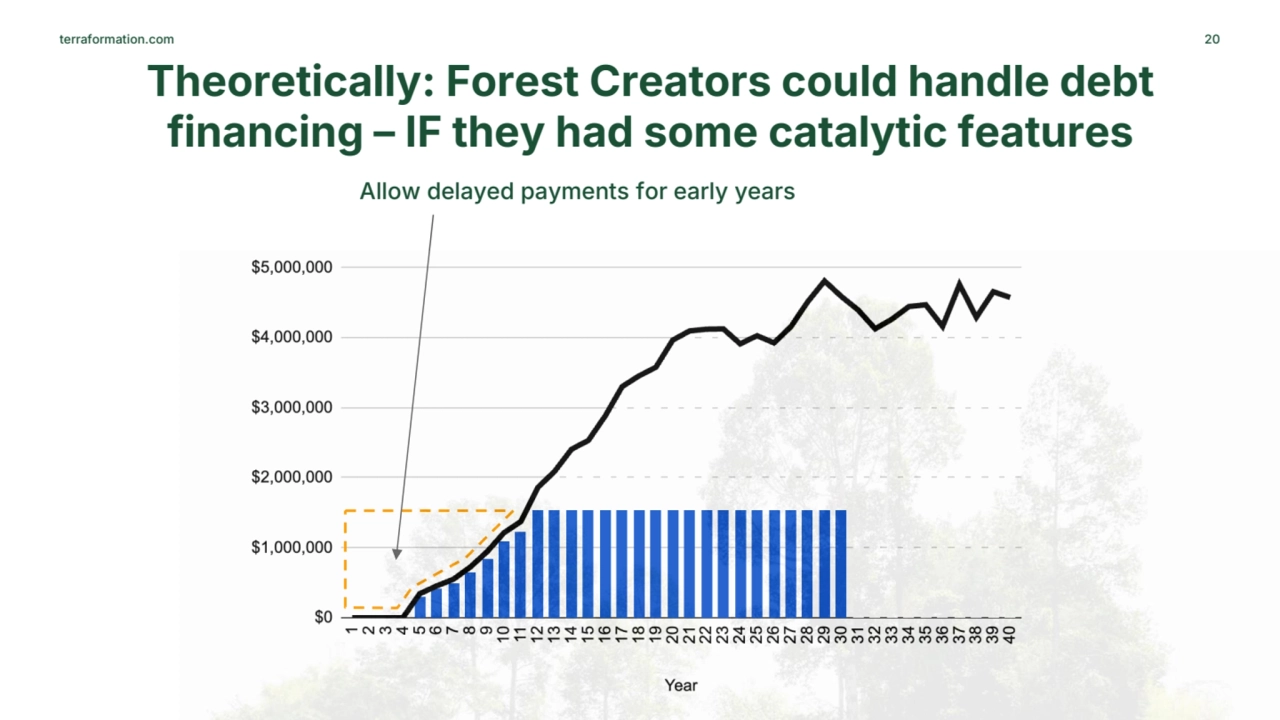

- 20. terraformation.com 20 Theoretically: Forest Creators could handle debt financing – IF they had some catalytic features Allow delayed payments for early years

- 21. terraformation.com 21 Theoretically: Forest Creators could handle debt financing – IF they had some catalytic features Allow delayed payments for early years Catch up after carbon revenue exceeds regular payments Profit share with lender to compensate for risk

- 22. terraformation.com 22 Sufficient area-under-curve to do some creative financing

- 23. Portfolio Economics

- 24. terraformation.com 24

- 25. terraformation.com 25 Portfolio Originator’s Revenue x 15 out of 25 originated projects

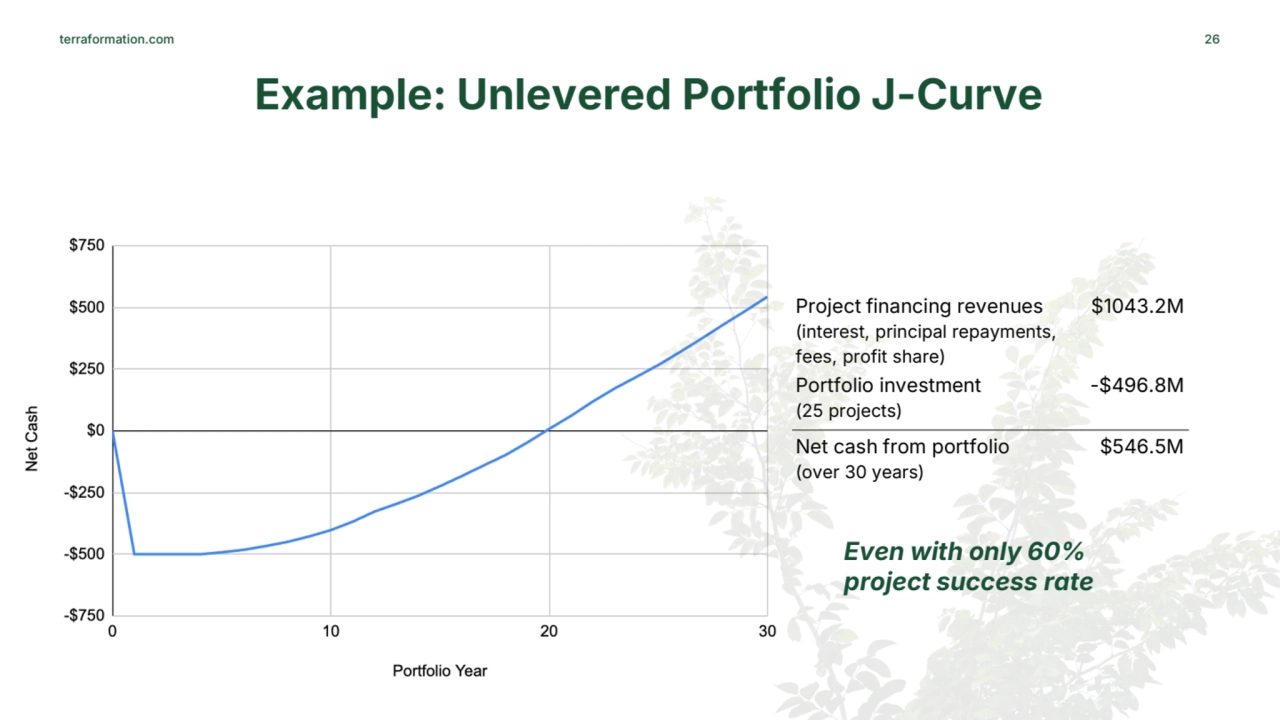

- 26. terraformation.com 26 Example: Unlevered Portfolio J-Curve Project financing revenues (interest, principal repayments, fees, profit share) $1043.2M Portfolio investment (25 projects) -$496.8M Net cash from portfolio (over 30 years) $546.5M Even with only 60% project success rate

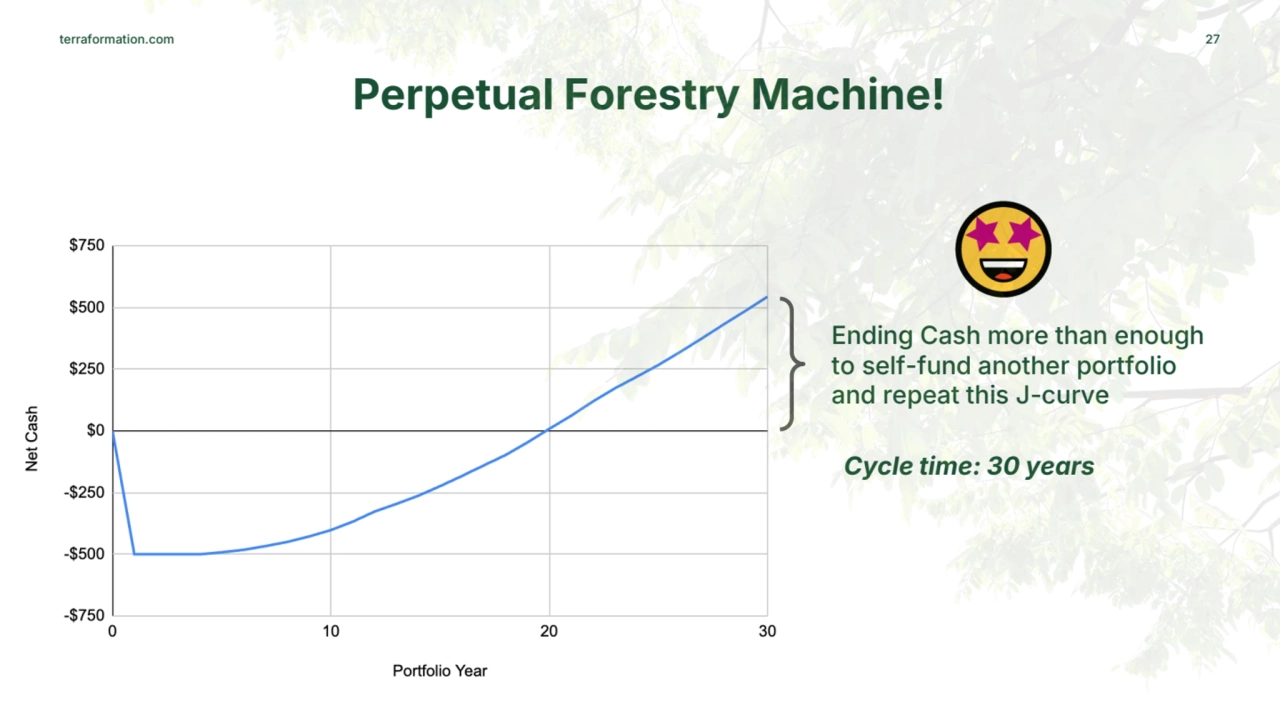

- 27. terraformation.com 27 Perpetual Forestry Machine! Ending Cash more than enough to self-fund another portfolio and repeat this J-curve Cycle time: 30 years

- 28. Key Result #1 ~$500M starts a perpetual forestry machine, running one (1) portfolio at a time

