TSMC's 2Q25 Earnings Overview

AI Summary

AI Summary

Key Insights

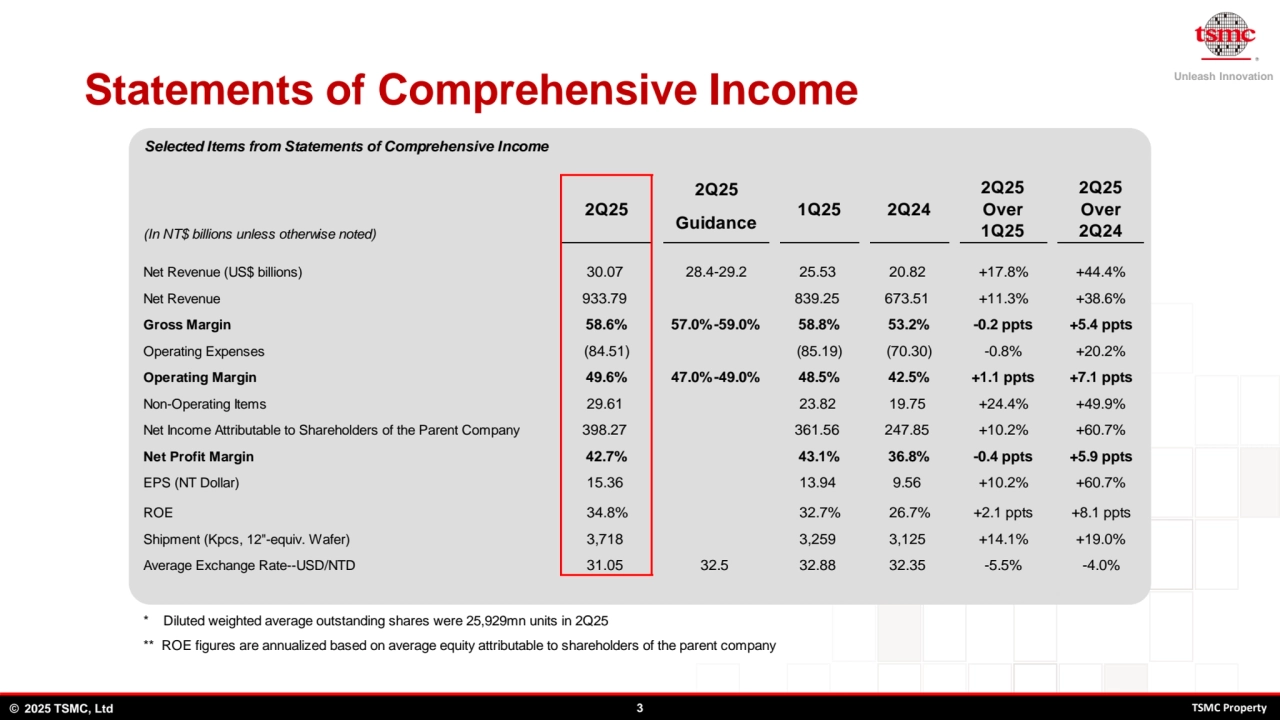

- 📈 Financial Overview: TSMC's 2Q25 financial performance showing significant revenue growth and strong profit margins compared to previous periods.

