Financing Startup Communities

Financing Startup Communities

Exploring innovative financing methods for sustainable startup communities, this session delves into the combination of equity, debt, and real estate strategies necessary for capital formation. Attendees will learn about crucial leadership tactics, community building, and how to create job opportunities while enhancing local economies through integrated financial approaches.

Financing Startup Communities

@maithri5 days ago

Financing Startup Communities #FSC

Dave McClure , PracticalVC.com @DaveMcClure linkedin.in/davemcclure

Vitalia , Startup Societies Feb 2024, Roatan, Honduras

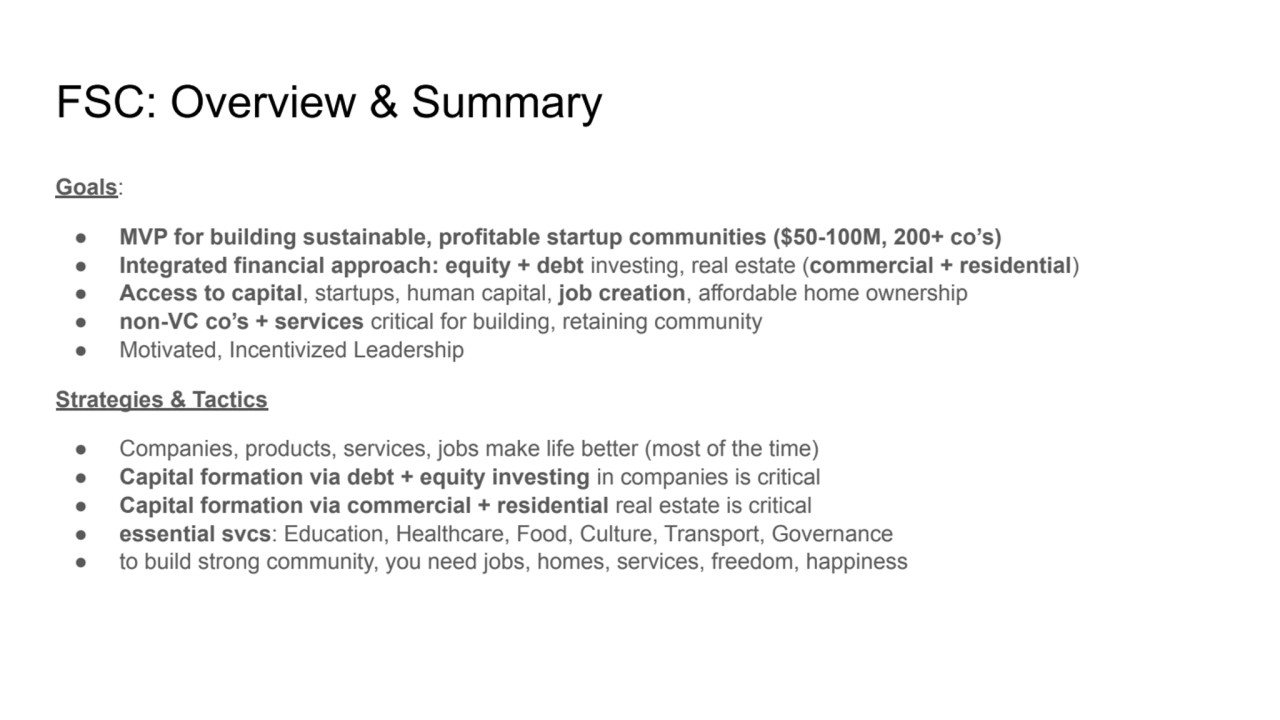

- â MVP for building sustainable, profitable startup communities ($50-100M, 200+ co's)

- â Integrated financial approach: equity + debt investing, real estate ( commercial + residential )

- â Access to capital , startups, human capital, job creation , affordable home ownership

- â non-VC co's + services critical for building, retaining community

- â Motivated, Incentivized Leadership

- â Companies, products, services, jobs make life better (most of the time)

- â Capital formation via debt + equity investing in companies is critical

- â Capital formation via commercial + residential real estate is critical

- â essential svcs : Education, Healthcare, Food, Culture, Transport, Governance

- â to build strong community, you need jobs, homes, services, freedom, happiness