- 29. 29

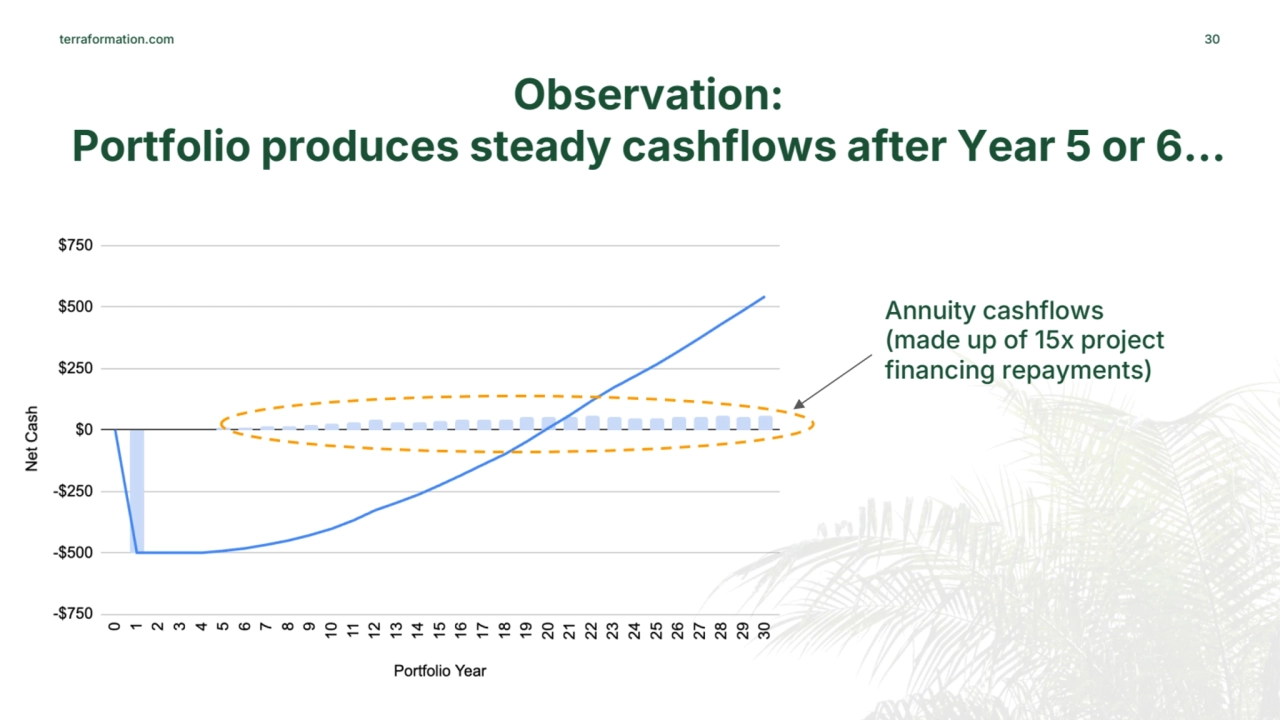

- 30. terraformation.com 30 Observation: Portfolio produces steady cashflows after Year 5 or 6… Annuity cashflows (made up of 15x project financing repayments)

- 31. Securitization

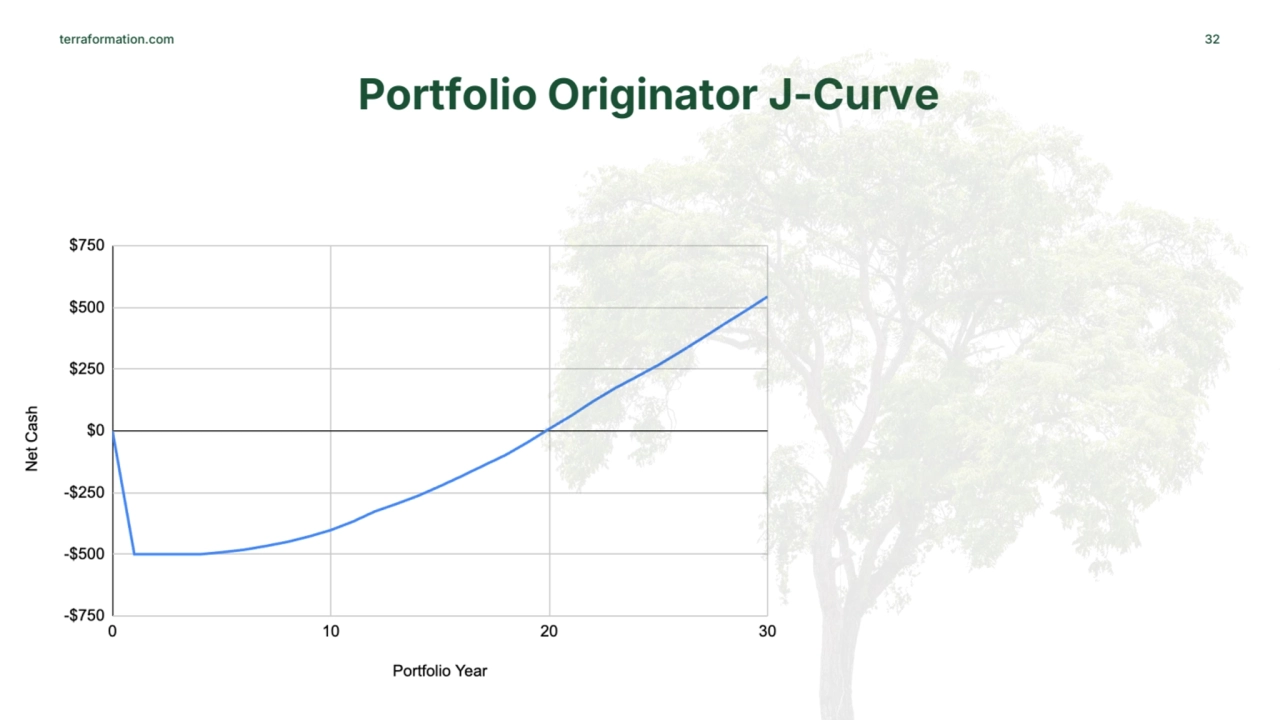

- 32. terraformation.com 32 Portfolio Originator J-Curve

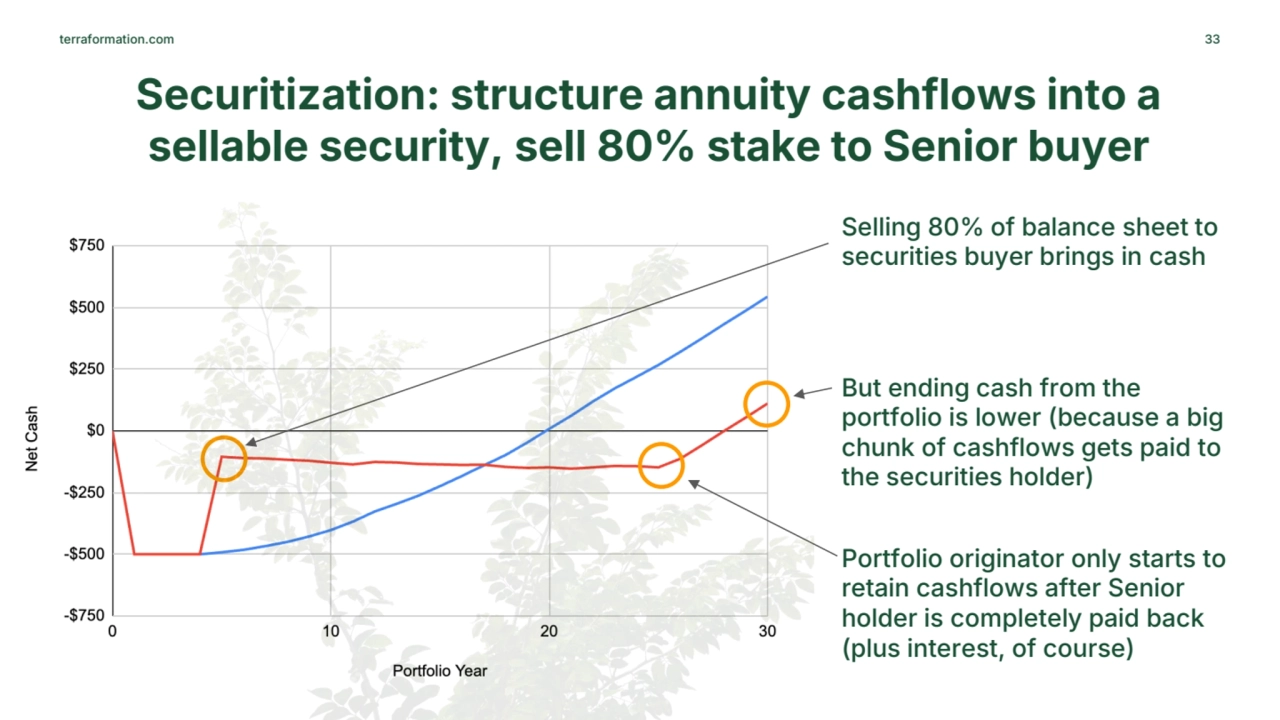

- 33. terraformation.com 33 Securitization: structure annuity cashflows into a sellable security, sell 80% stake to Senior buyer Selling 80% of balance sheet to securities buyer brings in cash But ending cash from the portfolio is lower (because a big chunk of cashflows gets paid to the securities holder) Portfolio originator only starts to retain cashflows after Senior holder is completely paid back (plus interest, of course)

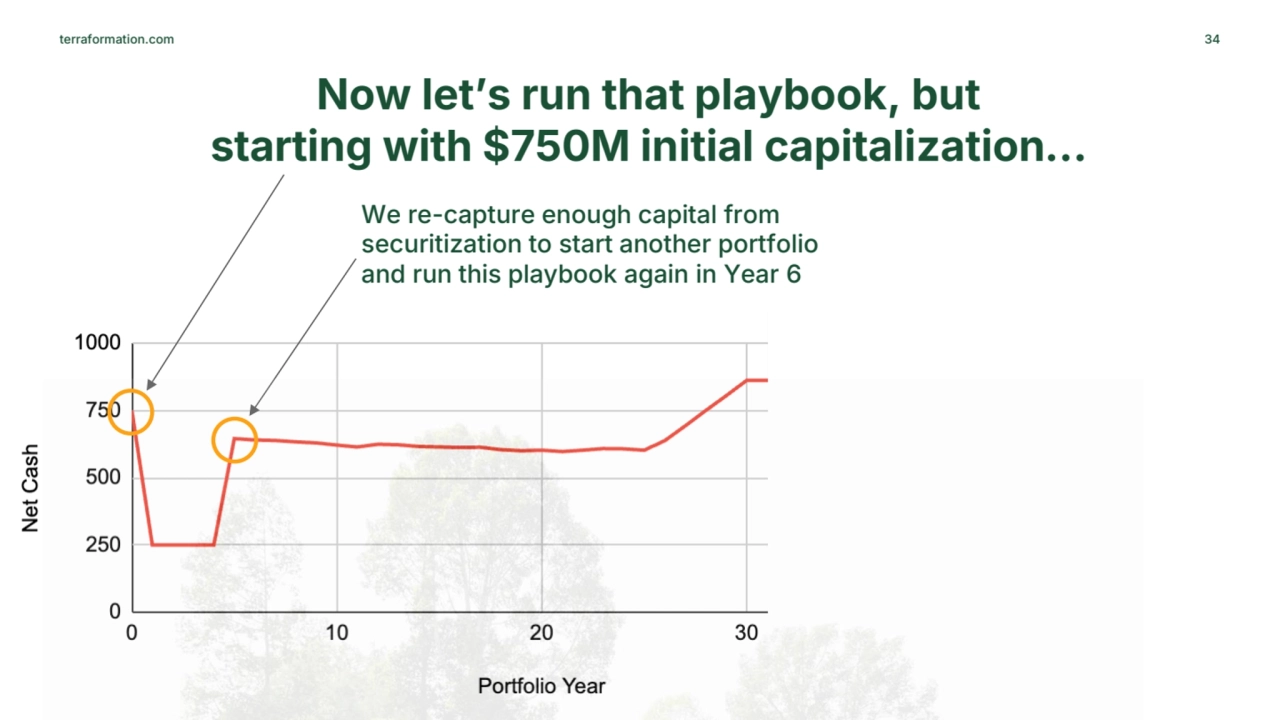

- 34. terraformation.com 34 Now let’s run that playbook, but starting with $750M initial capitalization… We re-capture enough capital from securitization to start another portfolio and run this playbook again in Year 6