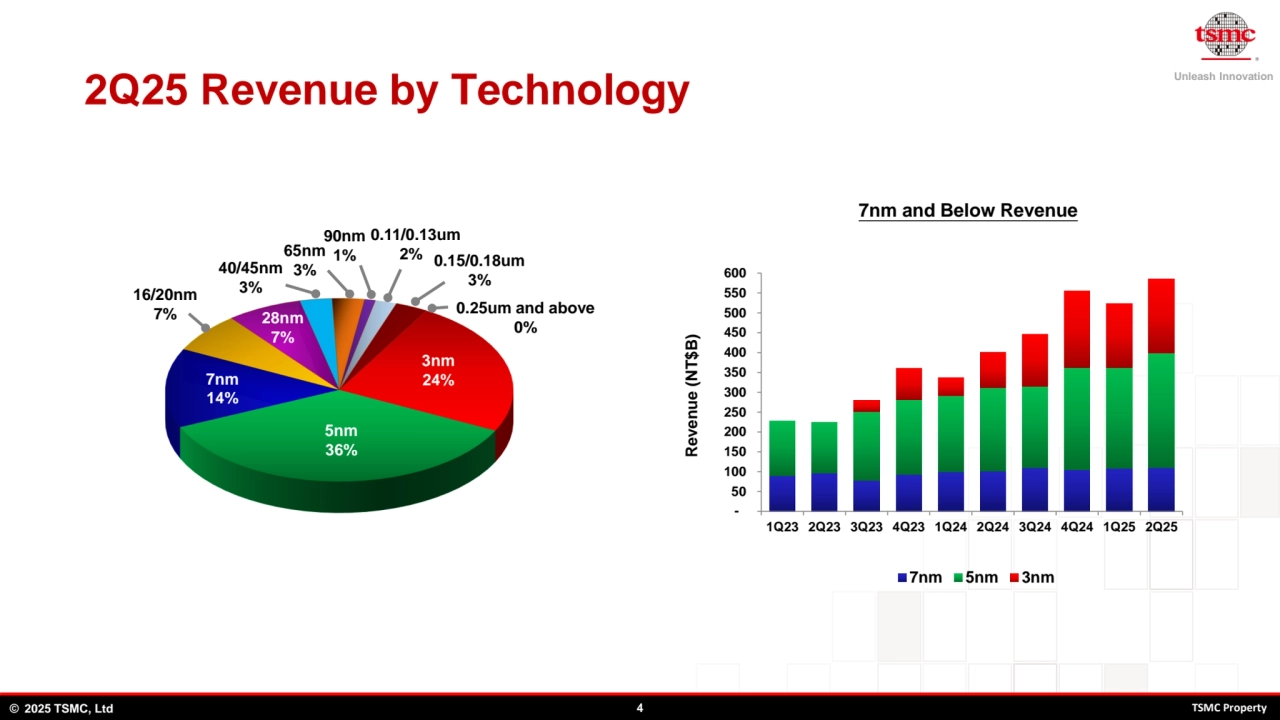

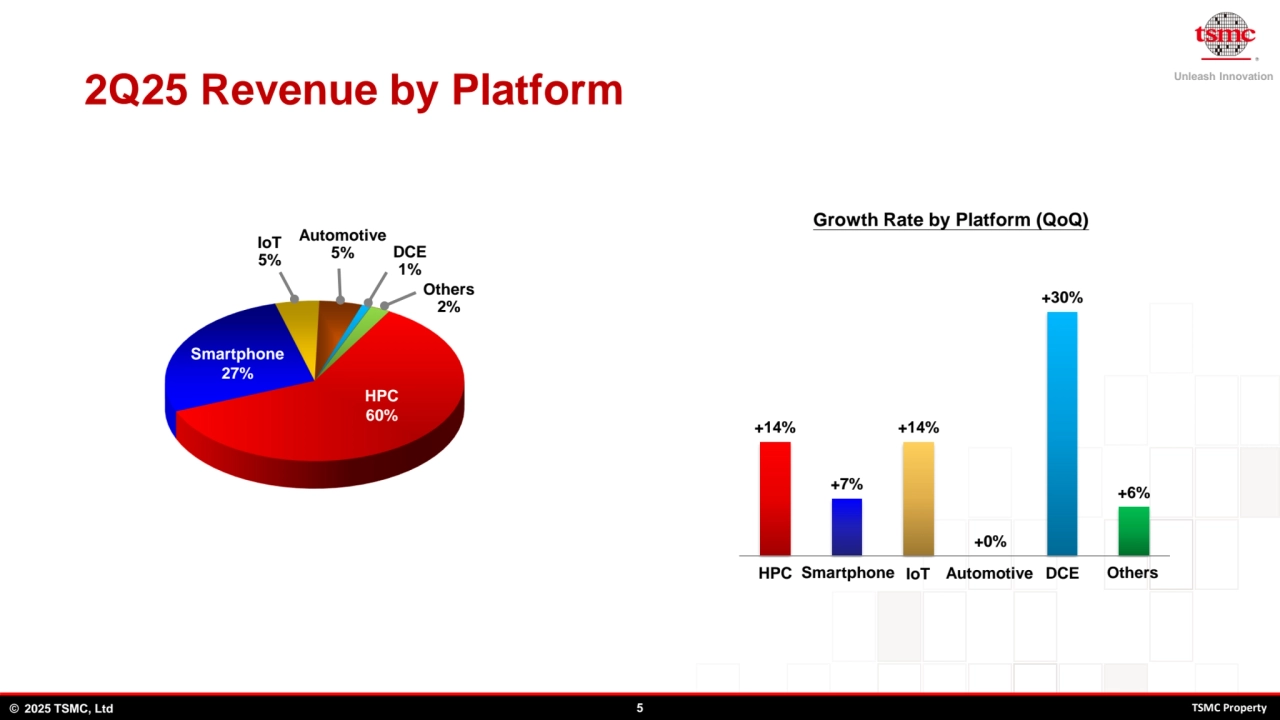

- 💻 Revenue Breakdown: Analysis of revenue by technology nodes (7nm, 5nm, 3nm) and platform (HPC, Smartphone, IoT) revealing key growth drivers.

