Was The Yield Curve Inversion Wrong In Predicting A U.S. Recession J.P. Morgan Asset Management

AI Summary

AI Summary

Key Insights

- The yield curve, specifically the spread between the 3-month and 10-year Treasury yields, has historically been a reliable indicator of U.S. recessions.

- Federal Reserve's rate hikes aimed at combating inflation caused short-term yields to rise, leading to the initial yield curve inversion in October 2022, which persisted until December 2024.

- Despite the prolonged inversion, a recession hasn't materialized, due to robust economic data like strong labor markets, consumer spending, and business investment.

- The economy's resilience to higher policy rates and elevated estimates of the neutral rate suggest potential mispricing of long-term rates by the markets.

Loading...

Loading...

Loading...

Loading...

Was The Yield Curve Inversion Wrong In Predicting A U.S. Recession J.P. Morgan Asset Management

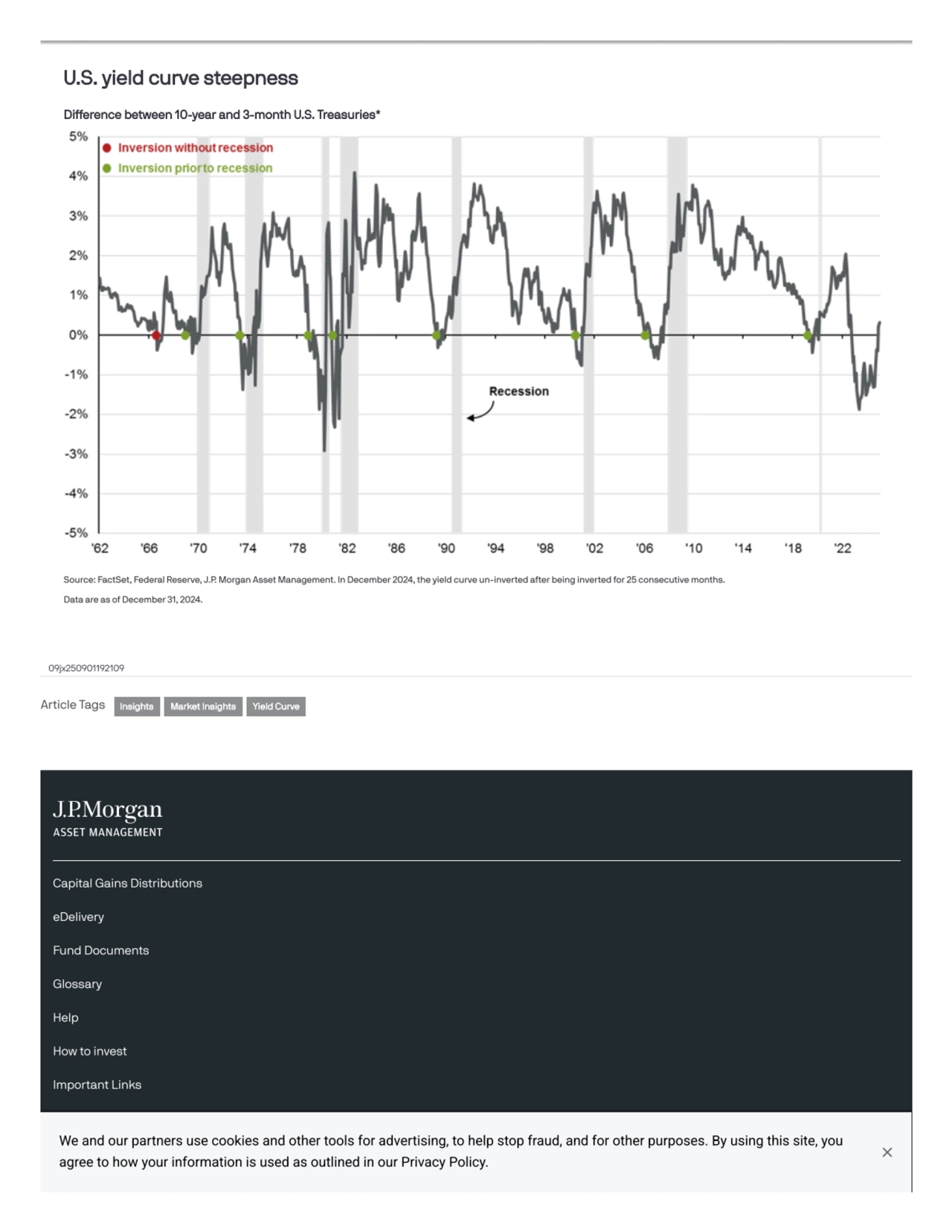

- 1. On the Minds of Investors Was the yield curve inversion wrong in predicting a U.S. recession? It's important to recognize that while the indicator has an impressive track record, no single economic metric is infallible. The spread between the 3-month U.S. Treasury bill yield and the 10-year U.S. Treasury yield, commonly referred to as the yield curve spread, is a vital indicator in financial markets and is closely monitored by investors and the Federal Reserve, particularly given the historical efficacy of its inversion predicting U.S. recessions. An inversion signals that markets believe current policy may be too restrictive, potentially triggering an economic slowdown. Indeed, since 1960, the spread between the 3-month and 10-year Treasury yield has inverted before every U.S. recession, making it one of the most reliable indicators of economic downturns. There has only been one instance where this spread inverted and a recession did not follow, or “false positive”—in 1966. With so few false positives, investors are still cautious around the general rosy economic outlook for 2025 following the prolonged inversion over the last couple of years. The Federal Reserve’s aggressive rate hikes to combat inflation pushed short term yields higher and caused the curve to first invert in October 2022, and the curve remained inverted until December 2024. However, while this has been