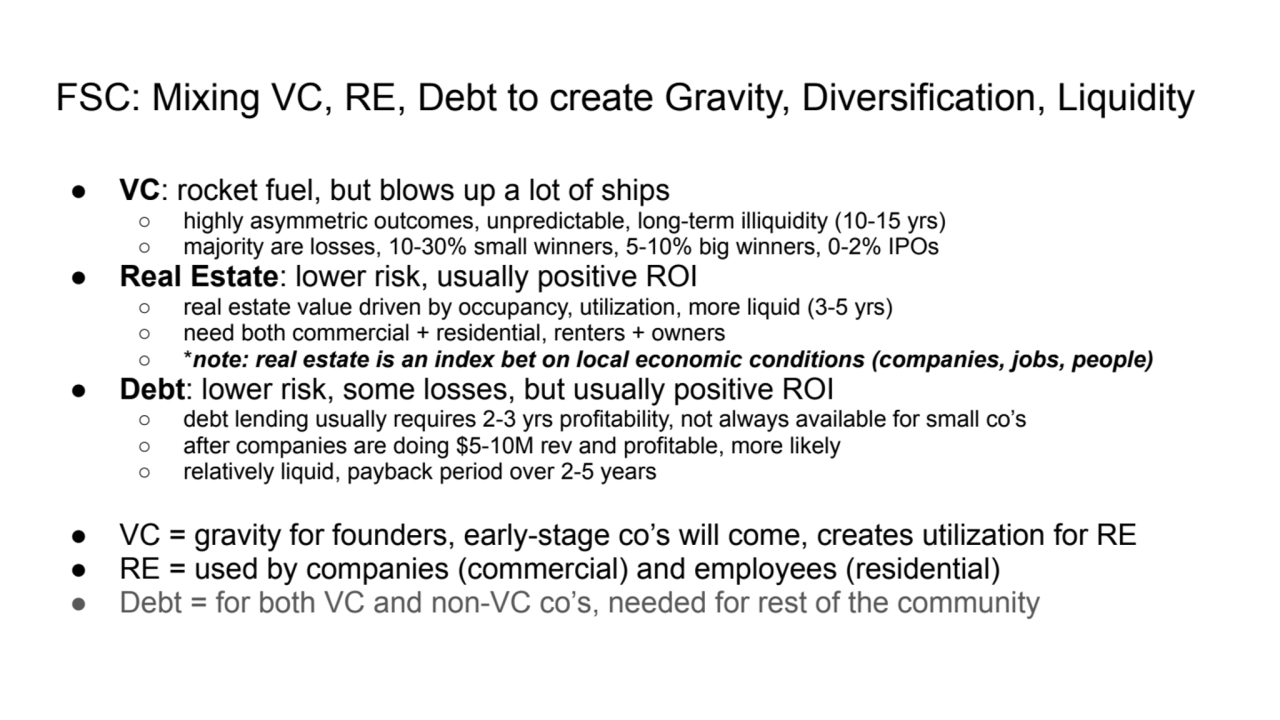

- â VC : rocket fuel, but blows up a lot of ships

- · highly asymmetric outcomes, unpredictable, long-term illiquidity (10-15 yrs)

- · majority are losses, 10-30% small winners, 5-10% big winners, 0-2% IPOs

- â Real Estate : lower risk, usually positive ROI

- · real estate value driven by occupancy, utilization, more liquid (3-5 yrs)

- · need both commercial + residential, renters + owners

- · * note: real estate is an index bet on local economic conditions (companies, jobs, people)

- â Debt : lower risk, some losses, but usually positive ROI

- · debt lending usually requires 2-3 yrs profitability, not always available for small co's

- · after companies are doing $5-10M rev and profitable, more likely

- · relatively liquid, payback period over 2-5 years

- â VC = gravity for founders, early-stage co's will come, creates utilization for RE

- â RE = used by companies (commercial) and employees (residential)