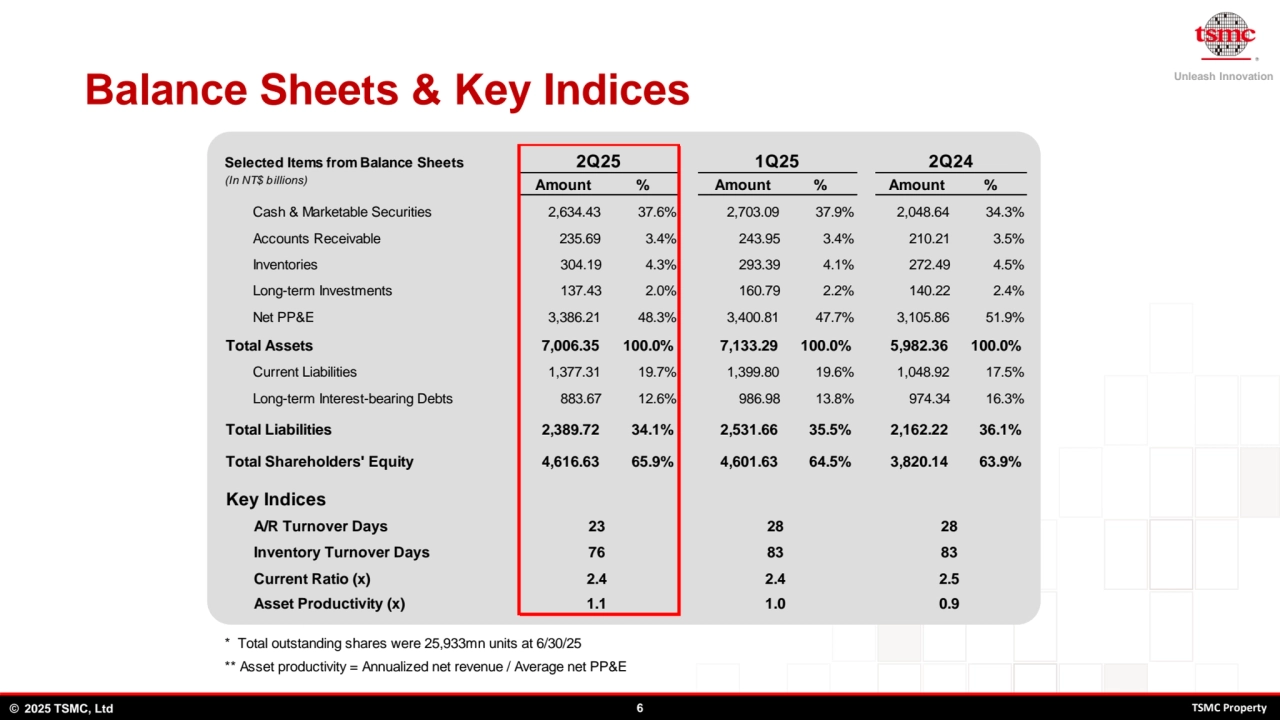

- ⚖️ Balance Sheet Insights: Key balance sheet figures including cash, assets, liabilities, and equity, providing a snapshot of TSMC's financial health.