the longest inversion in recent history, a recession has yet to materialize. That said, the recent steepening and un-inverting in the curve provide key reasons as to why the inversion may not signal a recession: . While the Fed typically cuts rates in response to weakening economic conditions, the Fed is already well underway in its cutting cycle while growth has remained resilient reducing restriction on the economy. . Stronger-than-expected economic data such as robust labor markets, consumer spending, business investment and industrial production indicate the economy is likely to remain on solid footing. . The economy has shown it can withstand higher policy rates and estimates of r-star or neutral rate in the economy have been rising suggesting markets may have been mispricing long-term rates too low. The spread between the 3-month and 10-year Treasury yields remains a critical economic indicator. Its current positive slope suggests optimism about a soft landing—where inflation continues to moderate without a severe economic downturn. However, it’s important to recognize that while the indicator has an impressive track record, no single economic metric is infallible. However, time will tell; the last four cycles saw the curve un-invert on average six months prior to a recession. This is why investors should consider yield curve inversions alongside other economic indicators to gauge the likelihood of a recession. Published:1 day ago Jordan Jackson Global Market Strategist We and our partners use cookies and other tools for advertising, to help stop fraud, and for other purposes. By using this site, you agree to how your information is used as outlined in our Privacy Policy.

- 2. Capital Gains Distributions eDelivery Fund Documents Glossary Help How to invest Important Links Mutual Fund Fee Calculator Accessibility U.S. yield curve steepness Difference between 10-year and 3-month U.S. Treasuries* Source: FactSet, Federal Reserve, J.P. Morgan Asset Management. In December 2024, the yield curve un-inverted after being inverted for 25 consecutive months. Data are as of December 31, 2024. 09jx250901192109 Article Tags Insights Market Insights Yield Curve We and our partners use cookies and other tools for advertising, to help stop fraud, and for other purposes. By using this site, you agree to how your information is used as outlined in our Privacy Policy.