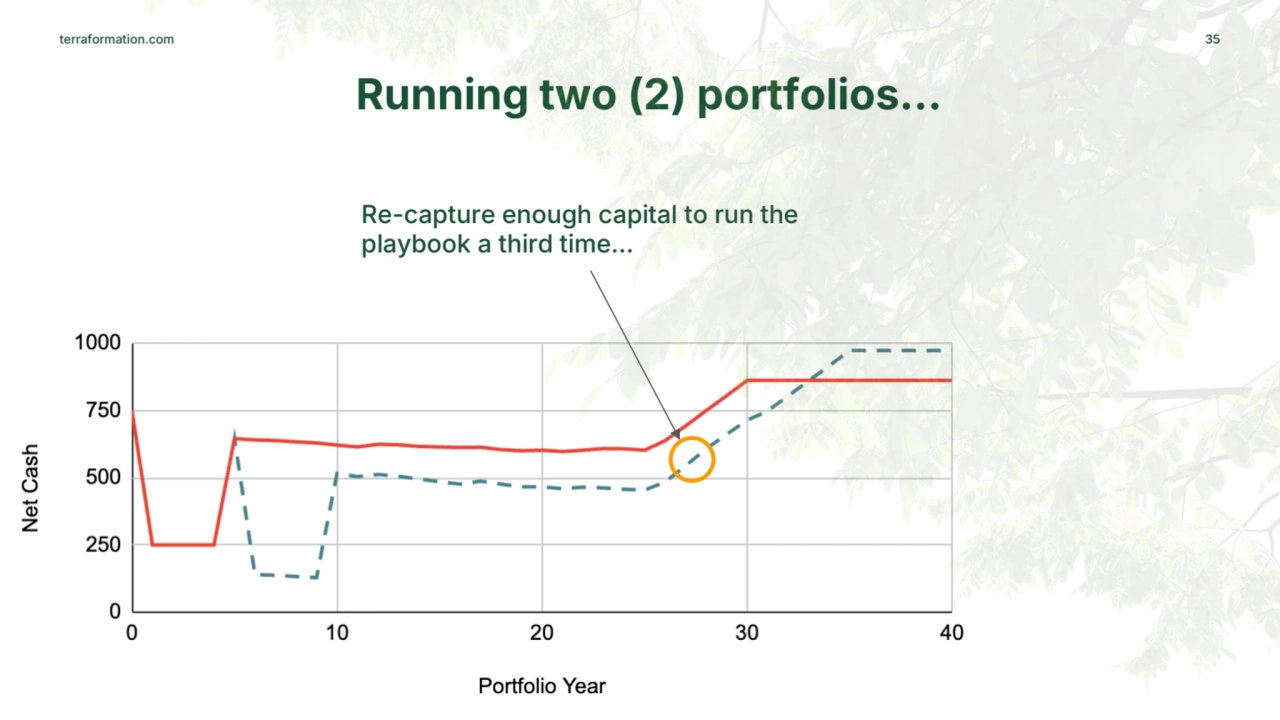

- 35. terraformation.com 35 Running two (2) portfolios… Re-capture enough capital to run the playbook a third time…

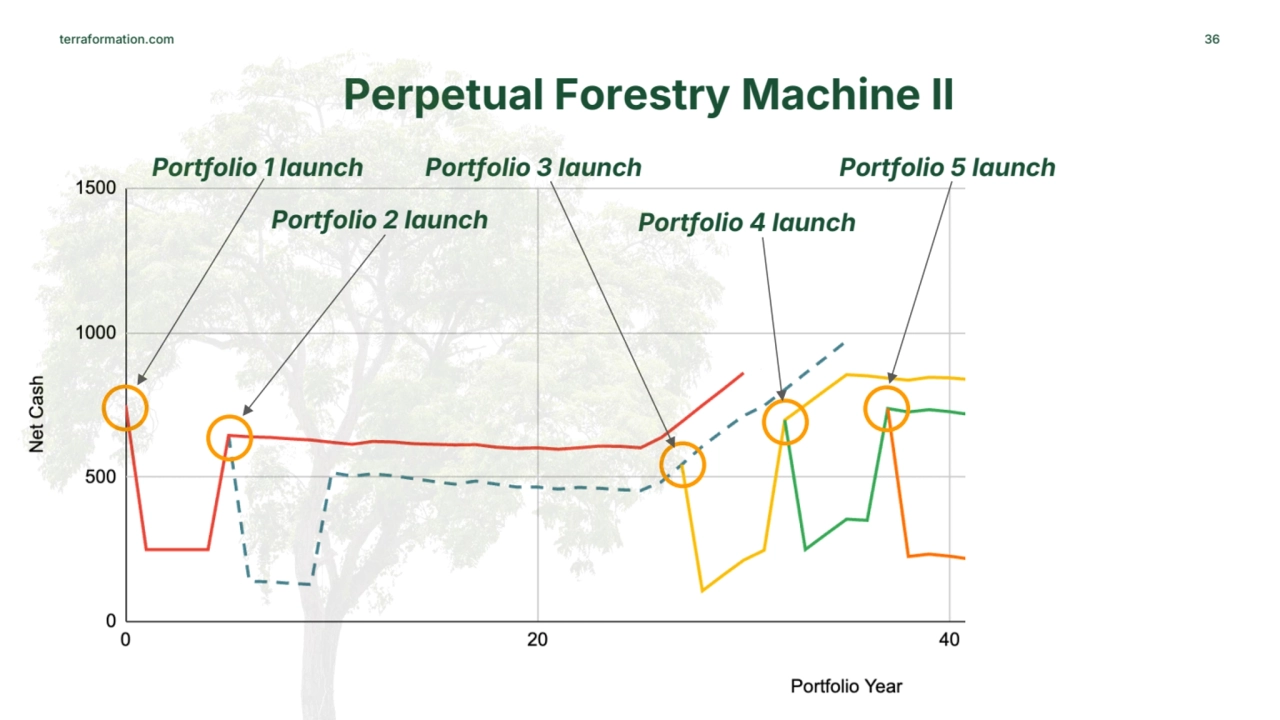

- 36. terraformation.com 36 Perpetual Forestry Machine II Portfolio 1 launch Portfolio 2 launch Portfolio 3 launch Portfolio 4 launch Portfolio 5 launch

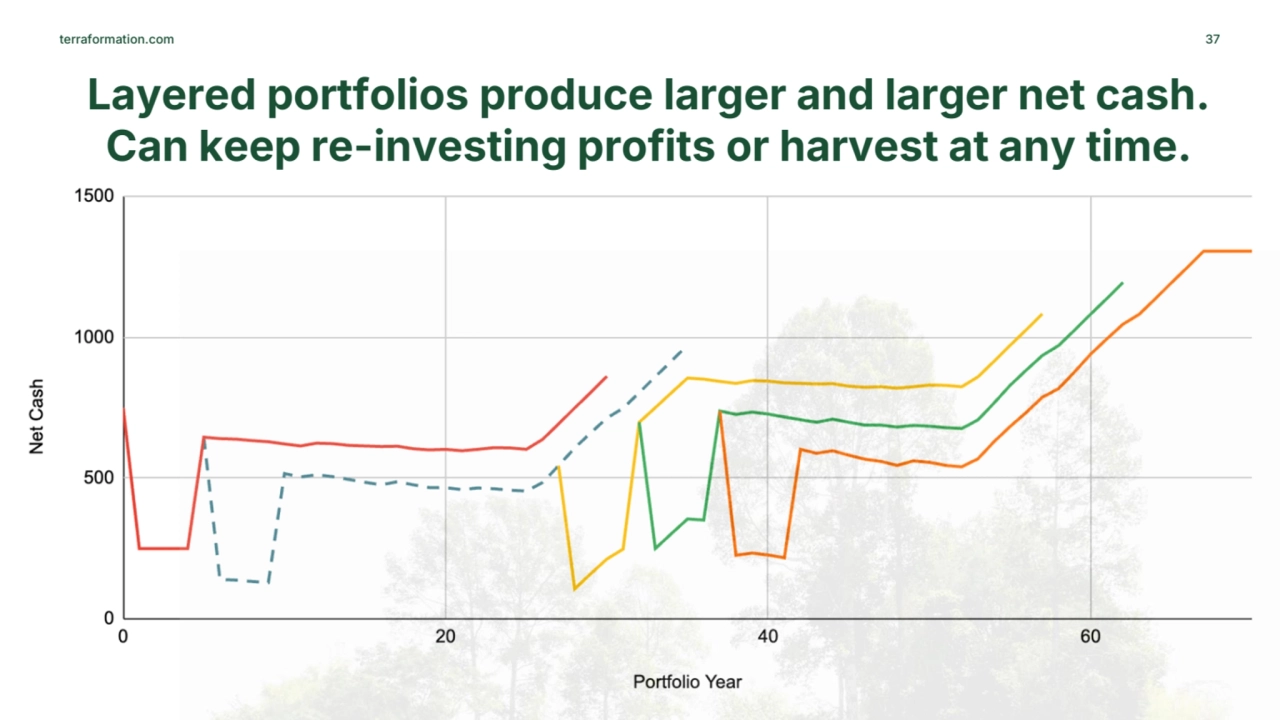

- 37. terraformation.com 37 Layered portfolios produce larger and larger net cash. Can keep re-investing profits or harvest at any time.