- â Debt = for both VC and non-VC co's, needed for rest of the community

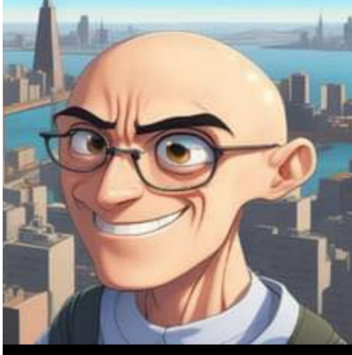

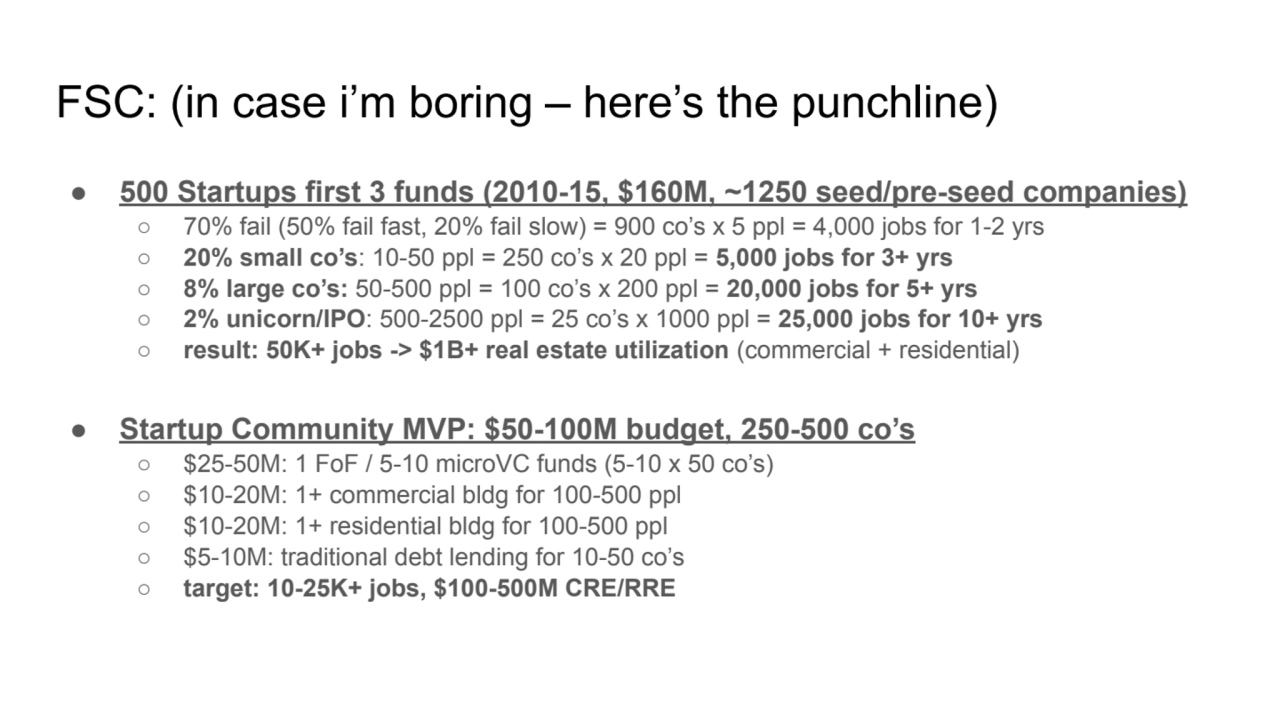

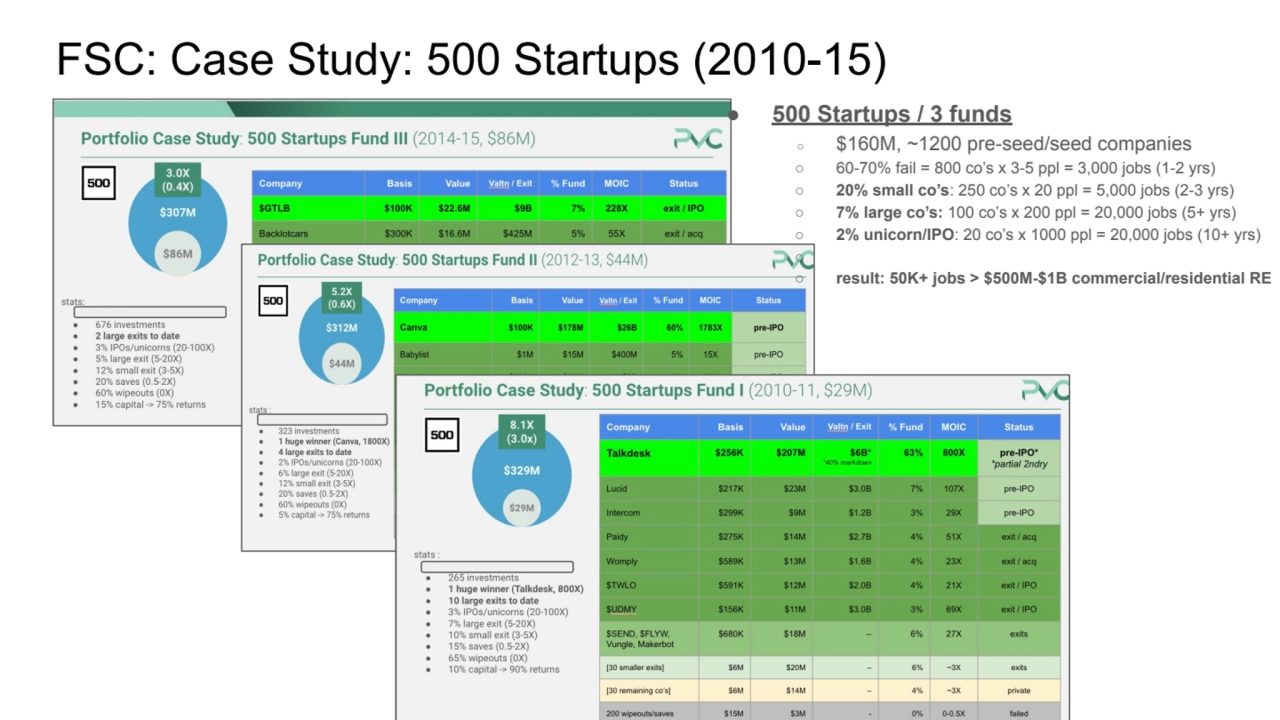

- · 70% fail (50% fail fast, 20% fail slow) = 900 co's x 5 ppl = 4,000 jobs for 1-2 yrs

- · 20% small co's : 10-50 ppl = 250 co's x 20 ppl = 5,000 jobs for 3+ yrs

- · 8% large co's: 50-500 ppl = 100 co's x 200 ppl = 20,000 jobs for 5+ yrs

- · 2% unicorn/IPO : 500-2500 ppl = 25 co's x 1000 ppl = 25,000 jobs for 10+ yrs

- · result: 50K+ jobs -> $1B+ real estate utilization (commercial + residential)