- 3. Form CRS and Form ADV Brochures Investment stewardship J.P. Morgan Funds U.S. Consumer Privacy Notice J.P. Morgan Online Privacy Policy Proxy Information Senior Officer Fee Summary SIMPLE IRAs Site disclaimer Terms of use J.P. Morgan JPMorgan Chase Chase This website is a general communication being provided for informational purposes only. It is educational in nature and not designed to be a recommendation for any specific investment product, strategy, plan feature or other purposes. By receiving this communication you agree with the intended purpose described above. Any examples used in this material are generic, hypothetical and for illustration purposes only. None of J.P. Morgan Asset Management, its affiliates or representatives is suggesting that the recipient or any other person take a specific course of action or any action at all. Communications such as this are not impartial and are provided in connection with the advertising and marketing of products and services. Prior to making any investment or financial decisions, an investor should seek individualized advice from personal financial, legal, tax and other professionals that take into account all of the particular facts and circumstances of an investor's own situation. Variable annuity guarantees are only as good as the insurance company that gives them. While it is an uncommon occurrence that the insurance companies that back these guarantees are unable to meet their obligations, it may happen. Annuity withdrawals prior to 59½ may be subject to tax penalties, are subject to market risk and may lose value. Riders have additional fees and costs associated with them, and are subject to additional conditions, restrictions, and limitations. Opinions and statements of financial market trends that are based on current market conditions constitute our judgment and are subject to change without notice. We believe the information provided here is reliable but should not be assumed to be accurate or complete. The views and strategies described may not be suitable for all investors. INFORMATION REGARDING MUTUAL FUNDS/ETF: Investors should carefully consider the investment objectives and risks as well as charges and expenses of a mutual fund or ETF before investing. The summary and full prospectuses contain this and other information about the mutual fund or ETF and should be read carefully before investing. To obtain a prospectus for Mutual Funds: Contact JPMorgan Distribution Services, Inc. at 1-800-480-4111 or download it from this site. Exchange Traded Funds: Call 1-844-4JPM-ETF or download it from this site. J.P. Morgan Funds and J.P. Morgan ETFs are distributed by JPMorgan Distribution Services, Inc. JPMorgan Private Markets Fund is distributed by J.P. Morgan Institutional Investments Inc. Both are affiliates of JPMorgan Chase & Co. Affiliates of JPMorgan Chase & Co. receive fees for providing various services to the funds. JPMorgan Distribution Services, Inc. is a member of FINRA FINRA's BrokerCheck INFORMATION REGARDING COMMINGLED FUNDS: For additional information regarding the Commingled Pension Trust Funds of JPMorgan Chase Bank, N.A., please contact your J.P. Morgan Asset Management representative. The Commingled Pension Trust Funds of JPMorgan Chase Bank N.A. are collective trust funds established and maintained by JPMorgan Chase Bank, N.A. under a declaration of trust. The funds are not required to file a prospectus or registration statement with the SEC, and accordingly, neither is available. The funds are available only to certain qualified retirement plans and governmental plans and is not offered to the general public. Units of the funds are not bank deposits and are not insured or guaranteed by any bank, government entity, the FDIC or any other type of deposit insurance. You should carefully consider the investment objectives, risk, charges, and expenses of the fund before investing. INFORMATION FOR ALL SITE USERS: J.P. Morgan Asset Management is the brand name for the asset management business of JPMorgan Chase & Co. and its affiliates worldwide. NOT FDIC INSURED | NO BANK GUARANTEE | MAY LOSE VALUE Telephone calls and electronic communications may be monitored and/or recorded. Personal data will be collected, stored and processed by J.P. Morgan Asset Management in accordance with our privacy policies at https://www.jpmorgan.com/privacy. If you are a person with a disability and need additional support in viewing the material, please call us at 1-800-343-1113 for assistance. We and our partners use cookies and other tools for advertising, to help stop fraud, and for other purposes. By using this site, you agree to how your information is used as outlined in our Privacy Policy.

- 4. Copyright © 2024 JPMorgan Chase & Co., All rights reserved We and our partners use cookies and other tools for advertising, to help stop fraud, and for other purposes. By using this site, you agree to how your information is used as outlined in our Privacy Policy.