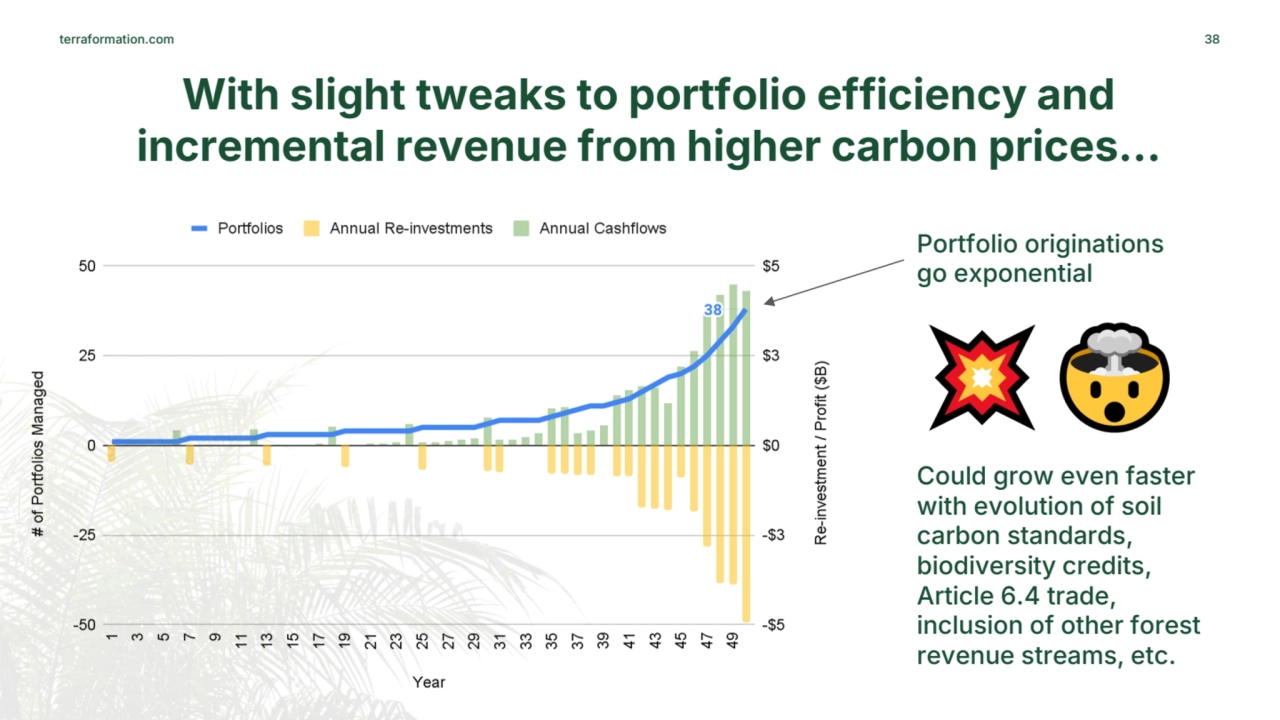

- 38. terraformation.com 38 With slight tweaks to portfolio efficiency and incremental revenue from higher carbon prices… Portfolio originations go exponential Could grow even faster with evolution of soil carbon standards, biodiversity credits, Article 6.4 trade, inclusion of other forest revenue streams, etc.

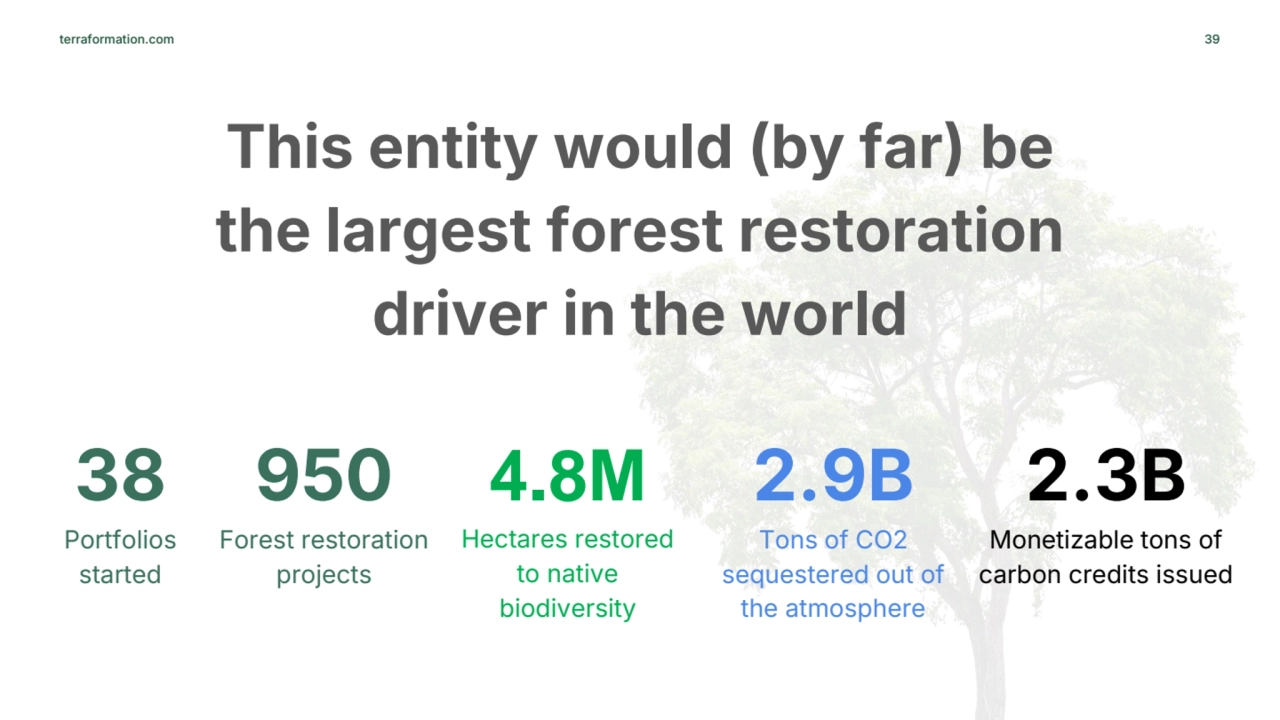

- 39. terraformation.com 39 38 Portfolios started 950 Forest restoration projects 4.8M Hectares restored to native biodiversity 2.9B Tons of CO2 sequestered out of the atmosphere 2.3B Monetizable tons of carbon credits issued This entity would (by far) be the largest forest restoration driver in the world

- 40. Key Result #2 ~$750M starts a perpetual forestry machine, running an exponentially increasing number of portfolios

- 41. Discussion

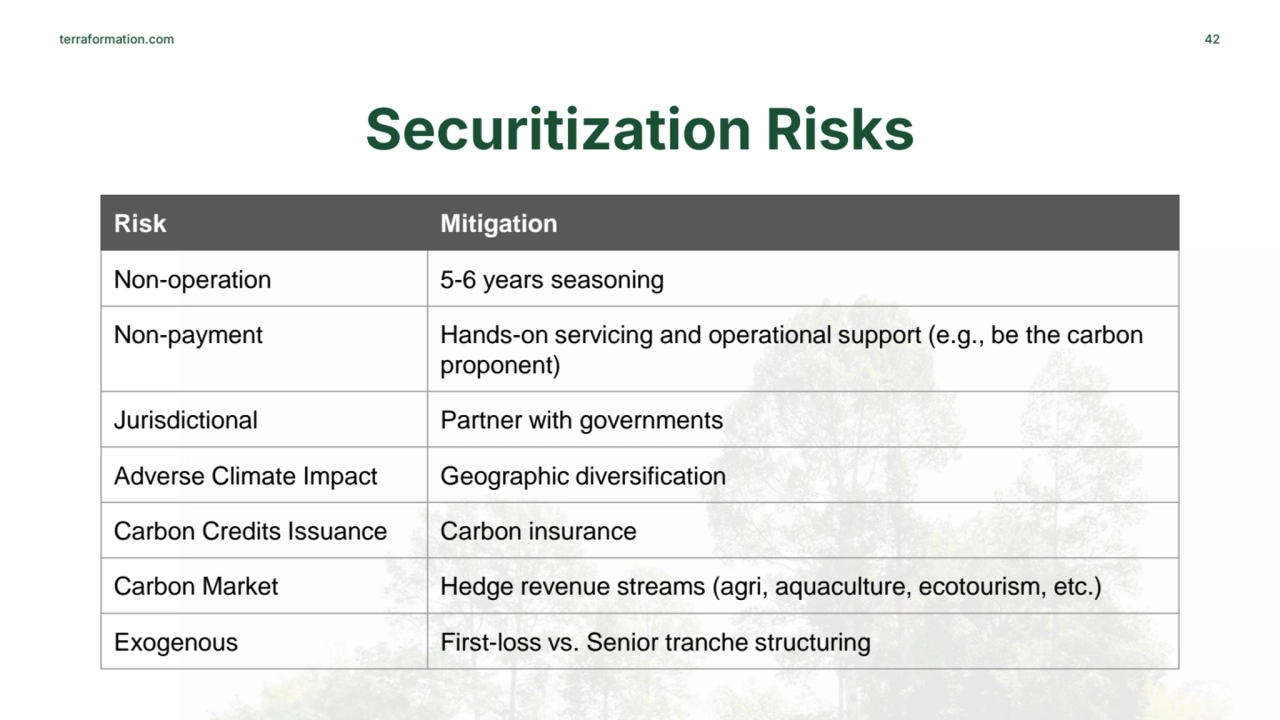

- 42. terraformation.com 42 Securitization Risks Risk Mitigation Non-operation 5-6 years seasoning Non-payment Hands-on servicing and operational support (e.g., be the carbon proponent) Jurisdictional Partner with governments Adverse Climate Impact Geographic diversification Carbon Credits Issuance Carbon insurance Carbon Market Hedge revenue streams (agri, aquaculture, ecotourism, etc.) Exogenous First-loss vs. Senior tranche structuring

- 43. terraformation.com 43 Question: What would you call a financial entity that raises a large initial capitalization, makes money from loans, sells securities, and perpetually grows its balance sheet?

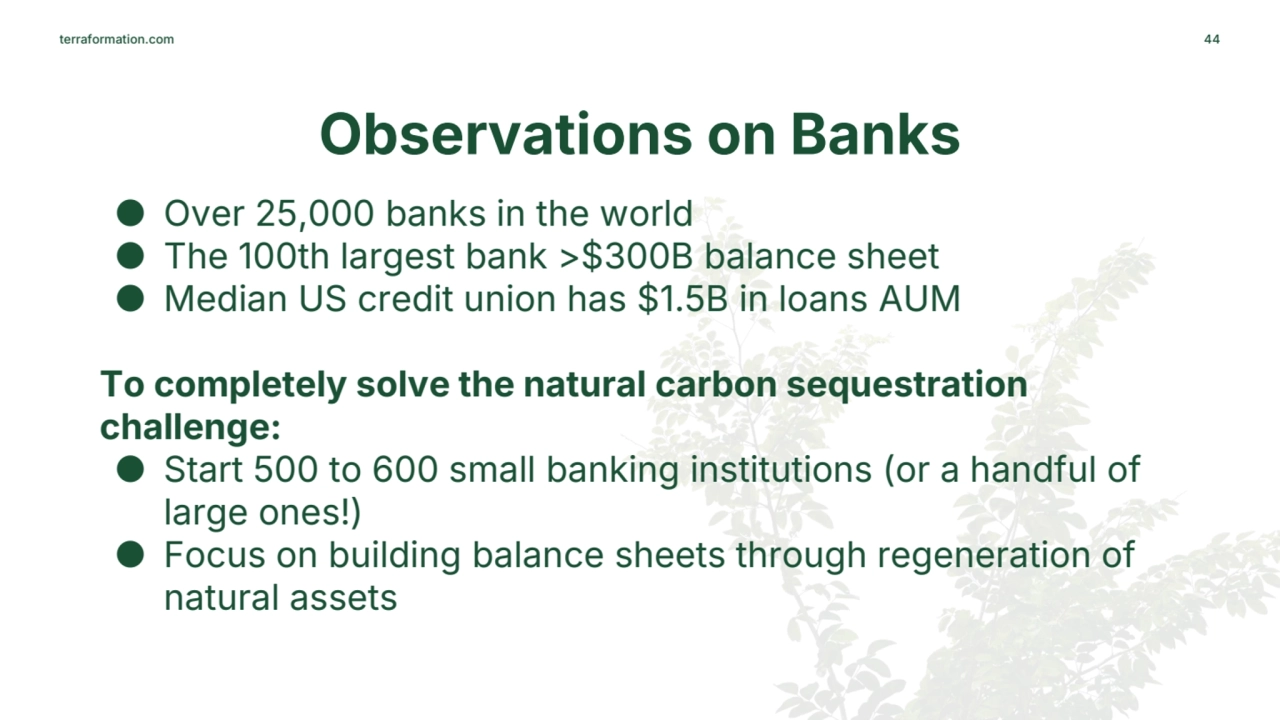

- 44. terraformation.com 44 Observations on Banks ● Over 25,000 banks in the world ● The 100th largest bank >$300B balance sheet ● Median US credit union has $1.5B in loans AUM To completely solve the natural carbon sequestration challenge: ● Start 500 to 600 small banking institutions (or a handful of large ones!) ● Focus on building balance sheets through regeneration of natural assets

- 45. terraformation.com 45 Bonus Question: If even a handful of these new forestry-banks get started, they will deploy $billions to communities. Local/indigenous people & businesses will receive those funds as payroll or commercial contracts. Where will they deposit those income receipts?