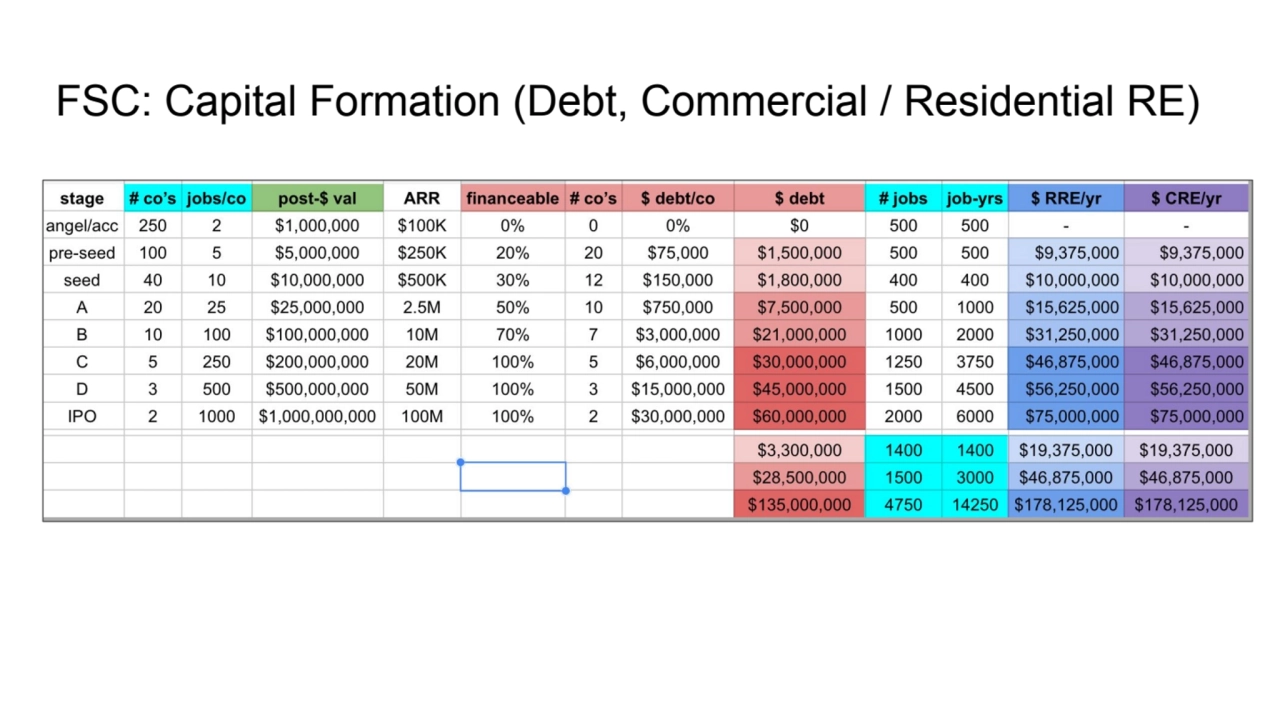

- · $25-50M: 1 FoF / 5-10 microVC funds (5-10 x 50 co's)

- · $10-20M: 1+ commercial bldg for 100-500 ppl

- · $10-20M: 1+ residential bldg for 100-500 ppl

- · $5-10M: traditional debt lending for 10-50 co's

- ·

- target: 10-25K+ jobs, $100-500M CRE/RRE

- â hillbilly from West Virginia + grew up in Columbia, MD

- â engineer , BS Applied Mathematics, Johns Hopkins Univ

- â moved to Silicon Valley in early 90's (tech startups + ultimate frisbee)

- â software developer, founder, angel investor, eventually VC

- â worked at PayPal , Founders Fund , other tech startups

- â founder 500 Startups (early-stage), Practical VC (later-stage, secondary)

- â side projects: GeeksOnaPlane, 42Geeks.com , Network States fanboi

- â I'm an optimist and I believe in humanity (altho we fuckup a lot)

- â I believe founders + capitalism can be a force for good (but far from perfect)

- â I want to work and live with fun, smart, caring people - all over the world

- â 'Make Love Trade, Not War' - people who trade are less likely to kill each other

- â Property Rights , Capitalism, Founders, Startups, Mortgage Finance

- â The Mystery of Capital , Hernando de Soto (also 'The Other Path')

- â Homesteading / Squatting (informal) -> formal ownership over time

- â Debt, Equity, Microfinance, Securitization, Financial Engineering

- â Bill Gross (Idealab), Paul Graham (YC), Vitalik Buterin (ETH)

- â Software Eats The World, Marc Andreessen (also 'It's Time to Build')

- â The Network State, Balaji Srinivasan

- â Erick Brimen, Prospera

- â Sesame Street , Bugs Bunny, Free to Be You and Me, Mary Tyler Moore

- â my mom (entrepreneur, solo parent, 60's/70's hippie, feminist, confident, occasionally wrong but never in doubt⦠thx for those crazy genes mom)

- â Silicon Valley, Sand Hill Rd : Stanford, Traitorous Eight, Fairchild, Intel, Bell Labs, AAPL, GOOG, META, NVDA, ORCL, TSLA, NFLX, multiple VC firms

- â Boston, Rt 128 : Harvard/MIT, DEC, Raytheon, ARD, bio tech

- â other US Tech Metros: Seattle ( AMZN, MSFT ), LA, NY, Austin, Miami?, etc

- â China : Beijing, Shanghai, Shenzhen

- â India : Bangalore, Delhi, Mumbai

- â other global metros: SG, Dubai , London, Tokyo, Tel Aviv, Riyadh?

- â next 20-50 yrs: the 'global south' (SE Asia, Latam, Africa, Middle East)

- â Idealab (1996, Pasadena, CalTech, Bill Gross)

- â Y Combinator (2005, Boston / Silicon Valley)

- â TechStars (2007), SeedCamp (2008), 500 Startups (2010)

- â Entrepreneur First (2011), Antler (2017), Ondeck (2019)

- â (sorry - other examples i'm forgetting / overlooking?)

- â 100+ companies , $10-100M+ seed-stage capital

- â talented, optimistic people, 'driven' founders with passion, mission

- â gravity around a physical location(s), daily/weekly community, cult-like following

- â not just an office, work / live environments , non-work activities

- â 1+ big winner (maybe 10 years later!) that create heros, mentors, role models