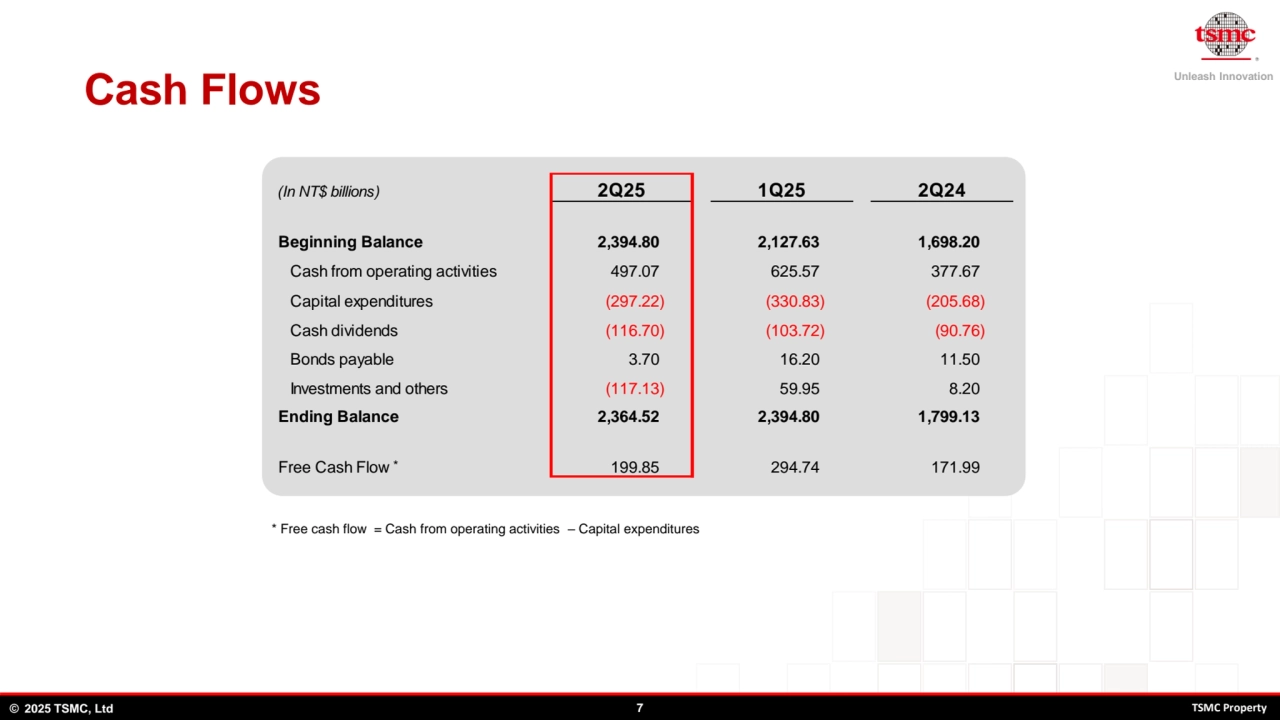

- 💰 Cash Flow Analysis: Examination of TSMC's cash flows from operating activities, capital expenditures, and investments.