- 46. Sensitivity & Risks

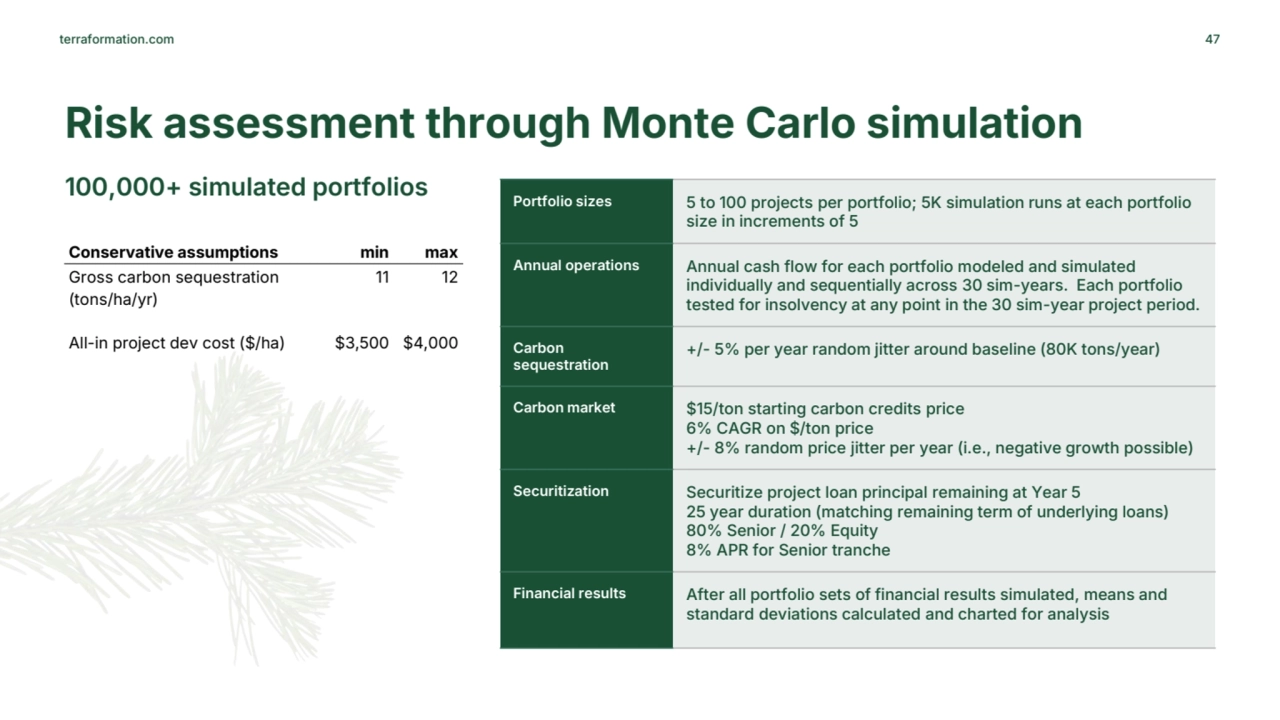

- 47. terraformation.com Risk assessment through Monte Carlo simulation 100,000+ simulated portfolios 47 Portfolio sizes 5 to 100 projects per portfolio; 5K simulation runs at each portfolio size in increments of 5 Annual operations Annual cash flow for each portfolio modeled and simulated individually and sequentially across 30 sim-years. Each portfolio tested for insolvency at any point in the 30 sim-year project period. Carbon sequestration +/- 5% per year random jitter around baseline (80K tons/year) Carbon market $15/ton starting carbon credits price 6% CAGR on $/ton price +/- 8% random price jitter per year (i.e., negative growth possible) Securitization Securitize project loan principal remaining at Year 5 25 year duration (matching remaining term of underlying loans) 80% Senior / 20% Equity 8% APR for Senior tranche Financial results After all portfolio sets of financial results simulated, means and standard deviations calculated and charted for analysis Conservative assumptions min max Gross carbon sequestration (tons/ha/yr) 11 12 All-in project dev cost ($/ha) $3,500 $4,000

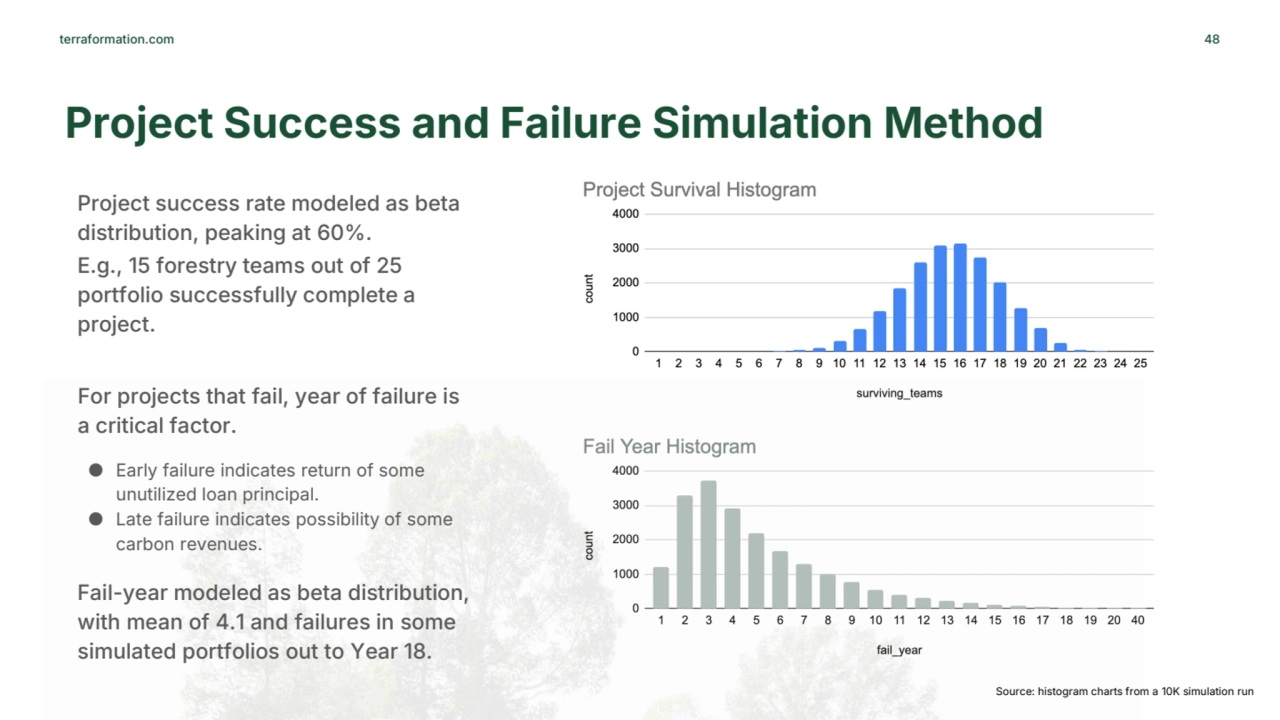

- 48. terraformation.com 48 Project Success and Failure Simulation Method Project success rate modeled as beta distribution, peaking at 60%. E.g., 15 forestry teams out of 25 portfolio successfully complete a project. For projects that fail, year of failure is a critical factor. ● Early failure indicates return of some unutilized loan principal. ● Late failure indicates possibility of some carbon revenues. Fail-year modeled as beta distribution, with mean of 4.1 and failures in some simulated portfolios out to Year 18. Source: histogram charts from a 10K simulation run

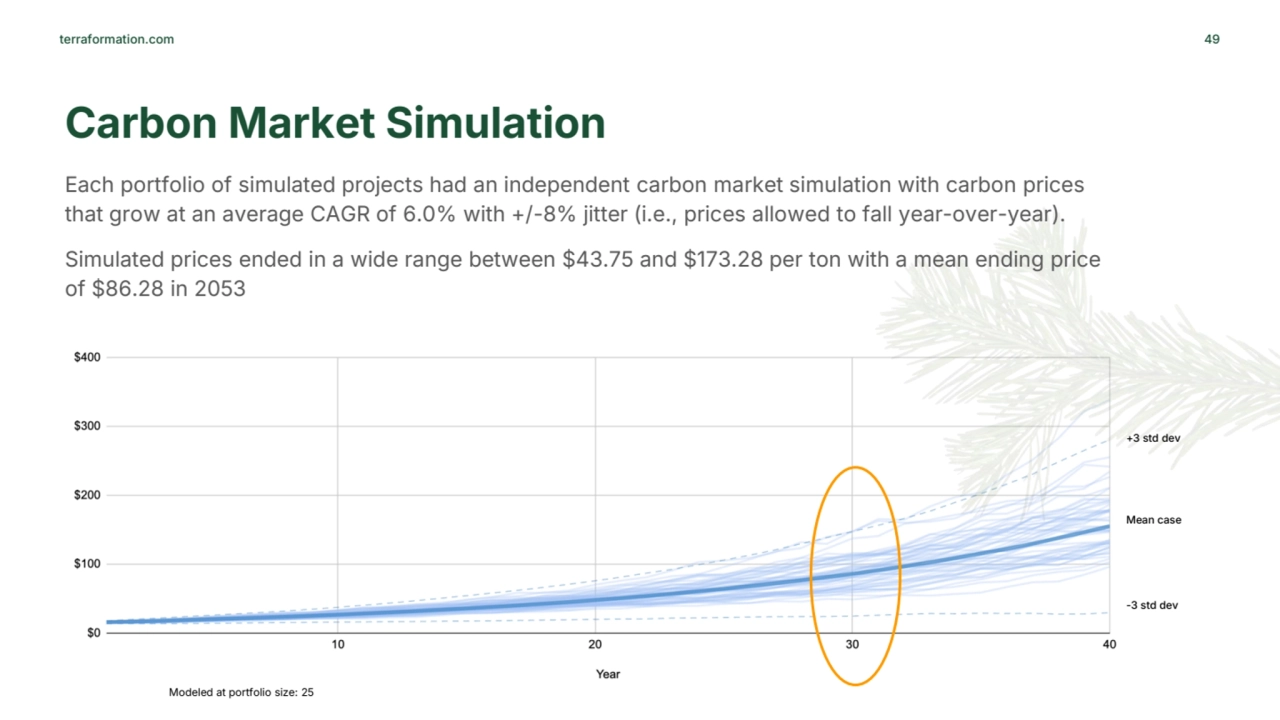

- 49. terraformation.com 49 Carbon Market Simulation +3 std dev -3 std dev Mean case Modeled at portfolio size: 25 Each portfolio of simulated projects had an independent carbon market simulation with carbon prices that grow at an average CAGR of 6.0% with +/-8% jitter (i.e., prices allowed to fall year-over-year). Simulated prices ended in a wide range between $43.75 and $173.28 per ton with a mean ending price of $86.28 in 2053