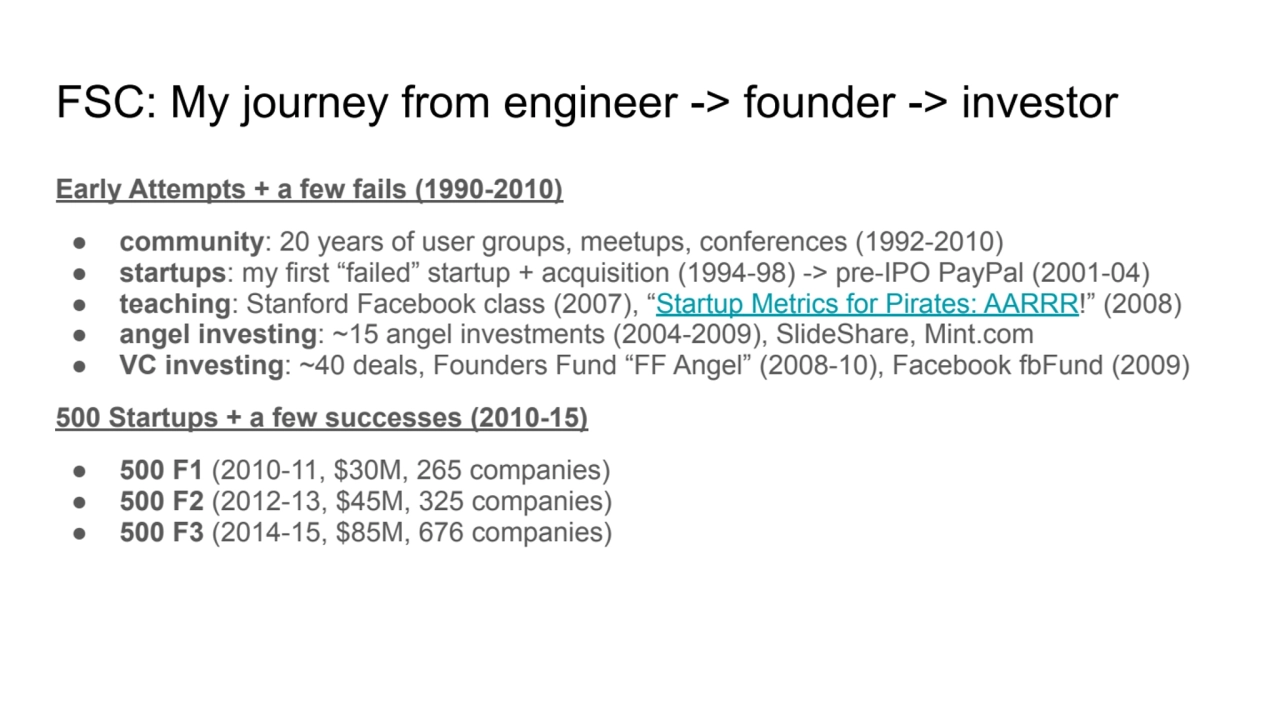

- â community : 20 years of user groups, meetups, conferences (1992-2010)

- â startups : my first 'failed' startup + acquisition (1994-98) -> pre-IPO PayPal (2001-04)

- â teaching : Stanford Facebook class (2007), 'Startup Metrics for Pirates: AARRR!' (2008)

- â angel investing : ~15 angel investments (2004-2009), SlideShare, Mint.com

- â VC investing : ~40 deals, Founders Fund 'FF Angel' (2008-10), Facebook fbFund (2009)

- â 500 F1 (2010-11, $30M, 265 companies)

- â 500 F2 (2012-13, $45M, 325 companies)

- â 500 F3 (2014-15, $85M, 676 companies)

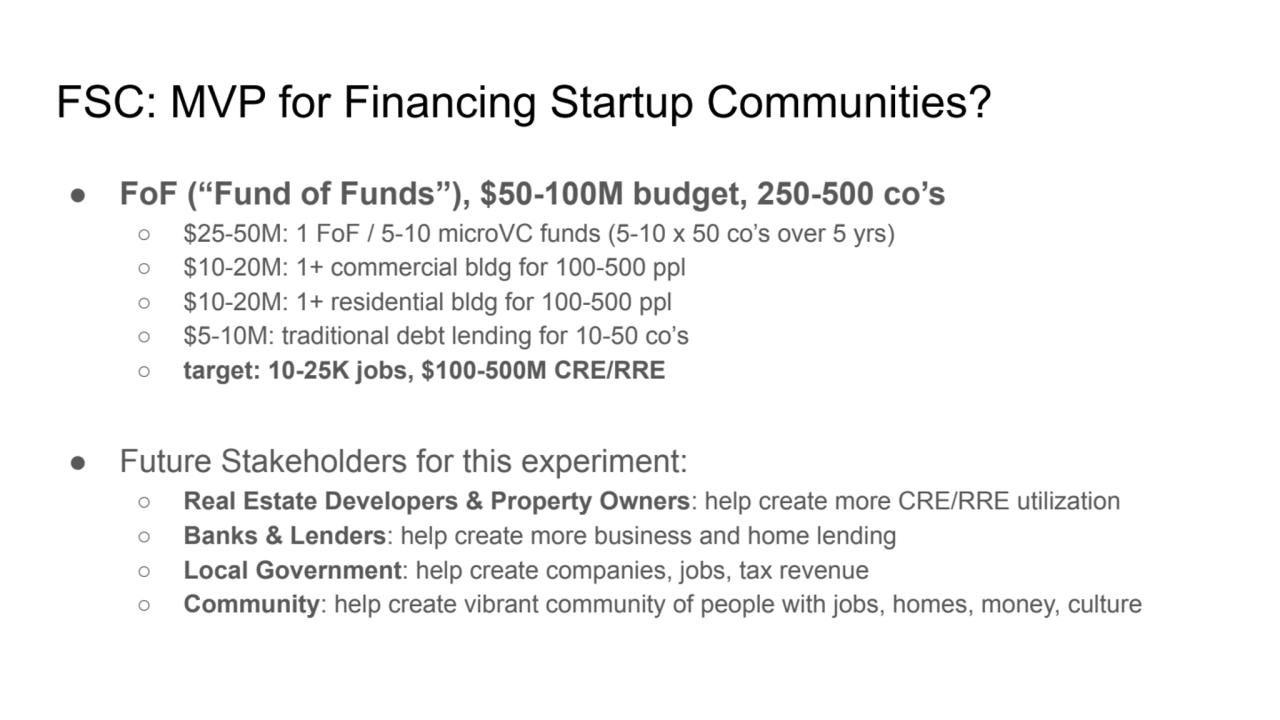

- â FoF ('Fund of Funds'), $50-100M budget, 250-500 co's

- · $25-50M: 1 FoF / 5-10 microVC funds (5-10 x 50 co's over 5 yrs)