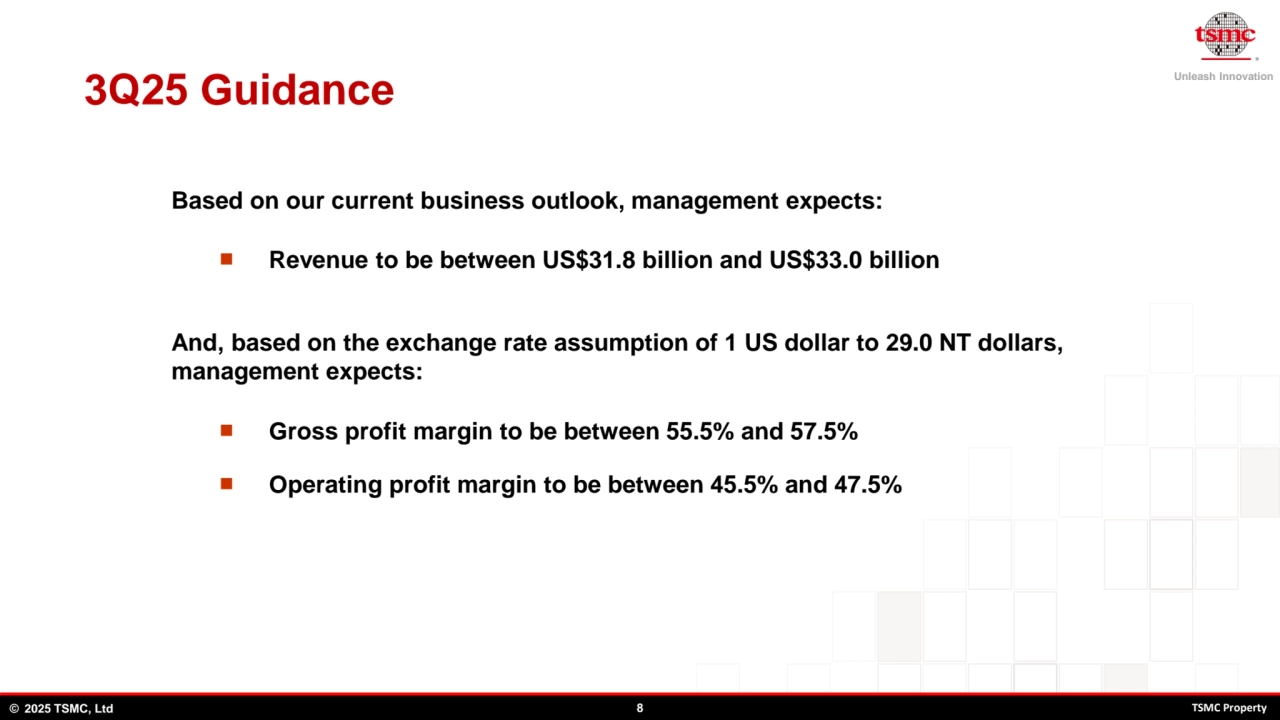

- 🔮 Future Guidance: Management's outlook for 3Q25, including revenue and profit margin forecasts, along with a broader future outlook indicating substantial revenue growth.

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

TSMC's 2Q25 Earnings Overview

- 1. Unleash Innovation © 2025 TSMC, Ltd 0 TSMC Property Unleash Innovation 2025 Second Quarter Earnings Conference July 17, 2025

- 2. Unleash Innovation © 2025 TSMC, Ltd 1 TSMC Property Agenda • Welcome Jeff Su, IR Director • 2Q25 Financial Results and 3Q25 Outlook Wendell Huang, CFO • Key Messages Wendell Huang, CFO C.C. Wei, Chairman & CEO • Q&A

- 3. Unleash Innovation © 2025 TSMC, Ltd 2 TSMC Property Safe Harbor Notice • TSMC’s statements of its current expectations are forward-looking statements subject to significant risks and uncertainties and actual results may differ materially from those contained in the forward-looking statements. • Information as to those factors that could cause actual results to vary can be found in TSMC’s 2024 Annual Report on Form 20-F filed with the United States Securities and Exchange Commission (the “SEC”) on April 17, 2025 and such other documents as TSMC may file with, or submit to, the SEC from time to time. • Except as required by law, we undertake no obligation to update any forward-looking statement, whether as a result of new information, future events, or otherwise.

- 4. Unleash Innovation © 2025 TSMC, Ltd 3 TSMC Property Statements of Comprehensive Income Selected Items from Statements of Comprehensive Income 2Q25 (In NT$ billions unless otherwise noted) Guidance Net Revenue (US$ billions) 30.07 28.4-29.2 25.53 20.82 +17.8% +44.4% Net Revenue 933.79 839.25 673.51 +11.3% +38.6% Gross Margin 58.6% 57.0%-59.0% 58.8% 53.2% -0.2 ppts +5.4 ppts Operating Expenses (84.51) (85.19) (70.30) -0.8% +20.2% Operating Margin 49.6% 47.0%-49.0% 48.5% 42.5% +1.1 ppts +7.1 ppts Non-Operating Items 29.61 23.82 19.75 +24.4% +49.9% Net Income Attributable to Shareholders of the Parent Company 398.27 361.56 247.85 +10.2% +60.7% Net Profit Margin 42.7% 43.1% 36.8% -0.4 ppts +5.9 ppts EPS (NT Dollar) 15.36 13.94 9.56 +10.2% +60.7% ROE 34.8% 32.7% 26.7% +2.1 ppts +8.1 ppts Shipment (Kpcs, 12"-equiv. Wafer) 3,718 3,259 3,125 +14.1% +19.0% Average Exchange Rate--USD/NTD 31.05 32.5 32.88 32.35 -5.5% -4.0% * Diluted weighted average outstanding shares were 25,929mn units in 2Q25 ** ROE figures are annualized based on average equity attributable to shareholders of the parent company 2Q25 1Q25 2Q24 2Q25 Over 1Q25 2Q25 Over 2Q24

- 5. Unleash Innovation © 2025 TSMC, Ltd 4 TSMC Property 2Q25 Revenue by Technology - 50 100 150 200 250 300 350 400 450 500 550 600 1Q23 2Q23 3Q23 4Q23 1Q24 2Q24 3Q24 4Q24 1Q25 2Q25 Revenue (NT$B) 7nm 5nm 3nm 7nm and Below Revenue 0.11/0.13um 2% 90nm 1% 0.25um and above 0% 40/45nm 3% 28nm 7% 16/20nm 7% 0.15/0.18um 3% 65nm 3% 7nm 14% 5nm 36% 3nm 24%