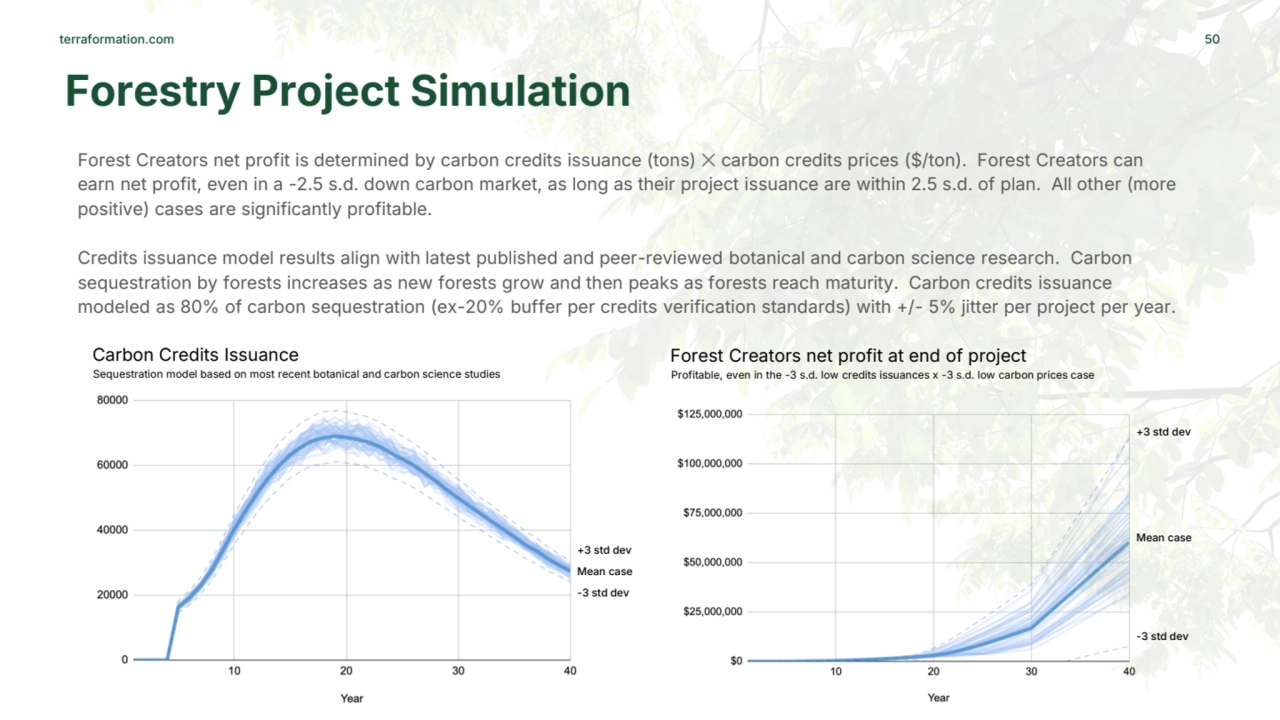

- 50. terraformation.com 50 Forestry Project Simulation +3 std dev -3 std dev Mean case +3 std dev -3 std dev Mean case Forest Creators net profit is determined by carbon credits issuance (tons) ✕ carbon credits prices ($/ton). Forest Creators can earn net profit, even in a -2.5 s.d. down carbon market, as long as their project issuance are within 2.5 s.d. of plan. All other (more positive) cases are significantly profitable. Credits issuance model results align with latest published and peer-reviewed botanical and carbon science research. Carbon sequestration by forests increases as new forests grow and then peaks as forests reach maturity. Carbon credits issuance modeled as 80% of carbon sequestration (ex-20% buffer per credits verification standards) with +/- 5% jitter per project per year. Forest Creators net profit at end of project Profitable, even in the -3 s.d. low credits issuances x -3 s.d. low carbon prices case Carbon Credits Issuance Sequestration model based on most recent botanical and carbon science studies

- 51. terraformation.com At least 40% of underlying projects need to survive in order to assure minimal variance and full returns 51 +3 std dev -3 std dev Mean case Senior Securities J-Curve Expected returns for Senior Securities holder in all simulated scenarios 40% project success rate is a critical threshold. Above that threshold, hundreds of thousands of simulated Senior securities show strong convergence on full payment of interest and principal obligations. Senior cumulative cash (normalized)

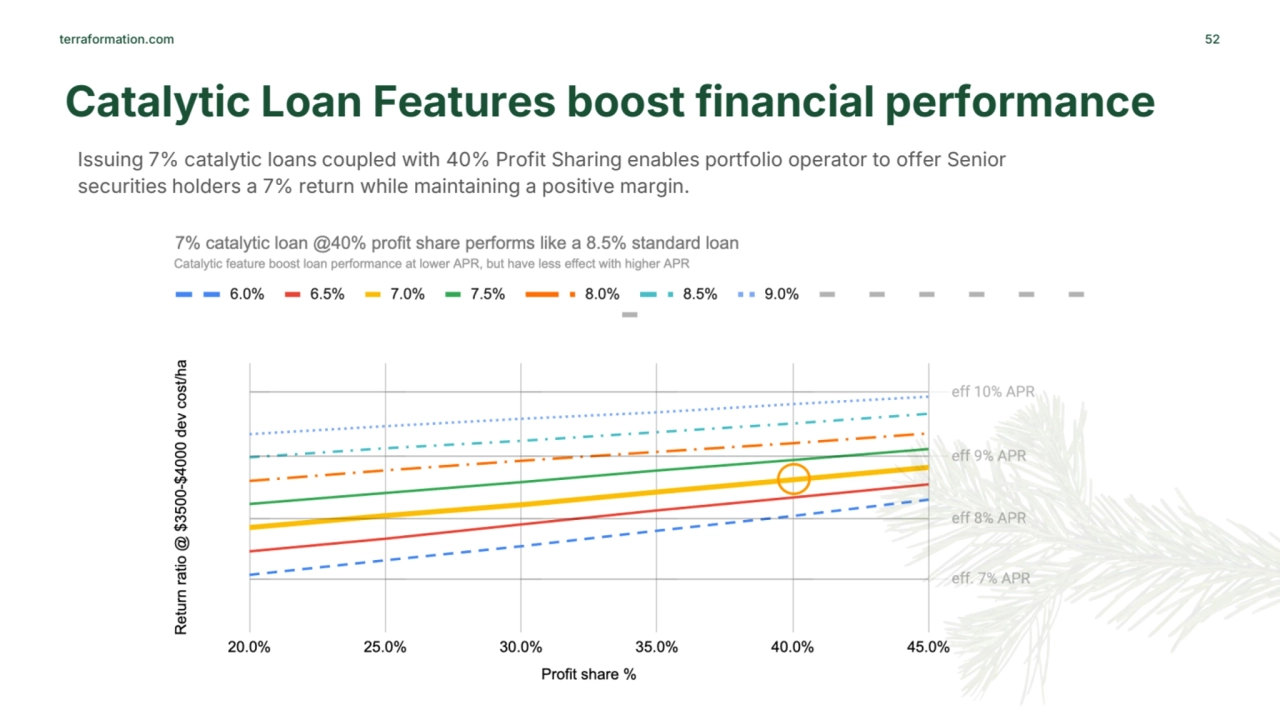

- 52. terraformation.com Catalytic Loan Features boost financial performance 52 Issuing 7% catalytic loans coupled with 40% Profit Sharing enables portfolio operator to offer Senior securities holders a 7% return while maintaining a positive margin.

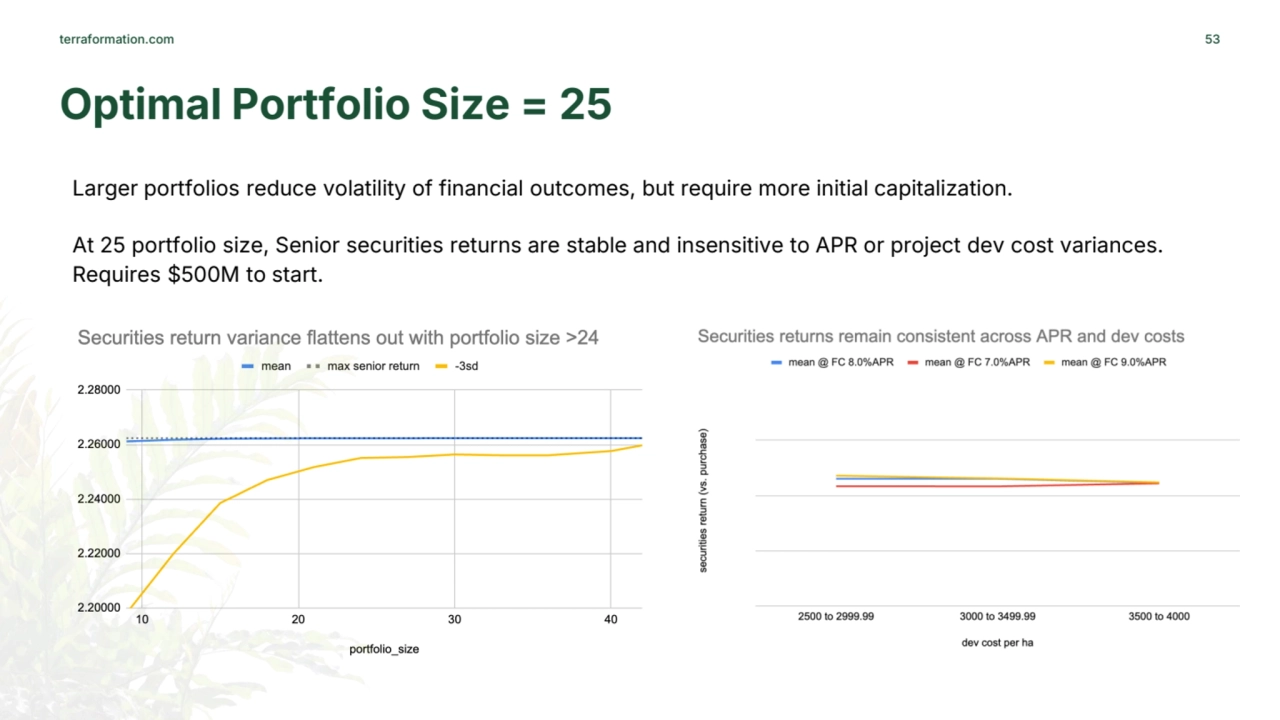

- 53. terraformation.com Optimal Portfolio Size = 25 53 Larger portfolios reduce volatility of financial outcomes, but require more initial capitalization. At 25 portfolio size, Senior securities returns are stable and insensitive to APR or project dev cost variances. Requires $500M to start.