- · $10-20M: 1+ commercial bldg for 100-500 ppl

- · $10-20M: 1+ residential bldg for 100-500 ppl

- · $5-10M: traditional debt lending for 10-50 co's

- · target: 10-25K jobs, $100-500M CRE/RRE

- â Future Stakeholders for this experiment:

- · Real Estate Developers & Property Owners : help create more CRE/RRE utilization

- · Banks & Lenders : help create more business and home lending

- · Local Government : help create companies, jobs, tax revenue

- · Community : help create vibrant community of people with jobs, homes, money, culture

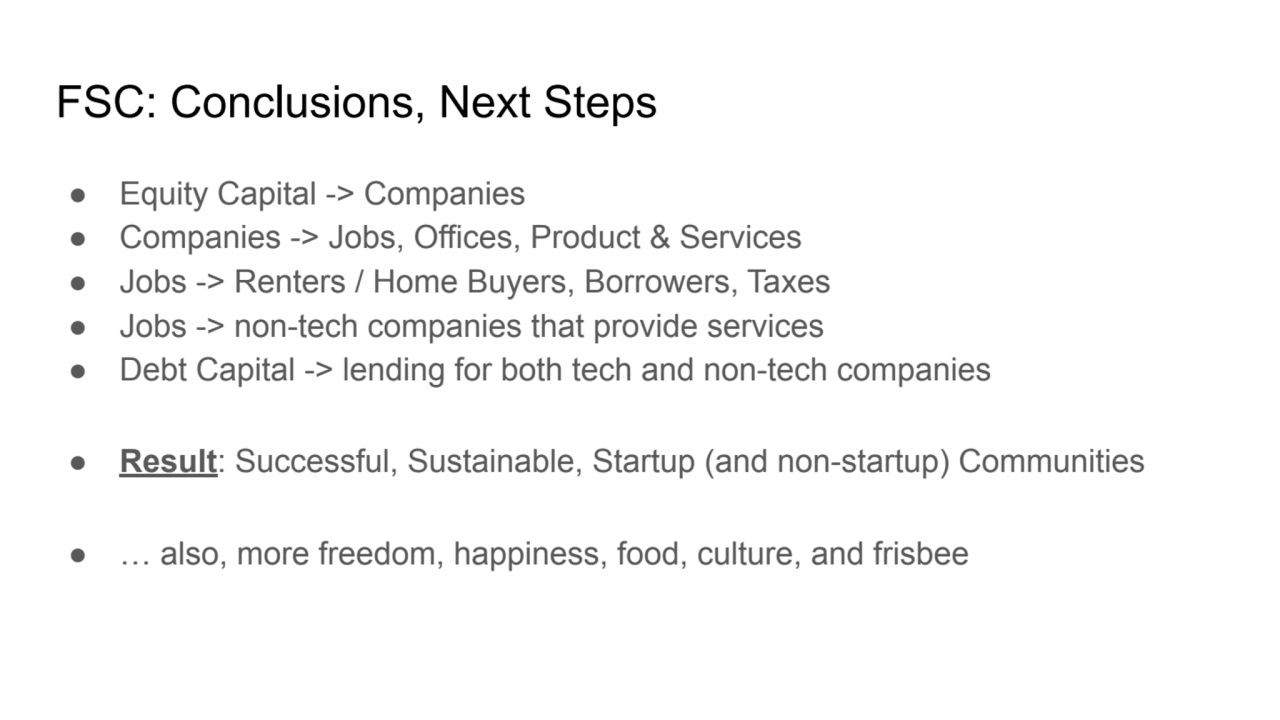

- â Equity Capital -> Companies

- â Companies -> Jobs, Offices, Product & Services

- â Jobs -> Renters / Home Buyers, Borrowers, Taxes

- â Jobs -> non-tech companies that provide services

- â Debt Capital -> lending for both tech and non-tech companies

- â Result : Successful, Sustainable, Startup (and non-startup) Communities

- â ⦠also, more freedom, happiness, food, culture, and frisbee

- â email: dave.mcclure@gmail.com

- â twitter/X: @davemcclure

- â Linkedin: https://linkedin.com/in/davemcclure

FSC: Overview & Summary

Goals :

Strategies & Tactics

FSC: Mixing VC, RE, Debt to create Gravity, Diversification, Liquidity

FSC: (in case i'm boring - here's the punchline)

â 500 Startups first 3 funds (2010-15, $160M, ~1250 seed/pre-seed companies)

â Startup Community MVP: $50-100M budget, 250-500 co's

FSC: Who is this crazy nerd?