- 6. Unleash Innovation © 2025 TSMC, Ltd 5 TSMC Property 2Q25 Revenue by Platform +14% +7% +14% +0% +30% +6% Growth Rate by Platform (QoQ) Automotive 5% DCE 1% Others 2% IoT 5% HPC Smartphone IoT Automotive DCE Others HPC 60% Smartphone 27%

- 7. Unleash Innovation © 2025 TSMC, Ltd 6 TSMC Property Balance Sheets & Key Indices Selected Items from Balance Sheets (In NT$ billions) Amount % Amount % Amount % Cash & Marketable Securities 2,634.43 37.6% 2,703.09 37.9% 2,048.64 34.3% Accounts Receivable 235.69 3.4% 243.95 3.4% 210.21 3.5% Inventories 304.19 4.3% 293.39 4.1% 272.49 4.5% Long-term Investments 137.43 2.0% 160.79 2.2% 140.22 2.4% Net PP&E 3,386.21 48.3% 3,400.81 47.7% 3,105.86 51.9% Total Assets 7,006.35 100.0% 7,133.29 100.0% 5,982.36 100.0% Current Liabilities 1,377.31 19.7% 1,399.80 19.6% 1,048.92 17.5% Long-term Interest-bearing Debts 883.67 12.6% 986.98 13.8% 974.34 16.3% Total Liabilities 2,389.72 34.1% 2,531.66 35.5% 2,162.22 36.1% Total Shareholders' Equity 4,616.63 65.9% 4,601.63 64.5% 3,820.14 63.9% Key Indices A/R Turnover Days Inventory Turnover Days Current Ratio (x) Asset Productivity (x) * Total outstanding shares were 25,933mn units at 6/30/25 ** Asset productivity = Annualized net revenue / Average net PP&E 2.4 2.4 2.5 1.1 1.0 0.9 76 2Q25 1Q25 2Q24 23 28 28 83 83

- 8. Unleash Innovation © 2025 TSMC, Ltd 7 TSMC Property Cash Flows * Free cash flow = Cash from operating activities – Capital expenditures * (In NT$ billions) 2Q25 1Q25 2Q24 Beginning Balance 2,394.80 2,127.63 1,698.20 Cash from operating activities 497.07 625.57 377.67 Capital expenditures (297.22) (330.83) (205.68) Cash dividends (116.70) (103.72) (90.76) Bonds payable 3.70 16.20 11.50 Investments and others (117.13) 59.95 8.20 Ending Balance 2,364.52 2,394.80 1,799.13 Free Cash Flow 199.85 294.74 171.99

- 9. Unleash Innovation © 2025 TSMC, Ltd 8 TSMC Property 3Q25 Guidance ◼ Revenue to be between US$31.8 billion and US$33.0 billion Based on our current business outlook, management expects: And, based on the exchange rate assumption of 1 US dollar to 29.0 NT dollars, management expects: ◼ Gross profit margin to be between 55.5% and 57.5% ◼ Operating profit margin to be between 45.5% and 47.5%

- 10. Unleash Innovation © 2025 TSMC, Ltd 9 TSMC Property Future Outlook Based on our current business outlook, management expects: ◼ 2025 revenue to increase by around 30% in US dollar terms

- 11. Unleash Innovation © 2025 TSMC, Ltd 10 TSMC Property • Please visit TSMC's website (https://www.tsmc.com) and Market Observation Post System (https://mops.twse.com.tw) for details and other announcements • “TSMC-UTokyo Lab” Launched to Promote Advanced Semiconductor Research, Education and Talent Incubation (2025/06/12) • TSMC Board of Directors Approved NT$5.00 Cash Dividend for the First Quarter of 2025 and Set September 16, 2025 as Ex-Dividend Date, September 22, 2025 as the Record Date and October 9, 2025 as the Distribution Date (2025/05/13) • TSMC Unveils Next-Generation A14 Process at North America Technology Symposium (2025/04/24) • TSMC Commits to Ambitious Carbon Reduction Path in Line with Science Based Targets Initiative (2025/04/22) Recap of Recent Major Events

- 12. Unleash Innovation © 2025 TSMC, Ltd 11 TSMC Property https://www.tsmc.com invest@tsmc.com