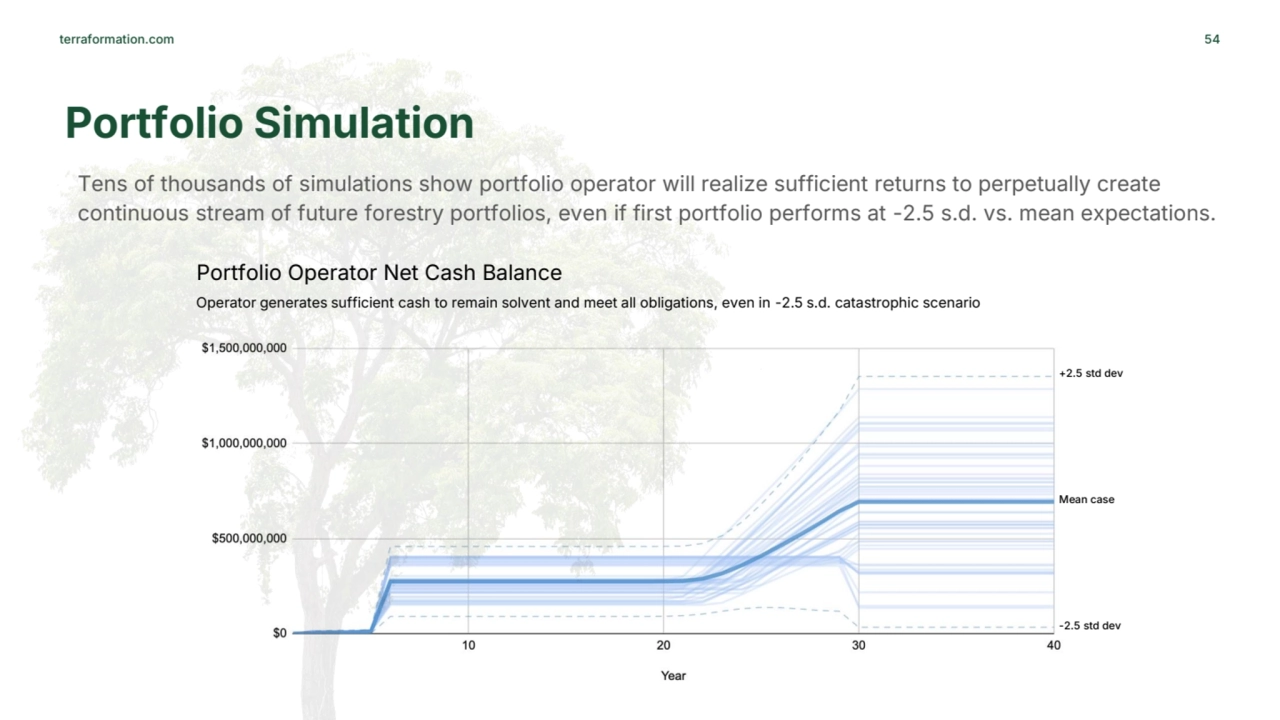

- 54. terraformation.com 54 Portfolio Simulation +2.5 std dev -2.5 std dev Mean case Tens of thousands of simulations show portfolio operator will realize sufficient returns to perpetually create continuous stream of future forestry portfolios, even if first portfolio performs at -2.5 s.d. vs. mean expectations. Portfolio Operator Net Cash Balance Operator generates sufficient cash to remain solvent and meet all obligations, even in -2.5 s.d. catastrophic scenario