Dave McClure

Optimism, Belief, Motivation

FSC: Inspirations, Role Models

FSC: Examples of Global / Regional Tech Communities

FSC: Examples of Startup Micro-Communities

Notable Micro-Communities

Attributes

FSC: My journey from engineer -> founder -> investor

Early Attempts + a few fails (1990-2010)

500 Startups + a few successes (2010-15)

FSC: Case Study: 500 Startups (2010-15)

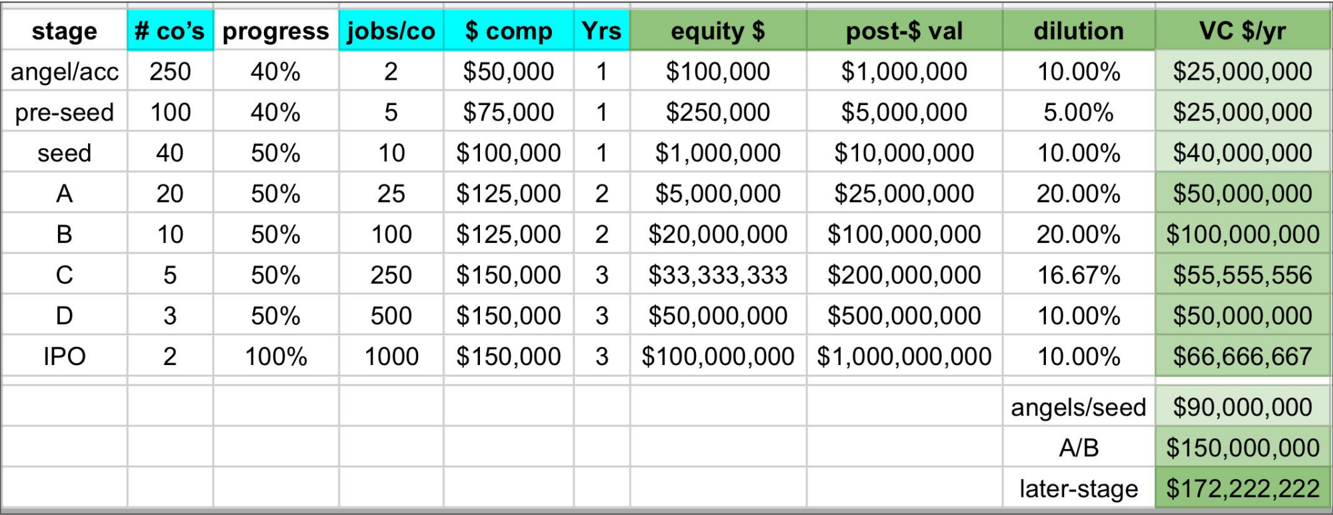

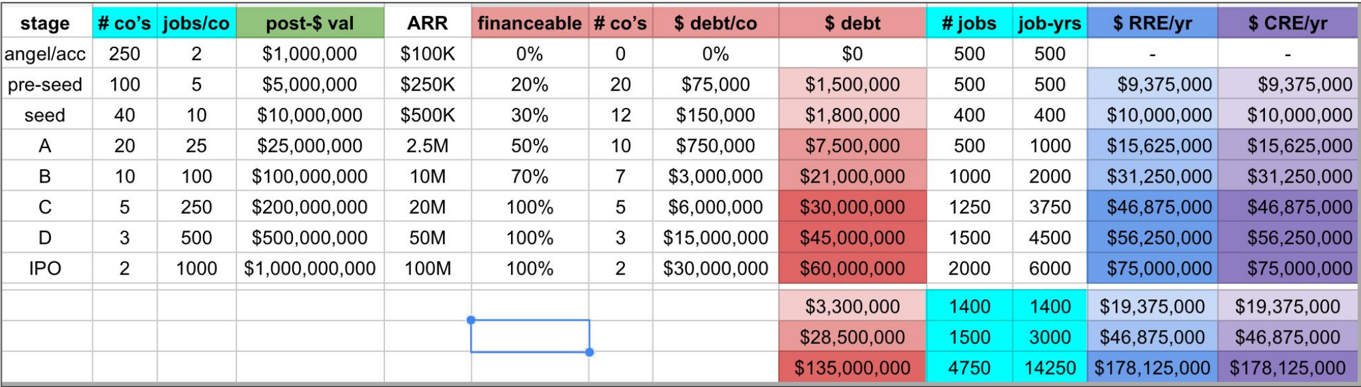

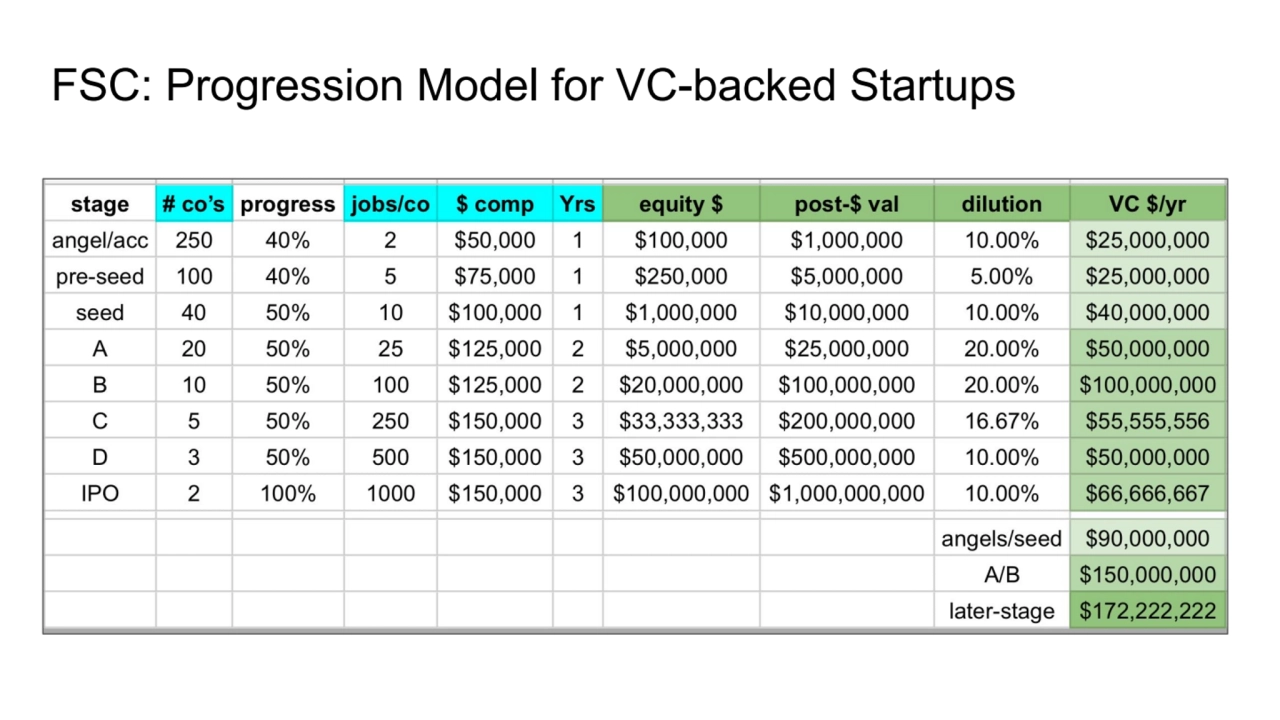

FSC: Progression Model for VC-backed Startups

FSC: Capital Formation (Debt, Commercial / Residential RE)

FSC: MVP for Financing Startup Communities?

FSC: Conclusions, Next Steps

Thanks for listening!

Please send feedback

tell me what you liked, what sucked, what could be done better

1/15

2/15

3/15

4/15

5/15

6/15

7/15

8/15

9/15

10/15

11/15

12/15

13/15

14/15

15/15

Related Jaunts

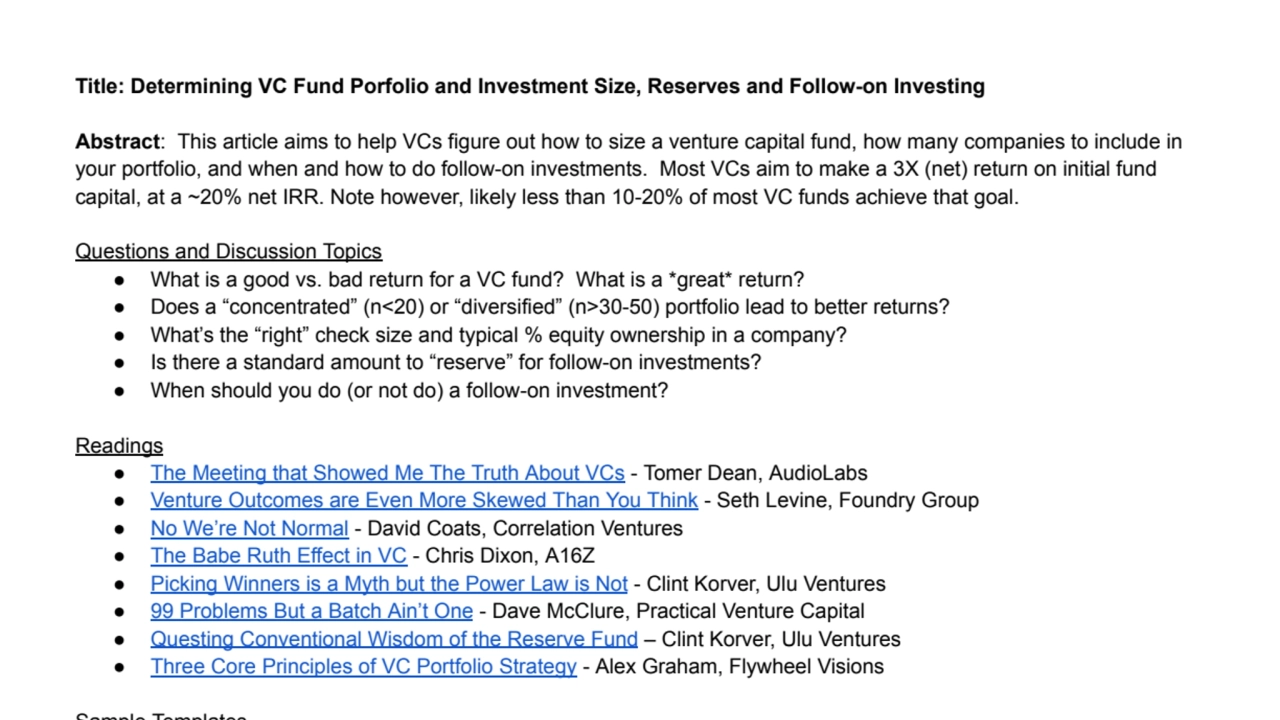

VC Portfolio Modeling: Determining Portfolio & Investment Size

@davemcclure

2 months ago •

1812 views

Raising your first round of investment - Are you sure you are investible?

@techcelerate

2 months ago •

363 views

More from author

Determining VC Fund Portfolio and Investment Size, Reserves and Follow-on Investing

@maithri

5 days ago •

16 views

De-risking tech startups for pre-seed investors through skilled volunteers

@maithri

5 days ago •

19 views

Determining VC Fund Portfolio and Investment Size, Reserves and Follow-on Investing

@maithri

5 days ago •

12 views