- 55. Case Study Simulated Portfolios

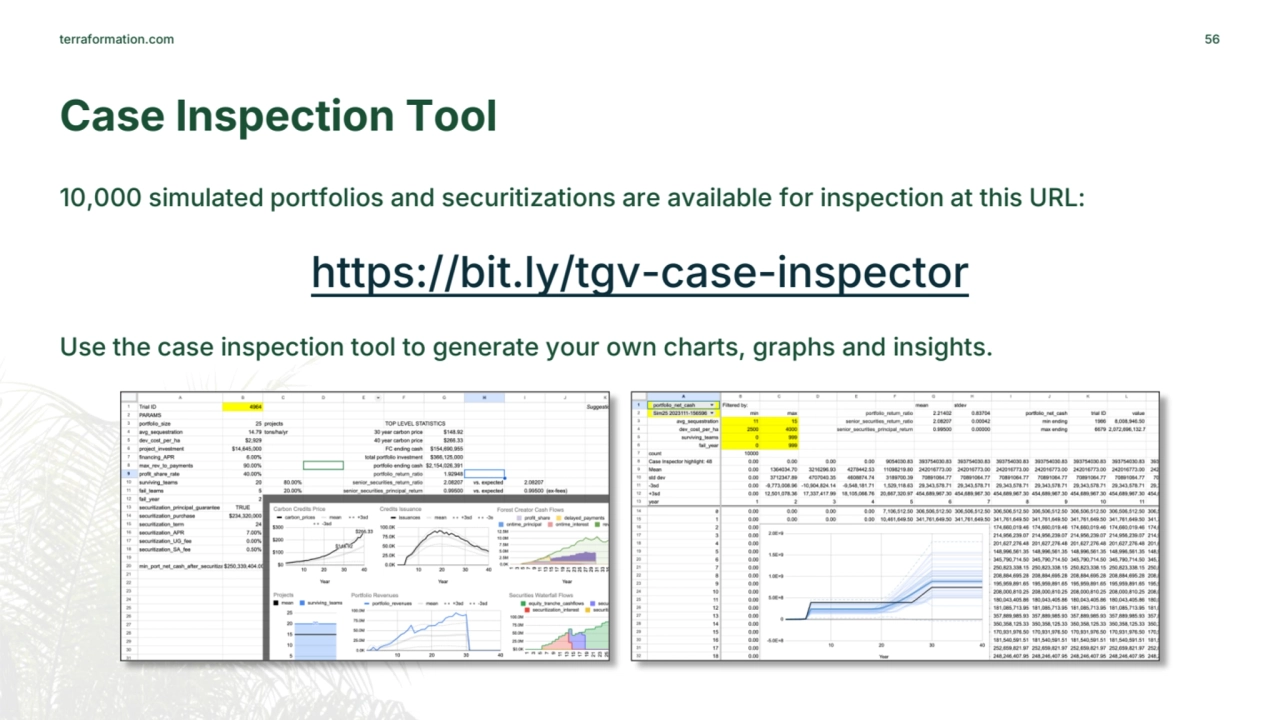

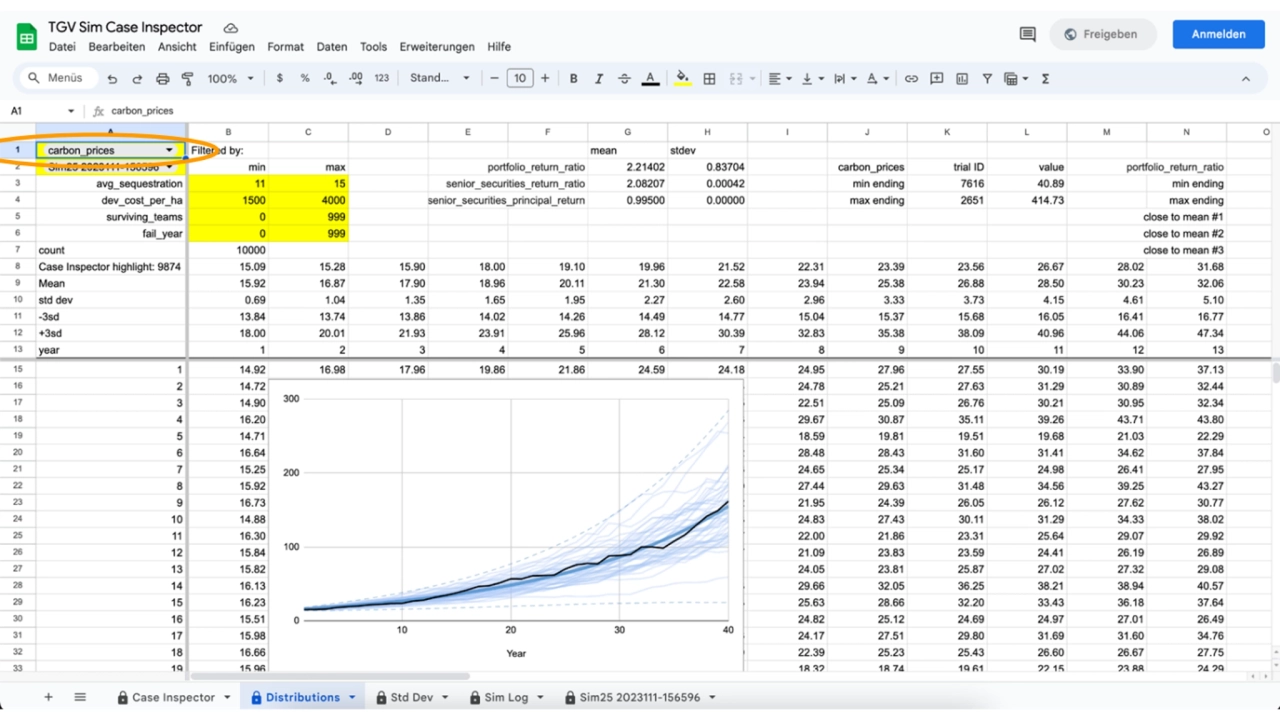

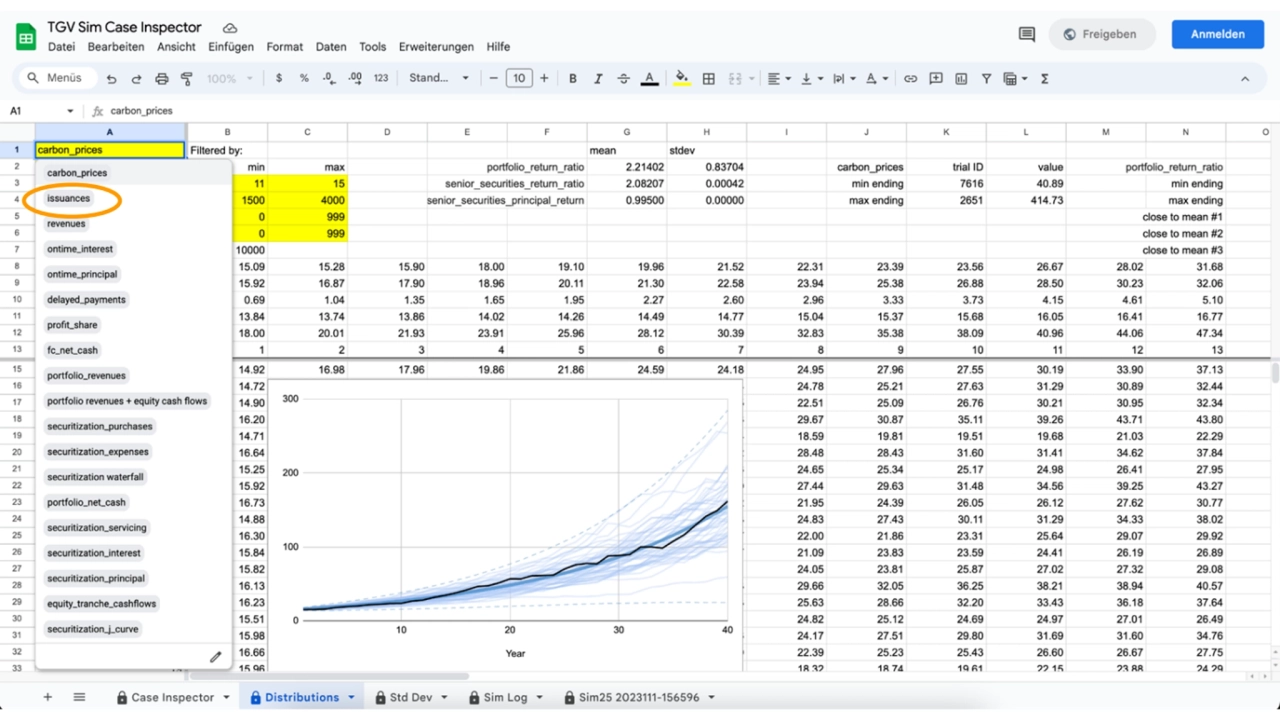

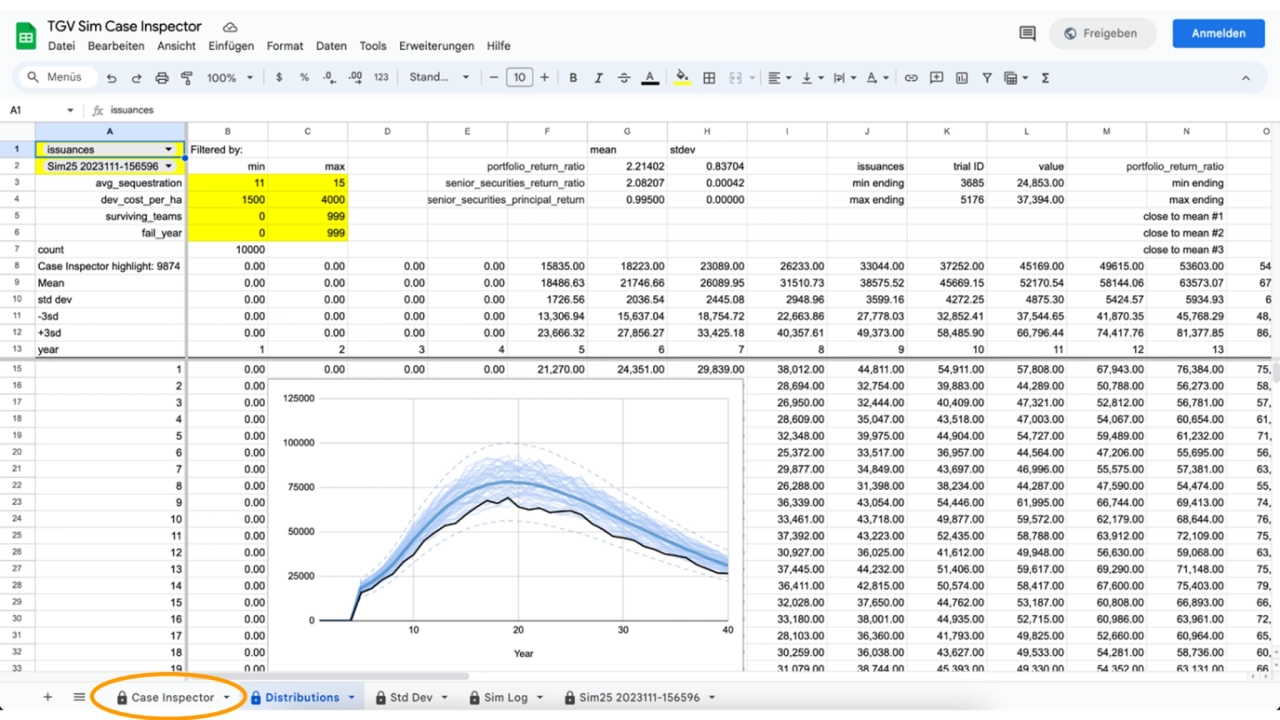

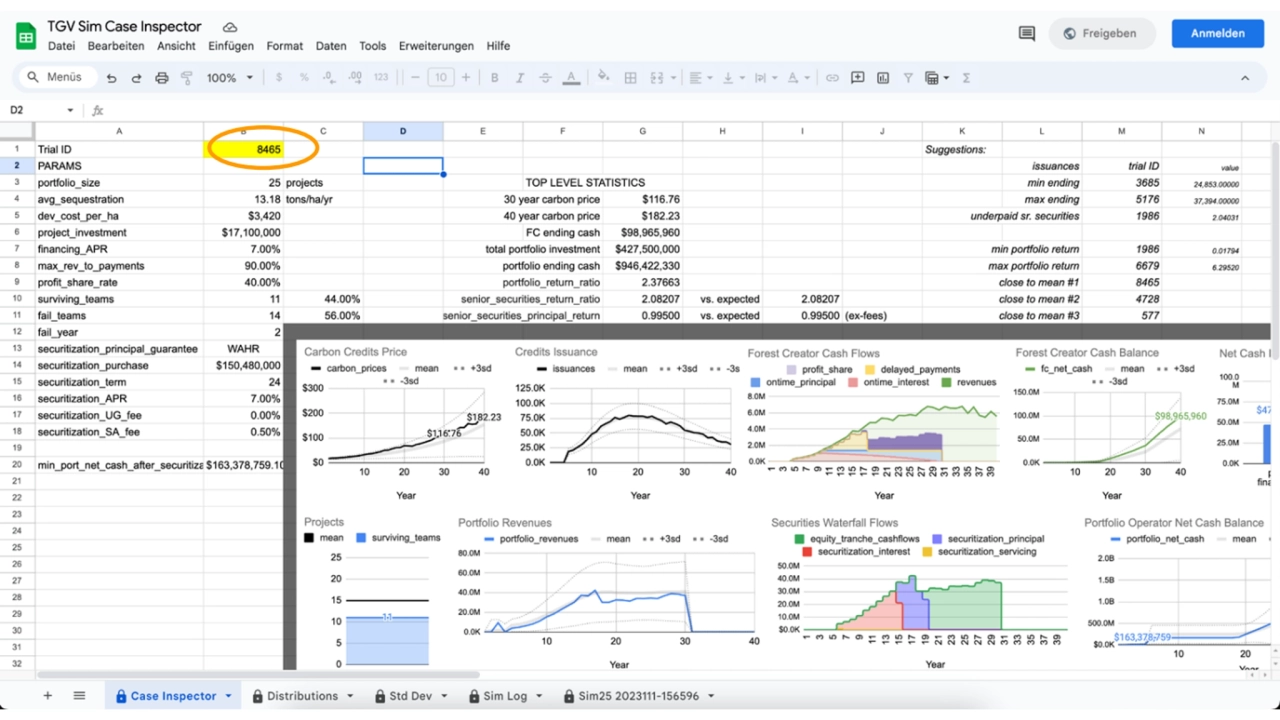

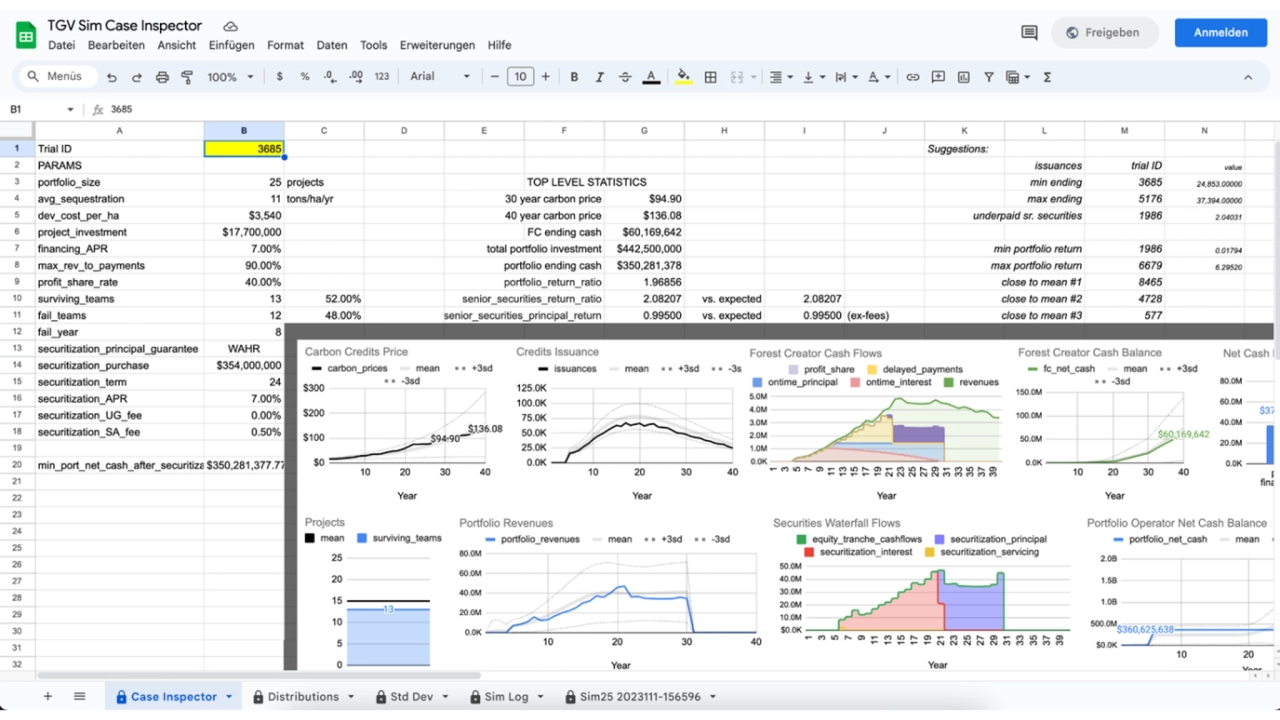

- 56. terraformation.com 10,000 simulated portfolios and securitizations are available for inspection at this URL: https://bit.ly/tgv-case-inspector Use the case inspection tool to generate your own charts, graphs and insights. Case Inspection Tool 56

- 57. terraformation.com 57

- 58. terraformation.com 58

- 59. terraformation.com 59

- 60. terraformation.com 60

- 61. terraformation.com 61

- 62. Thank You. “With your help, we can restore our native forests in THIS generation.” —Yishan Wong, CEO and founder of Terraformation This presentation https://bit.ly/noah-2023-terraformation-workshop Engage with us growth@terraformation.com Our Website terraformation.com